“Don’t sell economic stability to buy economic growth,” warned Tomáš Sedláček, chief macroeconomic strategist at CSOB Bank. Sedláček’s unconventional view is that our problem is not lack of growth but too much of it.

“Don’t sell economic stability to buy economic growth,” warned Tomáš Sedláček, chief macroeconomic strategist at CSOB Bank. Sedláček’s unconventional view is that our problem is not lack of growth but too much of it.

via CFA Institute, Usman Hayat, CFA

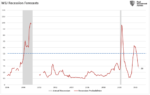

See more for“Don’t sell economic stability to buy economic growth,” warned Tomáš Sedláček, chief macroeconomic strategist at CSOB Bank and author of The Economics of Good and Evil (Oxford University Press 2011), to an audience of investment professionals at the CFA Institute European Investment Conference in Prague. Sedláček’s unconventional view is that our problem is not lack of growth but too much of it. He believes that the role of the economist should not be to encourage economic growth but to decrease the swings of the business cycle.

Sedláček said that there are parallels between how a depressed economy is treated by today’s economists and how a depressed patient is treated by doctors. The economist’s prescription of running budget deficits and thereby increasing debt is similar to the doctor’s prescription of anti-depressants. The problem with both debt and anti-depressants is that they can become addictive.

“Our problem is not lack of growth but too much of it,” Sedláček said. An economy that uses debt to grow must continue to do so by taking on more and more debt or, alternatively, face a slowdown that will lead to bankruptcy. It is like owning a car that explodes when it stops, argued Sedláček.

In Sedláček’s view, European countries have amassed “a Mount Everest of debt” to continue to grow, which becomes a problem in economic slowdown. He contends that in the past, economists sold stability to buy growth but now we need to do the opposite: to sell growth to buy stability.

He argued that Greece is not behind the rest of Europe but ahead of it because it has gone bankrupt before the rest of Europe. If other European countries do not change their economic course, he argued, they will follow Greece. He also highlighted Ireland, which used to be in a much worse economic situation than Greece. Before the start of the financial crisis in 2008, Ireland was portrayed as an example of achieving economic success through debt-driven economic growth. Now Ireland has come full circle, and the financial crisis has exposed the Irish model.

Elaborating on his point of debt and growth, Sedláček suggested that an economy with no debt and no growth has to face social problems but not bankruptcy. An economy grown through debt has to face both social problems and bankruptcy sooner or later. More credit and better credit ratings cannot solve the problem caused by excessive credit and questionable ratings. He said that the words “debt” and “credit” used in modern finance bear similarities to the words “sin” and “faith” in the Christian scriptures and that we have become “slaves of debt” in the same way that the Bible warned people of becoming “slaves of sin.”

He referred to the “subject–object reversal” that is found in myths such as Aladdin or the Golem of Prague. Sedláček said that this reversal is also portrayed in modern movies, where human beings create machines to serve them as slaves but the machines take over and enslave human beings. Sedláček is of the view that the same subject–object reversal has happened in debt-driven economic growth. It was supposed to serve us and lead us to prosperity, but now we are serving it and it is taking prosperity away from us.

Sedláček explained that economists were prescribing policies that favour debt-driven growth because they were under the false impression that they have the economies figured out. The financial crisis has brought back the realisation that there is a lot of uncertainty in how economies work and we cannot predict the effect of a contractionary or expansionary monetary policy. This uncertainty calls for a cautious approach favouring economic stability rather than economic growth. If you were driving a car in which the brakes and accelerator randomly swapped, you would drive it very slowly. We, however, were racing with it, argued Sedláček.

Sedláček is clearly in love with what he calls the “beautiful economics” but is critical of how it is being taught and applied. To quote from the conclusion of his book, The Economics of Good and Evil:

For economists, the philosophical question ‘what do we think a human being is?’ needs to be rethought. Perhaps we also teach economics in a strange way. Although we are the strongest believers in human freedom of choice, we do not allow students to choose their own school of economic thought; we teach them the mainstream only. After they are safely indoctrinated for a couple of years, only then may they learn of alternative, ‘heretical’ approaches — and a history of their own field. Even the history of economics is often thought of as a display of ‘trials and errors’ of the (stupid and primitive) history before us — before we finally hit the mainstream truth, which the past was so clumsily grasping for. This book tries to take the exactly opposite tack, to take our present state of the art with a grain of salt and take ideas of our forefathers a bit more seriously. Let us hope that we will be treated as kindly by our sons and daughters. Wild things are not in the past, in heroic stories and movies, or in distant jungles. They are within us.