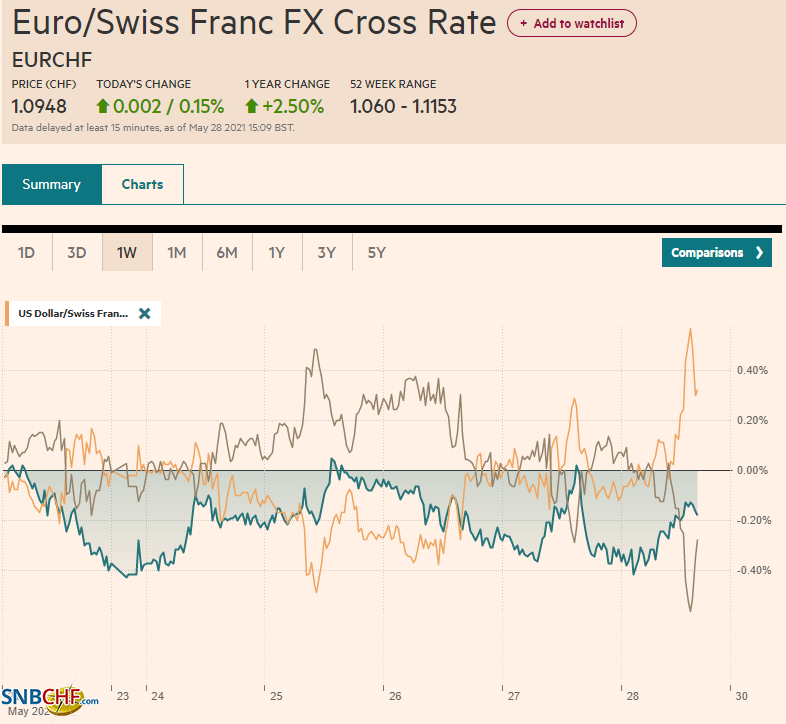

Swiss FrancThe Euro has risen by 0.15% to 1.0948 |

EUR/CHF and USD/CHF, May 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The recovery of the US 10-year yield, so it is flat on the week near 1.61% coupled with month-end demand, is helping the US dollar firm. While the yen is bearing the burden on the week, with a 0.8% loss, the Antipodeans are leading the downside on the day. Although the New Zealand dollar has not maintained the momentum spurred by the more hawkish RBNZ, it is holding on to about a 1% gain for the week to lead the majors. The Chinese yuan rose to new three-year highs today, and its 1.1% gain on the week is the most since last November. While the JP Morgan Emerging Market Currency Index is trading heavily today, it is snapping a two-week decline. The yen’s weakness helped lift the Japanese shares, and the Nikkei gapped higher, and its 2.1% gain was the most in ten weeks. The largest equity markets in the Asia Pacific region were stronger, save China and Hong Kong. European shares are firmer, and the Dow Jones Stoxx 600 is reaching new record highs with the seventh consecutive advance. US futures indices are trading 0.2%-0.4% better. US and European benchmark 10-year yields are little changed. Industrial commodities in China, including iron ore and steel rebar, are closing the week on the upside, though copper is trading lower. Lumber futures are bringing a four-week decline into today’s session. Oil prices are higher, and July WTI is rising for the sixth consecutive session. It reached $67.45 in Asia, a new high, before consolidating. Gold is also consolidating after being unable to close above $1900 despite intraday penetration for the past two sessions. |

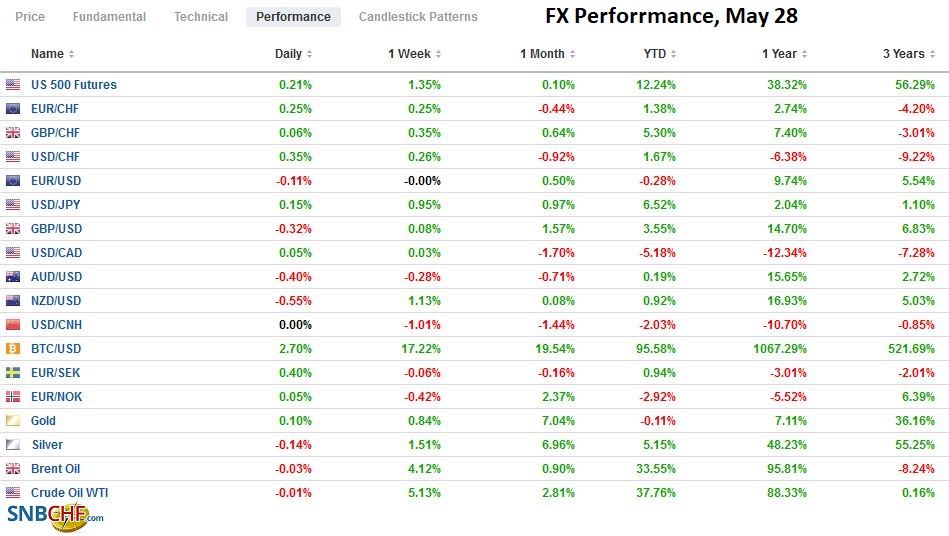

FX Perforrmance, May 28 |

Asia Pacific

The Japanese economy continues to struggle after contracting in Q1. The formal state of emergency is expected to be extended from the end of this month until June 20 in seven prefectures. Japan reported weaker than expected employment data for last month. April unemployment rose to 2.8% from 2.6%, and the job-to-applicant ratio slipped to 1.09 from 1.10. Next week Japan reports April industrial production and retail sales, which may capture the economic challenge. Exports should help underpin industrial output, but domestic demand is likely weakened. April retail sales are anticipated to have fully offset March’s 1.2% gain.

China’s PBOC and SAFE (State Administration of Foreign Exchange) reportedly met with market participants and issued a statement. The statement recognized that two-way price action is normal and that the exchange rate will not be used to pursue other policy goals. Appreciation will not be sought to offset commodity prices, nor depreciation used to stimulate exports. Given that the yuan had risen against the dollar for the past six sessions, the statement seemed mild and as neutral as one can imagine. Although some media accounts played it up, the market seemed to pay little heed and took the yuan higher. With the US (and UK) markets closed on Monday, note that China will report May PMI data and Caixin’s manufacturing PMI. China’s expansion is continuing, even if unspectacularly so.

The dollar jumped against the yen yesterday, helped by the small rise in US yields, but has held just below JPY110, where a $2 bln option will expire today. It has not traded above JPY110 since April 6. The range remains tight, and the greenback has not traded below JPY109.80. Recall that the dollar settled a touch below JPY109 last week.

The Australian dollar was turned back from $0.7800 in the middle of the week and returned to approach the week’s low earlier today near $0.7715. The RBA meets on June 1 and may lay the groundwork for the July decision on QE and the yield curve control. The $0.7750-level holds an option for nearly A$555 mln that expires today. On June 1, there are A$1.15 bln in options around there ($0.7740-$0.7750) that will be cut.

The Chinese yuan has not fallen since May 18. The dollar finished last week near CNY6.4340 and fell to CNY6.3630 today. The dollar’s 1.1% loss this week is the most since last November. The PBOC set the dollar’s reference rate at CNY6.3858, a little higher than banks in Bloomberg’s survey anticipated (CNY6.3857). This, too, seems like a restrained reaction. However, the PBOC could escalate its response, and this will be closely watched in the coming days.

Europe

Comments by the Bank of England’s Vileghe helped lift sterling back above $1.42 after it had briefly fallen below $1.4100 for the first time in ten days. He spoke indirectly about the currency by talking directly about interest rates. Vileghe seemed to take for granted that a rate hike would likely be delivered in the second half of next year. However, he held out the possibility of an earlier hike tied to the labor market’s performance after the expiration of the furlough program that subsidized wages for those impacted by Covid and may have masked a greater rise in unemployment. Vileghe is seen as a centrist, and his term ends on August 31. The 10-year yield rose nearly six basis points, while the two-year Gilt yield rose four basis points from one. Rates have edged a little higher today.

On the other hand, Health Secretary Hancock indicated that the final stage in the economic re-opening may not, in fact, materialize on June 21 as planned. A formal assessment of the data (the mutation first identified in India) is surging among cases in the UK. The number of infections in the UK has risen in recent days, and hospitalization is also increasing.

The doves at the ECB spoke loudest this week in opposition to slowing the PEPP bond-buying next month. Yields have fallen this week, and premiums over Germany have narrowed. Reports suggest economists at many of the large banks now see the doves prevailing. We are not convinced it makes much of a difference in the foreign exchange market, where the euro has traded higher since the mid-March decision to expand purchases, and yields rose. Note that on June 1, the eurozone reports the final (May) manufacturing PMI, April unemployment, and the preliminary estimate for May CPI (the year-over-year rate is expected to rise to almost 2%, with food and energy accounting for almost half).

The euro’s upside momentum that had carried it to around $1.2265 earlier this week has stalled, and the single currency has slipped to a marginal new low for the week a little above $1.2170. There is a 1.8 bln euro option expiring at $1.22 today. We suspect the near-term risk is on the downside and see potential toward $1.2135-$1.2155 today and/or Monday.

After several attempts, sterling closed above $1.42 yesterday (outside up day) for the first time in three years but has faltered and is better offered now. The near-term risk extends today $1.4120-$1.4140, and the nearly GBP817 mln option at $1.42 may expire quietly today.

America

The US finishes the week with a flurry of April real sector data. Look for a record goods trade deficit. It averaged $87.3 bln a month in the first quarter, a more than 20% widening from the average in Q1 19 (~$71.2 bln). The strong domestic demand is drawing down retail inventories while wholesale inventories are being rebuilt. However, the personal income and consumption figures will draw the most attention. Income is widely expected to slump after the government-induced 21.1% surge in March. The disappointing retail sales report (which accounts for almost 50% of personal consumption) has dampened expectations for the PCE report. The median forecast in Bloomberg’s survey calls for a 0.2% gain after the 3.6% surge in March. There is little doubt that the deflator jumped, but the Fed insists that it will be temporary. The University of Michigan’s preliminary long-term inflation (5-10 years) jumped to 3.1% from 2.7%, and it is often a close approximation of the final report that will be released today. If the trade deficit is one of the twins, the other one is also likely to be featured today as the Biden administration is set to provide initial details of the next fiscal year’s budget.

The Senate bill that seeks to bolster the US competitive position against China and includes some funds, like $100 bln for research and development and $52 bln for semiconductor fabrication, will allow the administration to shave its infrastructure proposals. A compromise was struck with Senate Republicans after 14 of their amendments were voted on (of 18 amendments proposed). Passage by the entire Senate is practically assured. China is one of the few issues in which there seems to be a strong bipartisan consensus in the US. The House of Representatives is considering its own bill, which makes reconciliation the next big challenge.

The economic diaries of Canada and Mexico are light. The US dollar approached last week’s high against the Canadian dollar yesterday (~CAD1.2145) and was turned down. It is finding support now in the CAD1.2060 area. A large $1.25 bln option at CAD1.2100 expires today, and there appears to be a battle over it now. The Canadian dollar has appreciated for seven consecutive weeks coming into this week. It finished last week near CAD1.2065.

The greenback carved out a shelf in recent days around MXN19.81-MXN19.83. The small rise in US rates appears to be encouraging some dollar short-covering that has lifted it a little above MXN20.0750, its highest level in two weeks. This month’s downtrend line comes in today around MXN20.03, and a close above it may signal further greenback gains next week ahead of the June 6 legislative and local elections.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,ECB,Featured,Japan,newsletter,U.K.