Category Archive: 8) Economics

How European Leaders Are Successfully Implementing Say’s Law

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

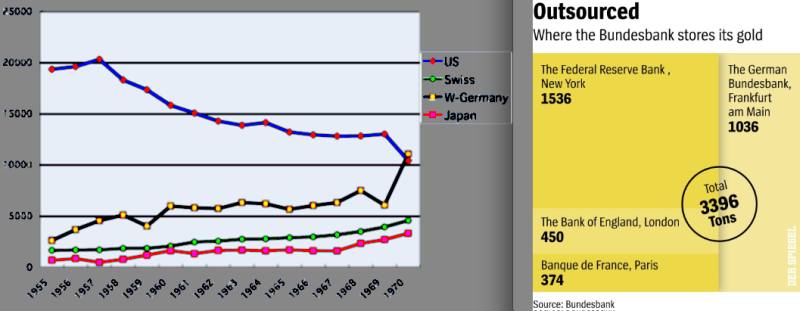

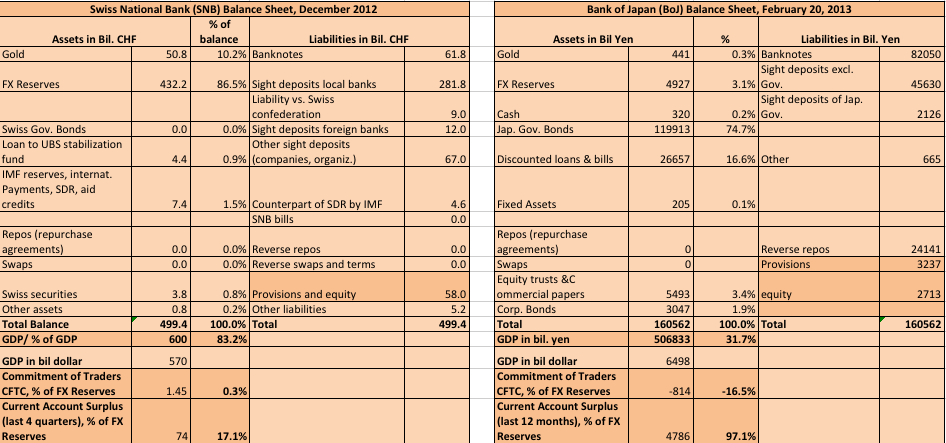

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

History of Wrong Forecasts by Swiss and Fed Economists: Update September 2013

Or how to talk down and how to talk up an economy with wrong forecasts American and Swiss mentalities are very different, the Americans have the tendency not to care about the future a lot, the Swiss, however, do things only after careful consideration of potential risks. This tendency can be proven economically with … Continue reading...

Read More »

Read More »

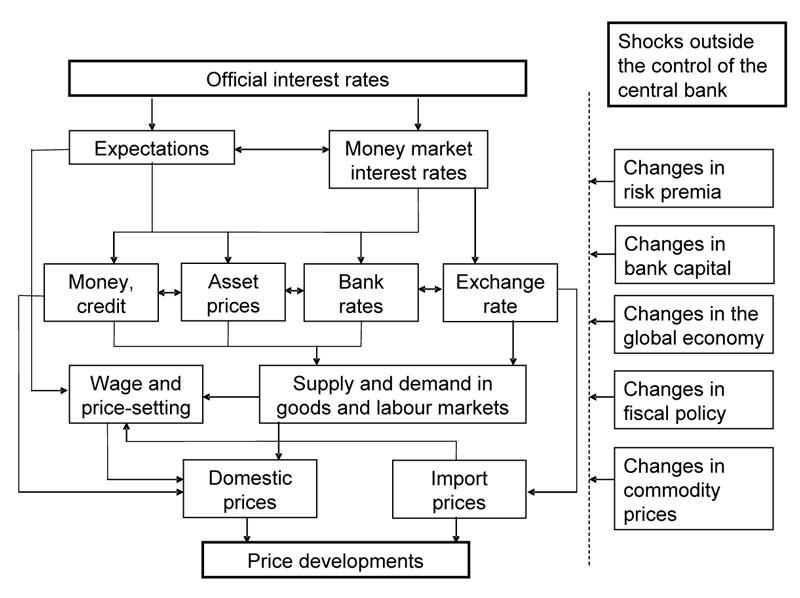

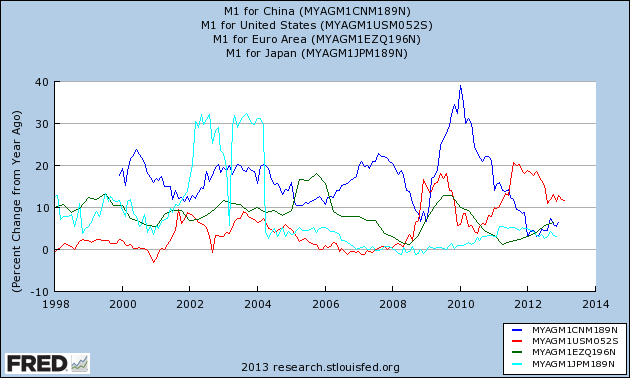

Quantitative Easing, its Indicators and the Swiss Franc, Update FOMC September 2013

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and both safe-havens like the CHF, gold or the Japanese …

Read More »

Read More »

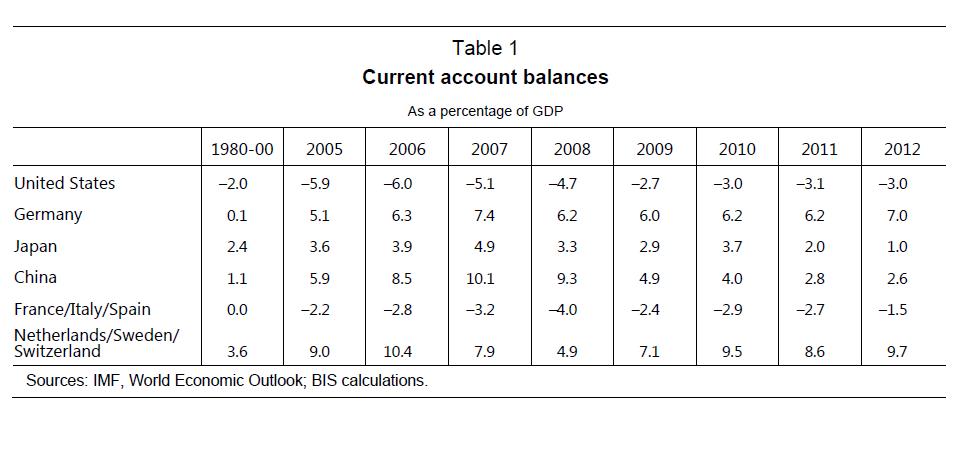

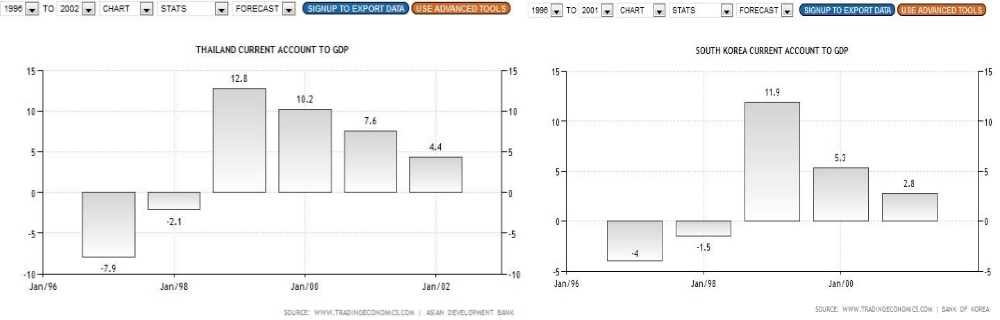

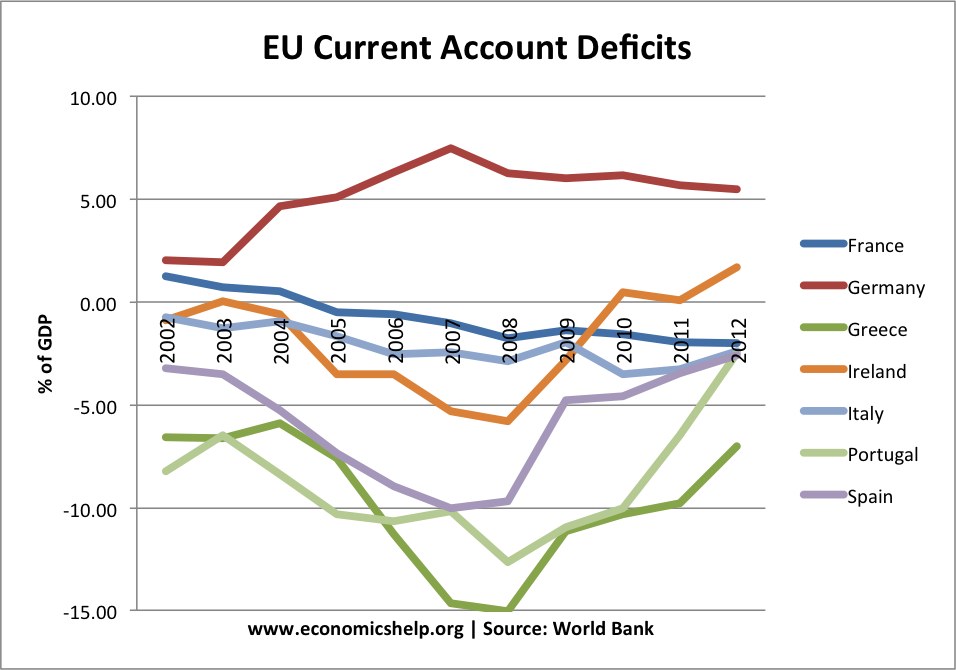

Overlending and Global Imbalances in Current Accounts

Some extracts from BIS Working Papers No 419 Caveat creditor: The Bank for International Settlement stresses the importance of getting "overlending" under control.

Read More »

Read More »

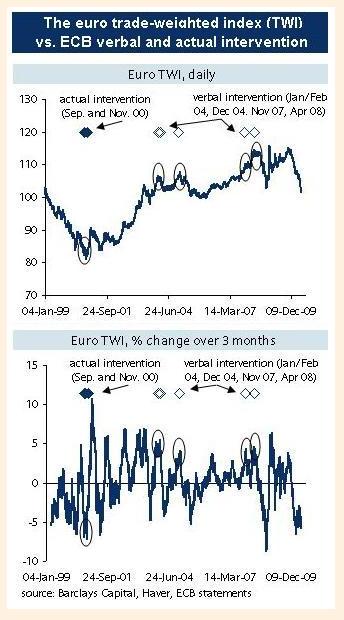

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »

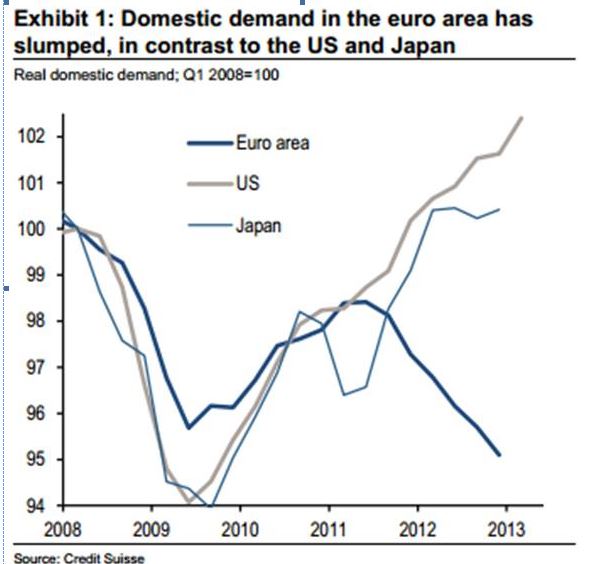

Strong Dollar: the Parallels Between Now, the 1980s and 1998-2002, Part 1: Austerity

We examine the relationship between strong dollar phases and austerity in other parts of the world. Between 1983 and 1985 one reason for the strong dollar were high real interest rates in the U.S. after the defeat of the Great Inflation period, the enforced austerity in Southern America and cheap commodity prices caused by generally …

Read More »

Read More »

Why negative interest rates are contractionary, the base money confusion

From FT Alphaville: Excess reserves do not mean banks are not lending, and enforcing negative rates may do more harm than good because it is ultimately contractionary rather than expansionary.

Read More »

Read More »

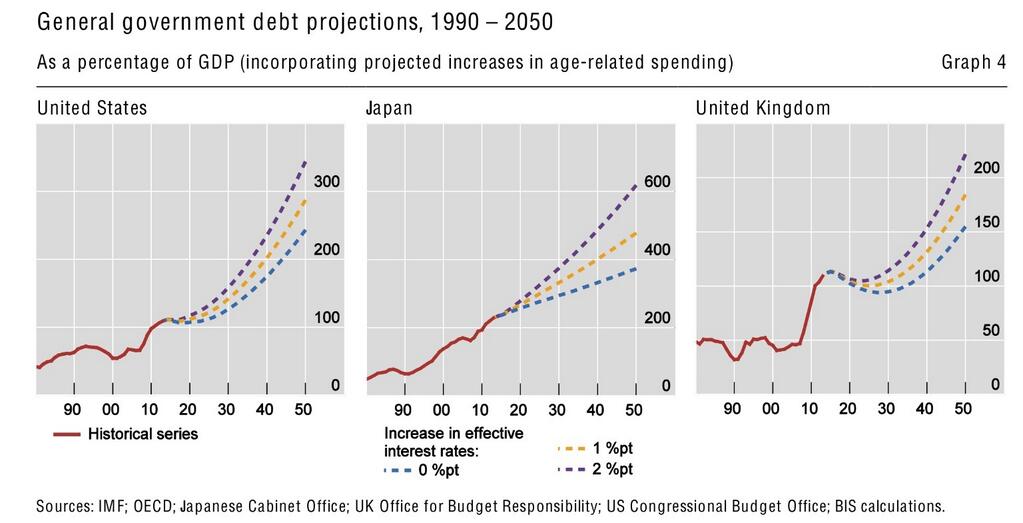

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

The Inflation Lie? Why and When Inflation Will Come Back

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »