|

On Sunday, Argentina’s government announced it was postponing payment on any domestically-issued debt instruments denominated in foreign currencies. That means dollars, just not Eurobonds. At least not yet. In response, ratings agencies such as Fitch declared the maneuver a distressed debt exchange. In other words, technically a default. Though this move was expected, still you have to appreciate the sensitivity. Argentina may be Argentina, but it is also the first of maybe eighty (actually the second, Lebanon already went first). The dominoes are falling, those with the biggest dollar shortage pushed toward that default window. The implications are for repo market collateral. The junk infection of 2016 and 2017 is coming back to haunt the real lender-of-last resort. Central banks like the Federal Reserve and ECB talk a lot about it, but they don’t come close to being a realistic substitute for repo. When you’re out of repo for lack of collateral, a systemic shortage, then all you can hope is that some central bank will take pity on you as you run to them begging for a partial sum. You’ll never get more than a partial parcel.

|

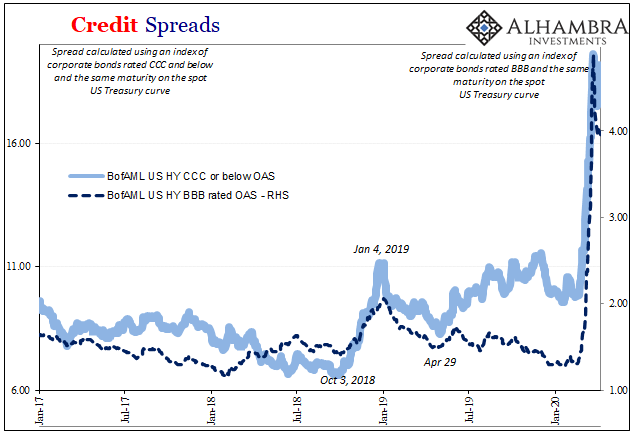

Credit Spreads, 2017-2020 |

Unsurprising, then, what the ECB announced just this morning:

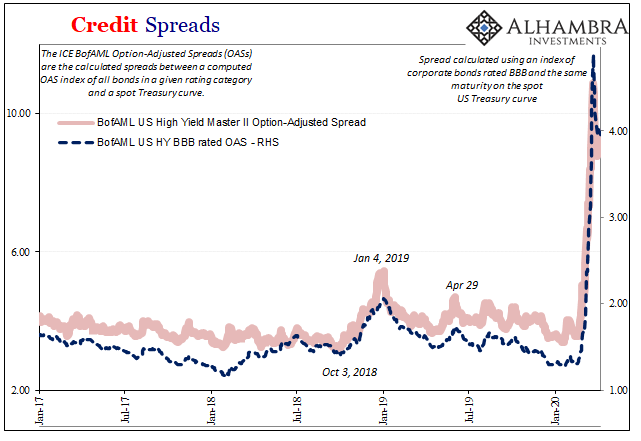

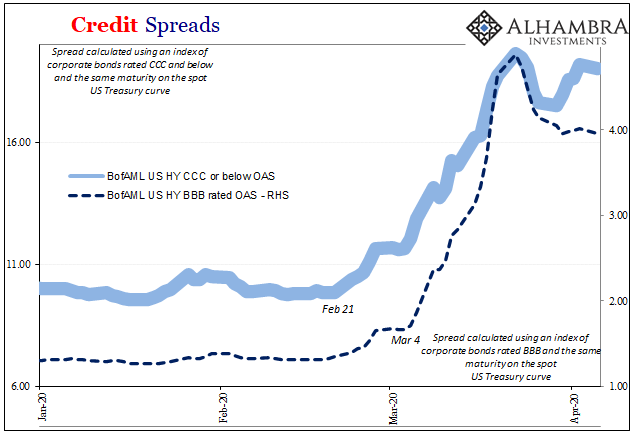

Funny how the highlighted just got kind of thrown in there at the end. While stocks have rallied, especially yesterday, corporate credit has not. Credit spreads remain highly elevated, the risks inside this part of the bond market not having come off much at all. US junk credit was used in the same way as Eurobond junk like Argentina, therefore we can reasonably assume collateral problems for the one like the other. |

Credit Spreads, 2017-2020 |

Credit Spreads, 2020 |

|

|

The federal government has issued some $270 billion in cash-management bills, which are like T-bills but feature more flexibility for Treasury, dating back to mid-March and the “stimulus” explosion. That (maybe) has helped some parts of the repo market but not nearly enough. The reason is simple: if the same money dealers who are sitting on their hands in all forms of US$ liquidity aren’t interested in securities lending because they are sitting on their hands in all forms of US$ liquidity, then don’t expect them to be redistributing T-bills to the rest of the system where they are desperately needed. Hoarding among dealers in all its forms; very GFC1-like. |

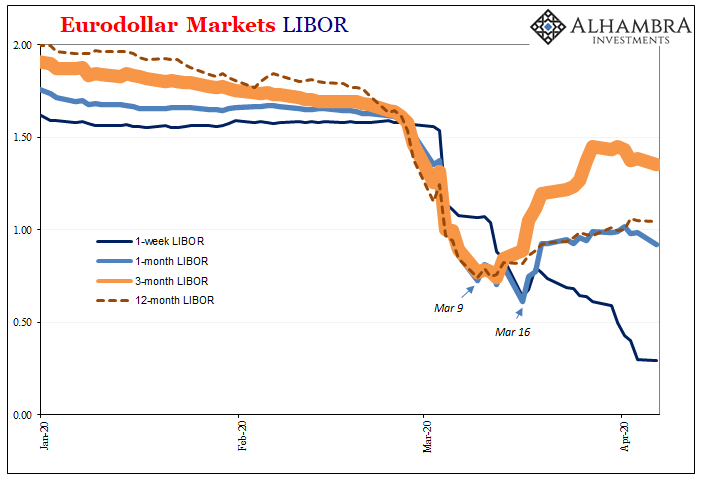

Eurodollar Markets LIBOR 2020 |

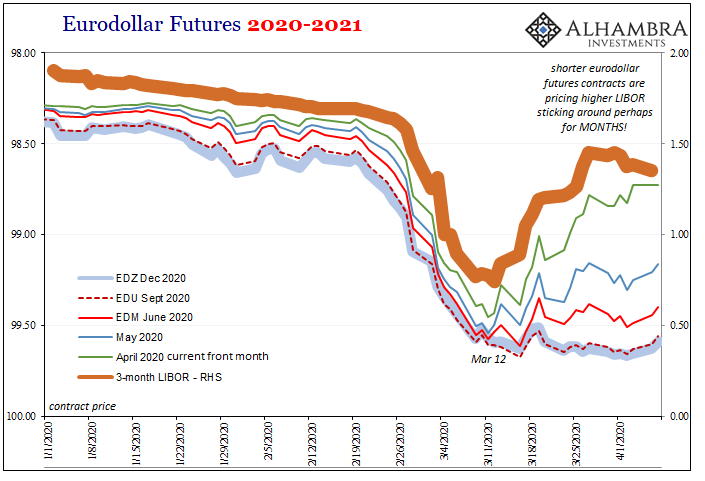

| In the same way credit spreads have remained high, so have LIBOR rates therefore completing the picture of global money dealers becoming very cozy on the sidelines.

Current LIBOR rates tell you what these crucial banks are thinking about as of right now, while eurodollar futures tell you about what these crucial banks might be thinking down the road. In terms of spreads, those right now are largely the same thing. Today, LIBOR across all tenors suggest the immediate pressure has come down, meaning it is no longer an ongoing crash that central banker kittens can’t stop. The massive illiquidity earthquake, GFC2, has receded somewhat back into the shadows after coming out of them and wrecking everything throughout the first half of March. This doesn’t mean it’s all over, only the first phase or wave. That’s why there are the LIBOR spreads you see below; dealer reticence is still on display if not for tomorrow then for the intermediate term. No doubt the now-proven collateral bottleneck is one key reason why the liquidity crisis has only sunk back beneath the surface, but only just beneath the surface, rather than having dissipated entirely. |

Eurodollar Futures 2020-2021 |

Jay Powell doesn’t figure in here no matter how many hundreds of billions in bank reserves. Even the Treasury Department’s crush of cash management bills doesn’t do much to solve the issue, which is as much about systemic redistribution (which is what dealer banks and securities lending businesses were good at, and central banks wholly unsuited for) as the stock of available usable securities.

What good is an extra quarter trillion in bills if they don’t go anywhere?

The whole system remains on watch for the (inevitable?) next wave. Eurodollar futures are steadily pricing a scenario where for the rest of the year benchmark 3-month LIBOR is likely going to spike again; that’s the elevated eurodollar futures contracts out for the balance of 2019, hedgers looking at a probability spectrum where even if 3-month LIBOR comes down it won’t stay down.

That means we have a situation brewing quite like the middle of 2008. As I described yesterday, officials saw post-Bear Stearns one way, as James Bullard stated in June 2008:

MR. BULLARD. There is, to be sure, still some potential for additional upheaval, depending in part on the managerial agility among key financial firms. However, the U.S. economy is now much better positioned to handle financial market turmoil than it was six months ago. This is due to the lending facilities now in place and to the environment of low interest rates that has been created. Renewed financial market turmoil, should it occur during the summer or fall, would not now be as worrisome from a systemic risk perspective. emphasis added

That’s just what’s being said in all financial media right now and surely inside the halls of the Federal Reserve, too. Officials reacted (with mostly the same programs!) and that, they believe, has put the financial system in much better shape should it all happen again.

The market in the middle of 2008 – like the market of today – disagreed (and was quite right to). Not only was it almost certain another bout would happen again, the market also increasingly rejected the idea central bankers had accomplished much of anything in response to the first one.

Fragile, not fortified.

Wouldn’t you know it, same things all over again. Only this time it’s not subprime mortgage collateral.

Full story here Are you the author? Previous post See more for Next postTags: Argentina,Bonds,collateral bottleneck,credit spreads,currencies,economy,Eurobonds,eurodollar futures,Federal Reserve/Monetary Policy,Libor,Markets,newsletter,T-Bills,U.S. Treasuries