Category Archive: 8) Economics

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »

Quantitative Easing: The Fed Wants Americans to Continue Deficit Spending

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This usually pushes down the dollar and inflation hedges like the Swiss franc and …

Read More »

Read More »

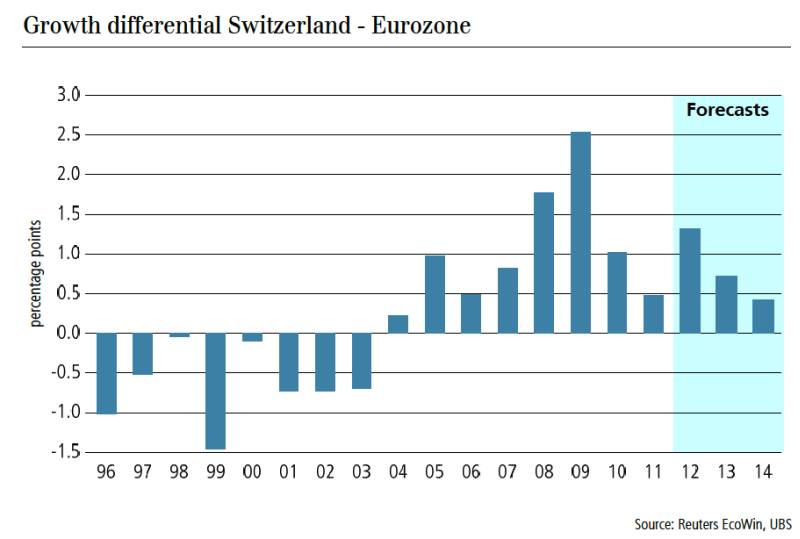

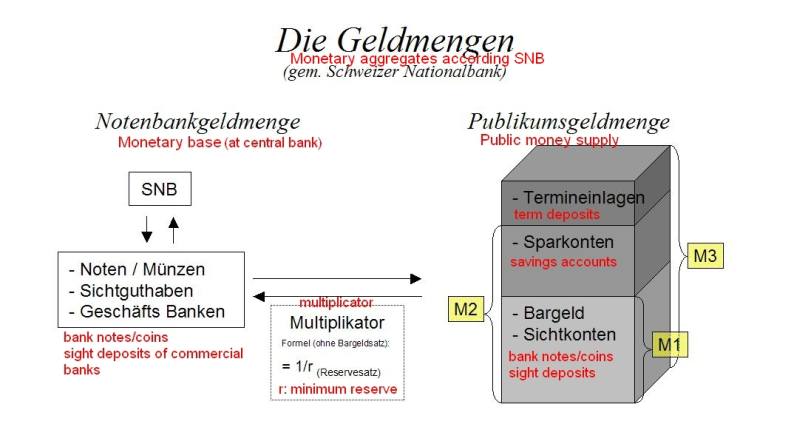

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »

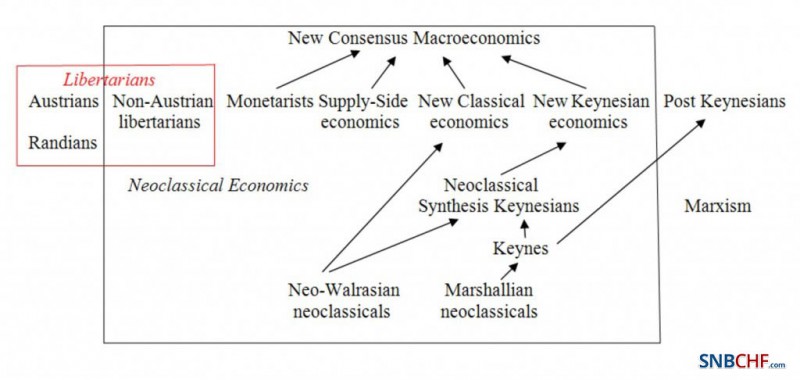

Robert Mundell: Why Libertarians Must Love the Euro

The idea that the euro has "failed" is dangerously naive. The euro is doing exactly what its progenitor planned for it to do. According to Robert Mundell, the creator of the Optimum Currency Zone concept, the euro would really do its work when crises hit. Removing Keynesian monetary and fiscal juice to pull a nation out of recession. More about this evil genius on

Read More »

Read More »

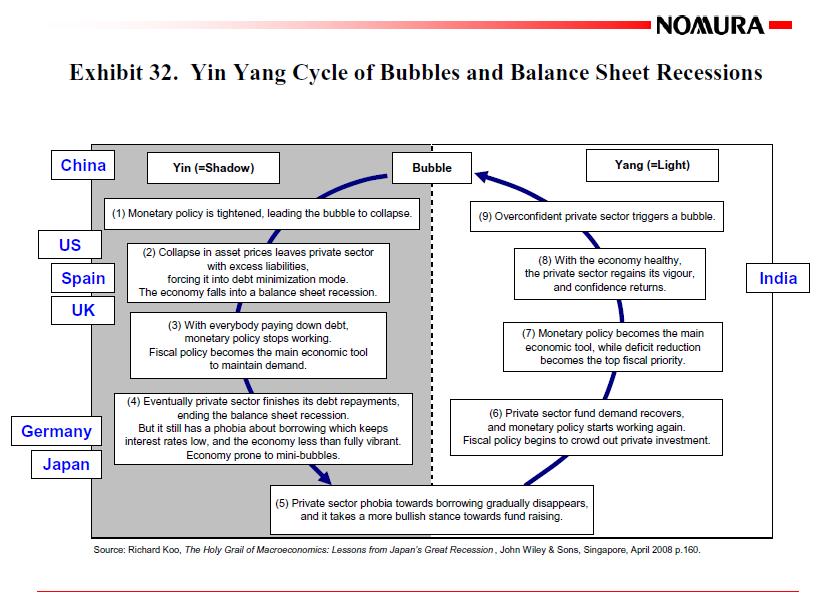

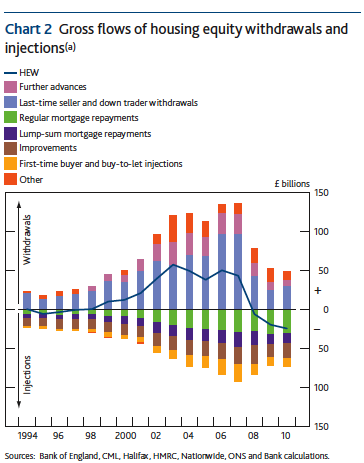

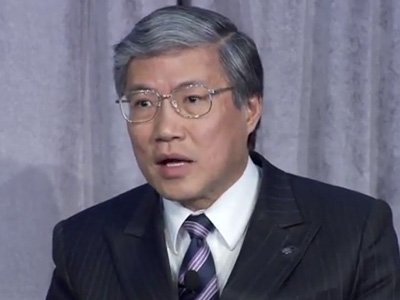

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

Don’t Sell Economic Stability to Buy Economic Growth, Warns Tomáš Sedláček

Don’t sell economic stability to buy economic growth,” warned Tomáš Sedláček, chief macroeconomic strategist at CSOB Bank. Sedláček’s unconventional view is that our problem is not lack of growth but too much of it. See more at the

Read More »

Read More »

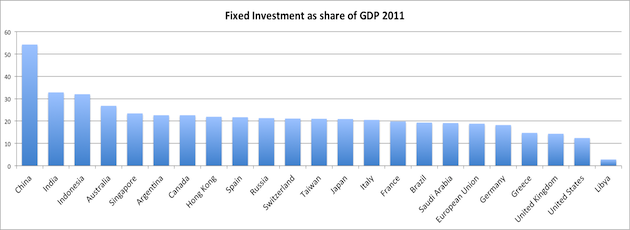

Is China’s Growth Rate Healthy Now? Golden Rule of Capital

After a slowing in Chinese growth this year, economists recently stated that a hard landing has been avoided and that the economy might have bottomed out. Marc Faber has changed his mind and considers buying Chinese stocks. Also Sprach Analyst provides the following data: Sequential growth rates since Q1 through Q3 were 1.5%, 2.0% and 2.2% respectively, or in annualised annual rate, 6.16%, 8.24%, and 9.09% respectively. Compared that with the...

Read More »

Read More »

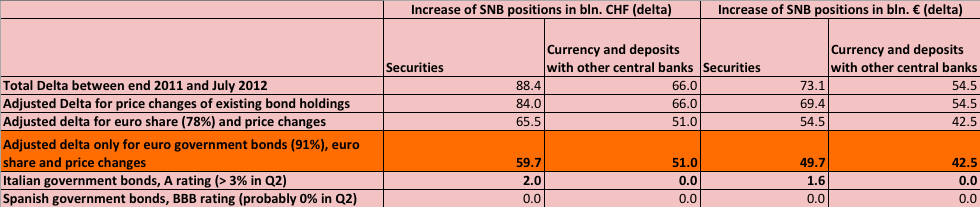

Order the Full Report on the S&P Critique

In the full report we explain in detail how one can analyze the balance sheet of the Swiss National Bank (SNB) based on several sources of information, for example the monthly bulletin, which shows the changes of the SNB balance sheet and the quarterly distribution of the SNB assets including the information about FX … Continue reading...

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

Swiss Franc at record highs (May 2011)

May. 27th 2011 Extracts from the history of the Swiss franc (May 2011) This month, the Swiss Franc touched a record high against not one, but two currencies: the US dollar and the Euro. Having risen by more than 30% against the former and 20% against the latter, the franc might just be the world’s … Continue reading »

Read More »

Read More »

EUR/CHF: A History of Interventions, April 2010

April 2010 Quick Look At The Order Books AUD/USD: stops below .9135 and again below .9070 USD/JPY: solid bids 92.70, stops below 92.40, heavy semi-official bids expected at 91.50 ( I’m hearing of “massive” stops below 90.50 so if market gets on a roll lower keep this level in mind) EUR/USD: looks like the order … Continue reading »

Read More »

Read More »