Category Archive: 4.) Marc to Market

FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

The US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen's speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month's meeting.

Read More »

Read More »

FX Daily, March 06: The Dollar Gives Back More Before Consolidating

The US dollar's pre-weekend pullback was extended in early European turnover but appeared to quickly run out of steam. The prospect of a constructive US employment report at the end of the week, especially given the steady decline in weekly initial jobless claims to new cyclical lows, underscores the likelihood that the Fed hikes rates next week. Bloomberg puts the odds above 90%, while the CME estimates a nearly 80% chance.

Read More »

Read More »

FX Weekly Preview: Four Sets of Questions and Tentative Answers for the Week Ahead

The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week's discussion of the drivers in terms of four sets of questions and offer some tentative answers.

Read More »

Read More »

The Resilience of Globalization and the US Dollar

Populism-nationalism is not really a wave sweeping across the world. Where it succeeded was where a center-right party in a two-party system embraced part of the populist agenda. Center-right parties in Europe are not embracing key agenda for populist-naitonalist, but appear to be tacking to the right on domestic issues.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

European Commission Offers 5 Scenarios

EC is committed to the future of Europe. Juncker presented five scenarios. Even if the populist-nationalist do not win the electoral contests, the national identity issues will continue to exert influence.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

Great Graphic: Fed’s Real Broad Trade Weighted Dollar

To begin assessing the dollar's impact on the US economy, nominal bilateral exchange rates may be misleading. From a policymakers' point of view, the real broad trade weighted measure is more important. The Federal Reserve tracks it on a monthly basis.

Read More »

Read More »

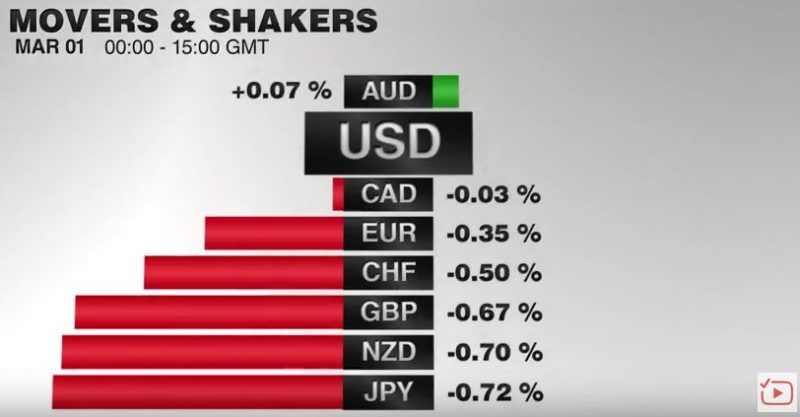

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »

Beware the Ides of March

Numerous events converge in the middle of March. We still lean toward a May hike rate than March. Wilders may garner a plurality of the vote in the Netherlands, but is unlikely to form a government for want of coalition partners. How will the Republican US Congress and President deal with the debt ceiling?

Read More »

Read More »

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

The Misplaced Animosity toward Imports

Pity imports, they are misunderstood. Imports create jobs directly and indirectly. Restricting US imports would likely also curb exports.

Read More »

Read More »

FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan's Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week.

Read More »

Read More »

FX Weekly Preview: Macroeconomics and Psychology

There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic considerations.

Read More »

Read More »

FX Daily, February 24: Anxiety? What Anxiety?

The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump's speech to a joint session of Congress next week.

Read More »

Read More »

FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

The US dollar is confined to narrow ranges today within yesterday's ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election.

Read More »

Read More »

Primary Budget Balances in EMU

Greece debt has rallied as a repeat of the 2015 crisis seems less likely. The EC may turn its attention to Italy's structural deficit. There are several countries, including France that is forecast to have a larger primary deficit in 2018 than 2017.

Read More »

Read More »

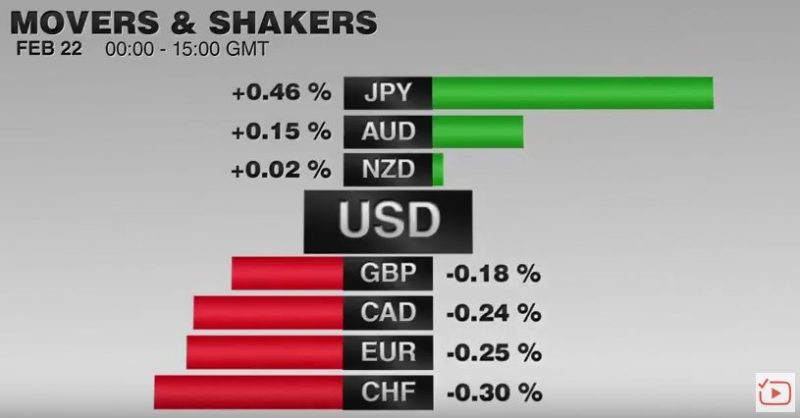

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

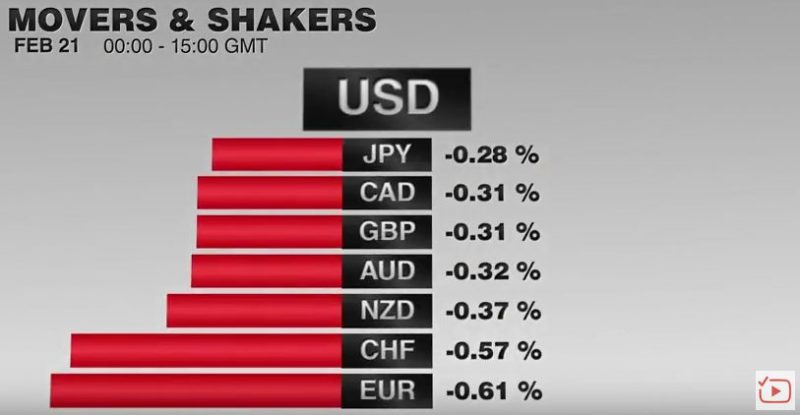

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

Dollar Index: The Chart Everyone is Talking About

Many are discussing a possible head-and-shoulders pattern in the Dollar Index. We are skeptical as other technical signals do not confirm. We recognize scope for disappointment over the border tax and the next batch of employment data, but European politics is the present driver and may not be alleviated soon.

Read More »

Read More »