Richard C. Koo

Chief Economist

Nomura Research Institute

March 16, 2012

The ongoing eurozone crisis has prompted many to argue that monetary union without fiscal union was bound to fail. As fiscal union would require some form of political union, those who are pessimistic about the latter’s prospects are now calling for a significant shrinkage of the eurozone or an outright dissolution of the euro. Others are arguing that a fiscal straightjacket in the form of a fiscal compact is the only option. This paper argues that the eurozone can still function as a viable currency zone without a fiscal union or fiscal straightjacket if the nature of the crisis is correctly understood and one simple constraint is introduced into the government bond markets of member countries.

Two Opposing Macroeconomic Problems

The current crisis in the eurozone consists essentially of two macroeconomic problems and one capital flow problem. The first macro problem is profligate government spending, as exemplified by Greece. In such cases austerity is required: the government must cut spending and raise taxes to regain its financial health and credibility.

The second macro problem is massive private sector deleveraging in spite of record low interest rates observed in countries such as Spain, Ireland and Portugal following the bursting of their real estate bubbles. The private sectors in these countries are minimizing debt instead of maximizing profits to repair balance sheets plunged underwater when asset prices collapsed but liabilities remained. But when the private sector as a whole is saving money even with near-zero interest rates, the saved funds will leak from the income stream and trigger the kind of deflationary spiral now known as a balance sheet recession. Left unattended, these economies will follow the path of the US during the Great Depression, when GDP shrank 46 percent in just four years because everyone was paying down debt and there were no borrowers.

Monetary policy is largely ineffective in this type of recession because those whose balance sheets are underwater are not interested in increasing their borrowings at any interest rate. Nor will there be many lenders, especially when the lenders themselves suffer from balance sheet problems. The only way to prevent the economy from falling into a deflationary spiral in such a recession—which happens only after the bursting of a debt-financed bubble—is for the government to borrow and spend the excess private savings.

Japan has used such policies to keep its GDP above bubble-peak levels for the last two decades even as an 87 percent decline in commercial real estate values prompted massive corporate deleveraging. Unfortunately, Japan’s lessons went largely unrecognized in the West until the 2008 Lehman failure and subsequent financial crisis because the economics profession gave little consideration to recessions caused by private-sector deleveraging at a time of near-zero interest rates.

The first macro problem demands fiscal austerity, but the second requires fiscal stimulus. Any solution to the eurozone crisis must address both of these challenges.

Destabilizing Capital Flows Unique to Eurozone

The capital flow problem in the eurozone is not only highly pro-cyclical and destabilizing, but also unique to the eurozone. The existence of these flows made the region’s asset bubbles and balance sheet recessions far worse than elsewhere. Here, a comparison with the UK and the US may help us understand the nature of the problem.

Today the US and the UK are also experiencing severe balance sheet recessions following the bursting of asset price bubbles, with the private sector undertaking massive deleveraging in spite of near-zero interest rates. The two countries are also running large trade and budget deficits. In spite of those twin deficits, however, government bond yields have fallen to historically low levels in both countries, with ten-year government bond yields hovering around 2 percent. With bond prices at all-time highs, there is no talk of a sovereign debt crisis. The same compression in bond yields was observed in Japan, where the concept of balance sheet recessions originated more than fifteen years ago. In contrast, bond yields in Spain, Portugal and Ireland have rocketed higher even though all three are in balance sheet recessions and are generating large private savings.

This difference in the behavior of bond markets stems from the fact that fund managers in non-eurozone countries face one constraint that their counterparts in the eurozone do not. When presented with a deleveraging private sector, fund managers in non-eurozone countries can place their money only in their own government’s bonds if constraints prevent them from taking on more currency risk or principle risk. Consequently, a large portion of excess private savings must be invested in JGBs in Japan, Gilts in the UK, and Treasuries in the US.

In contrast, eurozone fund managers who are not allowed to take on more principle risk or currency risk are not required to buy their own country’s bonds: they can also buy bonds issued by other eurozone governments because they all share the same currency. Thus, fund managers at French and German banks were busily moving funds into Spanish and Greek bonds a number of years ago in search of higher yields, and Spanish and Portuguese fund managers are now buying German and Dutch government bonds for added safety, all without incurring foreign exchange risk.

The former capital flow aggravated real estate bubbles in many peripheral countries prior to 2008, while the latter flow triggered a sovereign debt crisis in the same countries after 2008. Indeed, the excess domestic savings of Spain and Portugal fled to Germany and Holland just when the Spanish and Portuguese governments needed them to fight balance sheet recessions. That capital flight pushed bond yields higher in peripheral countries and forced their governments into austerity when their private sectors were also deleveraging. With both public and private sectors saving money, the economies fell into deflationary spirals which took the unemployment rate to 23 percent in Spain and to nearly 15 percent in Ireland and Portugal. With the recipients, Germany and Holland, also aiming for fiscal austerity, the savings that flowed into these countries remained unborrowed and became a deflationary gap for the entire eurozone. It will be difficult to expect stable economic growth until something is done about these highly pro-cyclical and destabilizing capital flows unique to the eurozone.

The Solution

There is a simple and straightforward solution to the two macro problems and one capital flow problem described above: eurozone governments should limit the sale of their government bonds to their own citizens. In other words, only German citizens should be allowed to purchase Bunds, and only Spanish citizens should be able to buy Spanish government bonds. If this rule had been in place from the outset of the euro, none of the problems affecting the single currency today would have happened.

The Greek government could not have pursued a profligate fiscal policy for so long if only Greeks had been allowed to buy its bonds, since private-sector savings in the country was nowhere near enough to finance the government’s spending spree.

The second macro problem—balance sheet recessions—can also be addressed with this rule because it allows governments to run the larger deficits necessary to fight this type of recession if they can convince their citizens of the need for such action. Because it provides both discipline and flexibility, this rule is far better than the current treaty provision limiting budget deficits to 3 percent of GDP.

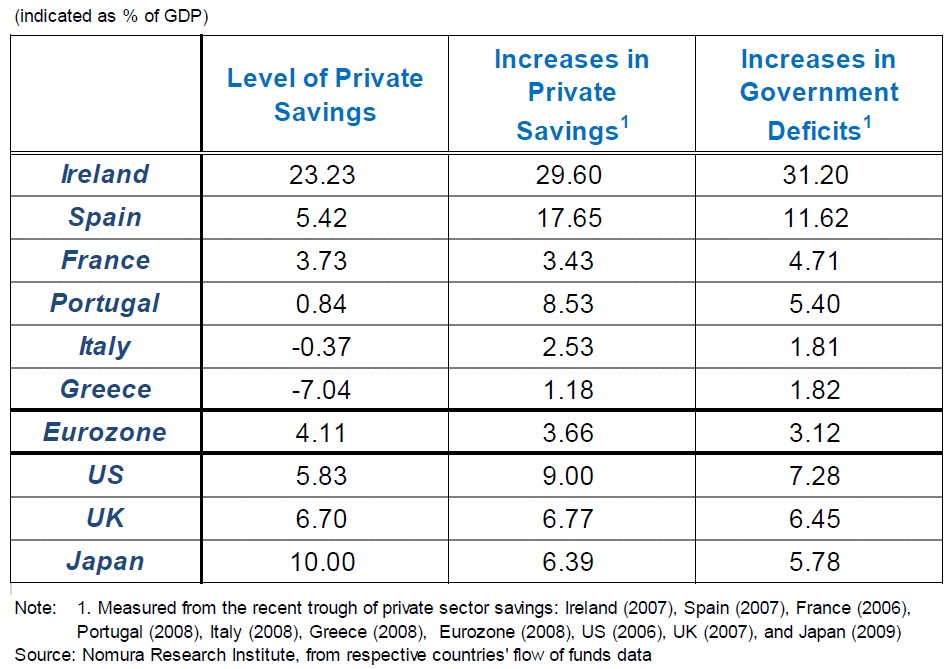

In fact, the current treaty makes no provision whatsoever for balance sheet recessions, in which the private sector may generate savings far in excess of 3 percent of GDP. Spain’s private sector, for example, is currently saving 6 percent of GDP, and the corresponding figure for Ireland is over 20 percent, both in spite of near-zero interest rates. When these governments are prohibited from borrowing more than 3 percent of GDP, the remaining (unborrowed) private savings can trigger deflationary spirals with devastating consequences.

The new rule will also resolve the capital flight problem by preventing Spanish savings from flowing into German Bunds. This will prompt Spanish fund managers facing private sector deleveraging to invest in Spanish government bonds, just as their counterparts in the US, UK or Japan must buy bonds issued by their own governments. That would allow Spanish government bond yields to come down to UK—if not to US—levels. With low bond yields and high bond prices, talk of a sovereign debt crisis would also disappear.

This rule would also ensure fiscal sovereignty for individual countries instead of subjugating them to bureaucrats in Brussels or politicians in Berlin. With large cultural and economic differences existing even between Germany and France, eurozone governments—which effectively gave up monetary sovereignty—actually need enhanced fiscal freedom if they are to remain accountable as democratic representatives of the people. Indeed the challenge for democracy in the eurozone is how to make citizens feel they are empowered to decide their own destiny without jeopardizing the credibility of the euro as a common currency. A rule limiting the issuance of government bonds to citizens of the issuing nation would address this challenge.

Orthodox Reactions of Eurozone Officials

The initial reaction of most eurozone officials to this proposal is outright dismissal; they argue it does not even deserve consideration because it runs counter to the principle of a single market. But the single market they are trying to defend is in danger of falling apart precisely because the problems the rule is trying to address have gone unaddressed.

These officials’ reactions soften a bit when it is pointed out that this rule applies only to holdings of government bonds and that all private-sector financial assets will remain free of capital controls. Thus German banks will still be allowed to buy Spanish corporate paper, and Portuguese fund managers will still be permitted to invest in German equities. The fact that efficiency gains from the enlarged market really accrue only to the private sector means that gains from the single currency will remain largely intact.

There is no evidence that government access to the enlarged market has improved public sector efficiency. It is hard to see, for example, how German bank purchases of Greek debt improved efficiency in any part of the eurozone. On the contrary, the ease of raising funds in the enlarged market often led to fiscal profligacy, as the Greek example demonstrates.

By internalizing fiscal issues, this rule also frees the ECB from having to worry about fiscal problems in member countries and allows it to concentrate on running monetary policy. Under it, the fiscal issues of individual countries are no longer eurozone issues—if the Greek government defaults, after all, only the Greek people will be hurt.

The ECB, of course, must be able to buy and sell government bonds of member nations in the conduct of monetary policy (the ECB should be accorded senior creditor status on its holdings to protect it from losses). Foreign governments and international financial institutions may hold those bonds for reserve management purposes. Special bonds may have to be issued outside the citizens-only rule in the event of natural or man-made disasters. But apart from such cases, foreign private-sector investors should not be allowed to participate in the government bond markets of individual member countries.

If this rule is adopted, governments may create incentives for their citizens to hold more government bonds in what some may characterize as a kind of “financial repression”. But many regional governments in the US and even Germany routinely establish special incentives for local residents to buy their bonds. And unlike trade barriers such as tariffs, those rules and incentives—if they do in fact distort resource allocation and are therefore detrimental to the economy—are detrimental only to those economies that adopt them. In other words, they are not an issue for the broader eurozone.

Finally, the rule is extremely simple and easy to understand. Once it is adopted, those protesting in the streets of Athens and elsewhere can no longer blame everything on rich, fat German bankers and IMF officials. Instead, they must redirect their energies to persuading friends, neighbors, and relatives to buy more of their own governments’ bonds if they hope to maintain their lifestyles.

Transition Challenges

If it is agreed that the “nationals-only” rule is the best solution after the unrealistic fiscal-political union, the next challenge will be implementing it in a eurozone that has gone without such a rule for over ten years. With foreigners now holding a large portion of member governments’ bonds, a transition period of five to ten years may be necessary to unwind the foreign holdings. Some countries may require bridge financing during this period.

Although navigating the transition period will be challenging, having a clearly defined end-game that will eradicate the causes of the present crisis should reassure market participants compared with the current situation, where there is no end-game for stability. This is particularly important in countries suffering from balance sheet recessions because the Fiscal Compact, the only game in town today, will further weaken and destabilize their economies.

For economies suffering from this rare recession and capital flight, the transition will require carefully sequenced policies with a blessing from supra-national entities such as the EU and ECB. In the short run, countries will need fiscal stimulus to stop the deflationary spiral and help private sectors repair their balance sheets, and that will require supra-national entities’ blessing and support to keep domestic savings from fleeing even faster. The governments of these countries should embark on fiscal consolidation only after their private sectors have regained health and are willing to borrow money again.

In 1997 the IMF and the OECD, lacking any understanding of balance sheet recessions, urged Japan to pursue fiscal austerity. The result was an economic meltdown characterized by five quarters of negative growth and a 68 percent increase in the budget deficit. It took Japan ten years to climb out of the hole created by this policy mistake. With the disastrous Japanese experience there for everyone to see, there is no reason for Spain, Ireland and other eurozone countries facing the same predicament to repeat Japan’s mistake.

Conclusion

The creation of the euro was truly one of mankind’s greatest achievements. It was also recognized from the beginning that some unusual restrictions would be needed to make the currency zone work. But when negotiations surrounding its creation were taking place in the 1990s, no one outside Japan had heard of balance sheet recessions. Nor had anyone anticipated the pro-cyclical and destabilizing capital flows that are unique to the eurozone. Now that both glitches have been identified, some modifications to the original design are necessary.

Although many argue that fiscal union is the first-best solution to the problem, politically nothing would be harder to achieve than such a union. The recently proposed and highly mechanical Fiscal Compact not only signals a drastic loss of fiscal sovereignty for member countries, but addresses only the first macro problem—that of fiscal profligacy. It makes no provision whatsoever for the second macro problem of balance sheet recessions and is likely to be highly counterproductive for countries suffering from this rare type of recession. All talk of firewalls or bazookas deals only with symptoms and ignores the underlying problems.

Among possible second-best solutions, a rule limiting the sale of government bonds to citizens offers both discipline and flexibility while addressing the capital flight problem unique to the eurozone. It is simple enough for anyone to understand and preserves the fiscal sovereignty of member governments so that people can feel they have a stake in the democratic process.

The euro may muddle through with short-term fixes for some time. But if it comes to the final choice, it is hoped that the authorities give this rule serious consideration before breaking up the eurozone or abandoning the common currency altogether. At a minimum, member countries should be given the choice of adopting either the Fiscal Compact or the “nationals-only” rule proposed here, which has the potential to usher in the kind of stable yet vibrant era envisioned by the eurozone’s founders. Limiting the sale of government bonds to citizens would be a small price to pay for saving one of mankind’s grandest and noblest accomplishments.

Record-low Interest Rates Coinciding with High Private Sector Savings (indicated as % of GDP)

The following video shows Richard at the Berlin event.

See more for