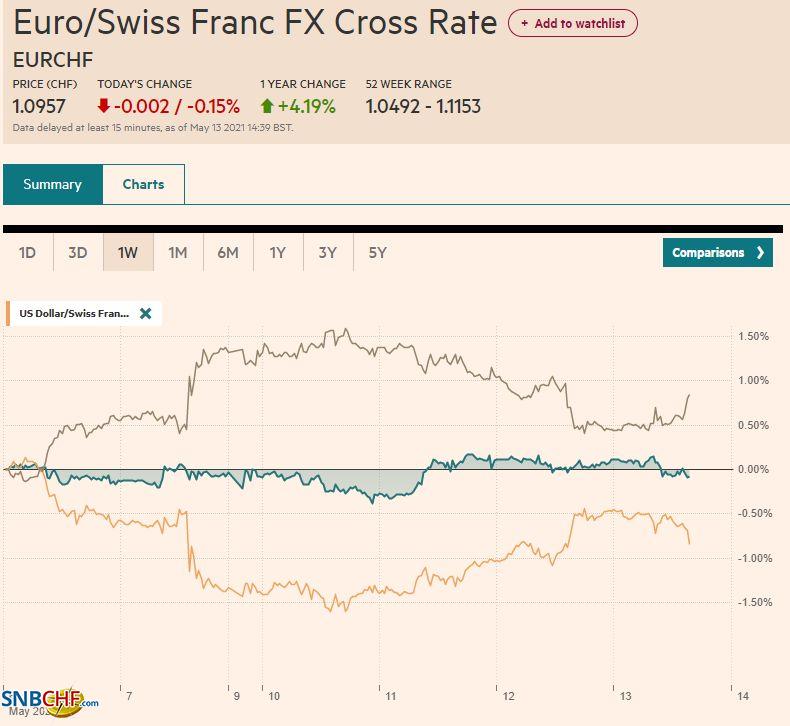

Swiss FrancThe Euro has fallen by 0.15% to 1.0957 |

EUR/CHF and USD/CHF, May 13(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It is as if the bond vigilantes were pushed too far. US inflation is accelerating more than expected, and it cannot all be attributed to the base effect, and the Federal Reserve, to many investors, is tone-deaf. With powerful fiscal stimulus, nominal growth above 10%, and the economy re-opening, albeit unevenly, does the monetary accelerator need to be fully engaged? The US 10-year yield jumped, providing a nice concession at the quarterly refunding and lifted the dollar broadly. Stocks got hammered, and still no safe-haven bid for Treasuries. Near 1.70%, the yield is almost 25 bp above the post-jobs disappointment low. The sharp sell-off in US shares, which continues today, with the futures indices off 0.3%-0.5%, knocked Asia Pacific bourses 1%-2% lower and the MSCI Asia Pacific Index is now nearly flat on the year. Europe’s Dow Jones Stoxx 600 appeared resilient yesterday but is off about 1.3% today to bring the week’s drop to almost 3%. Bonds have yet to see safe-haven demand. The US 10-year yield is steady, near 1.69%, while European yields are 2-5 bp higher, with benchmark yields at the high for the year. The dollar is mostly firmer, but the yen and Swiss franc are posting minor gains. The euro steadied in Asia Pacific turnover but found sellers in the European morning. Emerging market currencies have a clear downside bias today. The JP Morgan Emerging Market Currency Index is lower for the fourth consecutive session, which would be the longest losing streak in a couple of months. After four days of approached but unable to push above $1850, rising yields sapped gold, which fell to nearly $1810 in Europe. News that the US pipeline will re-open took the bid from crude oil. The June WTI contract reached nearly $66.65 yesterday and is now below $64.50 and poised to test the 20-day moving average around $63.90. It has not closed below that moving average in a month. |

FX Performance, May 13 |

Asia Pacific

China continues to appear clumsy on the international stage and is alienating regimes that seem somewhat friendly. Beijing’s foreign policy is counter-productive. It has been harassing Taiwan and has been encroaching on waters of the disputed islands that Japan also claims. However, reports suggest over 300 vessels have gathered around islands claimed by the Philippines. Philippine President Durterte has been perhaps the closest friend of China’s in the region. He recently called China a “benefactor” and sought to end the Visiting Forces Agreement with the US. In March, when the Philippines first protested the Chinese incursions, Beijing said they were “taking shelter from the wind.” Since then, the number of vessels has risen by a half. Some suspect China is probing and seeking to test the US resolve.

There are two developments to note in Japan. The first is what did not happen. Although Japan’s Topix has experienced its sharpest three-day decline since last June, the BOJ has not stepped into the market to buy ETFs. Recall that the BOJ ended its JPY6 trillion (~$55 bln) annual target and opted to act only in times of “heightened market instability.” It has only bought stocks once (April 21) since the new rules came into effect on April 1. Second, Japan reported a smaller than expected March current account surplus (JPY2.65 trillion vs. JPY2.76 median forecast in Bloomberg’s survey and JPY2.92 in February). However, the trade surplus itself was larger than projected (JPY983 bln vs. JPY788 bln forecasts and JPY524 bln in February). The primary income surplus, which tracks the flow of profits, interest, dividends, and worker remittances, fell by JPY835 bln to JPY1.44 trillion.

The dollar reached its best level in a month in Tokyo near JPY109.80 today but is trading broadly sideways and is holding above JPY109.40. Although resistance around JPY109.65 was frayed, a convincing move above it is needed to signal another try at the year’s high set at the end of March near JPY111.00. The Australian dollar peaked near $0.7890 on Monday before reversing lower. It found support yesterday near $0.7720, and today, it slipped below $0.7700 briefly. The low from earlier this month was closer to $0.7675. Initial resistance is now seen in the $0.7720-$0.7740 band. Note that there is a A$980 mln option at $0.7750 that expires tomorrow. The greenback traded in a particularly tight range against the Chinese yuan, consolidating yesterday’s gain. It briefly traded at new highs for the week (~CNY6.4580) and steading straddling little changed levels. After some deviations from expectations, the PBOC set the dollar’s reference rate at CNY6.4612, tight to what the bank models projected in Bloomberg’s survey.

Europe

The rise in European bond yields is challenging ideas that the ECB would slow its bond-buying next month. Recall that the surge in US yields helped pull European yields higher earlier this year. The ECB responded in March by stepping up its purchases under the Pandemic Emergency Purchase Program. However, the hawks at the central bank have been arguing that it was not needed anymore, and a decision is expected next month to reduce the buying. The new staff forecasts were expected to give them cover. Yesterday, the EU raised its GDP forecasts for the eurozone to 4.3% and 4.4% for this year and next, respectively, from 3.8% in both years. The ECB is likely to follow suit next month. It had projected growth of 4.0% this year and 4.1% next.

The Bank of England’s chief economist Haldane, who is stepping down next month, continues to have among the hawkish rhetoric of any major central banker presently. A week after the Bank of England agreed to reduce its weekly bond-buying, Haldane argued with inflation likely above the 2% target (medium-term) by the end of the year, “tightening the tap” may be necessary to “avoid a future inflation flood.” However, he does not appear to have persuaded any of his colleagues. The December short-sterling futures contract (three-month interest rate futures) remains in its trough where it has been stuck since the end of February, implying a yield of about 14 bp. The December 2022 contract implies 42 bp, matching the highest level since last April.

The euro extended yesterday’s slump to nearly $1.2050 trendline support. A break signals a test on the $1.2000 level, the (38.2%) retracement of the rally from the March 31 low (~$1.1705). The next retracement is around $1.1950, by where the 200-day moving average is found. There is an option at $1.21 that expires today for 1.36 bln euros and a smaller option (~715 mln euros) that expires tomorrow at $1.20. Sterling’s losses have also been extended today to test the (38.2%) retracement of this month’s gain seen near $1.4025. The next retracement (50%) is found near $1.3985. There options for GBP320-GBP360 mln at $1.40, expiring today and tomorrow.

America

Yesterday’s US CPI shock is followed by today’s PPI report. Economists had projected a 0.3% increase on the headline rate and 0.4% on the core rate in Bloomberg’s survey, but there is much talk about an upside surprise. Yet, if such a surprise does materialize it cannot be, well, as unexpected. Yesterday’s CPI, which the Fed’s Vice Chair Clarida admitted was surprising, seems to be the third such surprise for the central bank in a short period. The surge in US yields in March was said to have caught officials’ attention, and last week’s hugely disappointing employment report surely surprised officials as much as it did the market. The annualized rate of CPI this year is so far running a little north of 6%. This is not about the base effect but about the re-openings and supply chain, and shortage issues. Vehicle prices rose, and the 10% surge in US used car prices accounted for a third of the headline increase in CPI. Hotel accommodation and airfares were set low during the pandemic and registered what appears to be record gains last month.

In addition to the PPI today, the US reports weekly initial jobless claims. Recall that last week’s report showed the first drop below 500k since the pandemic struck. The median forecast looks for a small decline, though there is some talk of a reading closer to 450k (from 498k). The jump in US yields yesterday gave the 10-year note auction a concession, and the sale was solid with a higher bid-cover than the previous auction though the yield was nearly identical (~1.68%). Fed Presidents Barkin and Bullard speak today, as does Governor Waller. While Canada has a light economic diary, the central banks of Mexico and Peru meet. Although Banxico would like to cut rates, its hands are tied by the strong gains in inflation, which remain well above target. Peru’s reference rate is at 25 bp, and its inflation is above 2%. The sol has fallen by about 2.7% this year, and the lion’s share has taken place over the last several weeks.

The US dollar posted a potential key reversal against the Canadian dollar yesterday by falling to new multi-year lows (~CAD1.2045) before rebounding and settling above Tuesday’s high. Follow-through dollar buying saw it approach CAD1.2160. A move above there targets CAD1.2200-CAD1.2235. An option for $605 mln at CAD1.2110 expires today. The greenback had traded a little below MXN19.83 on Tuesday and jumped to MXN20.1850 yesterday. No follow-through dollar buying has emerged yet today, but the intraday technical indicators seem to favor it. Last week’s highs were set near MXN20.3450 and are the next targets.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of England,Banxico,Business,China,ECB,EUR/CHF,Featured,inflation,newsletter,Philippines,USD/CHF