Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › Quantitative Easing: A Boon or Curse?

Permanent link to this article: https://snbchf.com/2021/07/flood-quantitative-easing-boon-curse/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: decreased by 15 billion francs compared to the previous four weeks

18 days ago -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24 -

2025-06-25 – Quarterly Bulletin 2/2025

2025-06-25

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 15 billion francs compared to the previous four weeks

18 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Is offering a Rolex to a foreign official considered bribery under Swiss law?

Is offering a Rolex to a foreign official considered bribery under Swiss law? -

5 Dinge die nach Bargeldverbot kommen… #thorstenwittmann #finanzen #geldpolitik #bargeldverbot

5 Dinge die nach Bargeldverbot kommen… #thorstenwittmann #finanzen #geldpolitik #bargeldverbot -

Merz & Migration | Gewalt auf Weihnachtsmärkten | China demütigt Deutschland (Morning News #518)

Merz & Migration | Gewalt auf Weihnachtsmärkten | China demütigt Deutschland (Morning News #518) -

Wichtige Morning News mit Oliver Klemm #519

Wichtige Morning News mit Oliver Klemm #519 -

AUDUSD Technicals: The AUDUSD is correcting lower ahead of the RBA rate decision

AUDUSD Technicals: The AUDUSD is correcting lower ahead of the RBA rate decision -

Why avoiding gold exposes investors to systemic risks

Why avoiding gold exposes investors to systemic risks -

USDINR Technicals: The USDINR bases at the 100 hour MA and moved higher today

USDINR Technicals: The USDINR bases at the 100 hour MA and moved higher today -

USA: 50 Jahre Hauskredit abbezahlen🇺🇸

USA: 50 Jahre Hauskredit abbezahlen🇺🇸 -

Valcambi CombiBar: Why Preppers LOVE BREAKABLE Silver Bars

Valcambi CombiBar: Why Preppers LOVE BREAKABLE Silver Bars -

Tag 133

Tag 133

More from this category

Is offering a Rolex to a foreign official considered bribery under Swiss law?

Is offering a Rolex to a foreign official considered bribery under Swiss law?9 Dec 2025

Swiss key interest rate expected to remain at zero percent

Swiss key interest rate expected to remain at zero percent8 Dec 2025

Swiss hotel industry heading for new highs after strong summer

Swiss hotel industry heading for new highs after strong summer8 Dec 2025

Dollar Consolidates Ahead of Central Bank Meetings

Dollar Consolidates Ahead of Central Bank Meetings8 Dec 2025

- Are traditional Swiss livestock breeds at risk of extinction?

8 Dec 2025

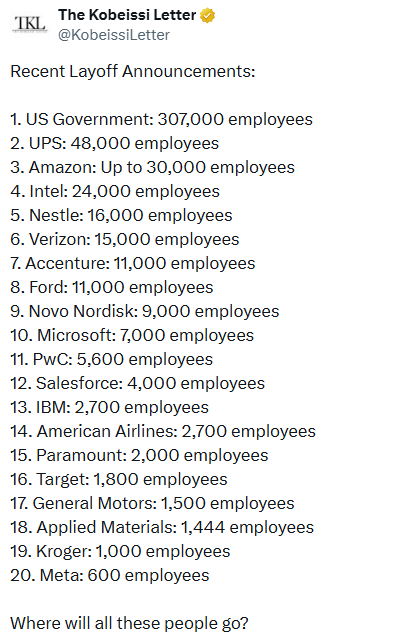

1 Million Layoffs

1 Million Layoffs8 Dec 2025

The DPI Link To Margin Debt

The DPI Link To Margin Debt8 Dec 2025

- The Government Is Lying About Inflation

6 Dec 2025

- The K-Shaped Economy

6 Dec 2025

Week Ahead: Fed to Cut but RBA, SNB, and Bank of Canada Set to Hold, and Market Thinks They are Done

Week Ahead: Fed to Cut but RBA, SNB, and Bank of Canada Set to Hold, and Market Thinks They are Done6 Dec 2025

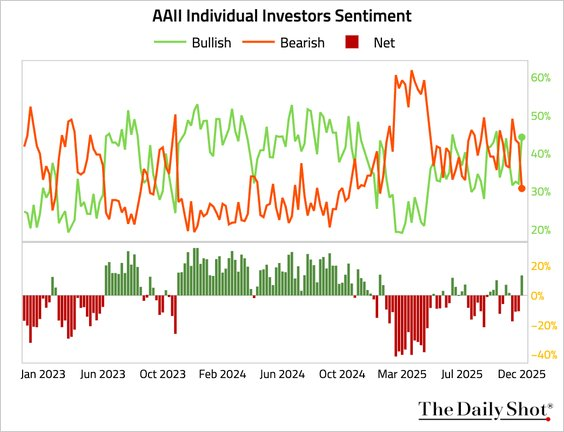

Bullish Case Or Bearish Backdrop

Bullish Case Or Bearish Backdrop6 Dec 2025

- Why Banning Hate Speech Is Evil

5 Dec 2025

- New York’s Political Left Turn: Why the Real Ballot Is Cast by Migration

5 Dec 2025

- Europe’s Innovation Is Drowned in a Sea of Government Intervention

5 Dec 2025

- The Affordability Equation

5 Dec 2025

- Money Supply Growth Surges to Multi-Year High as The Fed Loosens Policy

5 Dec 2025

- Trump’s Red-Carpet Welcome of Mohammed bin Salman

5 Dec 2025

- Karl-Friedrich Israel on The Peter McCormack Show

5 Dec 2025

Swiss to relaunch auction for ‘SO 1’ number plate

Swiss to relaunch auction for ‘SO 1’ number plate5 Dec 2025

- The Unjustified Conflict: Grant’s Memoirs on the Mexican-American War

5 Dec 2025

Quantitative Easing: A Boon or Curse?

Published on July 24, 2021

Stephen Flood

My articles My videosMy books

Follow on:

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the Great Financial Crisis many worried that consumer price inflation would rise rapidly due to the extra liquidity in the market. A fear that never materialized as many economies stayed well below central bank inflation targets.

Quantitative Easing Leading to Financial Crisis?

The question being asked now is have these programs led to financial mania?

This is how Peter Fisher, former executive vice president and manager of the System Open Market Account of the New York Federal Reserve, describes the effect of the action of the Fed in the PBS Frontline (U.S. based) program released on July 13. Mr. Fisher goes on to say that when he

The Frontline program does also have interviews with supporters of QE; “we’re lucky that the government was successful, or we could be living through a true depression”, stated Lev Menand, a former economic advisor to the Fed and the Treasury Department.

But the overall message of the program is that, “while well-intentioned, the Fed’s experiment has delivered mixed results over the years, some experts say in the documentary, with the biggest benefits going to Wall Street rather than Main Street, wealth inequity widening and the risk of inflation growing — over the past year, in particular. In addition, the Fed has insisted signs of inflation are temporary. However, has signaled it may taper quantitative easing and raise interest rates as early as 2023.”

Moreover, even investors that have greatly benefited from the Fed’s program. Such as Jeremy Grantham, spoke out against the unintended consequences of the massive QE programs;

Quantitative Easing Causing More Harm Than Cure?

Mr. Fisher describes QE as “pretty basic in medicine that our doctor may give us a drug, which, in a small punchy dose, for a brief period of time, might help us recover from whatever ails us … But that the same medicine, the same drug, taken in massive doses over long periods of time, might kill us or make us ill or have perverse side effects.”

…. Or the medicine intended to cure, or lessen the pain, could become an addiction. This is exactly what a report published on July 16th from the House of Lords, Economic Affairs Committee titled: Quantitative Easing: a Dangerous Addiction?

According to a Bloomberg article, penned by Mervyn King, a member of the committee which issued the report, the answer to this pointed question as the title is “Yes”. Mr. King goes on to say that the report has four important points.

The first point of the report is for central banks to not get locked in the mindset that all the rise in inflation is transitory. Although he agrees that some components will be due to base effects he warns central banks that “the lack of concern that has characterized central-bank statements — at least until the last few days — fuels the perception that policy makers are stuck with their “lower for longer” mindset. This matters, because if policy falls behind the curve, the cost of tackling a rise in inflation will be higher than it would be under a forward-looking, preemptive approach.”

The second point of the report is that: “QE is not a cure-all. QE has become a universal remedy for almost any macroeconomic setback. But only certain shocks merit a monetary-policy response. Moreover, the explanations provided by central banks to justify the scale of QE in 2020 changed over the course of the year. It failed to distinguish between shocks that justified a monetary response and those that didn’t.”

The third point of the report is that: “QE poses risks for central-bank independence. QE has made it easier for governments to finance exceptionally large budget deficits in the extraordinary circumstances of Covid-19. But when the central banks reduce this support, will they come under pressure to help finance ongoing budget deficits or to keep short-term interest rates close to zero? It’s possible they will.”

And the fourth point of the report is that: Central banks need to have an exit plan. QE tends to be deployed in response to bad news, but isn’t reversed when the bad news ends. Mr. King goes on to say that

Full story here Are you the author?Follow on:

No related photos.

Tags: Business,central-banks,Commentary,Economics,economy,Featured,Federal Reserve,federal-reserve,Finance,Financial crisis,inflation,Interest rates,Monetary,Monetary Policy,money,News,newsletter,Quantitative Easing