Category Archive: 5.) Emerging Markets

Emerging Markets: What Has Changed

Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

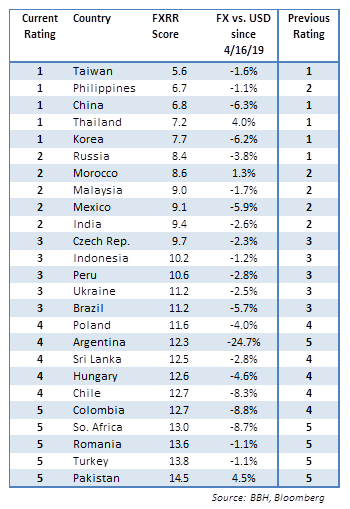

EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again.

Read More »

Read More »

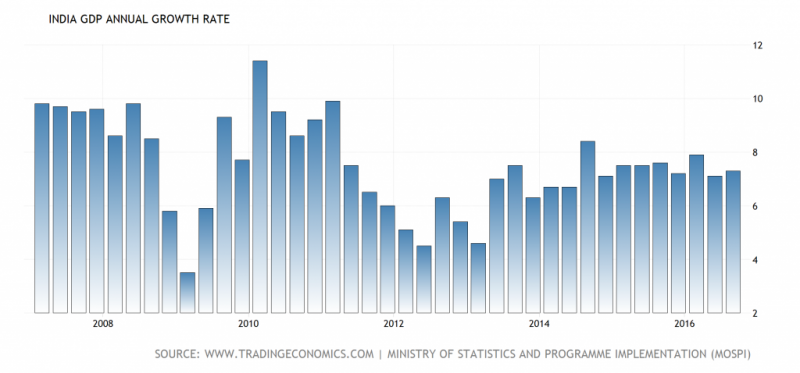

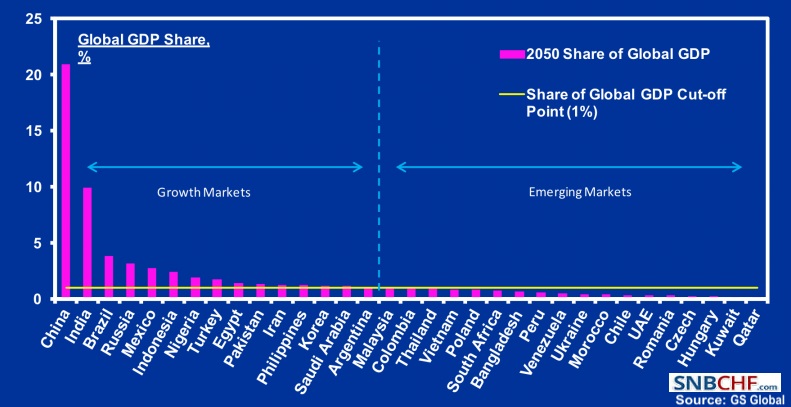

India: The World’s Fastest Growing Large Economy?

India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer now head up both houses of congress. Press...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

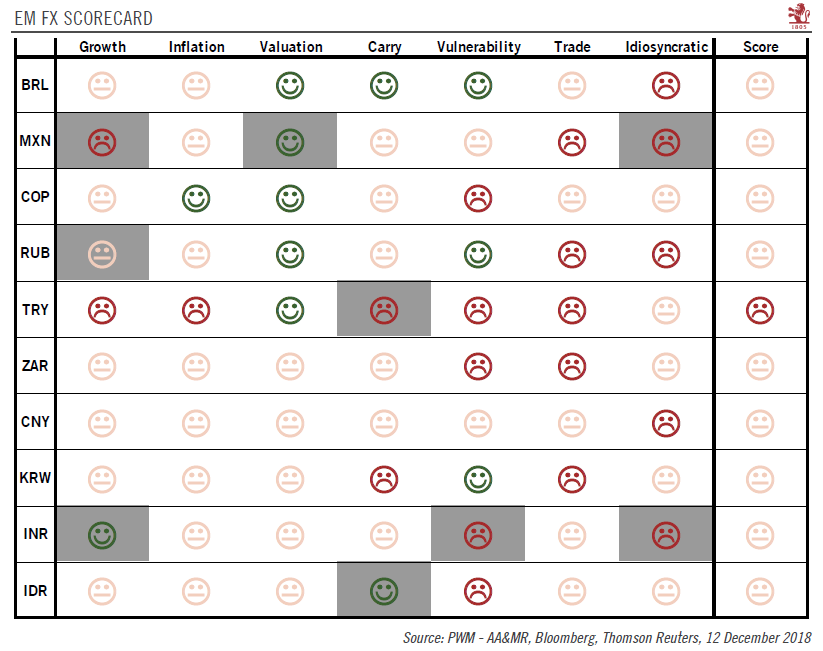

EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling.

Read More »

Read More »

Emerging Markets: What has Changed

Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended last week on a firm not, led by a huge MXN rally on Inauguration Day. We believe that the peso rally was largely driven by positioning and technicals, and so we view Friday’s gains as a correction since the fundamental outlook remains unchanged. Indeed, we think the broader EM rally will be short-lived too, as US interest rates remain elevated. The 10-year yield flirted with the 2.5% level, and we believe it will eventually head even...

Read More »

Read More »

Emerging Markets: What has Changed

Prime Minister Phuc said Vietnam will ease the limits on foreign ownership of banks this year. Russia’s government is working on measures to limit ruble volatility, including possible FX purchases. Turkey’s central bank start auctioning FX swaps to help support the lira. Brazil’s central bank resumed rolling over FX swaps. Brazilian Supreme Court Judge Zavascki was tragically killed in a plane accident. Chile’s central bank started the easing...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week mixed. Markets continue to grapple with the outlook for the so-called Trump Trade, which we believe is intact. MXN and TRY recovered from the relentless selling of recent days, but both remain vulnerable. Indeed, if the jump in US yields on Friday continues this week, most of EM should remain under pressure.

Read More »

Read More »

Emerging Markets: What has Changed

China’s government has asked banks to balance their yuan inflows and outflows. Indonesia partially lifted a ban on exports of nickel ore and bauxite. Czech President Zeman picked two new central bankers as the end of the koruna cap looms. Turkish central bank is taking limited measures to support the lira. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power of the presidency.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM FX was a mixed bag over the past week. Dollar softness vs. the majors allowed some in EM to gain traction, with ZAR and PEN the biggest gainers since Christmas. On the other hand, ARS TRY, and INR were the biggest losers. With markets coming back to life, we expect EM to remain broadly under pressure as the same major investment themes remain in place.

Read More »

Read More »

Modi’s Great Leap Forward

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, Part-V, Part-VI and Part-VII, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

India’s Rapid Progression Toward a Police State

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM gained some limited traction as last week ended. However, renewed concerns about China could limit this bounce as President Xi signaled the possibility that growth could fall below the government’s 6.5% target.

Read More »

Read More »

Emerging Markets: What has Changed

China President Xi raised the possibility of sub-6.5% growth. Fitch moved the outlook on Indonesia’s BBB- rating from stable to positive. The Philippine central bank raised its 2017 inflation forecasts for 2017 and 2018.

Read More »

Read More »

Modi’s Fantastic Promises

This article continues right where Part VI left off (for earlier updates on the demonetization saga see Part-I, Part-II, Part-III, Part-IV, and Part-V). There is still huge support for Modi even among the poor. A big carrot is dangled before them, which makes many stay numb to their current suffering. During his election campaign in 2014, Modi promised to deposit more than Rs 1.5 million (~$22,000) in each poor person’s account once the...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the weak on a soft note, as the hawkish Fed decision continued to have reverberations for global markets. Worst performers in EM last week were CLP (-3.3%), ZAR (-2%), and KRW (-1.5%). With little fundamental news expected this week, markets may take a more consolidative tone, especially with the holidays approaching. However, we continue to believe that the global backdrop for EM remains negative.

Read More »

Read More »

Emerging Markets: What has Changed?

China will raise the sales tax on small cars to 7.5% in 2017. New methodology used by Turkstat to measure Turkish GDP has led to significant upward revisions. Turkish authorities are growing more concerned about the weak lira. Fitch moved the outlook on Chile. Chile’s central bank shifted to an expansionary policy bias. Colombia selected Juan Jose Echavarria to be the new central bank governor. Fitch revised the outlook on Mexico’s BBB+ rating from...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also help insulate some EM countries from the...

Read More »

Read More »

200 Russian Propaganda Sites, or simply alternative media?

The following is the list of "Russian Propaganda sites", as published by PropOrNot. Several articles by the Washington Post refer to this list. Many sites on that list are based on libertarian ideas and Austrian economics. Those are in favor of a free market economy, they reject central banks and the establishment. The rejection of the U.S. establishment is possibly the only point that are in common with Putin.

Read More »

Read More »