Tag Archive: GDP

Dollar Mixed as Markets Digest US Political Developments

Overview: News that President Biden will not seek re-election has left investors unsure of the next step, but PredictIt.org still points to a Trump advantage of slightly better than 60-40. It is not clear yet whether Vice-President Harris will be challenged for the nomination. The dollar is mixed against the G10 currencies, with the dollar bloc and Norway weaker. The yen is up around 0.45% to lead the others higher. The Swiss franc, euro and...

Read More »

Read More »

Macro: GDP Q3 — Inflationary BOOM!

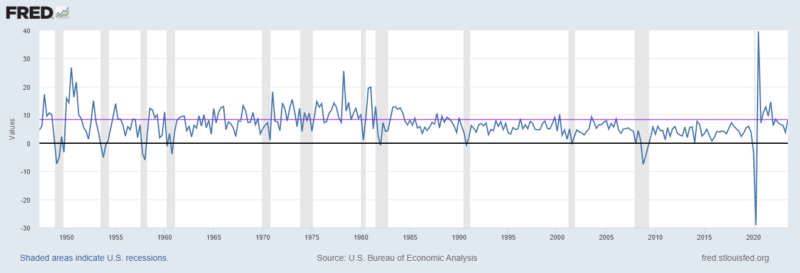

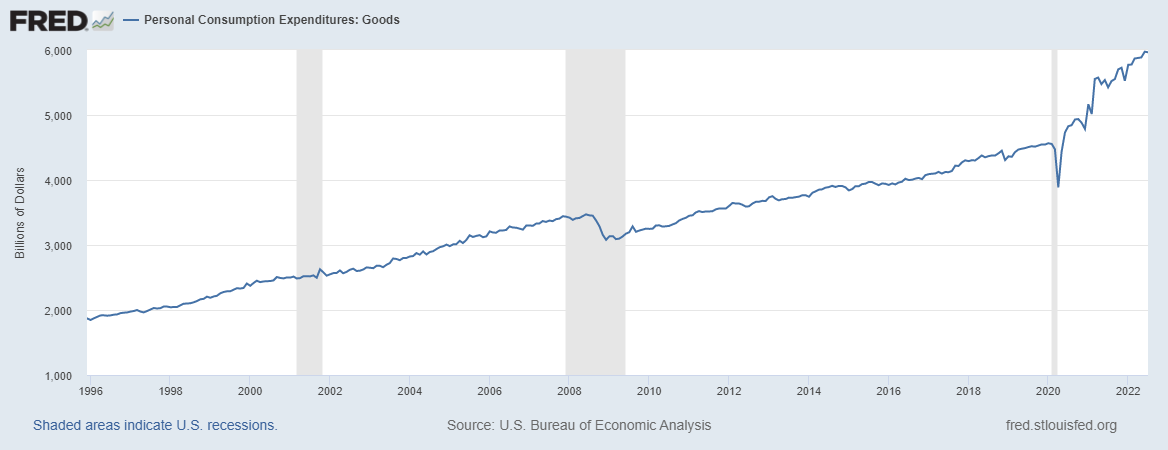

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years.

Read More »

Read More »

Is the Market Putting on Risk Ahead of the Weekend?

Overview: The US dollar is trading with a softer

bias. Among the G10- currencies, only the euro and Swiss franc are the laggards

and are nearly flat. In shifting expectations, the market sees the Reserve Bank

of Australia as the most likely to hike rates again, while the swaps market

appears to be bringing forward cuts by the European Central Bank and the Bank

of Canada. The Australian dollar is the strongest G10 currency today and this

week. After...

Read More »

Read More »

Market Awaits US Data and Leadership

Overview: The dollar staged a major technical

reversal yesterday, in a dramatic reaction to a considerably weaker JOLTs

report than expected, spurring a large drop in US interest rates. And this is

despite press reports that the participation rate in the survey is half of what

was three years ago. We suspect the price action said as much about market

positioning as it did about the data. The path to the US jobs data on Friday

goes through...

Read More »

Read More »

Markets Becalmed Ahead of Key Data and BOJ Meeting Outcome

Overview: Some regional bank earnings were weighing

on investor sentiment but reports that the FDIC is running out of patience with

First Republic Bank to strike a private deal and could decide to downgrade its

assessment. This could lead to limits on its ability to use the Fed's emergency

facilities. Other reports said that the bank's advisers are securing

commitments to buy a new stock as part of a broader restructuring. Still, while

the KBW bank...

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

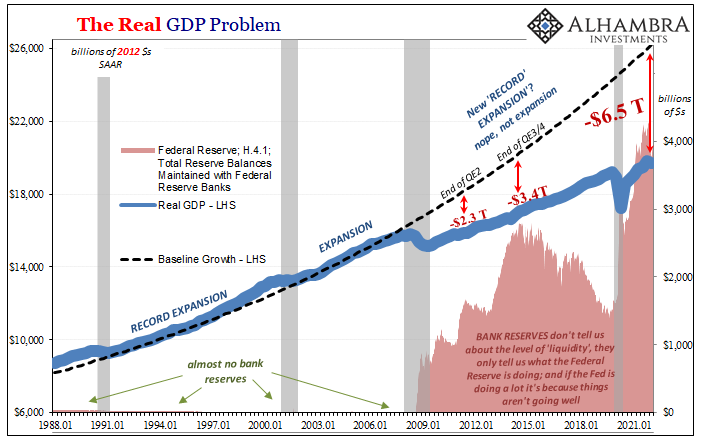

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Goldilocks Calling

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

The Fed and GDP: Week Ahead

The outcome of the Federal

Reserve Open Market Committee meeting on July 27 is the most important event in

the last week of July. After a brief flirtation with a 100 bp hike after the June

CPI accelerated, the market has settled back to a 75 bp move. The Fed

funds futures are pricing about a 10% chance of a 100 bp

hike. The market anticipates that after the second 75 bp hike, the Fed will most likely return to a 50 bp hike in September. Fed...

Read More »

Read More »

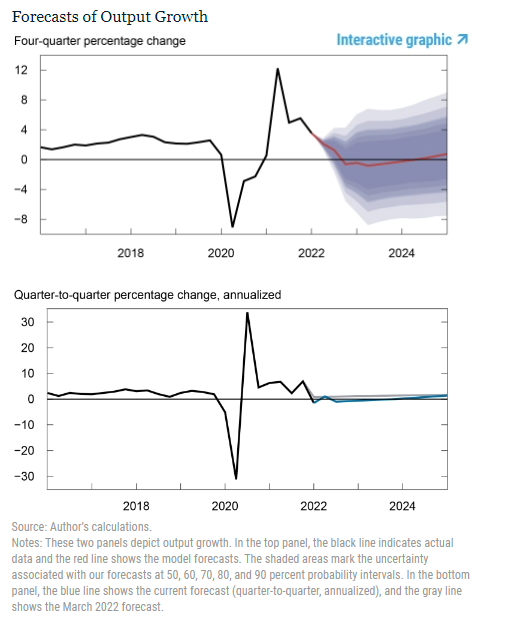

Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament.

Read More »

Read More »

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Another Month Closer To Global Recession

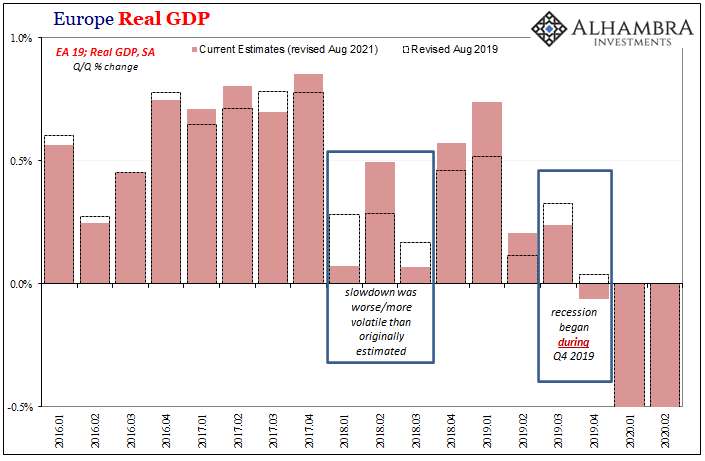

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

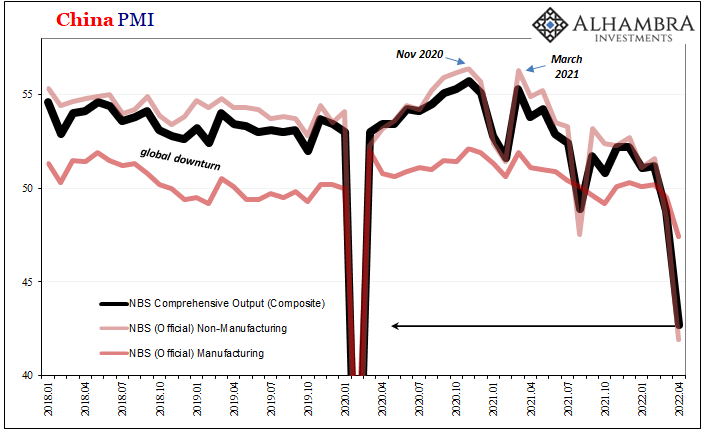

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Is It Recession?

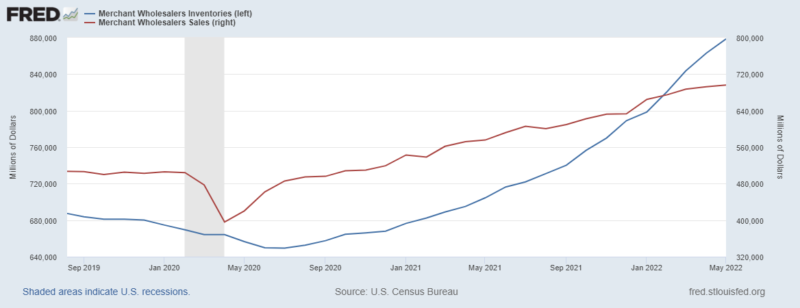

According to today’s advance estimate for first quarter 2022 US real GDP, the third highest (inflation-adjusted) inventory build on record subtracted nearly a point off the quarter-over-quarter annual rate. Yes, you read that right; deducted from growth, as in lowered it. This might seem counterintuitive since by GDP accounting inventory adds to output.

Read More »

Read More »

Did China’s Politburo Throw Markets a Lifeline?

Overview: Speculation that a midday statement by China's Politburo signals new efforts to support the economy ahead of next week's holiday appears to have stirred the animal spirits.

Read More »

Read More »

Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

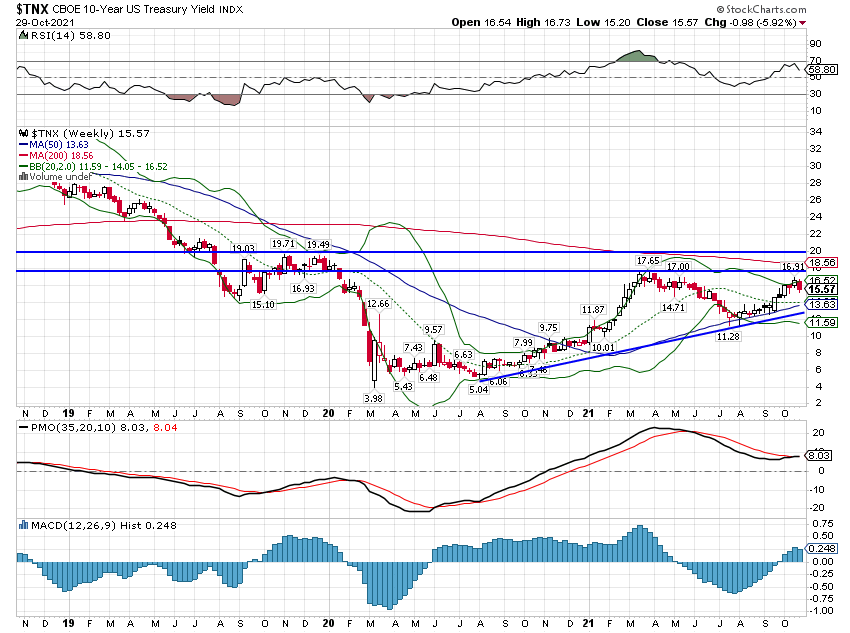

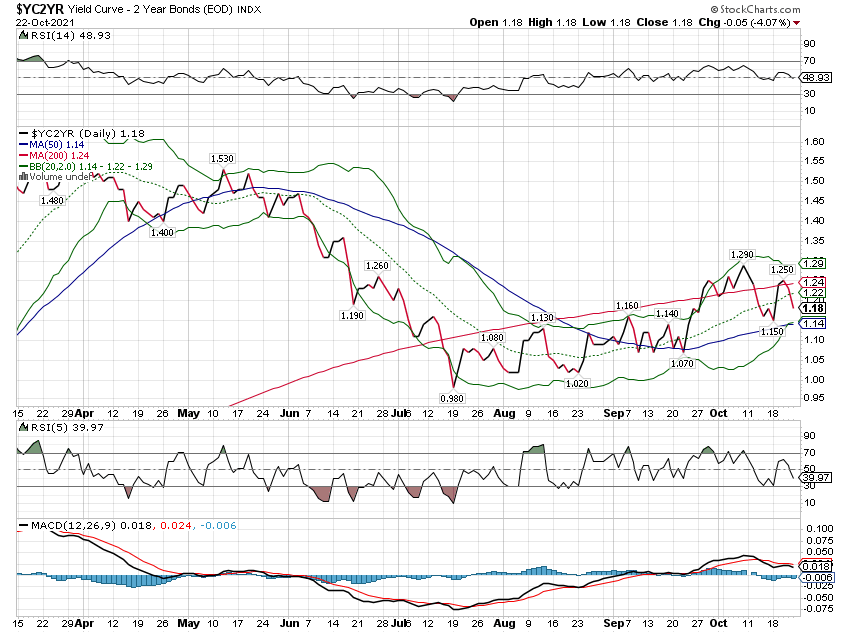

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »