The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics.1 The most important figures are summarised below.

|

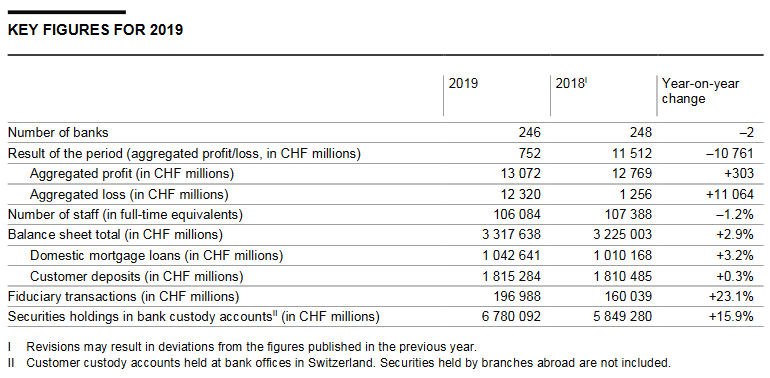

Key Figures for 2019 |

Overview

As at the end of 2019, there were 246 banks in Switzerland. Of this number, 216 reported a profit with an aggregate total of CHF 13.1 billion. Losses amounting to CHF 12.3 billion were recorded by 30 banks. The aggregate result of the period across all banks was thus CHF 0.8 billion, a decrease of CHF 10.8 billion over 2018.

Although the big banks reported profits at the consolidated group level2,based on the parent company financial statements used in this publication3 they posted an aggregate loss of CHF 5.6 billion. This was largely attributable to one big bank having changed its valuat ionprinciples in respect of participations in other group companies. This resulted in high value adjustments in the parent company financial statements, but not in the group financial statements. All other bank categories posted an aggregate profit totalling CHF 6.3 billion, with the cantonal banks accounting for around half this figure.

The aggregate balance sheet total for all banks in Switzerland rose by 2.9% or CHF 92.6 billion to CHF 3,317.6 billion. While the stock exchange banks (CHF –5.0 billion or –2.2%) and private bankers (CHF –0.6 billion or –9. 0%) reported lower balance sheet totals, all the other bank categories registered increases in this respect, in particular the cantonal banks (CHF 26.4 billion or 4.4%), Raiffeisen banks (CHF 23.0 billion or 10.2%) and big banks (CHF 19.9 billion or 1.3%). The rise in domestic mortgage loans continued (up CHF 32.5 billion or 3.2% to CHF 1,042.6 billio n), with a strong increase in the case of the cantonal banks (up CHF 15.7 billion or 4.2%). On the liabilities side, customer deposits rose slightly overall (by CHF 4.8 billion or 0.3% to CHF 1,815.3 billion).

Customer holdings of securities in bank custody accounts increased by 15.9% to CHF 6,780.1 billion, with stocks higher in all securities categories. Stocks of equities showed the biggest rise, up 23.5% to CHF 2,717.0 billion, with the marked rise in share prices in Switzerland and abroad in 2019 being a significant contributory factor in this regard. Fiduciary funds administered by banks were considerably higher in 2019 and closed the year at CHF 197.0 billion, an increase of 23.1% or CHF 36.9 billion. In particular, there was a pronounced rise of CHF 15.7 billion in fiduciary deposits invested in Swiss francs, increasing that currency’s share from 2.5% to 10.0%.

In terms of full-time equivalents, the number of staff declined by 1,304 to 106,084 (–1,130 in Switzerland, –175 abroad). The bulk of this drop is attributable to big banks having transferred staff to other group entities not included in the banking statistics. Staff numbers rose in the case of cantonal banks (by 228) and other banking institutions (by 194), while declines were registered by the foreign-controlled banks (–244) and stock exchange banks(–151).

Further information

- The report Banks in Switzerland 2019 (English, German and French), which features extensive commentaries, can be downloaded at www.snb.ch, Statistics, Reports and press releases, Banks in Switzerland, as can the Overview of reporting banks in Switzerland 2019/2020.

- Data (charts and tables), methodological basis and notes are available on the SNB’s data portal at data.snb.ch.

Tags: newsletter