Category Archive: 4.) Marc to Market

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

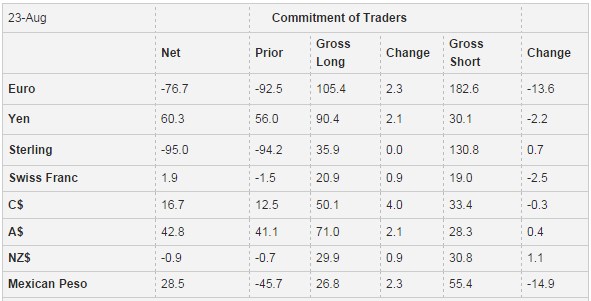

Weeky Speculative Positions: Euro Shorts Trimmed, More Sterling Shorts, Long CHF again

Three weeks ago speculators went net short in CHF, when the U.S. jobs report was published. Now the net position shifted to long again. Last week GBP shorts increased but Euro Shorts were reduced.

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

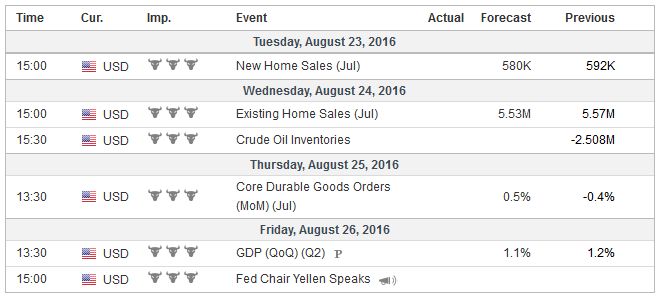

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »

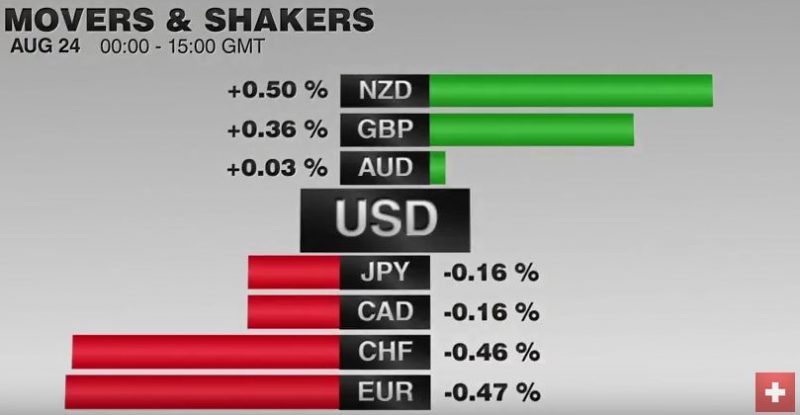

FX Daily, August 24: Narrowly Mixed Greenback in Summer Churn

The US dollar is going nowhere fast. It is narrowly mixed against the major currencies. The market awaits for fresh trading incentives, with much hope placed on Yellen's presentation at Jackson Hole at the end of the week. Is it too early to suggest that the build-up ahead of it is too much?

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

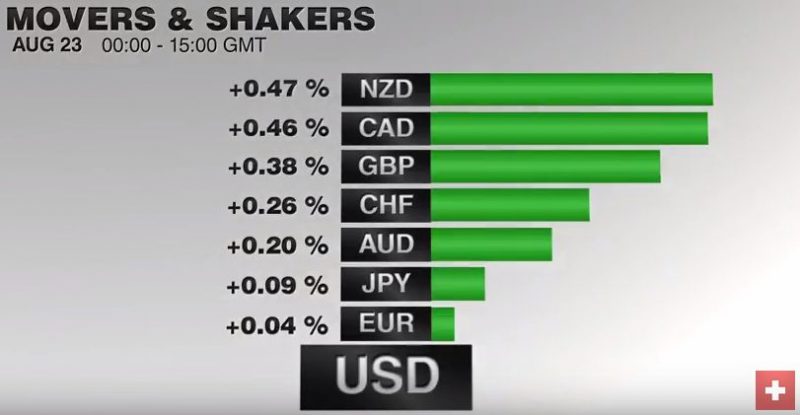

FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

The US dollar is mostly little changed against the major, as befits a summer session.There are two exceptions.The first is the New Zealand dollar. Comments by the central bank's governor played down the need for urgent monetary action and suggested that the bottom of cycle may be near 1.75% for the cash rate, which currently sits at 2.0%.This means that a cut next month is unlikely. November appears to be a more likely timeframe.

Read More »

Read More »

FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley's remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve Fischer seemed to echo Dudley's sentiment, and this has underpinned the dollar and is the major spur of today's price action.

Read More »

Read More »

Dollar Weakness and Fed Expectations

Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists.

Read More »

Read More »

FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley.

Read More »

Read More »

Speculators Make Small Bets in FX, but Bears Run for Cover in Treasuries and Oil

Summer doldrums continue to depress speculative activity in the currency futures market. In the CFTC Commitment of Traders reporting week ending August 16 speculators made small adjustments to gross currency positions. There was only one change more than 6k contracts. Continue reading »

Read More »

Read More »

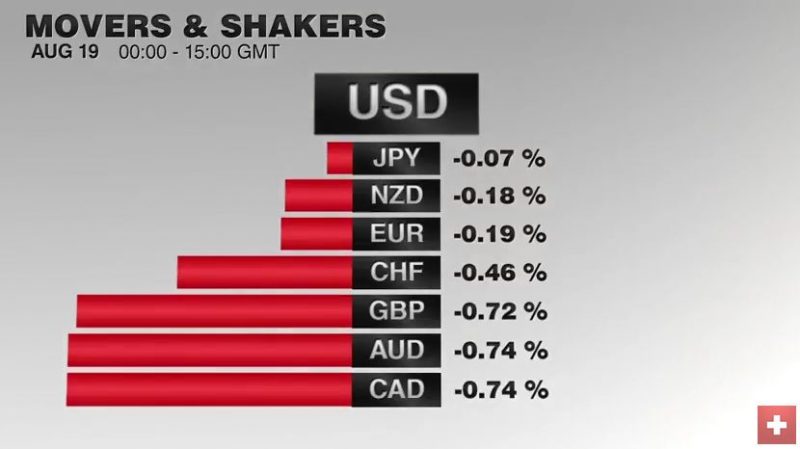

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

The Need for Higher Wages: Lots of Thunder, No Rain

Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who's goal is to boost labor's share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth.

Read More »

Read More »

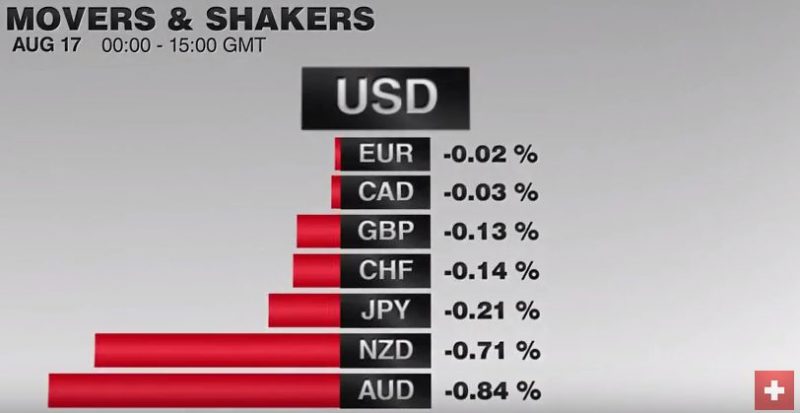

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

Great Graphic: Aussie Tests Three-Year Downtrend

The Australian dollar's technical condition has soured. Market sentiment may be changing as the MSCI World Index of developed equities posted a key reversal yesterday. It is not clear yet whether the Aussie is correcting lower or whether there has been a trend change.

Read More »

Read More »

Yuan and Why

It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with "seeming" and "being". So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest rates down or weakening the yuan? If so what happens when the markets do something which they...

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

Great Graphic: Dollar-Yen–Possible Head and Shoulders Continuation Pattern

This technical pattern is most often a reversal pattern, but not always. It may be a continuation pattern in the dollar against the yen. It highlights the importance of the JPY100 level and warns of risk toward JPY92.50. It aligns well with the sequence of macro events.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »