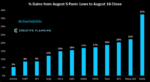

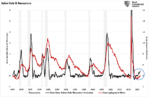

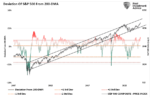

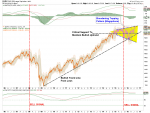

Seasonality has long influenced stock market trends, offering insights into predictable cycles of strength and weakness throughout the year. Yale Hirsch, the creator of the Stock Trader’s Almanac, is one of the most well-known contributors to studying these patterns. His research has highlighted that certain periods of the year consistently present better opportunities for investors to generate returns, while other times warrant caution.

The adage ” Sell May and Go Away “ is a common topic of discussion that many investors are familiar with. The historical analysis supports that the market tends to be the weakest of the year during the summer months. Hirsch’s Stock Trader’s Almanac introduced the idea that the stock market follows a seasonal rhythm, where certain times of the year

Read More »