Category Archive: 8) Economics

Cleveland Fed: Price inflation is a monetary phenomenon

Cleveland Fed: Price inflation is a monetary phenomenon. Hence, the money multiplier theory is still valid, just not in the US and in Europe.

Read More »

Read More »

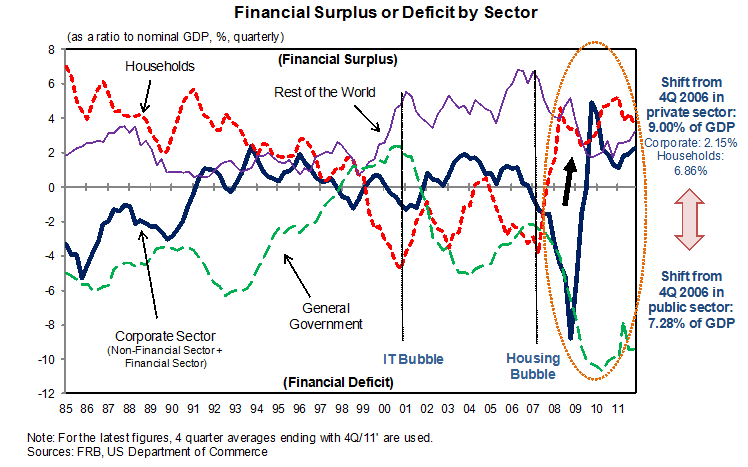

7d) Richard Koo’s and other Sector Balances

A list of long-term sector balances and related provided by Nomura's research institute and its chief economist Richard Koo.

Read More »

Read More »

Hans Werner Sinn’s Piketty Critique: r ≠ i > g

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that r ≠ i > g. Interest rate are usually higher than economic growth, but not necessarily increases of wealth.

Read More »

Read More »

Hans Werner Sinn’s Piketty Critique: “r ≠ i > g”

Hans Werner Sinn has formulated his critique with Piketty. Sinn says that:

r ≠ i > g, hence Interest rates i are usually higher than economic growth g, but r is not the same as i. Hence r can be higher or lower than g.

Read More »

Read More »

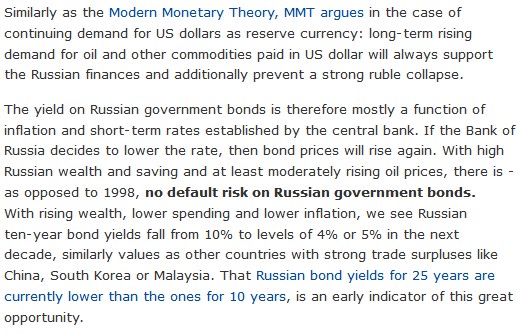

Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation

There are different discussions ongoing if a central bank may monetize debt and act of a quasi-fiscal agent. One opinion was the Modern Monetary Theory that advocates monetizing debt.

Read More »

Read More »

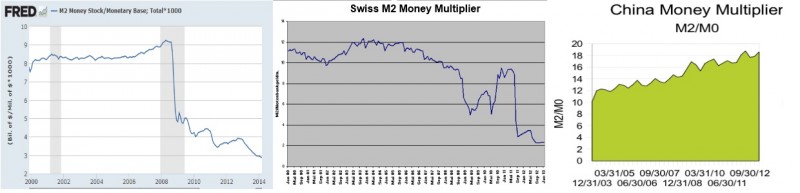

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

The Indian central banker Rajan recently accused his Western colleagues of lax policy until 2007. Furthermore he argued that FX intervention using so-called “quantitative easing or exchange intervention” (QEE) help to dry up the needed money supply in India. We will look on his statement from this money supply angle: In some countries, the money …

Read More »

Read More »

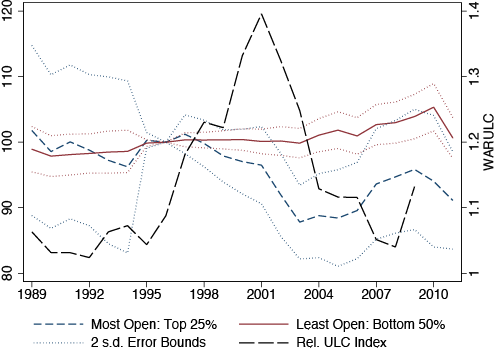

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

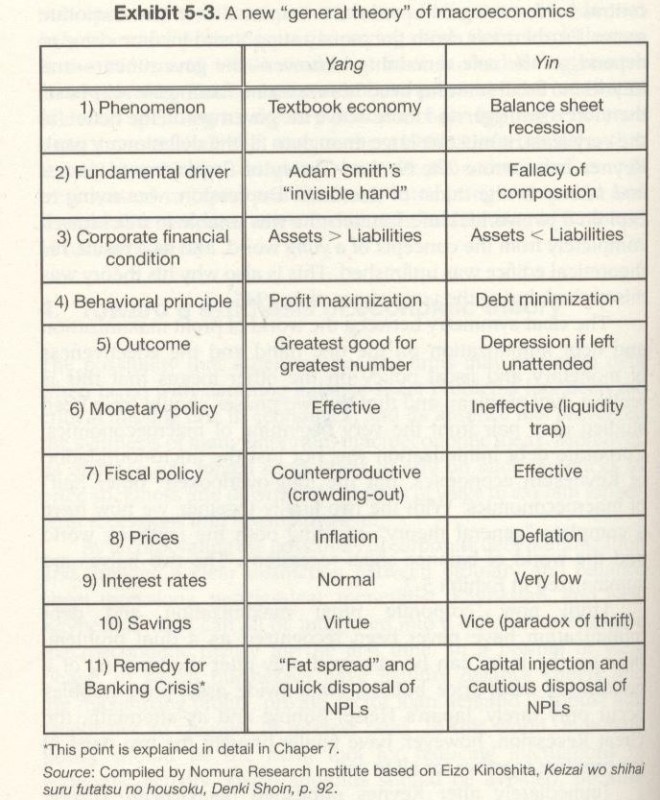

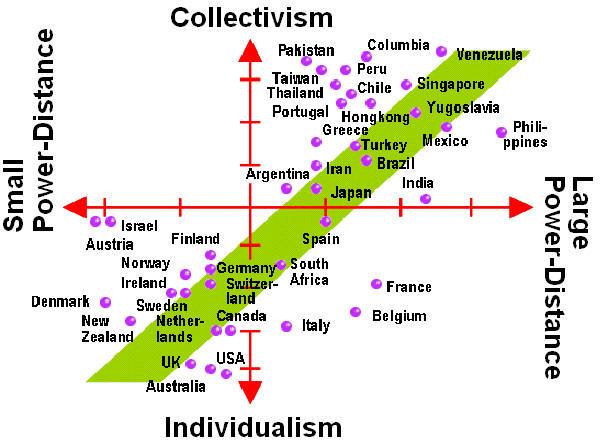

Cultural Reasons for Japan’s Deflation: Can the U.S. Go into a Balance Sheet Recession?

The power distance between employer and employee enforces the importance of the leader, the entrepreneur. Moreover, the collectivite Asian society does not want unemployment, employees prefer to renounce to salary hikes in favor of the collective. These cultural reasons can qualify as drivers of the Japanese balance sheet recession.

Read More »

Read More »

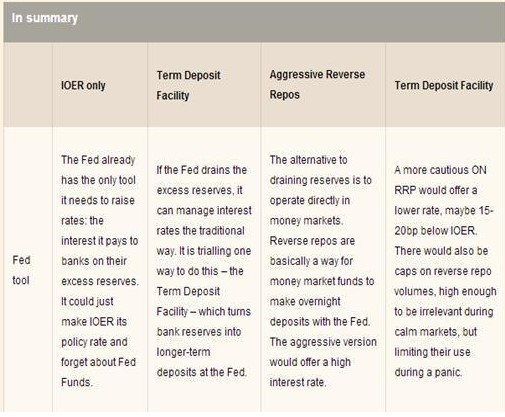

SNB Bills, Chinese Repos and Reverse Repos

A repo provides liquidity to banks while the reserve repos aims to reduce liquidity and reduce inflation. In 2011, the SNB used SNB bills and reverse repos to reduce inflationary pressure. SNB bills are short-term bonds that pay a certain interest.

Read More »

Read More »

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

Somebody who follows regularly the trade balance figures from Eurostat, may have noticed a sentence that was repeated in each monthly release from the Eurostat trade statistics in 2013: “The EU28 trade surplus increased significantly with Switzerland”. The reason was massive gold sales from the UK to Switzerland.

Read More »

Read More »

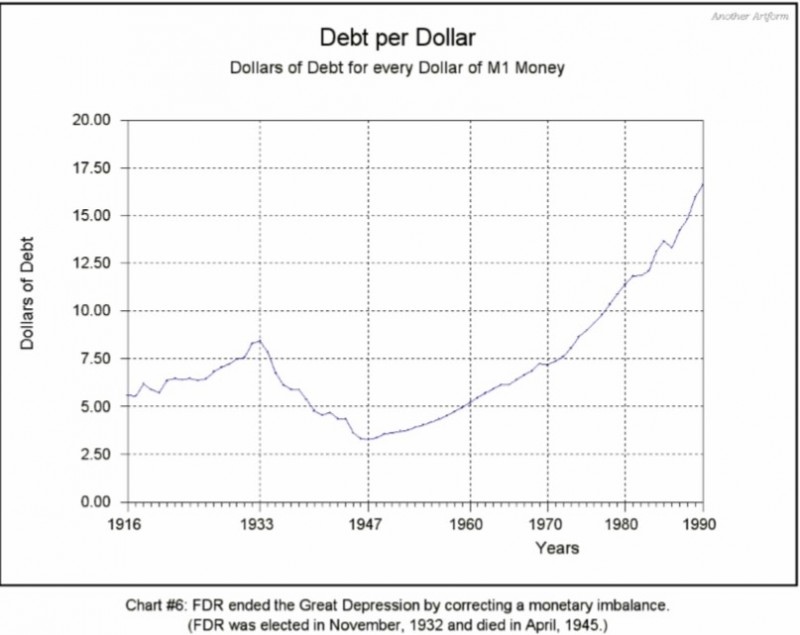

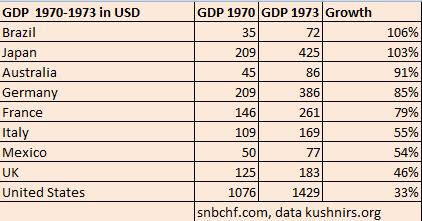

The “Cost-Push Inflation” Myth and the 1970s Stagflation

Economists commonly explain rising oil price between 1998 and 2008 with the growth of emerging markets. We argue that the cost-push inflation of the 1970s was also a reflection of rising global demand.

Read More »

Read More »