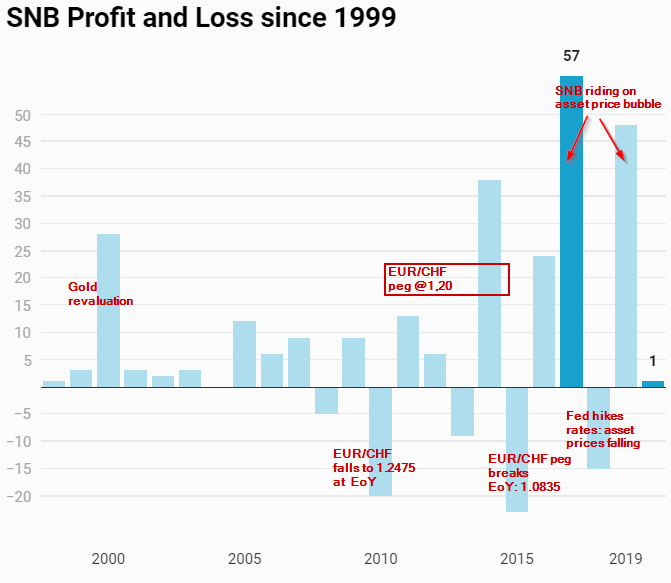

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse.

|

|

Franc will rise again with crisis or inflationWith a new crisis or a with a big rise of inflation, the run into the Swiss franc will start again. Deflationary period (e.g. Corona Crisis)During deflationary periods and recessions, the SNB will strongly intervene, similarly as she did in 2008/2009. During the Corona Crisis, the SNB intervened at 1.05 – 1.06 for a euro, in 2009 even for 1.50 These high intervention levels pave the way for losses in later periods, which are the inflationary periods. First inflationary period in 2018There has been a very small first inflationary period. This was the year 2018, when the Fed hiked rates. As result asset prices fell and the SNB had a loss. However this period was very short, the Fed already reversed course in 2019. |

|

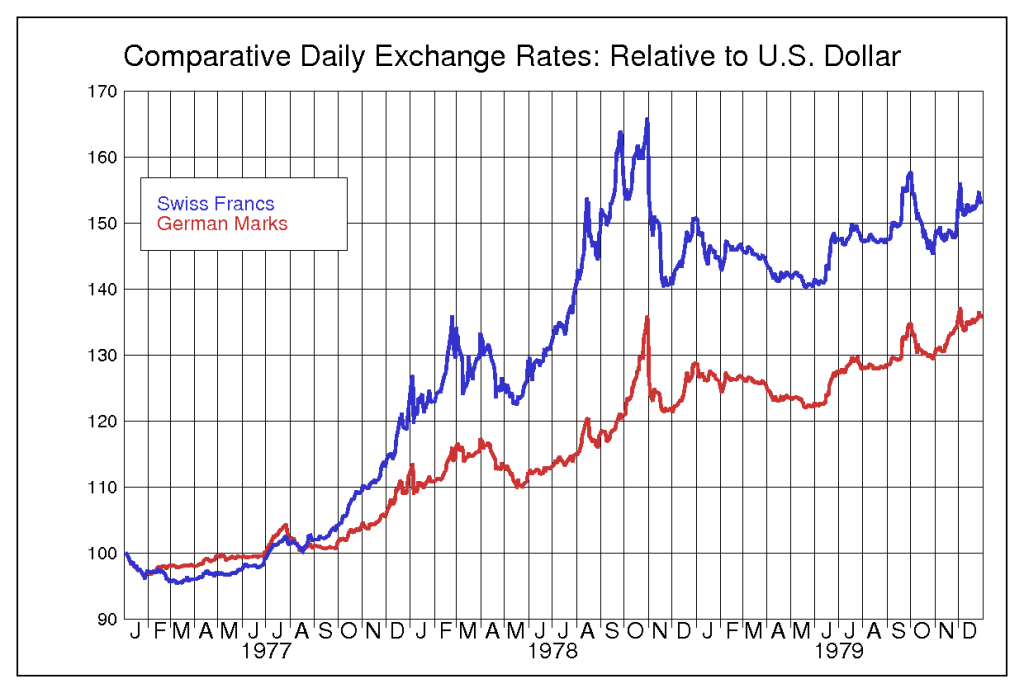

Inflationary periodsDuring a real inflationary period (like the one during the 1970s) the

And this will lead to a massive SNB of at least 150 billion CHF. This is not a black swan, but a normal inflation scenario. We have seen a 60% rise of CHF in the 1970s; this was a black swan. In this case all assets except gold will fall. However, SNB’s gold share of 6% is too small to cushion this scenario. Some additional technical details: The crux, however, is

|

Comparative Daily Exchange Rates: Relative to US Dollar(see more posts on US dollar, ) |

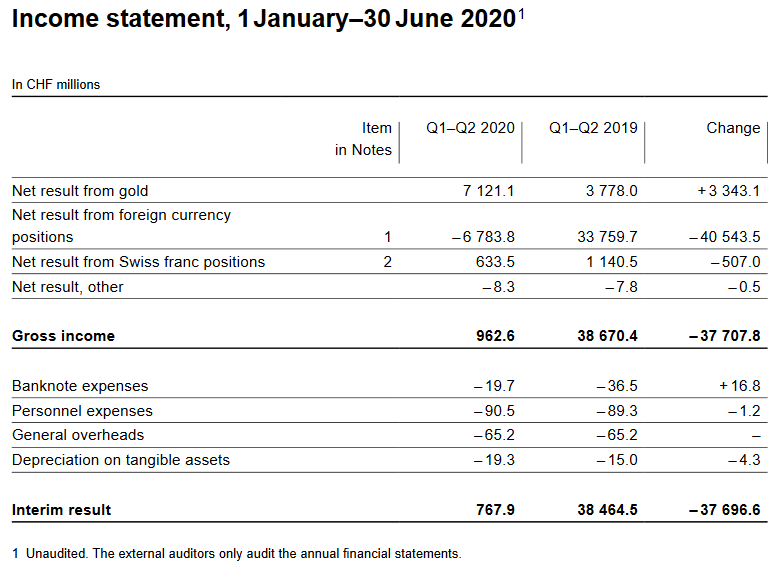

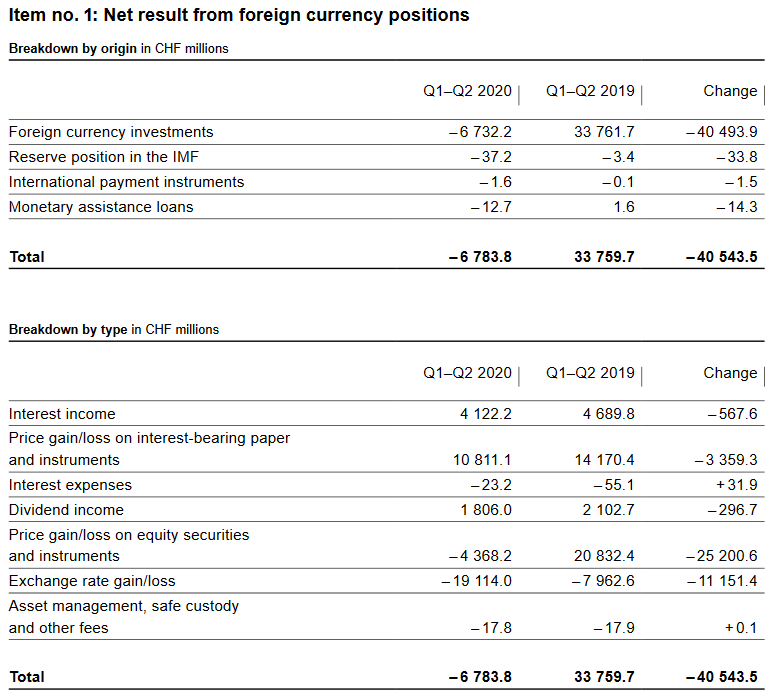

Some extracts from the official statement with annotations.

|

Income Statement for Q2 2020 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Profit on foreign currency positionIn a period of low interest rates asset prices rise; last but not least because of margin debt. When the Fed raised rates in 2018, the SNB had a loss of 15 billion francs. Fortunately for the SNB, the Fed stopped raising rates in 2019, on the contrary U.S. rates went down. Rising asset prices implies that the SNB obtains a profit.

The following numbers are in billion Swiss Francs.

|

SNB Loss on Foreign Currencies Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation gain on gold holdings

Percentage of gold to balance sheetThe percentage of gold has risen to 5.88% thanks to these rising prices. The SNB has maintained the same quantity of gold.

Balance Sheet compared to GDP

|

SNB Balance Sheet for Gold Holdings for Q2 2020 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability. Still, as compared to the FX profits or gains on equities, this number is relatively low.

|

SNB Result for Swiss Franc Positions for Q2 2020 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

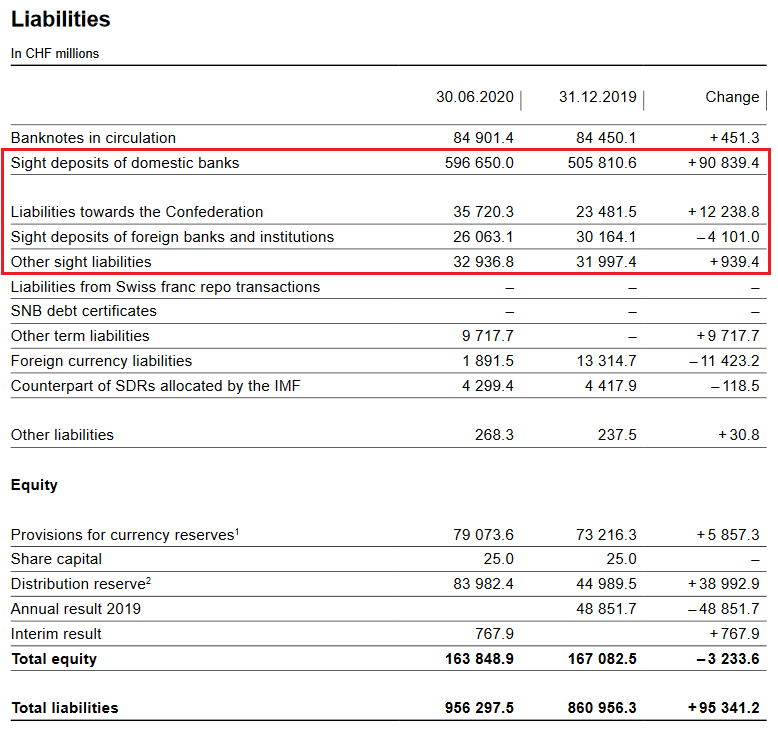

SNB LiabilitiesElectronic Money Printing: Sight Deposits Sight deposits is the biggest part of SNB interventions. In Q2 2020 the SNB intervened again, increasing sight deposits and its debt towards the Swiss state.

Paper PrintingBanknotes in circulation: +0.45 bn francs to 84.9 bn. CHF This old form of a printing press, today a less important form of central bank interventions. It showed that safe-haven Swiss francs, e.g. 1000 franc bank notes are currently less in demand than previously. Provisions for currency reservesAs at end-June 2020, the SNB recorded a profit of CHF 0.8 billion before the allocation to the provisions for currency reserves. In accordance with art. 30 para. 1 of the National Bank Act (NBA), the SNB is required to set aside provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. The allocation for the current financial year is determined at the end of the year. |

SNB Liabilities and Sight Deposits for Q2 2020 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,Swiss National Bank