Summary:

Divergence between US and Canada’s two-year rates is key for USD-CAD exchange rate.

Canada’s 2 hikes in Q3 were not part of a sustained tightening sequence.

Policy mix considerations also favor the greenback if US policy becomes more stimulative.

| Many observers saw Canada as one of the canaries in the coal mine, warning that the divergence theme was over. The Bank of Canada did hike rates twice in Q3. The Federal Reserve did not hike at all. Isn’t that the definition of convergence?

Yes and no. The Bank of Canada’s rate hikes were not the beginning of a sustained effort to normalize policy. The hikes were largely about removing the accommodation provided in 2015 as Canada was hit by a terms of trade shock when oil prices tumbled. With a December Fed seen as highly probable, the spread between the policy rates will finish wider than they started the year. |

|

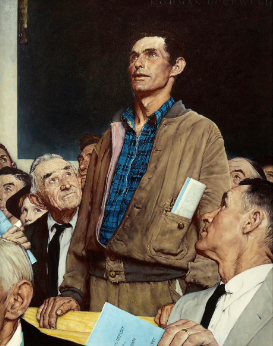

| The US-Canadian dollar exchange rate is very sensitive to two-year interest rate differential. The first Great Graphic here, created on Bloomberg shows this correlation on a rolling 60-day basis. Here we ran the correlation on the level of the US-Canada exchange rate. The US dollar moved in the same direction as the interest rate differential 90% of the time over the past 60 days. The correlation has been above 0.90 for more than three months. |

Correlation CAD |

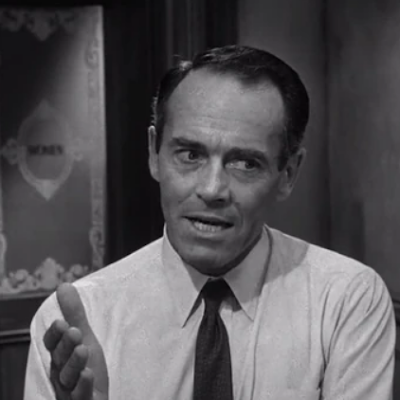

| The second Great Graphic depicts the two time series, the USD-CAD exchange rate than the two-year interest rate differential. We are not so fond of such charts (two time series and two scales) but in this case, it cannot be avoided, and we are suggesting eyeballing the correlation, which is why we show that work first. |

Rates and CAD |

This chart shows the co-movement of the exchange rate and the two-year interest rate differential. The differential peak in May within days of the dollar’s peak. The differential narrowed as the market understood the signals from the Bank of Canada of the likelihood it would hike in July and September.

The market had to be led by Fed officials to price in both the March and June hikes. It became clearer around the middle of the year that the Fed would shift toward its balance sheet operations at the September FOMC meeting, which did.

Meanwhile, the market initially was pricing in an October hike by the Bank of Canada. However, comments by officials and some disappointing data spurred on unwind of such expectations at roughly the same time the market felt more confident of a December Fed hike. The interest rate differential and dollar peaked in early May and both bottomed on September 8. What was a 40 bp US premium on two-year borrowing at the start of theyear fell to a 25 bp discount by early September. Over the past several weeks, the US premium has been restored. At about 10.basis point it is the most in two months. Since September 8, when the US dollar bottomed near CAD1.2060, US dollar has appreciated roughly 4.9% against the Loonie and around CAD1.2640 is at its best level since the end of August.

Fiscal policy is also at work. The prospects for tax reform in the US appear elevated. We are still somewhat skeptical as the challenges that appeared to repeal and replace health care are still operative, and the most important of these challenges is the lack of agreement within the majority party. That said, the most policy mix for a currency is tighter monetary policy and looser fiscal policy.

Canada’s Finance Minister Morneau is expected to provide a fiscal update as early as tomorrow, ahead of the Bank of Canada meeting on October 25. The stronger than expected growth this year in Canada has a positive knock-on effect on the deficit (smaller) and boosts revenue. This has created leeway for new initiatives. Back-of-the-envelop calculations suggest the current fiscal shortfall is around a third smaller than anticipated or almost C$10 bln.

The fiscal update will be an opportunity for Morneau to change the news cycle. He has been caught in a controversy by not putting his assets in a blind trust. Also, Morneau has been forced to pull back two of this three tax proposal. The first related to passive income, and Morneau responded by proposing a tax cut for small businesses, which is also proving controversial. Morneau also has pulled the proposal that would have limited the ability to convert funds held in a private corporation into capital gains to reduce the tax burden.

In conclusion, the divergence of the trajectory of monetary policy between the US and Canada remains intact. The two-year interest rate differential remains highly correlated with the US-Canada exchange rate. Between the FY2018 budget and the prospect of tax reform, the policy mix is also supportive for the US dollar. The CAD1.2660 offers immediate resistance. Above there we target CAD1.2725. Over the medium-term (mid-2018) we expect the US dollar to return into the CAD1.30-CAD1.32 area.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CAD,Bank of Canada,Great Graphic,newslettersent,policy mix