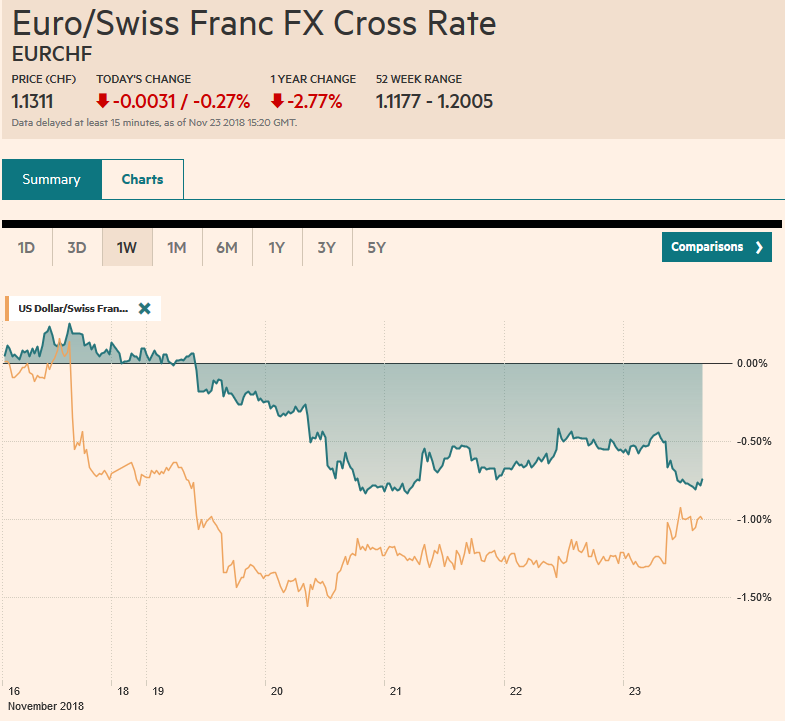

Swiss FrancThe Euro has fallen by 0.27% at 1.1311 |

EUR/CHF and USD/CHF, November 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is firmer against most of the major currencies. Japanese and Indian markets were closed for holidays and a weaker than expected flash EMU PMI helped keep the euro pinned near this week’s lows. Although the EU seemed to thrown UK’s embattled May a lifeline with some compromise wording in a draft declaration, the challenge remains the same–Parliament’s approval. Asian equities were mostly lower, and the MSCI Asia Pacific Index has fallen for a third consecutive week. It has risen in only one week since September 21. Chinese markets led this week’s losses with the Shanghai Composite off 3.5% and the Shenzen Composite down 5.3%. European equities are firm, but the Dow Jones Stoxx 600 is still off over 1% on the week. Bond yields are mostly softer, with Italy’s 10-year benchmark yield off eight basis points to bring this week’s decline to 22 bp, which is quite remarkable given the poor reception to this week’s auctions. Oil prices are trading heavily, and both WTI and Brent are headed for the seventh week of losses. Yesterday, the South African central bank hiked rates (25 bp to 6.75%) for the first time in more than two years. It was a split decision, which helped give it a dovish aura. The rand is giving back most of yesterday’s gains. |

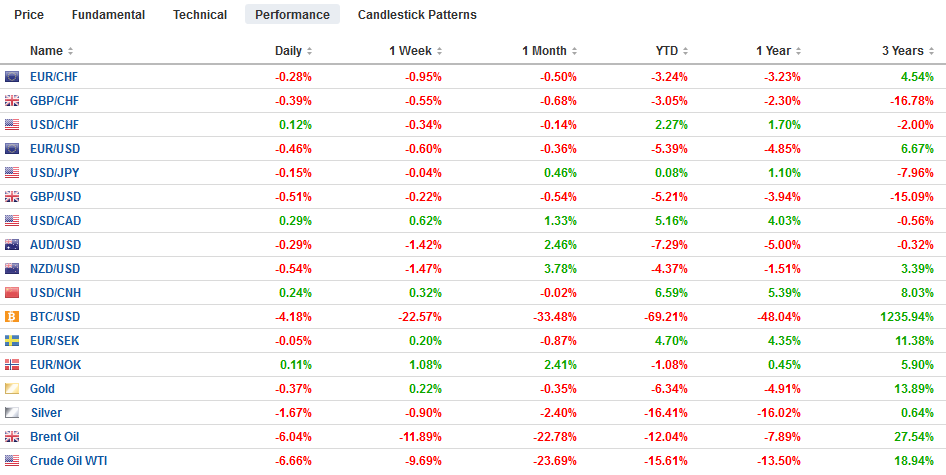

FX Performance, November 23 |

Asia Pacific

China announced yesterday that retroactive to November 7, it will exempt foreign institutional investors from taxes on interest income from onshore bond purchases. The exemption will last three years, according to press reports. China is experiencing capital outflows, despite the controls, illustrated by the more than $85 bln decline in reserves this year. The yuan slipped marginally this week and has spent the month alternating between weekly gains and declines this month leaving it virtually flat so far in November.

Yesterday, Japan reported headline inflation rose to 1.4% in October from 1.2% in September. The BOJ targets core inflation, which excludes fresh food, and that was unchanged at 1.0%. However, it still exaggerates the price pressures in Japan. When fresh food and energy are excluded, consumer prices have risen 0.4% from a year ago, which is an unchanged pace. The dollar is little changed on the week against the yen. It finished last week near JPY112.85, where a roughly $765 mln expiring option is struck. The technical indicators are still heavy, warning of the near-term risk to return to the week’s low set on Tuesday near JPY112.30.

Weaker commodity prices, concern about trade, and a larger short-end discount to the US weighed on the Australian dollar in recent days. It snapped a three-week advance and near $0.7240, is off 1.2% on the week. A break of the 20-day moving average (~$0.7220) would likely signal a retest on the month’s low seen near $0.7165. The New Zealand dollar has also ended a three-week rally with around a 1.2% loss this week. There is an NZ$506 mln option at $0.6800 that will be cut today.

Europe

The flash PMI for the eurozone was weaker than expected, and this can only increase the likelihood that the new economic forecasts (by a combination of the ECB’s staff and the national central banks) will have to have growth and inflation forecasts. Officials appear to have been too quick to dismiss the economic weakness because of the shift in the German auto sector. That explanation is wearing thin. The flash German manufacturing PMI fell to 51.6 from 52.2, and the non-manufacturing sector eased to 53.3 from 54.7. This translates into a 52.2 composite reading, down from 53.4 and is the lowest since the end of 2014. The French composite slipped to 54.0 from 54.1. Manufacturing and non-manufacturing sectors both slowed. For EMU as a whole, the composite reading stands at 52.4 compared with 53.1 in October. The rolling three-month average stands at 52.9, the lowest since October 2016. Some economist may be reluctant to change their Q4 GDP forecasts quite yet, but surely the risk that is at 0.4% in H1 and 0.2% in Q3, EMU growth slowed further in Q4. Note that new orders have fallen every month this year.

The record of the ECB’s October meeting was published yesterday. It seemed to be somewhat less optimistic than ECB President Draghi. It recognized that the incoming data was weaker than expected and that was before the release of Q3 GDP. Although the ECB links its decision to complete its asset purchases at the end of next month incoming data, the bar to continuing sees very high. However, the likely shaving of the growth and inflation forecasts may not be sufficient to get the ECB to change its balance of risk to the downside. While the OIS seems to suggest a 10 bp hike after next summer is mostly discounted, the implied yield of the December 2019 Euribor futures is making new two year highs today at (~19 bp). The implied yield has fallen about 15 bp over the past month.

High drama over Brexit continues to flummox traders. The EC appears to have tried to help May over the objections of some national leaders. The draft declaration is not thought to be legally binding but offered some softer wording that made references to a future free-trade area with “deep regulatory and customs cooperation.” It also seemed to recognize the possibility of a technological solution to for the Irish backstop.

We remain skeptical. Like in the handshake agreement with Trump, the EC Juncker is pressing for an enhanced role for the EC over say the European Council (President Tusk), and this irks some national leaders. In recent days, the dispute over Gibralter with Spain has escalated, and the draft declaration further alienated Spain. Many in the UK fear that the backstop is the deal, which is to say that there is no way to square the circle–to have the UK out of the single market and not have a border between either the UK and Northern Ireland or between Northern Ireland and the Irish Republic. Former UK negotiator Raab expressed this frustration today by asserting that staying in the EU was preferable to May’s plan (which he helped negotiate).

At $1.2840, sterling is essentially flat on the week. There is a GBP470 mln option at $1.2850 that expires today. Cable has not built on yesterday’s gains, sparked by that draft agreement when it reached the high for the week a little above $1.2925. Three-month implied sterling volatility reached 13.2% last week, and it has eased every day this week, but around 12.4% remains sticky. Recall that it had averaged (five-day average) a little more than 10% at the end of last month. In late morning activity in Europe, the euro has been sold to new lows for the week and moving below $1.1360, where a roughly 880 mln euro option will expire today. The bears have some slogging to do to succeed in pushing the euro below $1.1300. Chart support is seen near $1.1340 and then $1.1310. There is a 512 mln euro option at $1.1325 that may offer support before it expires today.

North America

Canada’s government appeared to make a downpayment toward next year’s election yesterday, It announced a C$14 bln tax cut for businesses. The tax break is in the form of accelerated depreciation of capital investment in manufacturing. It ostensibly is meant to address productivity and competitiveness. The Canadian dollar rallied yesterday in response, but today, amid a broadly stronger US dollar, its gains have been pared. A move above CAD1.3260 could spur a move back to the week’s five-month high above CAD1.3300.

Canada report September retail sales and October CPI. Retail sales are expected to be flat but dragged down by weaker auto sales. Consumer prices are expected to be little changed at 2.2% headline rate and the core measures between 1.9% and 2.1%. The broad performance of the US dollar and other markets, like stocks and oil, may have more impact on the Canadian dollar today than the data.

The US economic calendar features the flash PMI. Although it poses some headline risk, it tends not to have a lasting impact. One of the most important developments this week has been the reconsideration of the trajectory of Fed policy. The implied yield of the December 2019 fed funds futures contract is three basis points lower this week after falling almost 15 bp last week. Fed speeches next week, including Powell’s at the NY Economic Club, will be closely scrutinized for clues.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,newsletter,USD/CHF