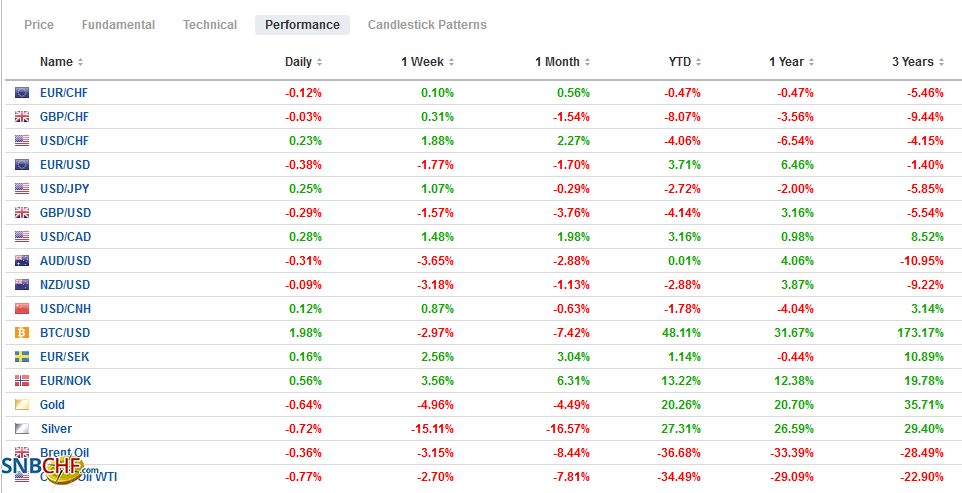

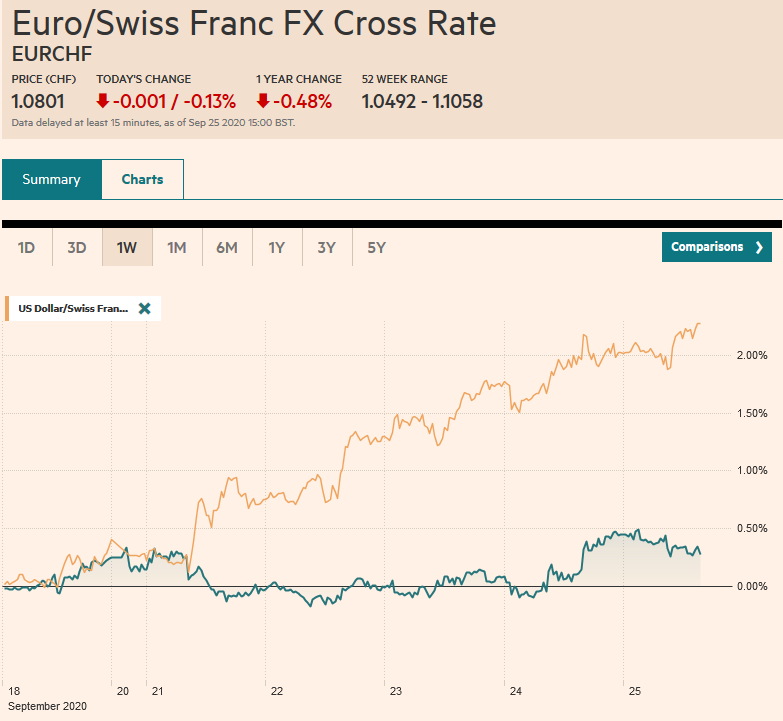

Swiss FrancThe Euro has fallen by 0.13% to 1.0801 |

EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock market close higher on the week. However, the coattails were not long enough to lift Europe. A record number of virus cases in the UK and France dampened the mood, and most markets are off around 0.5%, and US shares are also trading with a heavier bias. European benchmark 10-year yields are 1-2 bp lower, while the US 10-year Treasury continues to hover around 66 bp. It has been in less than a five basis point range this week. The dollar is mixed but mostly firmer on the day before the US open. The Australian and New Zealand dollars are leading majors, while the Norwegian krone remains near what is almost a three-month low recorded yesterday. For the week, the Antipodeans and Scandis are off 2.7%-4.7%. Among the emerging market currencies, the Indian rupee and Turkish lira lead the effort to pare the weekly losses. The JP Morgan Emerging Market Currency Index is fractionally lower after rising almost 0.5% yesterday. It is around 2% lower for the week, the largest loss in five months. Gold is around $16 above yesterday’s lows, but near $1865 is off about 4.4% for the week. November WTI is above $40 a barrel and has firmed every session since Monday’s 4% drop to cut the loss in half. It rose in four sessions last week as well. |

FX Performance, September 25 |

Asia Pacific

Most observers focus on the quantitative, bilateral trade targets in the Phase 1 trade deal between the US and China. There were also numerous other actions, including market access measures that were in the agreement. Many and some say most of these are being delivered. Practical improvements in the market structure were cited by FTSE-Russell as it announced that it will include Chinese bonds in its indices starting a year from now. Estimates suggest it could spur almost $100 bln of inflows.

Australia announced a dramatic cut in regulatory procedures for bank lending to households and small businesses. The burden is shifted from the lender to the borrower to provide income and spending information instead of their own lengthy (costly) verification process. Yesterday Australia’s Treasury announced wholesale reform of insolvency laws. Both measures are aimed at strengthening economic activity in the face of the pandemic.

The dollar recovered smartly off the JPY104 seen at the start of the week. While it remains firm in the upper end of this week’s range, the momentum has stalled near JPY105.50. About $830 mln in options between JPY105.80 and JPY105.87 expire today. Initial support is seen near JPY105.20. The Australian dollar held $0.7015 yesterday, its lowest level since late July. It has traded a little above $0.7085 today, and $0.7100 is seen as initial resistance. The US dollar’s eight-week slide against the Chinese yuan, the longest in more than 2 1/2 years, ended this week with about a 0.75% advance. The PBOC set the reference rate at CNY6.8121, which was fractionally weaker dollar than the bank models, according to Bloomberg anticipated.

Europe

UK Chancellor of the Exchequer Sunak will replace the furlough job program, which expires at the end of October, with a new program that is the centerpiece of the government’s initiative especially given the new social restrictions. The expiring program saw the government pick up 80% of the wages of employees that could not return to work. The latest effort will pay subsidies to workers who cannot work more than a third of their regular hours. Actually, the government and employers will split the wages for the hours that cannot be worked. This might mean that some employers pay a little more than half the wages for one-third of the work. Projections suggest employees may be able to secure a little more than three-quarters of their normal wages. Sunak also will give businesses more time to pay back government-guaranteed loans.

Eurozone money supply growth unexpectedly slowed in August to a 9.5% pace. Economists had expected a 10.1% pace, which would have been unchanged from the July revision (from 10.2%). Lending to households and non-financial firms remains steady at 3.0% and 7.1%, respectively. Separately, ECB Governing Council member Villeroy seemed to make a passionate appeal that “close to but below 2%” inflation target has been misunderstood. Rather than be a cap, he suggested a symmetrical reading making it more like the Federal Reserve’s two percent average rate. The ECB has begun its own strategic review.

The euro is trading within yesterday’s ranges, and there is some cautiousness over its inability to push back above $1.17, where there are a 630 mln euro option that expires today. If the $1.1685 area is the cap, then nearby support is seen near $1.1640. The euro finished last week near $1.1840, and the 1.5%+ loss this week is the largest since April. With today’s decline, it has fallen in seven of the past 10 sessions. The one-month risk-reversal is still favoring euro puts, but the two-month has flipped back in favor of calls. Late Asian turnover saw the sterling pop above $1.28, a three-day high, but it met a wall of sellers in Europe and fell to new session lows a little below $1.2735. The $1.2700-$1.2725 area offers band support and a break, puts the recent lows near $1.2675 at risk. Sterling finished last week near $1.2915.

America

The House of Representatives is working toward passing a $2.4 trillion stimulus bill next week along party lines. It presents a backdown from the $3.4 trillion package approved in May. The White House says it can see $1.5 trillion, but the Republicans have problems finding a consensus for more than $1 trillion. The Chair of the Senate Appropriations Committee was not optimistic that a deal could be worked out before the election. The lack of new fiscal measures prompted at least two large US banks to cut Q4 GDP forecasts (one from 3.5% to 2.5%, the other from 6% to 3%). The US reports August durable goods orders today and a sharp slowing after the 11.4% surge in July, underscoring that the strong momentum of late Q2 was fading by late Q3.

Trudeau’s Liberals modified their proposals to include maintaining income supports at the current levels looks sufficient to win over New Democrat Party. In turn, this means that the Liberal-minority government will survive. The last three minority governments lasted an average of two years, though the roughly 1/3 of the votes garnered by the Liberals is the least. Next month, the government is a year old.

The central bank of Mexico delivered the 25 bp rate cut yesterday that was widely expected. We had thought that with inflation rising sharply since April to above the target range, and the peso falling, that the chances of a cut were lower, but the target rate now stands at 4.25%. It was the 11th cut in the cycle that began at 8.25%. The decision was unanimous. Its next meeting is on November 12. The peso was already recovering before the rate announcement, and it hesitated momentarily but made new session highs later in the day.

The dollar rallied from a low at the start of the week near MXN20.8450 and peaked yesterday near MXN22.70, before reversing lower. It met the (38.2%) retracement objective near MXN21.99. The next important support is the MXN21.67-MXN21.77 band, but the dollar is staging a recovery late in the European morning, and a looks poised to test resistance near MXN22.40. The US dollar is snapping a 6-week drop against the peso with an exclamation point. Its 5% gain this week is the most in five months. The greenback is well within yesterday’s range against the Canadian dollar. It is encountering some offers in the CAD1.3370 area. A move above there could signal a re-test on the high near CAD1.3420. It is the third consecutive weekly gain for the US dollar, the longest advance here in Q3.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Canada,Currency Movement,ECB,Featured,Mexico,newsletter,U.K.