Category Archive: 4.) Marc to Market

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, November 01: Super 48 Hours

This is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a verdict on interest rates but also provides an update of its economic projections (Quarterly Inflation Report). And, among the innovations, the MPC minutes will be released. Ahead of the Federal Reserve meeting, the market will have the ADP private-sector job estimate.

Read More »

Read More »

FX Daily, October 31: Month-End Leaves Market at Crossroads

Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe's Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May.

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain.

Read More »

Read More »

Three Developments in Europe You may have Missed

The focus in Europe has been Catalonia's push for independence and the attempt by Madrid to prevent it. Tomorrow's ECB meeting, where more details about next year's asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many are seeing convergence,...

Read More »

Read More »

Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors (Julie Chatterley, Scarlet Fu, and Joe Weisenthal on the set of "What'd You Miss" today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility.

Read More »

Read More »

FX Daily, October 27: Greenback Finishing Week on Firm Note

This has been a good week for the US dollar. The Dollar Index's 1.25% gain this week is the largest of the year. The driver is two-fold: positive developments in the US and negative developments abroad. The positive developments in the US include growing acceptance that the Fed will raise rates in December and that there will be more rate hikes next year. The Fed says three.

Read More »

Read More »

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Most participants seemed comfortable marking time ahead of tomorrow's ECB meeting, and an announcement President Trump's nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3 GDP injected fresh incentives. Australia reported headline CPI rose 0.6% in Q3.

Read More »

Read More »

FX Daily, October 24: Dollar Treads Water as 10-year Yield Knocks on 2.40percent

The US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of asset purchases at a pace half of the current 60 bln a month. Anticipation of the new Fed Chair, which President Trump says will be announced: "very, very soon."

Read More »

Read More »

Canada: Monetary and Fiscal Updates This Week

Divergence between US and Canada's two-year rates is key for USD-CAD exchange rate. Canada's 2 hikes in Q3 were not part of a sustained tightening sequence. Policy mix considerations also favor the greenback if US policy becomes more stimulative.

Read More »

Read More »

FX Daily, October 23: US Dollar Starts New Week on Firm Note

The US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the governing coalition has maintained its super-majority is seen as confirmation of continuity. This helped lift Japanese shares and weighed on the yen. The Nikkei advanced 1.1%, the most in a month, and extends the...

Read More »

Read More »

FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are diverging the most since the late 1990s and...

Read More »

Read More »

Abe’s Third Arrow

Abe's political gamble appears likely to pay off. The third arrow of structural reforms continues. The FSA is continuing to push for shareholder value. Foreign investors have gone on a three-week buying spree that appears to be the largest in years, and the Nikkei is leading G7 bourses higher this month.

Read More »

Read More »

FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies.

Read More »

Read More »

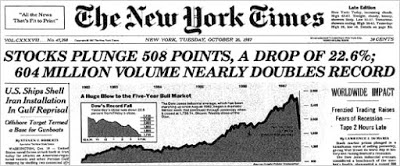

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

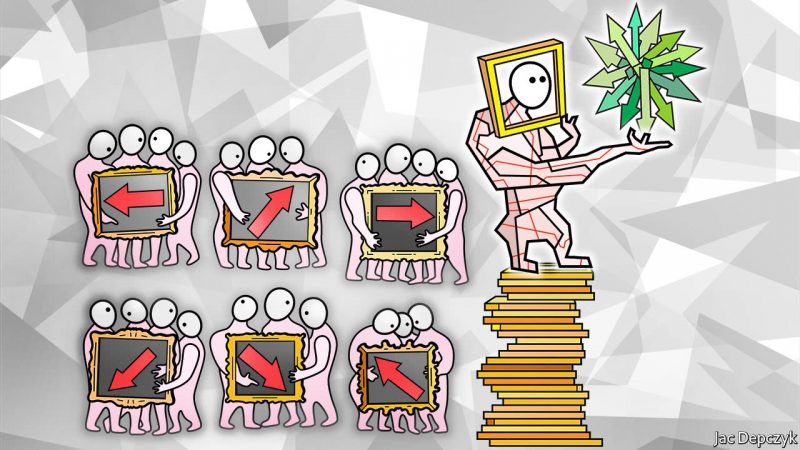

Great Graphic: The Euro’s Complicated Top

Euro looks like it is carving out a top. The importance also lies in identifying levels that the bearish view may be wrong. Widening rate differentials, a likely later peak in divergence than previously anticipated, and one-sided market positioning lend support to the bearish view.

Read More »

Read More »

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »