Category Archive: 4.) Marc to Market

FX Weekly Preview: Forces of Movement in FX: The Week Ahead

The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again.

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

FX Daily, September 06: Wake Me up when September Ends

The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank's decision. We are concerned that given the strong performance and market positioning, a rate hike could spur "buy the rumor, sell the fact" activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales.

Read More »

Read More »

Great Graphic: Young American Adults Living at Home

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds).The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

Cool Video: CNBC Clip Tactical and Strategic Dollar Outlook

I appeared on CNBC earlier today to talk about the dollar. I was given the time to briefly sketch out my view of the dollar. Near-term, I am concerned about the political and economic events in September, but I am looking for a better Q4 for the greenback.

Read More »

Read More »

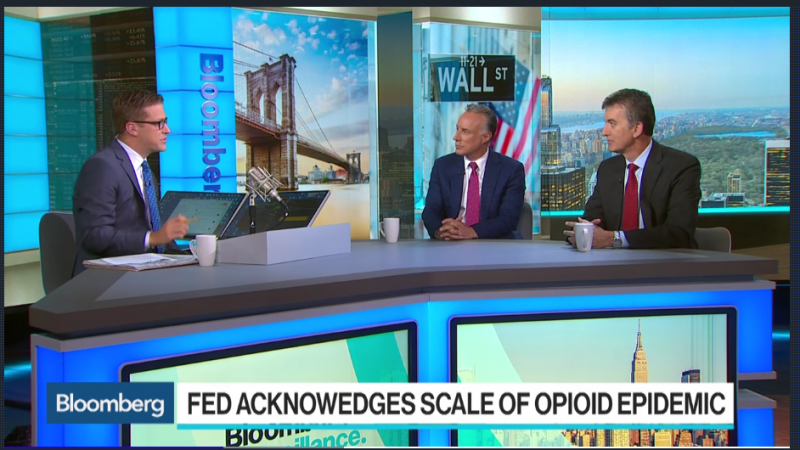

Cool Video: Bloomberg Discussion of Opioid Epidemic and US Labor

I had the distinct of honor of being on Bloomberg television today with David Gura and Francine Lacqua. Dino Kos, formerly of the NY Fed and now at CLS, joined this segment as well. The broad topic was the Jackson Hole Symposium, and the challenge is fostering more dynamic growth.

Read More »

Read More »

FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback's gains yesterday. Manufacturing PMIs from China, EMU, and the UK have been reported, while in the US, the August jobs data stand in the way of the long holiday weekend for Americans.

Read More »

Read More »

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »

Chandler: Good Chance Fed Hikes in December

08/30/17 Brown Brothers Harriman's Marc Chandler weighs in on expectations for the Federal Reserve in 2017. Chandler considers the divergent outlook for the ECB vs the FOMC and the implications for the EUR/USD.

Read More »

Read More »

Chandler: Good Chance Fed Hikes in December

08/30/17 Brown Brothers Harriman’s Marc Chandler weighs in on expectations for the Federal Reserve in 2017. Chandler considers the divergent outlook for the ECB vs the FOMC and the implications for the EUR/USD.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding.

Read More »

Read More »

FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend's test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea responded with its own symbolic display of force by dropping bombs by the DMZ.

Read More »

Read More »

FX Daily, August 28: Monday’s Dollar Blues

The US dollar's pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson Hole speeches.

Read More »

Read More »

FX Weekly Preview: Three Drivers in the Week Ahead

EMU preliminary August CPI headline rise may not translate into core. US jobs growth is fine; earnings growth is key. Trump's coalition is fraying, and the weekend pardon will not help mend fences.

Read More »

Read More »

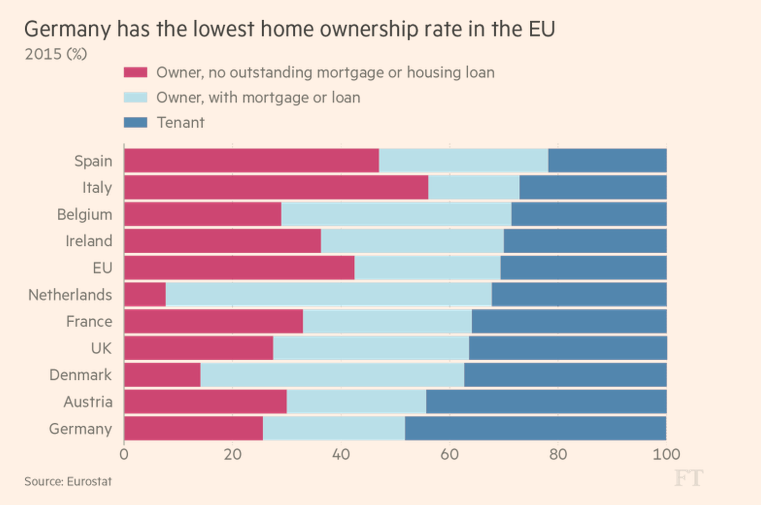

Great Graphic: Home Ownership and Measuring Inflation

Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not.

Read More »

Read More »

Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market.

Read More »

Read More »