Tag Archive: GDP

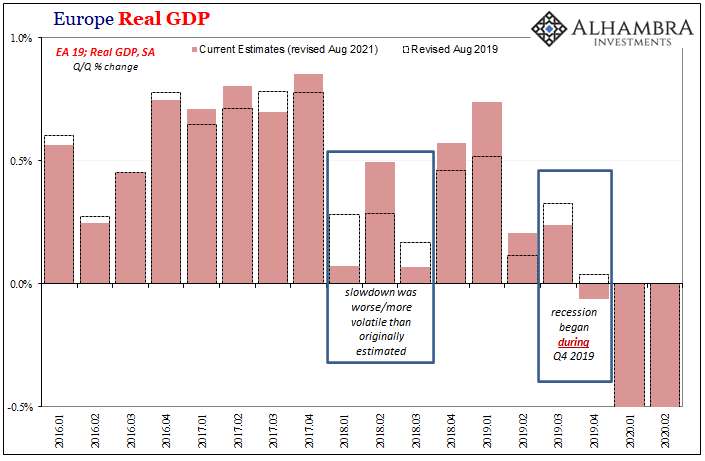

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

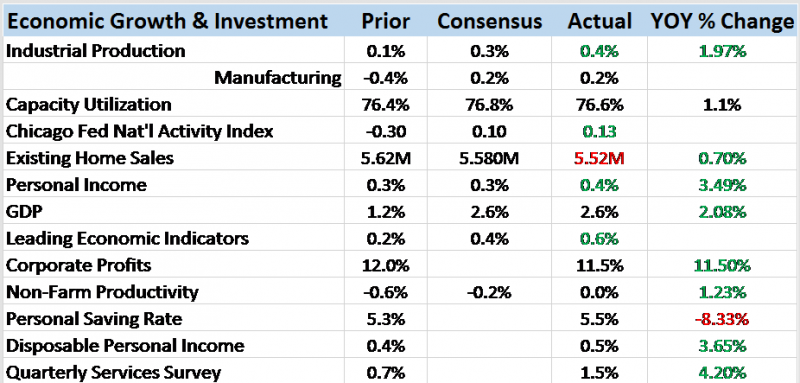

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

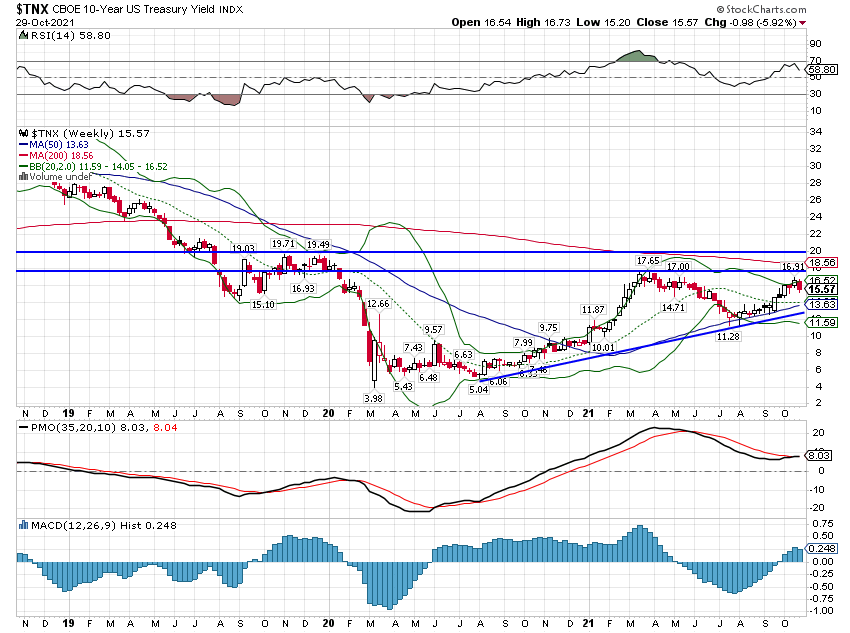

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy.

Read More »

Read More »

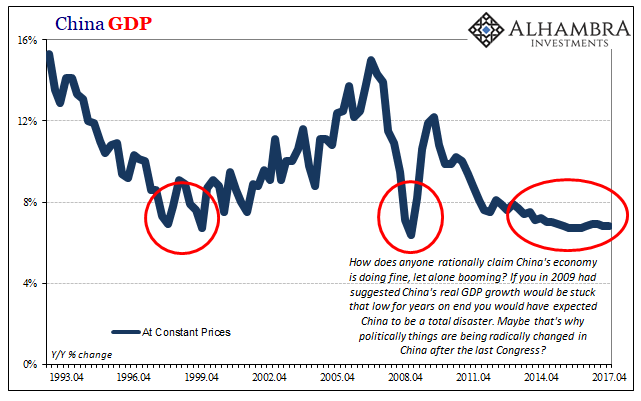

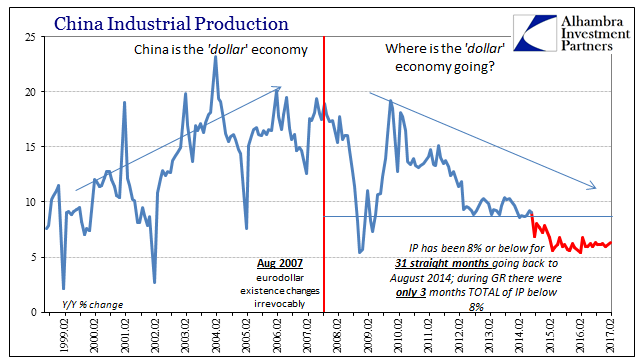

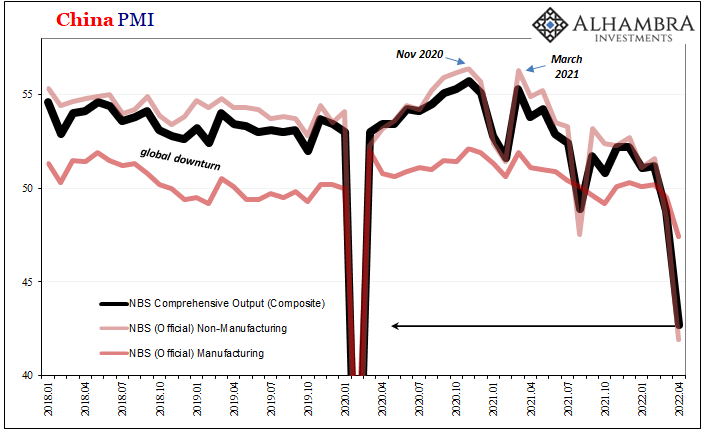

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

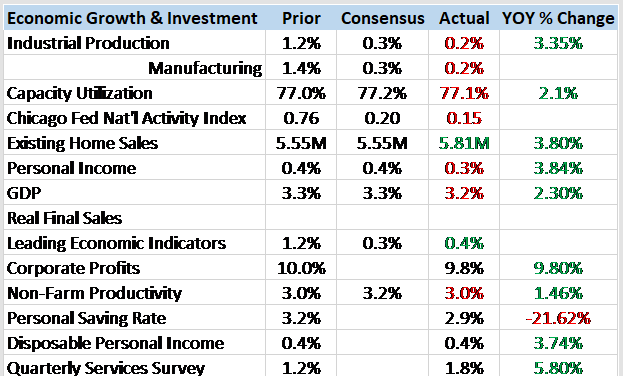

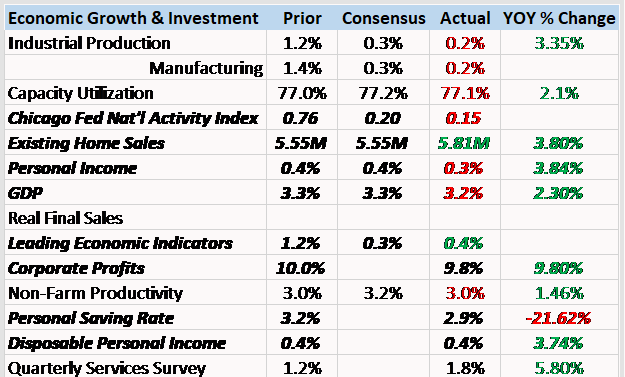

Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

Europe Is Booming, Except It’s Not

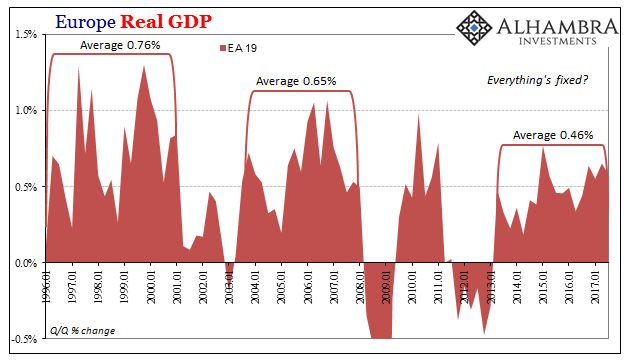

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »

Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate.

Read More »

Read More »

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »

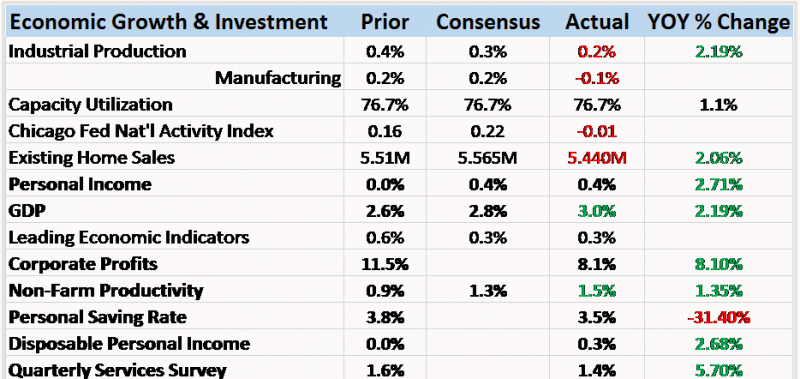

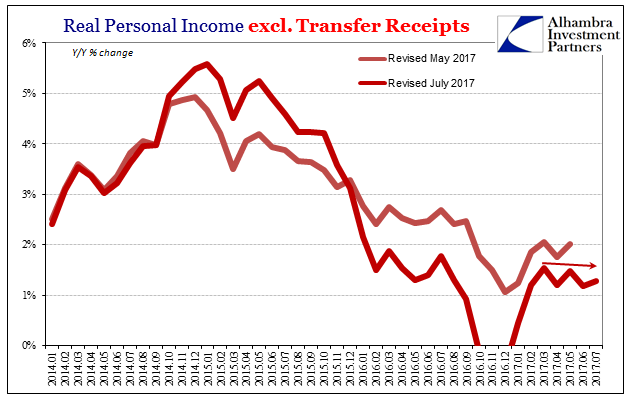

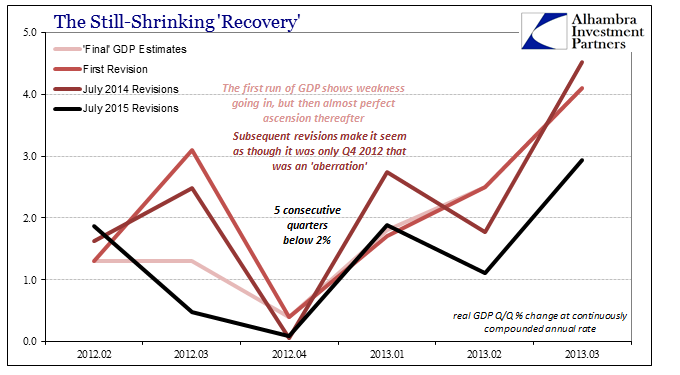

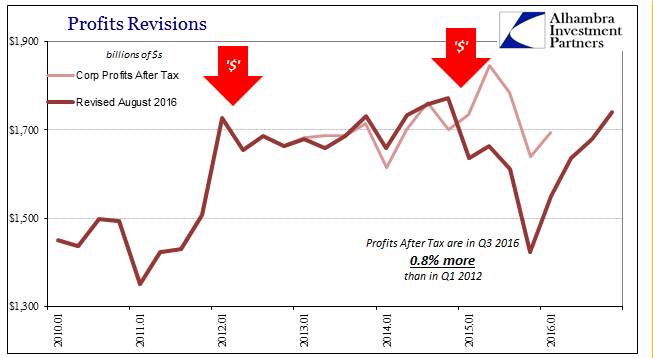

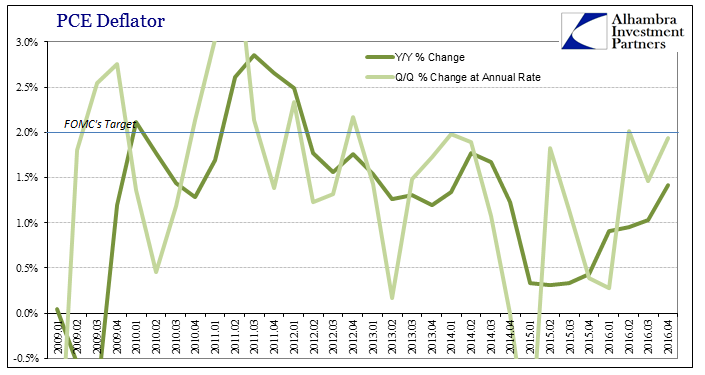

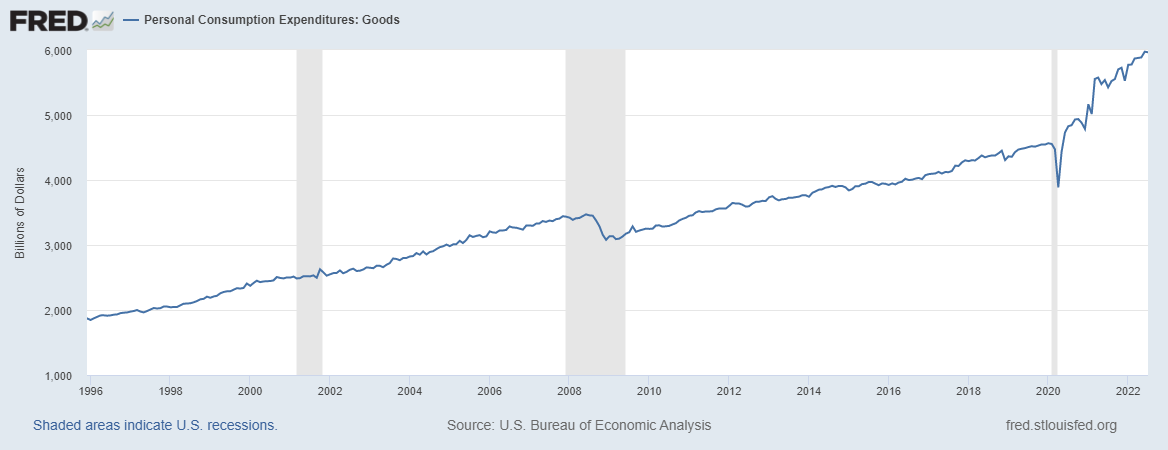

Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income.

Read More »

Read More »

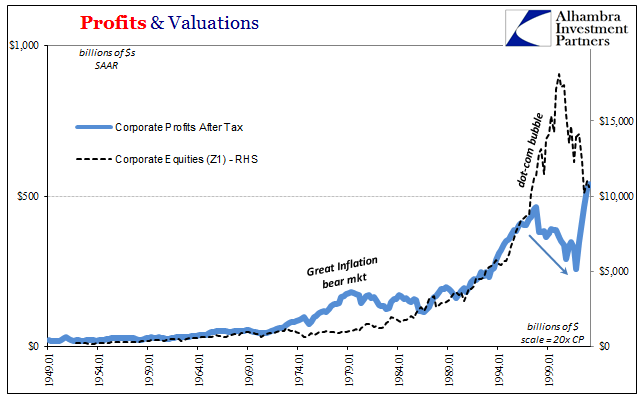

The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really going on.

Read More »

Read More »

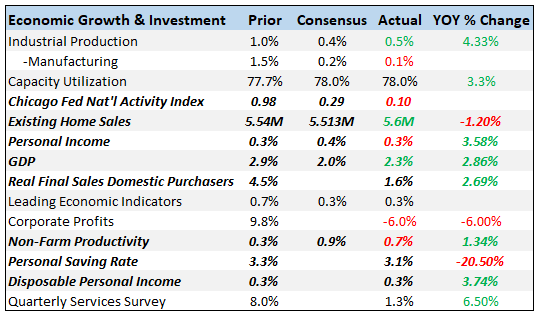

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

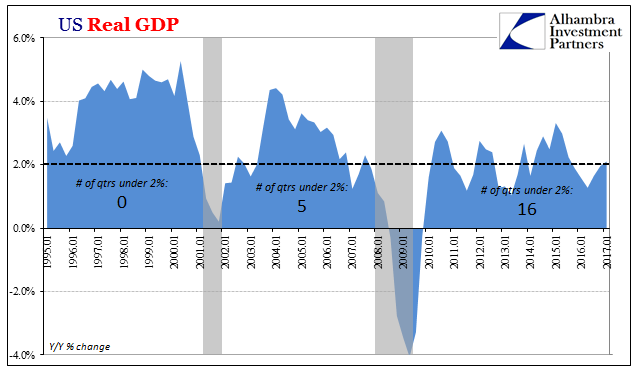

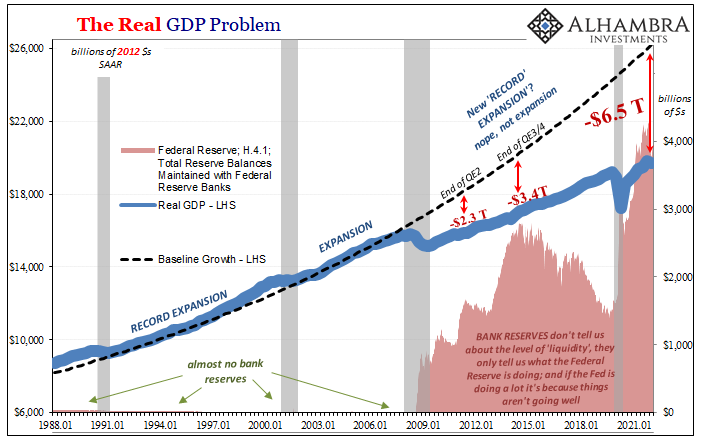

U.S. Gross Domestic Products: Near Record Expansion (Really Reduction)

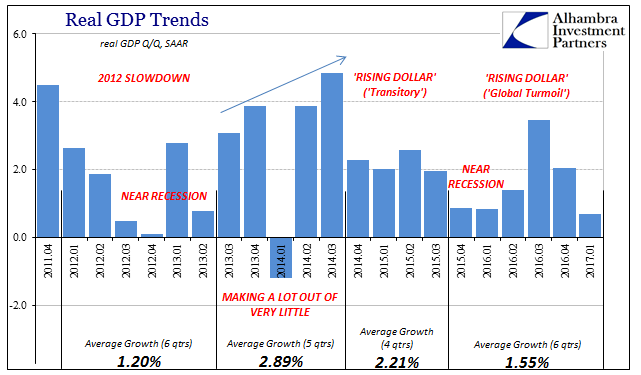

Real GDP in the US was revised up to 1.41% quarter-over-quarter (annual rate), still the fourth of the last six to be less than 1.5%. While economists and policymakers have taken to judging the economy by its downside, that is only because the extent of the global problem is revealed by complete absences of an upside. The occasional decent quarter doesn’t come close to making up for the more plentiful disappointing ones, let alone to still resolve...

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »

Hopefully Not Another Three Years

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions shouldn’t be surprising.

Read More »

Read More »

This Is Not Expansion

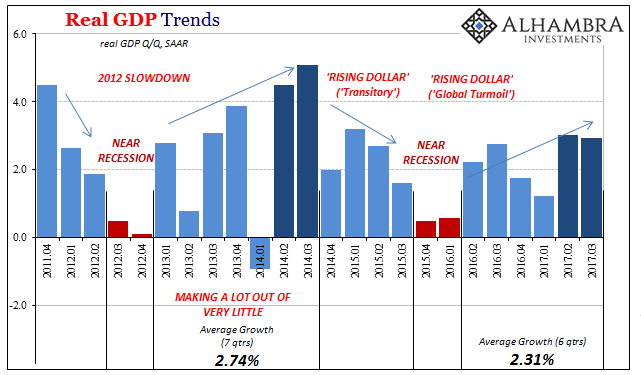

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric.

Read More »

Read More »

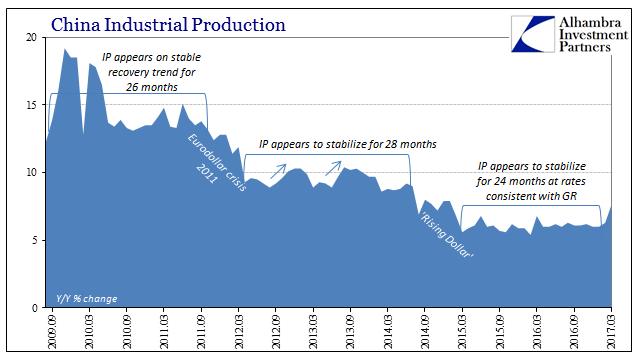

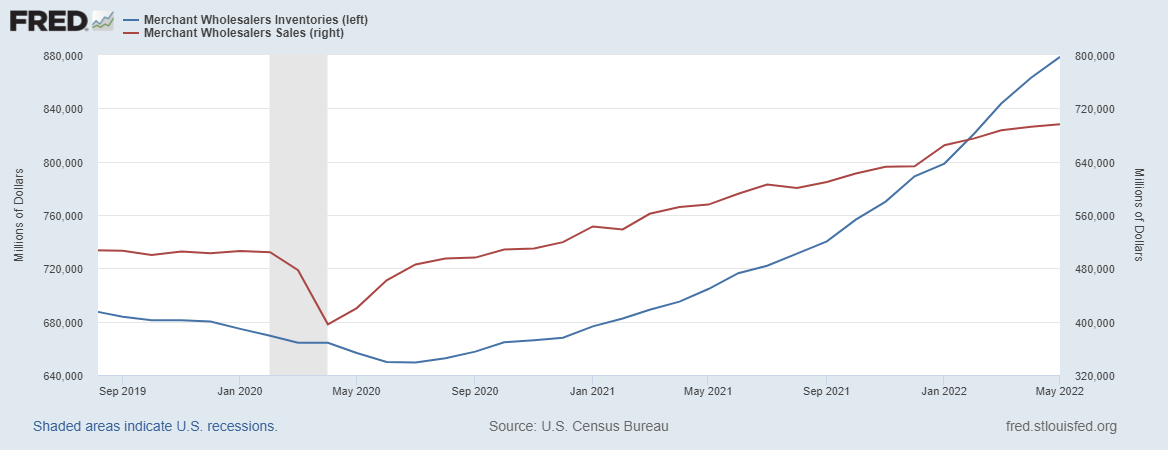

Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

Ending The Fed’s Drug Problem

Gross Domestic Product was revised slightly higher for Q4 2016, which is to say it wasn’t meaningfully different. At 2.05842%, real GDP projects output growing for one quarter close to its projected potential, a less than desirable result. It is fashionable of late to discuss 2% or 2.1% as if these are good numbers consistent with a healthy economy.

Read More »

Read More »

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion.

Read More »

Read More »