(Find the description of MMT on this page)

During a period when international trade was weak compared to today and FX rates did not fluctuate, Milton Friedman wrote:

From Milton Friedman, Capitalism and Freedom, Chapter V

When the initial expenditures failed to eliminate unemployment and were followed by a sharp economic contraction in 1937/38, the theory of “secular stagnation” developed to justify a permanently high level of government spending. The economy had become mature, it was argued. Opportunities for investment had been largely exploited and no substantial new opportunities were likely to arise. Yet individuals would still want to save. Hence, it was essential for government to spend and run a perpetual deficit. The securities issued to finance the deficit would provide individuals with a way to accumulate savings while the government expenditures provided employment. This view has been thoroughly discredited by theoretical analysis and even more by actual experience, including the emergence of wholly new lines for private investment not dreamed of by the secular stagnationists……

[On the balance wheel theory which comes close to MMT]

More recently, the emphasis has been on government expenditures neither to prime the pump nor to hold in check the specter of secular stagnation but as a balance wheel. When private expenditures decline for any reason, it is said, governmental expenditures should rise to keep total expenditures stable; conversely, when private expenditures rise, governmental expenditures should decline. Unfortunately, the balance wheel is unbalanced. Each recession, however minor, sends a shudder through politically sensitive legislators and administrators with their ever present fear that perhaps it is the harbinger of another 1929-33. They hasten to enact federal spending programs of one kind or another. Many of the programs do not in fact come into effect until after the recession has passed…

The haste with which spending programs are approved is not matched by an equal haste to repeal them or to eliminate others when the recession is passed and expansion is under way. ..

On the contrary, it is then argued that a “healthy” expansion must not be “jeopardized” by cuts in governmental expenditures. …

If the balance-wheel theory has in practice been applied on the expenditure side, it has been because of the existence of other forces making for increased governmental expenditures; in particular, the widespread acceptance by intellectuals of the belief that government should play a larger role in economic and private affairs; the triumph, that is, of the philosophy of the welfare state. This philosophy has found a useful ally in the balance-wheel theory; it has enabled governmental intervention to proceed at a faster pace than would otherwise have been possible.

How different matters might now be if the balance-wheel theory had been applied on the tax side instead of the expenditure side. Suppose each recession had seen a cut in taxes and suppose the political unpopularity of raising taxes in the succeeding expansion had led to resistance to newly proposed governmental expenditure programs and to curtailment of existing ones. We might now be in a position where federal expenditures would be absorbing a good deal less of a national income that would be larger because of the reduction in the depressing and inhibiting effects of taxes.

Nick Rowe argues that the MMT view of the IS-LM model has some issues. While the MMT proponent Warren Basler answers that the IS-LM model is based on fixed exchange model. This is taken over by the Austrian economist Robert P. Murphy, arguing that MMT completely left out the trade deficit. Murphy adds:

And there you have it: When MMTers speak of “net saving,” they don’t mean that people collectively save more than people collectively borrow. No, they mean people collectively save more than people collectively invest.

On the FX rate as automatic stabilizer

MMTers claim that the FX rate is an automatic stabilizer that makes e.g. US products cheaper again, when the government follows the MMT doctrine and increases debt.

We think that, as long as wage (and implicitly inflation) increases in the “crisis countries”, United States and Southern Europe are smaller than in the rest of the world, due to missing (relative) competitiveness and the repayment of debt, the MMT strategy may be successful, in the sense that locals will buy their government bonds.

But when wages rise too much, inflation will move upwards and consequently interest and borrowing rates. The FX rate might have helped to make labour cheaper, but the other major production factor, capital, will have become far more expensive.

On monetizing debt

But what happens when wages and short-term interest rates move up again? Will central banks sit on a lot of debt with high interest rates?

Will the Fed never be able to raise rates again? What will happen when in 100 or 200 years the United States will be stripped off its reserve currency status and when it becomes an economic slave to China, Russia, India and Germany, just like Germany was in 1923 or like countries of Emerging Markets and poorer countries are to cheap money from the Fed and U.S. investors? In the article Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation we discuss briefly that already today the U.S. is partially losing its status as world reserve currency.

Economonitor discusses the closely related issue, namely that central bank are no source of funds for lending and implicitly for fiscal expenses.

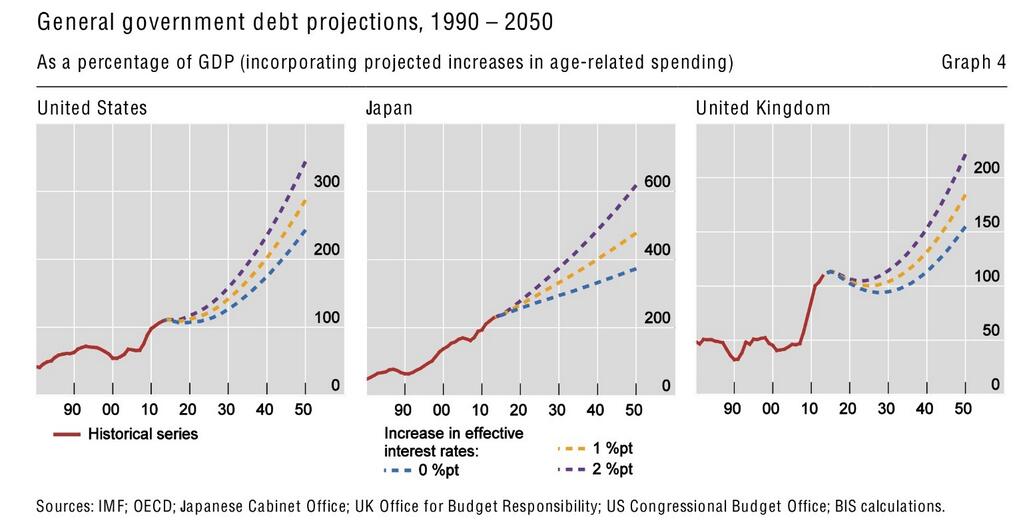

Economists like Kyle Bass of Hayman Capital insist that in the future government debt levels, our driver number 4 for government bond yields, will be the key driver of government bond yields. This is in particular valid for Japan from the moment when criterion 5b, the current account balance, becomes negative. Moreover Bass claims that the level for total government debt, not only the level of foreign debt, is important.From time to time, there are suggestions that the future seigniorage income of a central bank is an asset that is available for current lending. Buiter (2008) argues that the discounted present value of future seigniorage should be included as an asset on the balance sheet of the central bank, implying a large capacity to sustain losses. Soros (2012) sees it as a source of funds (via a Special Purpose Vehicle) for buying the debts of stressed eurozone sovereigns.

This note argues that it is wrong to consider the future seigniorage income of central banks as a source of funds for current lending.

(source Economonitor)

In a new investor letter -- posted on ZeroHedge -- Bass takes aim at critics who think that Japan (or the US, presumably) can create money at will, and not have to worry about their burgeoning national debt loads. "The fallacy of the belief that countries that print their own currency are immune to sovereign crisis will be disproven in the coming months and years. Those that treat this belief as axiomatic will most likely be the biggest losers. A handful of investors and asset managers have recently discussed an emerging school of thought [MMT], which postulates that countries, as the sole manufacturer of their currency, can never become insolvent, and in this sense, governments are not dependent on credit markets to remain fiscally operational. It is precisely this line of thinking which will ultimately lead the sheep to slaughter. " (Source Business Insider)Kyle Bass' arguments are rejected by many opinion leaders that maintain that inflation remains far too important as a driver for government bond yields for countries with high wealth and low foreign debt:

Another way of saying this is that Japan and the USA cannot “run out of money” while a nation like Greece most certainly can. There is a very real solvency constraint in Greece so bond traders have different concerns than they might in Japan or the USA. It’s been widely reported that Hayman’s funds have suffered substantial losses in the last few years in large part due to this trade. The flaw in the Kyle Bass thesis is that interest rates will surge due to market fears over high debt. But seasoned bond traders know that solvency is not the concern in a nation like Japan or the USA. They know that these nations cannot run out of money due to institutional design. So the focus then, is always inflation. And the reason Japan’s bond market has continued to rally throughout the years is due to persistent stagnant economic conditions and low inflation as a result. We feel that the environment in the USA is remarkably similar to the environment in Japan. But more importantly, we must note that it is crucial to understand this institutional design structure before entering into potentially misguided trades based on an apples to oranges (Europe vs Japan) comparison. (Source Cullen Roche, ORCAM Macro)

While Cullen Roche seems to be right on "stagnant economic conditions" and implicitly inflation expectations, he is apparently wrong on peripheral bond yields: Falling and stagnating wages have also depressed yields of peripheral bonds so that for a certain period even Spanish bonds yielded less than US Treasuries.

A mistake in the MMT thinking? Why are Europe and Japan different if wages in the periphery are falling and euro zone austerity policy helps to avoid inflation and default risks?

Furthermore, why does MMT exclude the possibility that in an ageing society the smaller and smaller share of workers demand higher salaries with time? What is when Japan's wages rise by 5% each year: Won't inflation rise to around 5% and bond yields maybe too? Could bond yields even rise to values higher than the inflation rate? In the year 1998, Germany saw bond yields bond yield rise to 5% despite inflation levels of 1%.

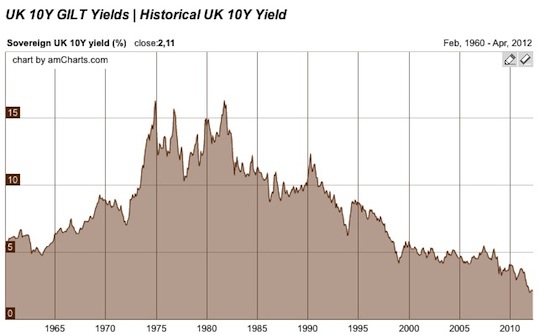

And maybe over time, high debt leads to a weaker currency, higher (imported) inflation and potentially even to a wage-price spiral and high bond yields? The history of UK bond yields, a country that is able to issue its own currency and a former world reserve currency, shows what can happen in a wage-price spiral.

At the time in the 1970s, the UK had low debt levels and quite strong nominal GDP growth. But imagine nowadays when all remaining debt needs to be rolled over with high interest rates.

The Bank of International Settlement (BIS) gives the following consequences of higher interest rates: An explosion of public debt.

At the time in the 1970s, the UK had low debt levels and quite strong nominal GDP growth. But imagine nowadays when all remaining debt needs to be rolled over with high interest rates.

The Bank of International Settlement (BIS) gives the following consequences of higher interest rates: An explosion of public debt.

Why MMT's "apples to oranges (Europe vs Japan) comparison" was wrong: The new Widow Maker trade: Shorting Italian government bonds

In following paper Eichengreen, Chitu and Mehl show that “financial deepening” and wealth is most important driver of a reserve currency.

Chiţu, L, B Eichengreen and A Mehl, “When Did the US Dollar Overtake Sterling as the Leading International Currency? Evidence from the Bond Markets”, Journal of Development Economics, forthcoming and VoxEU, Online Link

We show that China will overtake U.S. wealth i some years time.

Read also:

B. Eichengreen, Mehl, A., Chitu, L: “One or multiple international currencies? Evidence from the history of the oil market”, VoxEU, Online link

See more for

4 comments

Skip to comment form ↓

Frances_Coppola

2014-11-27 at 19:43 (UTC 2) Link to this comment

It would help if those who talk about the UK actually knew of what they speak. The spike in bond yields in 1975 was due to a run on sterling because of inflationary worries – with reason, since the UK’s inflation rate in 1975 touched 26%. The UK still had exchange controls at the time and was therefore forced to defend by raising interest rates. Bond yield rises inevitably followed – oh, and an IMF intervention in 1976. Please, do your homework before writing posts….

GeorgeDorgan

2014-11-28 at 09:11 (UTC 2) Link to this comment

Then we come to the discussion what determines longer term bond yields. Three alternatives:

1) The central bank or

2) inflation expectations

3) currency devaluation (you do not buy bonds if the currency is in free fall, see currently the Russia case)

Read for this sake:

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

https://snbchf.com/monetary-fiscal-policy/inflation-expectations-gdp-growth-bond-yield/

What Drives Government Bond Yields?

https://snbchf.com/global-macro/government-bond-yields/

The collapsing currency is not fully finished, but started in the second part of bond yields for emerging markets

https://snbchf.com/global-macro/government-bond-yields-emerging-markets/

I would judge that the collapsing currency was the main reason for high yields in the 1970s. Then inflation expectations, then the central bank.

GeorgeDorgan

2014-11-28 at 09:56 (UTC 2) Link to this comment

Frances, still I miss what you actually criticize apart from throwing insults on the arguments of the people cited or rephrased above.

Frances_Coppola

2014-11-28 at 10:27 (UTC 2) Link to this comment

George,

Your description of the UK of 1975 as having low debt levels and quite strong NGDP is not one I recognise. Its debt levels were not particularly low for an advanced economy at that time, and the term “stagflation” was inventd by a Beitish politician…..NGDP may have been strong, but it was mostly inflation. RGDP was on the floor. Indeed the proximate cause of the UK’s exceptionally high inflation was the Chancellor’s fiscal and monetary stimulus in a “dash for growth”. I wonder if you have confused MMT with market monetarism: to my knowledge MMT apologists do not concern themselves with NGDP.

However, if you look at bond yields for all advanced economies at that time you will see the same pattern. UK was not alone. The “great inflation” was driven ultimately by global conditions – oil price rises due to two wars. I guess this supports your argument that the external constraint is important, but then I don’t disagree with that.