Category Archive: 1) SNB and CHF

Monetary policy assessment of 24 September 2020

The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation.

Read More »

Read More »

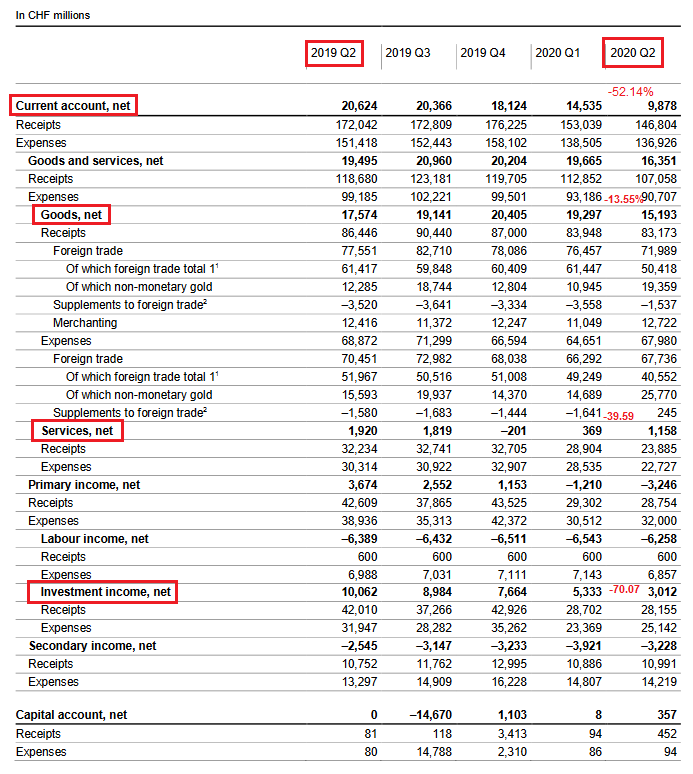

Swiss balance of payments and international investment position: Q2 2020

In the second quarter of 2020, the current account surplus amounted to CHF 10 billion; in the same quarter of 2019 it was CHF 21 billion. This decline was principally due to lower receipts from direct investment abroad. While the goods trade balance and the services trade balance changed only marginally, there was a significant decrease in receipts and expenses.

Read More »

Read More »

Versicherungsmarkt Schweiz: deutlich höhere Ergebnisse

Die aggregierten Daten über den Schweizer Versicherungsmarkt zeigen eine deutliche Steigerung der Ergebnisse 2019. Diese fallen pro Teilbranchen zwar unterschiedlich aus, sind aber hauptsächlich auf die Ergebnisse am Kapitalmarkt zurückzuführen.

Read More »

Read More »

Credit Suisse “Beschattungsaffäre”: FINMA eröffnet Enforcementverfahren

Die Eidgenössische Finanzmarktaufsicht FINMA hat im Kontext der "Beschattungsaffäre" ein Enforcementverfahren gegen die Credit Suisse eingeleitet.

Read More »

Read More »

U.S. dollar liquidity-providing operations from 1 September 2020

In view of continuing improvements in U.S. dollar funding conditions and the low demand at recent 7-day maturity U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to further reduce the frequency of their 7-day operations from three times per week to once per week.

Read More »

Read More »

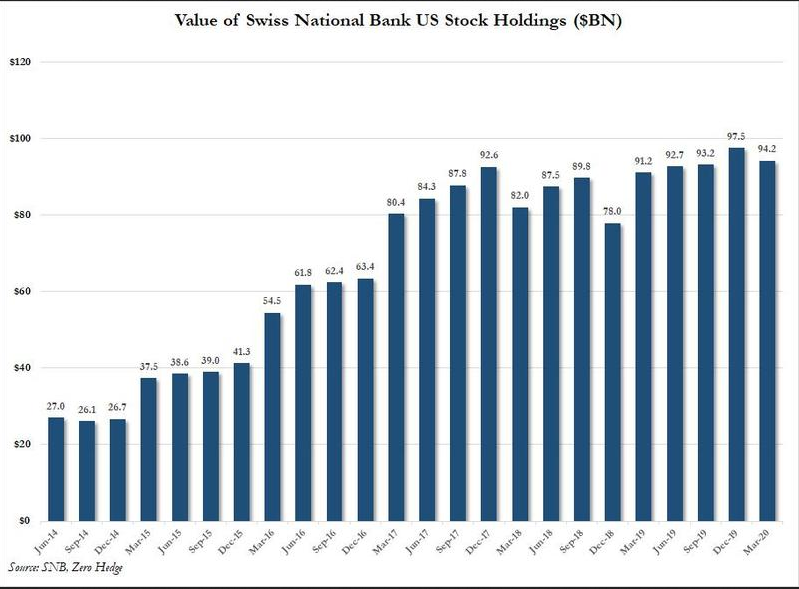

As Markets Crashed, The Swiss National Bank Went On A Tech Stock Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and shore up confidence. That joke is now the truth.

Read More »

Read More »

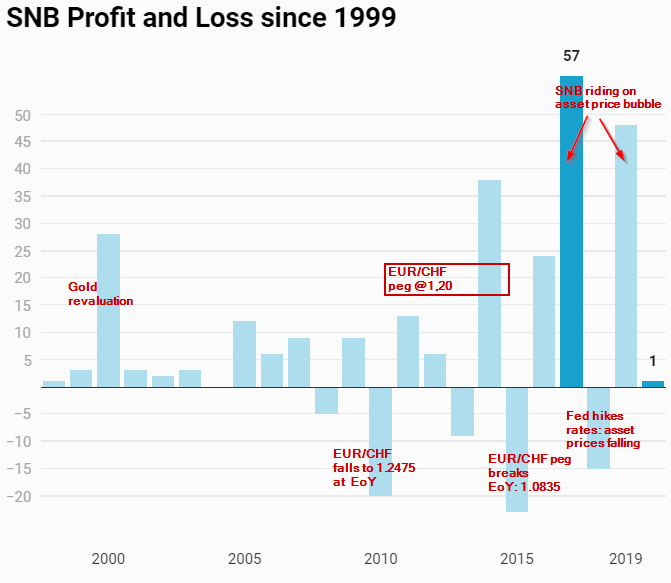

Fed and ECB Money Printing Helps SNB Back into Positive Territory

Fed and ECB money printing and massive fiscal stimulus help the SNB to come back into positive territory for the year.

The renewed asset price inflation compensate for losses on the US dollar.

Read More »

Read More »

“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Von verschiedenen Seiten werden Ansprüche an den Gewinn der Nationalbank gestellt. Es sollte in der Kompetenz der SNB liegen, zu entscheiden, welchen Teil ihrer Bilanz sie nicht zur Erfüllung ihrer Aufgaben benötigt.

Read More »

Read More »

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »

2020 IMF Michel Camdessus Central Banking Lecture with Thomas Jordan, 14.07.2020

Referat Thomas Jordan - Conférence de Thomas Jordan - Speech by Thomas Jordan - Discorso di Thomas Jordan, "Small country - big challenges: Switzerland's monetary policy response to the coronavirus pandemic", 2020 IMF Michel Camdessus Central Banking Lecture, 14.07.2020

00:00 Introductory remarks by Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department, IMF

01:35 Introductory remarks by...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 18.06.2020

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 18.06.2020

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas...

Read More »

Read More »

Umsetzung FIDLEG/FINIG: FINMA bewilligt erste Aufsichtsorganisationen

Die Eidgenössische Finanzmarktaufsicht FINMA erteilt OSIF und OSFIN die ersten Bewilligungen als Aufsichtsorganisationen, zuständig für die Aufsicht über Vermögensverwalter und Trustees. Weiter liess sie die erste Registrierungsstelle für Kundenberaterinnen und Kundenberater zu. Das Eidgenössische Finanzdepartement anerkannte ausserdem die ersten Ombudsstellen nach FIDLEG für Finanzdienstleister.

Read More »

Read More »

Willkommen in einer Zukunft ohne Zins

Die SNB, die EZB und andere Zentralbanken erwarten auch langfristig keine Zinswende – und machen Nullzinsen zur Regel. Eine Übersicht der Prognosen. Diese Woche ist die Welt einer Zukunft ohne positive Zinssätze ein Stückchen näher gerückt. Schwedens Notenbank erneuerte ihren Zinspfad.

Read More »

Read More »

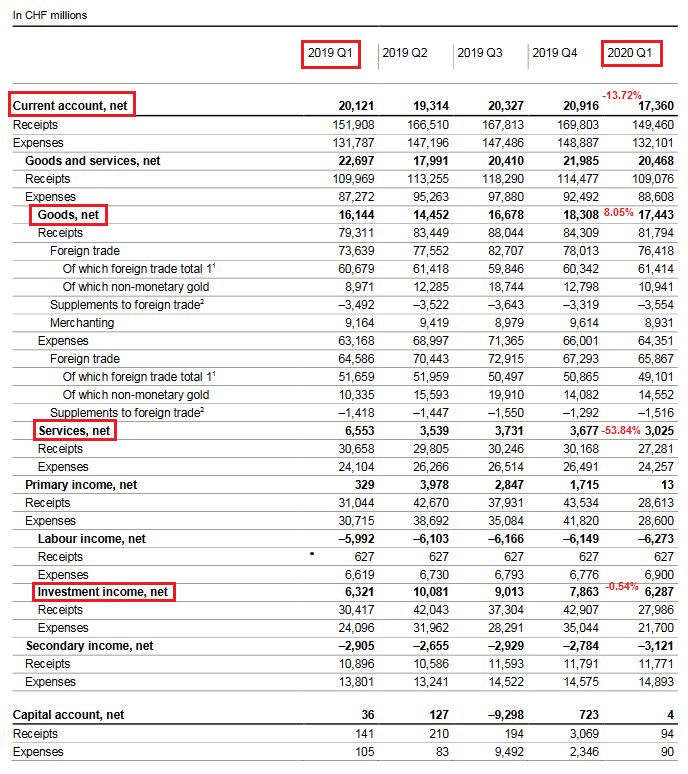

Swiss Balance of Payments and International Investment Position: Q1 2020

Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF.

Read More »

Read More »

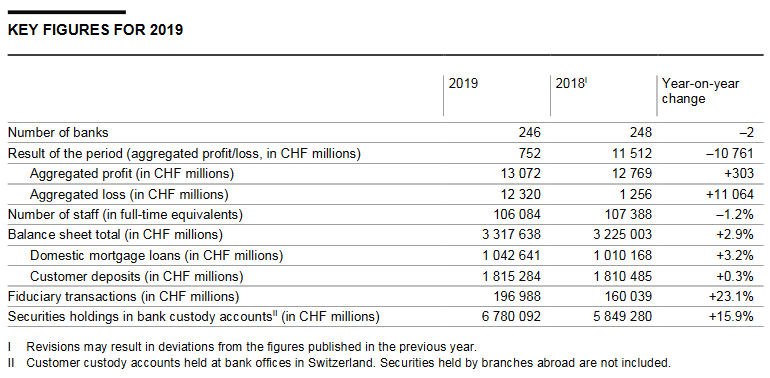

Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics. The most important figures are summarised below.

Read More »

Read More »

Omkar Godbole (Market Reporter, Coindesk) | The Road to Metamorphosis Blockchain Summit by Octaloop

More details about the summit: https://www.octaloop.com/events/theroadtometamorphosis/

Our past and future events: https://www.octaloop.com/events/

Read More »

Read More »

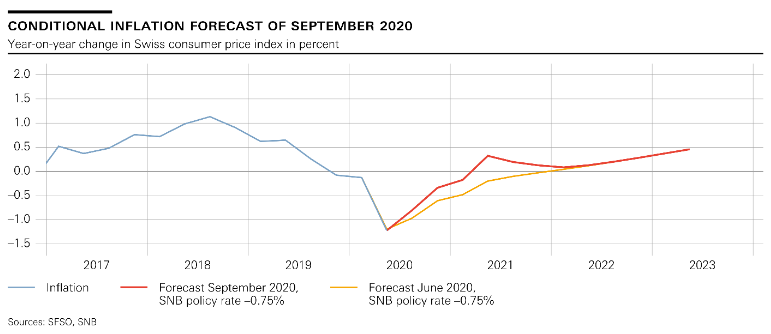

Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market.

Read More »

Read More »

SNB Monetary Policy Assessment June 2020 and Videos

The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland.

Read More »

Read More »

SNB Preview

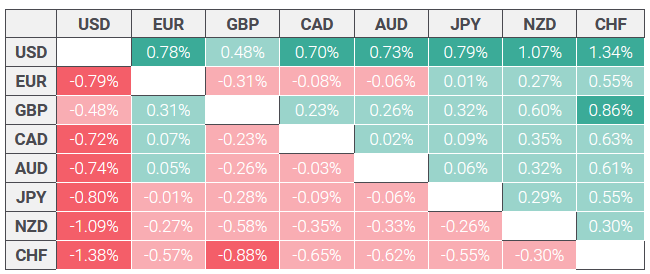

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB.

Read More »

Read More »

-638453232816314704.png)