Category Archive: 4) FX Trends

USDCAD rotates lower toward MA support after testing the low of the upper swing area

Will the buyers buy the dip in the USDCAD?

Greg Michalowski of Forexlive.com takes a technical look at the USDCAD and sets up a target level to lean against on a dip.

Read More »

Read More »

The risk defining ceiling for the EURUSD. Do you want to know what it is?

The EURUSD moved below a key swing area in the 0.98056 to 0.9816 area. The break below opened the downside up more, put the sellers more in control, and defined risk for sellers. Stay below 0.9816 keeps the sellers firmly in control.

In this video, Greg Michalowski of Forexlive.com, outlines the level and the risk for traders.

Read More »

Read More »

FOREX QUICK: USDJPY moves off resistance and back toward MA support

IN this video Greg Michalowski from Forexlive, takes a look at the technicals driving the USDJPY pair in trading today.

On the topside, a downward sloping trend line stalled the rally. In the US session, the corrective move lower is finding some support near the 100/200 hour moving averages and the 38.2% retracement.

Levels are defined. Traders looking for the next shove.

Read More »

Read More »

Fed’s Hawkishness Roils the Capital Markets

Overview: The Fed delivered the expected 75 bp

rate hike, and although it says it will take into account the cumulative effect

of past hikes and their lagged impact, the takeaway has been a hawkish message.

Risk appetites have evaporated. The dollar is stronger, while stocks and bonds

have been sold. Japan’s markets were spared due to the national holiday, but the

other large markets in the area were sold, lead by the 3% decline in the Hang

Seng....

Read More »

Read More »

VIDEO: A follow-up to the GBPJPY trade idea. Did the anticipation work?

Yesterday, Greg Michalowski of ForexLive.com looked at the GBPJPY. The hourly chart showed 6 separate tests of the 200 hour MA and support buyers leaning.

With 6 separate tests, traders who are looking for more downside in the pair, can anticipate a break below with momentum. Moreover, risk could be defined and limited on the break.

There was indeed a break of the 200 hour MA in the trading day today, but the momentum stalled a short time...

Read More »

Read More »

It’s FOMC Day:What technical levels are in play ahead of the rate decision? Be prepared!

A technical look at some of the major currency pairs and why for your pre-FOMC preparation.

In this video Greg Michalowski of Forexlive, outlines the technical levels in play for some of the major currency pairs through the FOMC rate decision.

If you trade technically, the price action and technical tools applied to the price action, define the bias and the risk. Knowing what levels that are in play, allow traders to game plan in case they...

Read More »

Read More »

It is not So Much about the Fed’s hike Today but the Forward Guidance

Overview: A consolidative tone has emerged ahead of the outcome

of the FOMC meeting later today. The focus is not so much on the 75 bp rate

hike, but on its forward guidance. Many expect the Fed to signal it will return

to a 50 bp move next month, but we are not convinced that it will go beyond indicating

that 50 bp or 75 bp will be debated in December, depending on the data. The market

has a 5% terminal rate discounted. The Fed does not need to...

Read More »

Read More »

VIDEO: Are you anticipating the next trade? The GBPJPY technicals are setting up a trade.

The last 6 tests of a key technical in the GBPJPY have seen a bounce. What would you expect if it doesn't bounce.

Traders need to react...yes.

They also need to anticipate the next low risk trade.

The GBPJPY has a trade setup that might open the door for a low risk/high reward trade, but you have to be ready for it.

Read More »

Read More »

The USD is the weakest of the major currencies ahead of the FOMC rate decision tomorrow

The morning technical video looks at the price action dominating in the EURUSD, USDJPY, GBPUSD and USDCHF.

The USD is the weakest of the major currencies in trading today ahead of the Fed rate decision as markets react to the hope of China abandoning their zero-covid policy. Stocks are higher. Yields are lower. Hopes are the Fed is more dovish tomorrow or at least they signal the near end of policy rate hikes.

- EURUSD (2:04)- The EURUSD is...

Read More »

Read More »

RBA Hikes by 25 bp, Chinese Stocks Surge, and the Greenback Trades Heavier

Overview: Risk appetites have returned today. Bonds

and stocks are advancing, while the dollar is better offered. Unsourced claims

that Beijing has formed a committee to assess how to exit the zero-Covid policy

sent Chinese shares sharply higher. An index of mainland companies list in Hong

Kong jumped nearly 7% and closed up almost 5.5%. The Hang Seng surged 5.2%,

while all the large markets in the region advanced. Europe’s Stoxx 600

recovered...

Read More »

Read More »

Coffee Price Forecast: Looking Strong!

The price of coffee is predicted to rise for the rest of 2022 and into 2023, based on the following technical analysis and price chart of coffee futures, provided by ForexLive.com

For additional perspectives on a variety of financial assets, please visit: https://www.forexlive.com/technical-analysis

Trade cofee futures at your own risk.

Read More »

Read More »

The Dollar Returns from the Weekend Bid

The dollar has come back from the weekend bid. After the ECB and BOJ meetings last week, the focus has shifted back to the US where the FOMC meeting concludes in the middle of the week and the October employment report is out ahead of the weekend. Sterling and the yen are the weakest performers among the G10 currencies and are off 0.45%-0.50%. The Antipodeans are performing best and are straddling little changed levels.

Read More »

Read More »

Three down.Three to go. The RBA, BOE and Fed will be the next CBs to report policy changes

IN the weekend report, I also look at the technicals that will drive the major currency pairs in the new trading week

Read More »

Read More »

Russell 2000 technical analysis

There is a double magnet pulling price to 1885 to 1900 where partial profit taker will probabably be waiting. But on the medium term, this will probably be temporary selling within a bigger bullish reversal up.

Read More »

Read More »

November 2022 Monthly

With this month's hike, the Federal Reserve would have raised overnight rates by 300 bp while doubling the pace that its balance sheet is shrinking over the past 100 days. The US economy is the largest in the world, and US interest rates and the dollar are vital benchmarks.

Read More »

Read More »

Apple stock forecast for 2023: Going to $170

37 analysts have predicted a 12-month median price of $180 for Apple Inc.

Apple stock forecasts range from $200 to $122.

Read More »

Read More »

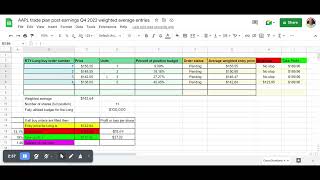

AAPL trade plan post earnings Q4 2022 weighted average entries – Google Sheets

This is a supplement video explaining one advanced way to scale into a buy of Apple stock, part of the stock price forecast at

The method includes heavier buying as the price declines, a stop loss and take profit target with a note that buyers can consider taking partial profit (eg, 50%) if the target is reached.

Read More »

Read More »

RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In

addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.

Read More »

Read More »

The technicals are having a profound impact in the major currency pairs today.Find out why

Being in tune with the rhythm of the markets is just as important as a musician's instrument being in tune with the orchestra's instruments. If you are not in tune, you will not do well in your trading/sound well in your orchestra. In the morning technical report, I look to get you in tune with the technicals that are driving the markets and show why. So take a few minutes to get in tune with the market.

Read More »

Read More »

BOJ Doesn’t Surprise, but EMU does with October CPI and Q3 Growth

Bonds and stocks are being sold ahead of the weekend. Poor corporate earnings and higher inflation in Japan and Europe are weighing on sentiment. The dollar is mostly higher. Hong Kong and mainland China led large Asia Pacific markets lower. India and Singapore were notable exceptions.

Read More »

Read More »