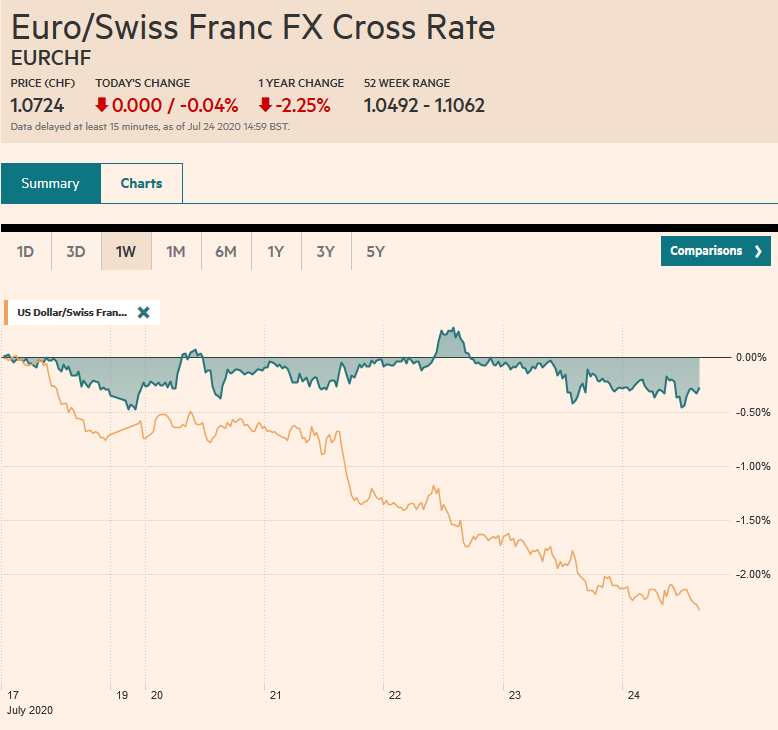

Swiss FrancThe Euro has fallen by 0.04% to 1.0724 |

EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: US stocks stumbled yesterday, and the S&P 500 nearly gave back the week’s gains with its roughly 1.25% loss, the largest of the month. The NASDAQ 100 fell to two-week lows. Slower cloud growth at Microsoft and a delay in the next generation of chips at Intel were among the drags. Asia Pacific and European shares were pressed lower. Chinese stocks were crushed by almost 4% in Shanghai and a little more than 5% in Shenzhen. Only South Korea, Taiwan, and India fell less than 1%, while Japanese markets may play catch-up on Monday as they were closed today for a national holiday. Europe’s Dow Jones Stoxx is off nearly 1.5%% and is threatening to snap a three-week advance, despite stronger than expected preliminary PMI readings. US shares are extended yesterday’s slide. Bond markets are quiet, with two exceptions. European yields, especially in the periphery, have backed up as risk assets are shunned, and China’s 10-year yield eased around four basis points to 2.85%, the lowest in three weeks. The US benchmark is hovering around 58 bp and could snap a four-day decline today. The dollar bloc is weaker against the greenback, while the yen, despite the absence of Tokyo, is leading in resisting the greenback’s advance. Most emerging market currencies are also lower, and the JP Morgan Emerging Market Currency Index is paring this week’s gains to a little less than 1%. Gold is making good on claims of a safe haven or a hedge against equities. It is firm and knocking on $1900. Oil has stabilized after reversing lower in the US yesterday. The September WTI contract is trading around almost a dollar off yesterday’s $42.35 high. |

FX Performance, July 24 |

Asia Pacific

China is insisting that the US close its Chengdu consulate office. As retaliatory measures for the expelling China’s consulate office in Houston, this seems like a moderate response. Closing the Wuhan consulate as first looked possible would have been a lighter measure while closing Shanghai would have been more severe. One of the consequences of losing the Chengdu office is that some believe it was a listening post for Tibet. This seems part of China’s modus operandi: find a step that helps meet more than one objective. In the US, and perhaps more broadly, it appears that it is often thought in terms of one policy for one purpose.

Australia’s preliminary July PMI has set the broad tone of strong reports today. Its manufacturing PMI rose to 53.4 from 51.2, and the service PMI rose to 58.3 from 53.1. Together, they sent the composite to 57.9 from 52.7 and the highest since April 2017. New orders jumped to their highest in three years.

The dollar peaked near JPY107.50 for the week on Monday and has been making lower highs since, and today not traded above JPY107.00 for the first time since early May. It recorded a new low for July near JPY106.15. The JPY106.00 area has offered solid support since March, and market participants seem reluctant to break it without Tokyo. Initial resistance is now seen in the JPY106.60-JPY106.80 area. The Australian dollar has drifted lower after slipped a little more than 0.5% yesterday. It recorded the year’s high near $0.7180 in the middle of the week. It has found support in the $0.7060-$0.7070 area. Provided that area holds, the Aussie could recover into $0.7120-$0.7130 range ahead of the weekend. The PBOC’s reference rate for the dollar was CNY6.9938, a little softer than the bank models suggested. Still, the dollar rose for the third consecutive session, and the weekly gain of about 0.33% is the most in two months.

EuropeThe preliminary July PMI for the eurozone was considerably better than expected. The composite PMI rose to 54.8 form 48.5 in June as both manufacturing and services surged. The manufacturing PMI rose to 51.1 from 47.4 while the services PMI jumped to 55.1 from 48.3. The cloud in the silver lining was weaker employment and order backlog, which warns that the surge may not be sustained. |

Eurozone Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

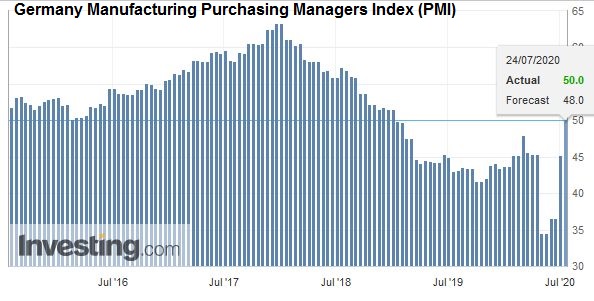

| Markit provides preliminary German and French national PMIs. These were solid. German manufacturing PMI returned to the 50 boom/bust level from 45.2, while the services PMI rose to 56.7 from 47.3. This was reflected in the composite boost to 55.5, its highest since August 2019, from 47.0. France saw its manufacturing PMI consolidate the June jump (52.3 from 40.6 in May) and slip back to a still respectable 52.0. Service activity continued to expand, and the 57.8 reading compares with 50.7 in June. The composite stands at 57.6, improving from 51.7. |

Germany Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

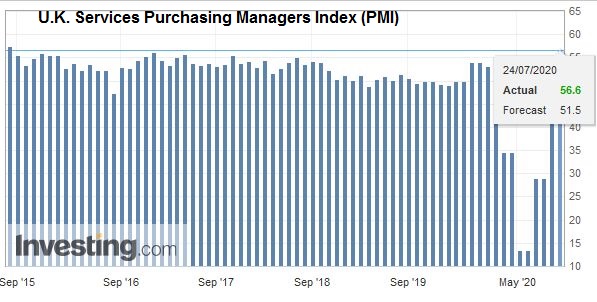

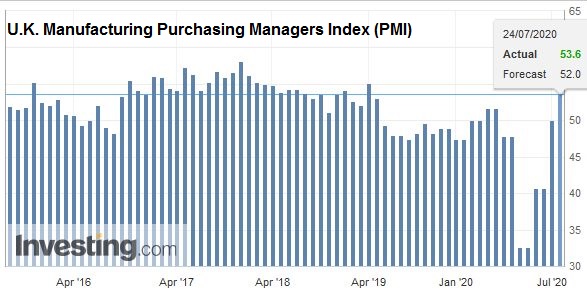

| The UK reported strong June retail sales and its highest PMI in five years. Retail sales jumped 13.9% in June, well above the median forecast in the Bloomberg survey for an 8.3% increase after May’s 12.3% rise (initially reported as 12.0%). It leaves retail sales off 1.6% from a year ago, but if gasoline is excluded, UK retail sales are 1.7% above year-ago levels. |

U.K. Services Purchasing Managers Index (PMI), July 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

| The manufacturing PMI rose to 53.6 from 50.1, while the services PMI rose to 56.6 from 471. That lifted the composite to 57.1 from 47.7. |

U.K. Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

UK and EU trade negotiations are not going well. Yet, broad dollar weakness may mask from the quick observation, sterling’s underperformance. It has fallen nearly 4% against the dollar this year, it is off around 7.5% against the euro. Just yesterday, EU negotiator Barnier complained that the UK was not showing the necessary “level of engagement.” Frost, the UK negotiator, explained there would not be an agreement this month because the EU was not willing to accept Prime Minister Johnson’s principles. And there you have it. If the UK government abandons talks, as it has threatened to do (despite our “game-theory” insights to the contrary), the market will likely drive sterling lower. UK interest rates, which are negative out seven years, will probably fall further. It would boost the chances that the Bank of England adopts negative interest rates, an option that it has warned banks of the possibility (without committing to it). The MPC meets in a couple of weeks (August 6).

Previously, the euro seemed sensitive to the broader risk environment, but it remains resilient in the face of the profit-taking seen in equities. It is in a narrow 30 pip range below $1.1620 today, after briefly poking above $1.1625 yesterday. North American dealers have shown a penchant to sell the greenback. There does not appear to be much chart resistance until closer to $1.1800. Sterling made a new high for the week near $1.2775. Recall it finished last week nearly two cents lower. It is struggling to maintain the upside momentum in the European morning. Still, initial support in the $1.2700-$1.2720 area remains intact, and the high for the session may not be in place.

AmericaThe Republican counter-proposal to the House’s $3 trillion+ fiscal package is taking shape, but it does not seem to be quite ready yet. What is not in it may be more revealing than what is being proposed. The Senate Republicans appear to have nixed President Trump’s pet issue–payroll saving tax cut. This may be among the first signs of Senate Republicans distancing themselves from the president, as the November election is moving to the top of mind. That Trump blamed it on the Democrats, who did oppose it, but that was not material in the Senate GOP, and White House negotiations also seem to be classic deflection. The bill reportedly will be flexible on what states and local governments can do with federal funds, there is no money earmarked for them. In the House (Democrat) version, there was around $1 trillion for state and local governments. It appears that the unemployment insurance has not yet been worked out among the Republican negotiators. With time running out, it looks likely that the $600 a week in federal unemployment insurance is likely to expire even if the new package includes something. There does seem to be something in the GOP plans, but it could be as little as $100 a week. |

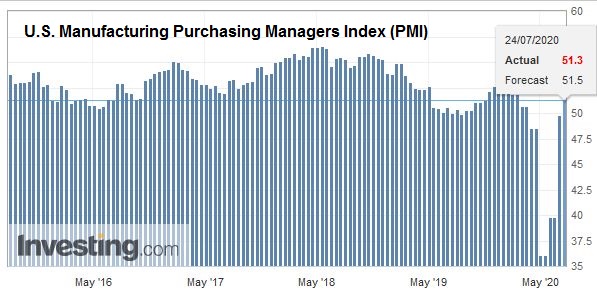

U.S. Manufacturing Purchasing Managers Index (PMI), July 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

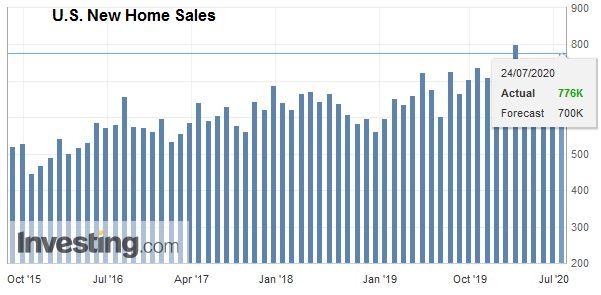

| The calendar for the Americas is light today and features the preliminary US PMI and new home sales. Economists expect both manufacturing and service PMIs to rise above the 50-level, and new home sales are expected to build on the 16.6% recovery seen in May. Next week, the US reports Q2 GDP on July 30, the day after the FOMC meeting concludes. The median forecast in the Bloomberg survey is for the world’s largest economy to have contracted at a 34% annualized pace after the 5% contraction in Q1. The economy is rebounding in Q3, though the disappointing increase in weekly jobless claims, even if a seasonal adjustment distortion played a role, keeps enthusiasm in check. |

U.S. New Home Sales, June 2020(see more posts on U.S. New Home Sales, ) Source: investing.com - Click to enlarge |

The US dollar has stabilized against the Canadian dollar after falling to around CAD1.3350 yesterday. It was the fourth consecutive decline. It is straddled CAD1.3400 today. The greenback finished near CAD1.3580 a week ago. It may now be capped in the CAD1.3460-CAD1.3480 area. Last month’s low was near CAD1.3315, and that is the next target. The greenback reached almost MXN22.18 in the middle of the week and saw MXN22.6250 today, to fray this month’s downtrend line (~MXN22.5650) before finding new offers. Initial support is seen near MXN22.40 ahead of the weekend.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,Featured,newsletter,PMI