| At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent.

Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament. From there, to try to get the public to believe the Fed has the tools, the willingness, and the resolve to deal with it – first convincing people policymakers have correctly identified the problem. From the political perspective behind all this, everyone’s been told that’s inflation. But how does the Fed replace Russian oil on European markets, get more energy of any kind out from the ground, or fabricate a batch of semiconductors while moving global goods and resources in a more efficient manner? Rate hikes won’t change any of those actual afflictions, so Powell has to trick people into believing those aren’t the only major issues; or even the Big Thing. That’s why both he and President Phillips brought up the Phillips Curve. According to this (long-since debunked) theory, officials claim to be able to consciously trade some employment growth for lower inflation through rate hikes which are said (though disproven) to retard economic therefore labor growth. This idea of this “exploitable” Phillips Curve was laughed out of serious consideration by Milton Friedman and others only starting in the late sixties, yet here is Jay Powell resurrecting its rotted carcass out of sheer desperation. Since his policies can’t fix the supply shock, he’ll instead distract you into believing “inflation” is primarily due to a tight labor market which for decades we’ve been led to believe (contrary to every evidence) that rate hikes can do something about. Chairman Powell spent much of that press conference on selling this setup. |

|

| Its final piece was a thread-the-needle, Hollywood-style ride off into the sunset end. Sure, he said, he’s going to stomp hard on the economic brakes to trigger the exploit on AW Phillips’ bastardized curve, fret not, Dear Public, the economy is in such awesome shape it can easily swap less growth for less inflation and come out the other side totally Goldilocks.

To make the sale, Powell:

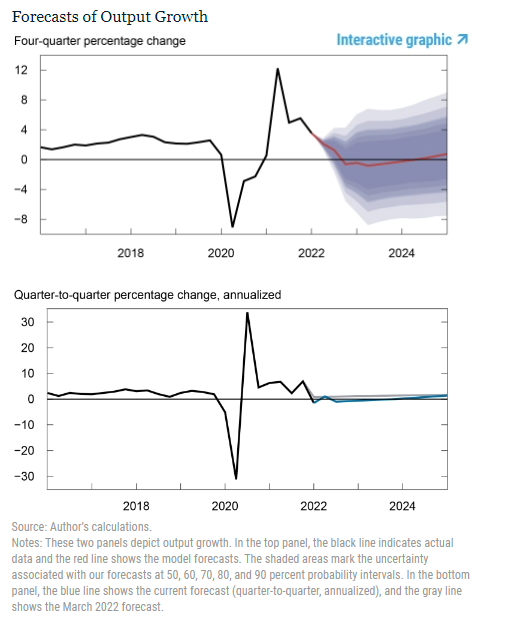

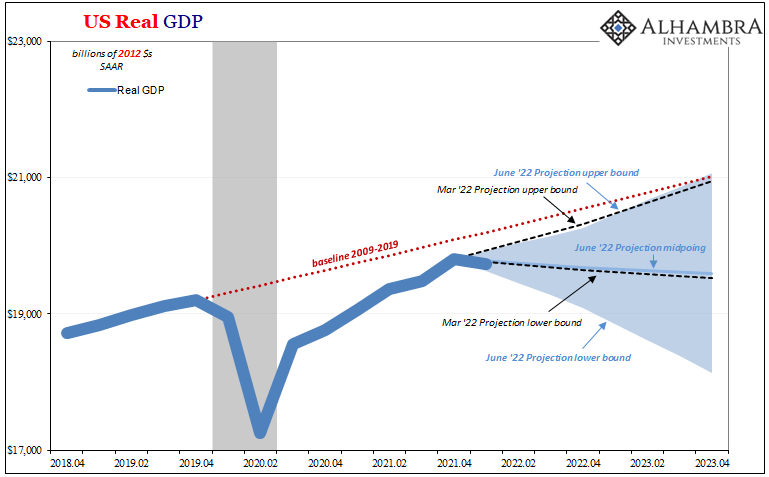

The Chairman might want to check on these points with some of his staff’s own models. There are so many nowadays, it’s impossible to keep track, yet those at FRBNY just spit out some its own DSGE predictions and they, shall we say, now predict an economy that is more than slowing, not really healthy on many levels of growth, and every possible warning sign of a broader slowdown if not much, much worse. More worrisome than that, current numbers represent big changes in the models’ projections from…March. According to these, the potential economic upside (in terms of output, or real GDP) didn’t change from March to June. What did is how there is now a huge and maybe growing markdown that if it keeps going in that direction wouldn’t just be recession, it’d be prolonged and severe. In fact, the June midpoint for GDP over the next two years (2023 & 2024) is negative for each, making the current midpoint about the same as what in March had been the lower bound! In other words, it is now more likely than not, using these regressions, the next few years will add up to less GDP than currently for an economy that remains significantly behind every baseline including the prior pre-2020 lackluster-ness. |

|

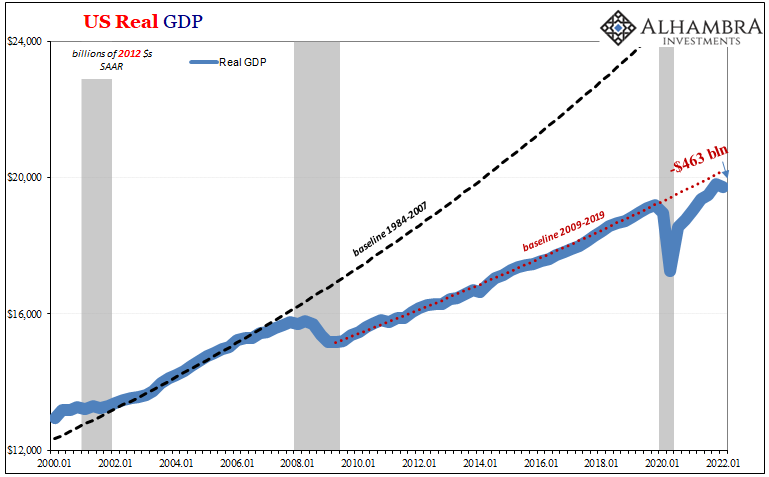

| That’s how bad things have been, everyone fooled and misled into believing CPIs were the economy; rather than overheated recovery, we never made one even now going past the two-year mark.

These new projections don’t tell us how the economy might reach their lowered levels – maybe a very short but very intense recession, or, on the other hand, a milder recession that hangs around much longer – just that it is increasingly likely the situation has materially changed for the worse, to put it mildly. Since these are mainstream, conventional econometrics, the primary reason for such serious forecast downgrades is, well, Jay’s rate hikes. No matter how many times it never works out, every model merely assumes that “monetary” policy works as intended. Therefore, since March, a more hawkish Fed is presumed to exploit more Phillips; though in this case, the same FRBNY models raised their PCE Deflator estimates if only because of oil. |

|

| But while the New York branch math may finger the FOMC for a recession-filled future, that’s not entirely its case, either. These numbers also have to factor, and start to factor, from a much worse meaning weaker starting point than previously thought (the “shocking” and “unexpected” negative GDP in Q1 and what is already likely to be another negative quarter in Q2).

That much markets can agree with the Economic assumptions employed here; the US economy is heading into 2022 having already stumbled, never having recovered, which raises the prospects in reality as well as these theoretical exercise for both immediate and prolonged contraction. |

|

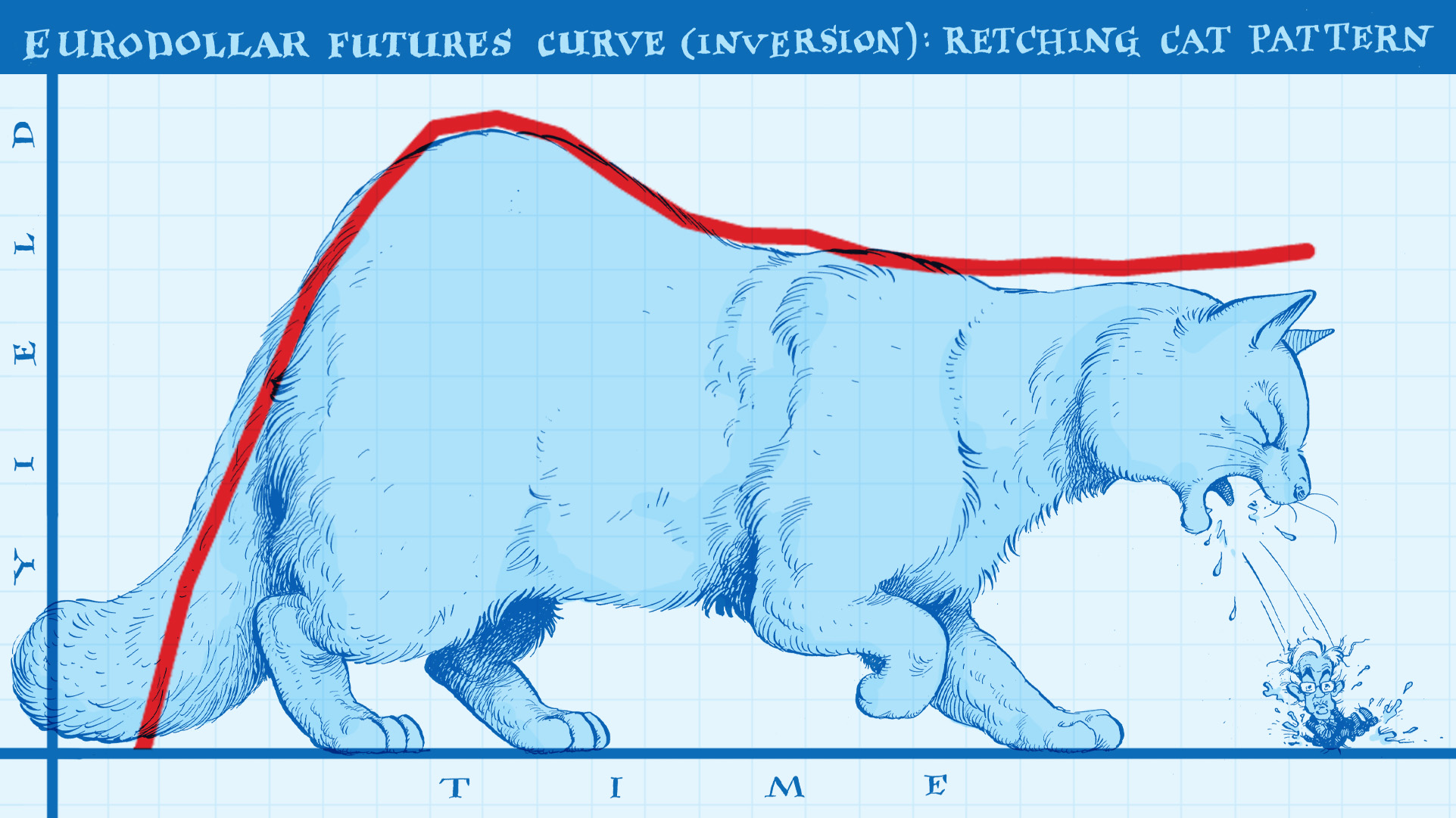

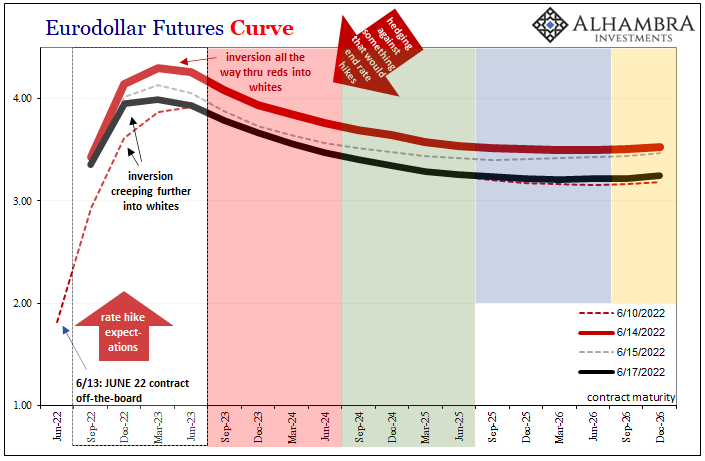

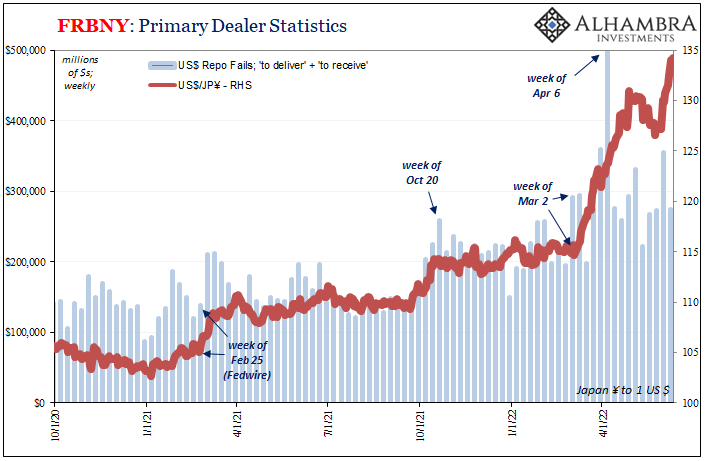

| The Fed says rate hikes, the market knows better, each indicating big problems either way.

And that means a whole lot of trouble and not just for President Phillips or Jay Volcker. Their models are already picking up a ton of downside risk because the reality of such an awful and awfully weak starting point can’t be ignored or dismissed in the math as it can out of the Chairman’s insincere mouth. Markets have been into recession territory and high probabilities for a lot longer, for much sounder reasoning. Now just imagine if these DSGEs had any way to incorporate and factor increasingly dangerous Euro$ #5 like markets already have! |

|

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,GDP,inflation,jay powell,Markets,newsletter,rate hikes,recession