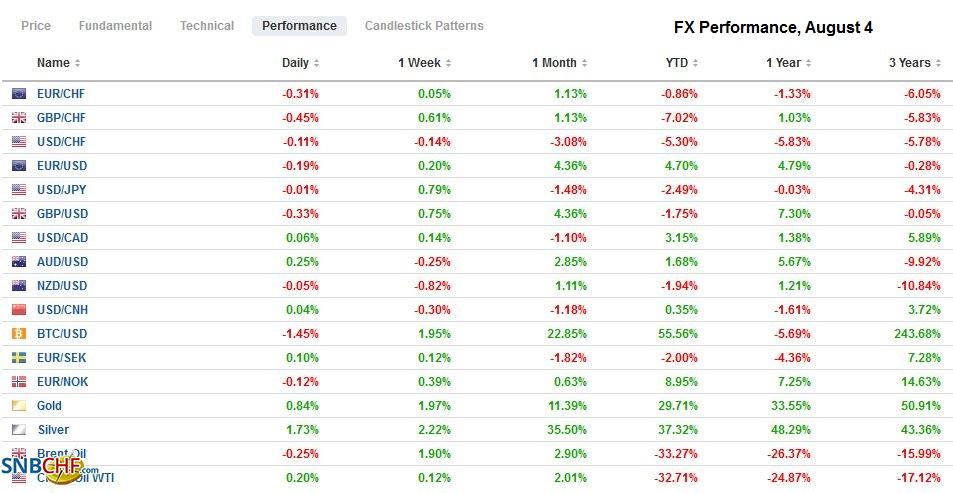

Swiss FrancThe Euro has fallen by 0.39% to 1.0751 |

EUR/CHF and USD/CHF, August 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

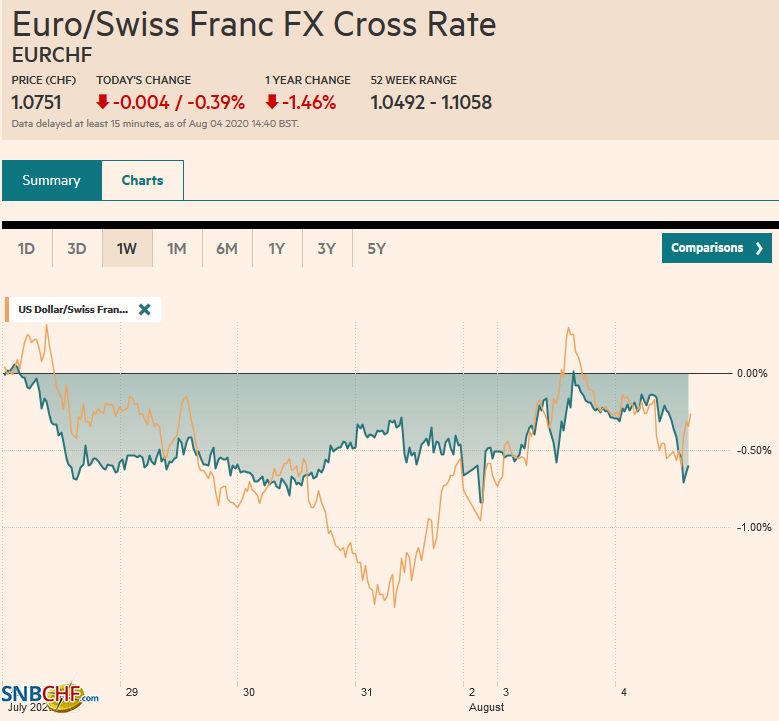

FX RatesOverview: Asia Pacific equities rallied after the US shares rallied with the Nasdaq reaching record highs after it and the S&P 500 gapped higher yesterday. Japan and Hong Kong led the rally with more than 2% gains, while the Shanghai Composite lagged with about a 0.1% gain. However, the momentum did not carry into Europe, where the Dow Jones Stoxx 600 is paring yesterday’s 2% gain, which was the most in two months. US shares trading with a heavier bias (~-0.3%). European bond rally, though is intact and Spanish and Portuguese benchmark 10-year bond yields have slipped to new lows. The US 10-year is little changed around 54 bp. The dollar is narrowly mixed among the majors, though we suspect the greenback’s upside correction may not be over. Emerging market currencies are mostly lower, though eastern and central European currencies are mostly a little higher. The JP Morgan Emerging Market Currency Index is off a little for the fourth consecutive session. Gold is consolidating after setting a new marginal high near $1988.50 yesterday. September WTI recorded an outside up day yesterday was has been unable to sustain the momentum and is consolidating in roughly a 60 cents range below $41 a barrel. |

FX Performance, August 4 |

Asia Pacific

We had suggested that the risk of a small rate cut by the Reserve Bank of Australia was more likely than the consensus view of a standpat policy. The RBA did not deliver the rate cut, but it did resume its bond-buying. The three-year yield that it targets at 25 bp has been confined to less than such a tight range around it that the central bank has not felt obligated to buy any bonds since May 6. Governor Lowe, like other central bankers, has argued that the heavy lifting left is for fiscal policy. Separately, Australia reported its June trade surplus of A$8.2 bln after May’s A$7.3 bln. Exports rose 3% on the month after a revised 7% slide in May (initially -4%), while imports rose 1%, recovering from a revised 7% slide (initially -6%). Meanwhile, retail sales slowed to a still strong 2.7% gain in June after May’s 16.9% surge.

Tokyo’s July price pressures were stronger than expected. Headline CPI rose by 0.6%, twice the median forecast in the Bloomberg survey up form 0.3% in June. The core, which excludes fresh food, also doubled to 0.4% from 0.2%. Excluding fresh food and energy, Tokyo’s CPI rose by 0.6%. It bodes well for the national figures (August 20), where the headline rate stood at 0.1%, and the core rate was zero in June.

China objects to the US forced sales of TikTok to a US company. While President Trump has indicated, Microsoft can do it. His trade advisor Navarro raised questions about Microsoft because it “helped China construct its firewall.” Meanwhile, Trump has demanded that the US government get a “finders fee” for making the deal. It is not clear the basis for the demand, and no doubt the US would object to similar actions by any other country.

The US dollar has been confined to about a 15 tick range on either side of JPY106.00 and is well within yesterday’s roughly JPY105.60-JPY106.50 range. There are a few nearby options that expire today. There is an option for about $400 mln at JPY105.75 and another $520 mln at JPY106.00. Lastly, there is a third set at JPY106.07 for $444 mln. The Australian dollar is trading at the upper end of yesterday’s range (~$0.7150) after recovering from a pullback that began at the end of last week to about $0.7075. The high is corresponds to the halfway mark of the recent range. We suspect the Aussie is still, well, in the middle of the corrective phase and could see new lows. The PBOC’s reference rate for the dollar was set at CNY6.9803, a little weaker than bank models suggested. The central bank drained liquidity from the banking system for the second consecutive session, and money market rates firmed. Hong Kong stocks and the Hong Kong dollar have shown no adverse effect from the decision to postpone the election a full year. The US criticized China for the move within a day or two of President Trump, suggesting the US delay its election. The Hong Kong dollar remains pinned against the upper end of its band.

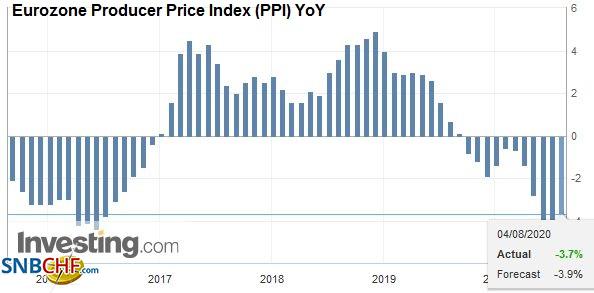

EuropeTomorrow ends the three-month period the German Constitutional Court gave for the ECB to demonstrate “proportionality” of its measures or the Bundesbank could no longer participate in the asset purchases under the Public Sector Purchase Program. The ECB, the Bundesbank, and the German Bundestag all have indicated that proportionality has been demonstrated. The Bundesbank will continue to participate in the bond-buying. While the specifics have been addressed, the broader issue raised by the German Court ruling, that a national court can review the decisions of the European Court of Justice. It is possible, maybe even likely, that another national court in a different context will use it as the German court as precedent. This risk may not be imminent, and the sentiment has been on the “unity” showed in the EU’s unanimous decision on the recovery fund and a common bond issue. Some observers suggest that if the Democrats capture the White House, the US will improve its strained ties with Europe. Yet, the op-ed by former Clinton Administration’s trade representative Barshefsky warned it may not be so easy. She objected to what she dubbed as “techno-nationalism.” She cautioned that if Europe continues on the current path, which includes a digital tax, conformity on AI application, and a European cloud infrastructure, the US would have little choice but to treat Europe as a “strategic threat” and would sink efforts to reach a trade deal. |

Eurozone Producer Price Index (PPI) YoY, June 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

Turkey surprised with a lower than expected July inflation reading. Headline inflation eased to 11.76% to snap a two-month rise and return to below where it finished last year (~11.84%). The month-over-month rise of 0.58% was the smallest since March. A key element, energy, slowed to 8.6% from 9.1%. Food prices, which account for a little more than a fifth of the CPI basket, were sticky at 12.7% (vs. 12.9% in June). Core inflation, which strips out food and energy, softened to 10.25% from 11.64%, the lowest since April. The dollar fell to a four-day low against the lira as its consolidates last week’s 1.8% surge.

The euro has continued the recovery that began in the US yesterday after the single currency dipped briefly below $1.17. It had firmed a little through $1.18, to recoup about half of the push down that seen starting before the weekend when it punched through $1.19. We are not convinced that the corrective phase is over. A move above the $1.1830 area, however, would likely provide such a signal. Initial support is seen near $1.1750, where an option for a little more than 825 mln euros will expire today. For its part, sterling is trading within yesterday’s range and looks poised to retest the $1.30 area which held yesterday. Recall that a ten-session rally was snapped before the weekend, and the backing and filling is not a surprise.

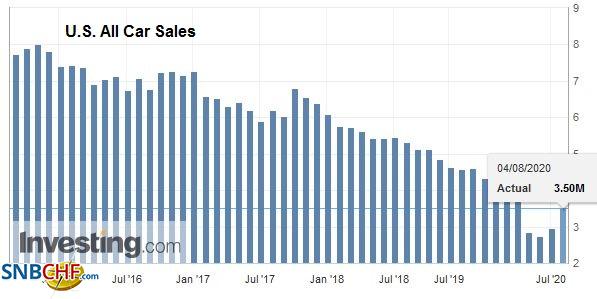

AmericaIt is not just that the July EMU PMI was revised up and the US down, but the US policy has shifted to a less supportive stance. Although many are still talking about how the Fed is buying everything and corrupting the price discovery process, the fact of the matter is that its balance sheet has fallen for five of the past seven weeks, shrinking by almost $220 bln. The dollar trended lower over this period, while the ECB and BOJ balance sheets were still expanding. Now the fiscal support will diminish. The federal government spent about $109.5 bln on unemployment benefits last month after almost $116 bln in June. And nearly at the same moment that people will lose the $600 a week payment, the moratorium on evictions and foreclosures has expired. There will be a material loss of income this month, which will have an inevitable impact on spending. The eviction moratoriums expired in around 30 states, and protections under the CARES ACT also ended. Estimates suggest that some 40 mln Americans are at risk, four times more than in the Great Financial Crisis. The Trump Administration is looking if executive action could resolve both the unemployment insurance and evictions. With Q2 US GDP reported last week, the June factory orders report may not draw much attention, though, for the record, a 5% rise is expected by the median forecast in the Bloomberg survey, after an 8% gain in May. The recovery re-starting of the auto sector appears to be playing an important role in the recovery of the manufacturing sector, and US auto sales last month were stronger than expected, a 14.5 mln seasonally-adjusted annual rate. The median forecast was for a 14.0 mln unit pace. Canada reports June’s leading economic indicators and July’s manufacturing PMI. It was at 47.8 in June and may have approached 50 in July. Mexico reports its June economic indicator and July domestic auto sales. US auto sales fell by about 25% in H1 20 compared with H1 19. Mexico’s local sales are off closer to 32%. Separately, note that Argentina appears to be close to finalizing the debt restructuring agreement of around $65 bln of debt, while Ecuador has completed its $17.4 bln debt restructuring effort. |

U.S. All Car Sales, July 2020 Source: investing.com - Click to enlarge |

The US dollar remains confined to last Thursday’s range against the Canadian dollar: CAD1.3335 to CAD1.3460. The technical indicators favor an eventual upside break but could be resolved by an extended consolidation. A close above CAD1.3400 would lift the greenback’s tone. Meanwhile, the dollar has been confined to a tight range near yesterday’s high of around MXN22.70 against the peso. Some momentum traders moved to the sidelines. The near-term risk extends to MXN23.00, which the dollar has not traded above since July 1. Initial support is seen near MXN22.55.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,ECB,Europe,Featured,newsletter,RBA,Turkey