Category Archive: 4.) Marc to Market

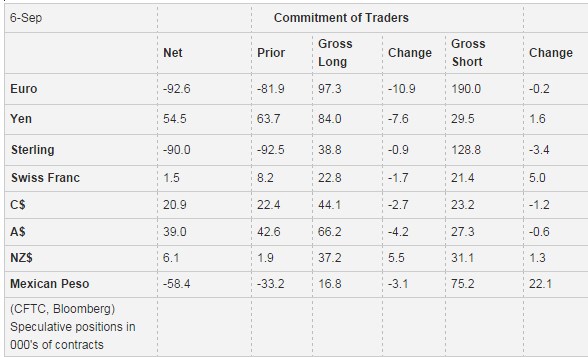

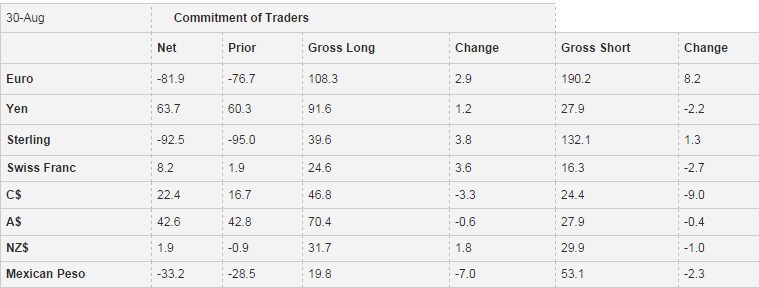

Weekly Speculative Postions: CHF net long positions down from 8.2K down to 1.5K

The Swiss Franc depreciated this week again. The euro rose to 1.960. One reason is the reduction in net long CHF speculative position from 8.2K to 1.6K contracts. Given the weak ISM non-manufacturing PMI, it remains unclear. why speculator now move into the dollar.

Read More »

Read More »

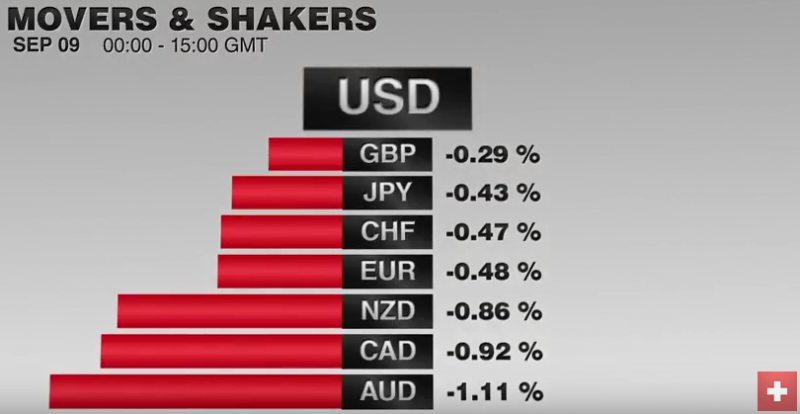

FX Daily, September 9: Ahead of the Weekend

The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed.Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning.

Read More »

Read More »

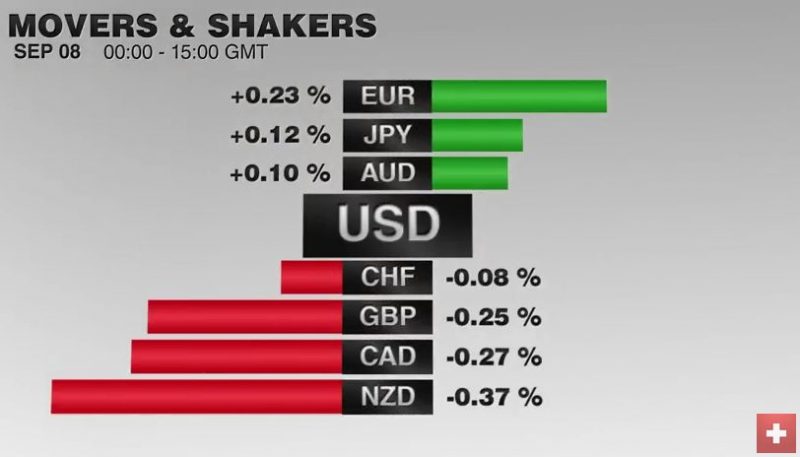

FX Daily September 8: Draghi Says Little, Door Still Open for More

In the last two days, the euro moved upwards against CHF. Given that Swiss GDP was stronger than the one in the euro zone, this is surprising. But we must recognize that Draghi could be the reason. Inflation forecasts of 1.2% in 2017 and 1.8% in the euro zone would mean the ECB hikes rates maybe in 2018 or 2019. I personally do not believe it, given that wage inflation in Italy or Spain is clearly under 1%. This is lower than Swiss wage inflation...

Read More »

Read More »

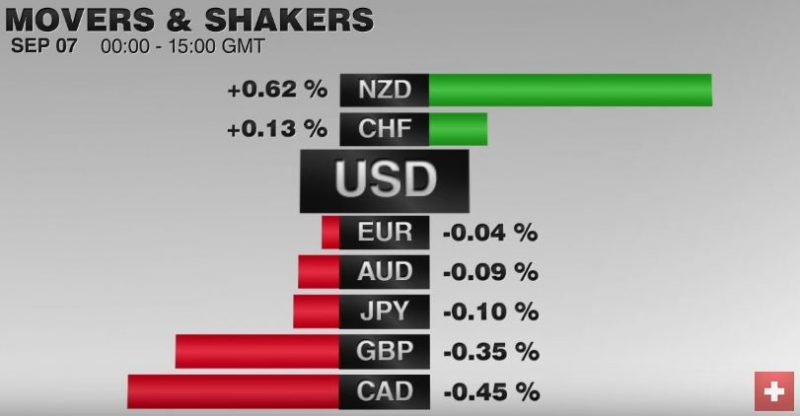

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

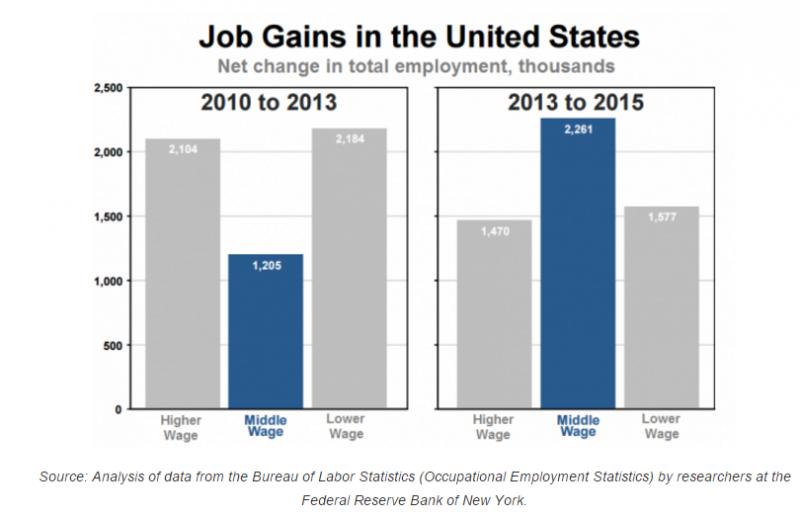

Great Graphic: What Kind of Jobs is the US Creating

The oft repeated generalization about the dominance of low paying jobs is not true for the last few years. This does note refute the disparity of wealth and income in the US. There is a restructuring taking place that favors educated and skilled workers.

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

Services ISM Sends Greenback Reeling

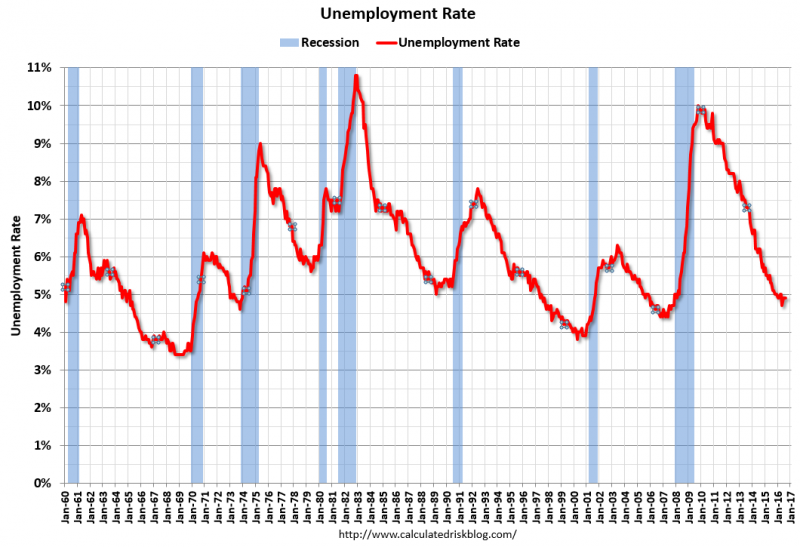

ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Weekly Preview: Parsing Divergence: Focus Shifts from Fed to ECB

Net-net, the September Fed funds futures contract was little changed on the week. Four high-income central banks meet in the week ahead; the ECB is the only one in play. China accounted for a full three quarters of the US trade deficit in July.

Read More »

Read More »

Weekly Speculative Positions: Rising Swiss Franc Longs

Speculative activity remained light in the latest CFTC reporting period ending August 30. There were no gross position adjustments that we recognize as significant; 10k contracts or more. There were only three gross adjustments by speculators of more than 4k contracts. With the higher EUR/CHF FX rate and weaker U.S. jobs date, speculators went long CHF by 8.2K contracts.

Read More »

Read More »

US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

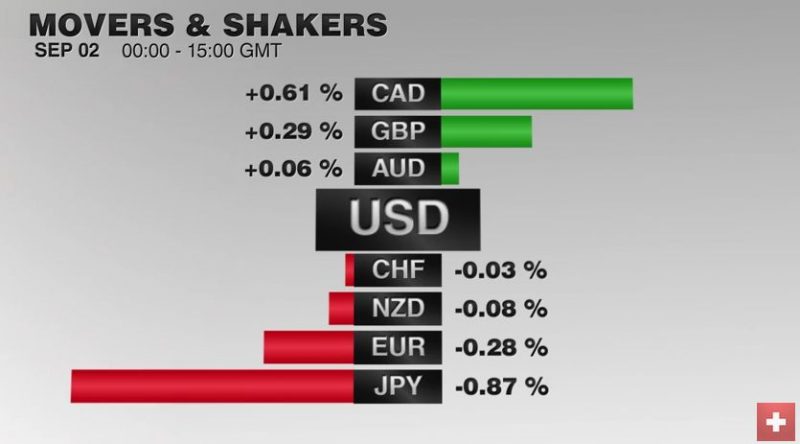

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

Great Graphic: Oil is Looking Crude

Oil is breaking down. Doubts are growing over output freezes while US inventories rise. The technicals are poor.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

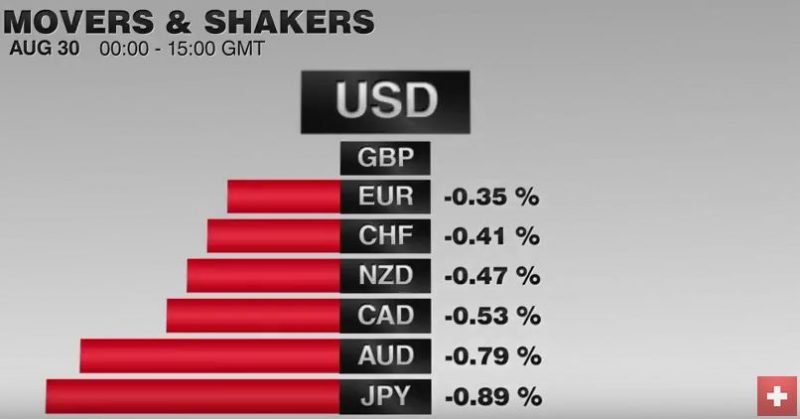

FX Daily, August 30: Greenback Remains Firm, Awaiting Fresh Cues

The US dollar is trading firmly, largely within yesterday's ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer's Bloomberg TV appearance, and tomorrow's ADP employment estimate, the market seems cautious about fading the dollar's strength.

Read More »

Read More »

Natural Rates and Terminal Fed Funds

The neutral or natural interest rate is linked to potential growth. Potential growth has fallen so has the neutral rate. The implication is that the FOMC has made the bulk of the adjustment on its long-term Fed funds forecast.

Read More »

Read More »

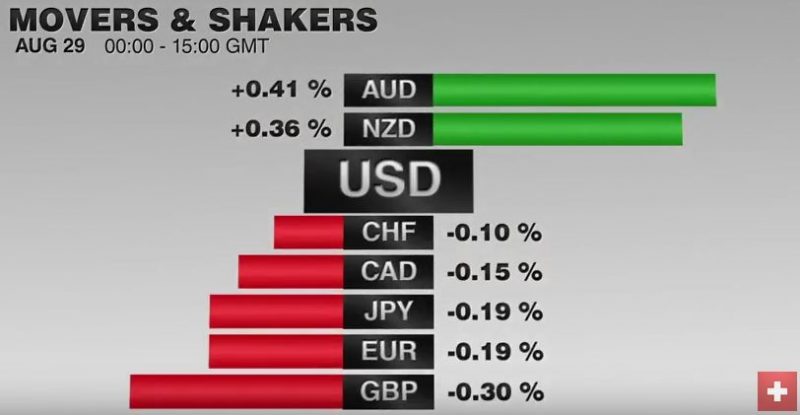

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

Great Graphic: Low Wages in US Rising

The bottom of the US wage scale is rising. The added wage costs are being blunted by less staff turnover, hiring and training costs. It is consistent with our expectation of higher price pressures.

Read More »

Read More »