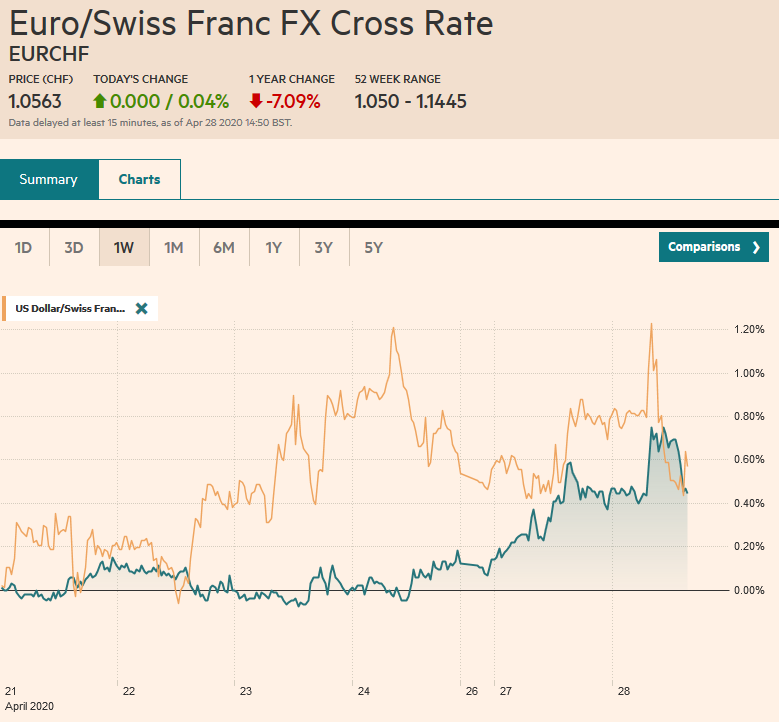

Swiss FrancThe Euro has risen by 0.04% to 1.0563 |

EUR/CHF and USD/CHF, April 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Equities are building on yesterday’s gains. The MSCI Asia Pacific Index rose 2% yesterday and edged higher today. Shanghai and Austalia stand out as exceptions. In Europe, the Dow Jones Stoxx 600 is extending yesterday’s 1.8% gain to reach its best level since March 11. Today would be the fourth advance in the past five sessions. US shares are firmer. The S&P gapped higher yesterday (~2842.7-2852.9), and the next target is the 2882-2901 area. It is poised to gap higher again today. The peripheral bonds in Europe are underpinned by the risk appetites, while core bond yields are a little firmer. The US Treasury raised $190 bln yesterday, and the 10-year yield is little changed around 66 bp. The dollar is trading lower against all of the major currencies, led by the Scandi bloc, following the Riksbank’s decision to keep policy steady. Emerging market currencies are mostly firmer and the JP Morgan Emerging Market Currency Index is poised to snap a six-day slide. Gold is lower for a third session, the longest losing streak this month. Oil is sinking, with June WTI near $12 after having approached $10, and June Brent around $20, after testing $18.75. The lack of storage space and funds shifting out of the front-month contracts is taking a toll. June WTI bottomed near $6.50 on April 21. The US formalized its contracts to lease about 23 mln barrels of storage capacity in its Strategic Petroleum Reserves. |

FX Performance, April 28 |

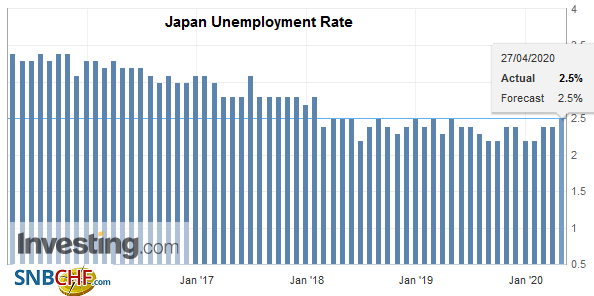

AsiaJapan’s employment data are holding up. The unemployment rate edged up to 2.5% from 2.4%. Japan had a tight labor market going into the crisis. The deterioration is seen mostly as the reduction of jobs to applicants. The ratio narrowed to 1.39 jobs for each applicant vs. 1.45 in February. The ratio is the lowest since August 2016. It stood at 1.62 in March 2019. Separately, we note that an Asahi poll, only 26% favor Abe seeking a fourth term. His third term ends in September 2021. While some are reading this to mean his support has slackened, a Reuters poll from the end of last year found less than 20% favor a fourth term. Lastly, note that Japan reports March retail sales and industrial production tomorrow. The median forecast in the Bloomberg survey expects 4.5% and 5.0% declines, respectively, in the month. |

Japan Unemployment Rate, March 2020(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

Hong Kong Monetary Authority continues to intervene to defend the peg. Its intervention efforts have been stepped up as it increases the amount of Hong Kong dollars it is selling and US dollars it is buying. Today’s operation was the third this month. It sold nearly HKD13 bln, which is almost double what it did in the previous two operations (~HKD7.5 bln).

Unable to re-establish a foothold above JPY108, the stale long dollar positions exited today and pushed the greenback to its lowest level since March 17 near JPY106.65. The dollar had found support near JPY107 in Asia, but the early European activity pushed it lower. The next support is seen near JPY106.45 and then JPY106.00. The intraday technicals are stretched, and offshore traders may be reluctant to extend the yen’s gains much more without Tokyo’s participation. The Australian dollar is extending yesterday’s apparent upside break (~$0.6450) and is testing $0.6500 in Europe, a level not seen since March 11. Here, too, the intraday technical readings are stretched. The Chinese yuan edged slightly higher. The dollar is trading near CNY7.08, net-net little changed since the end of last week.

Europe

The European Commission may not yet have seen it way clear to fund the reconstruction of Europe after the economic disaster. Still, it is finding other ways to support banks and companies. Reports indicate that it is considering relaxing more regulatory measures that will ease the calculation of the leverage ratio. This would ostensibly free up more capital for the banks in the hope that they will maintain lending activities. There are other measures that EC could take, such as considering software costs an investment and exclude reserves held at the central bank from measures of asset that require capital reserves.

Sweden’s Riksbank left policy on hold. The key rate was kept at zero, and the central bank affirmed its plans to continue buying assets until the end of September. To be sure, it kept its options open for a further adjustment in policy. However, the bar to return to negative interest rates is high, and new asset purchases seem more likely than negative rates. Sweden has also taken a somewhat different approach to coronavirus, with a less severe approach. The results so far appear a bit worse than other countries in the region, but better than the UK and Italy. The economic hit, while severe, may also be less than elsewhere. March retail sales were reported off 1.7%. The median forecast in the Bloomberg survey was for a decline of 3%.

After briefly dipping below $1.08 yesterday, the euro has bounced back to test the $1.0885-level, matching a six-day high. It has not traded above $1.09 since April 16. The buying came in the European morning and seemed to reflect the broader dollar decline. A close above $1.09 would lift the technical tone, but the intraday studies are stretched. Sterling is testing $1.25. A close above there would also be constructive, but it peaked in the middle of the month in the $1.2630-$1.2650 area, and it needs to be taken out to be significant. The 200-day moving average is just above that band. The Scandis are the strongest today, with about a 1% gain against the dollar.

America

In the Great Financial Crisis, the Federal Reserve did not support local government debt. In this crisis, the Fed has, but its first bite of the apple was cautious. It limited its support to cities with a million people and counties with two million. Some criticize the Fed for doing too much (“buying everything”), and others accuse it of not doing enough. Late yesterday, it widened the universe of local bonds it would buy to include cities of 250k and counties of half a million. The new criteria will allow other cities, like Atlanta, Miami, Boston, and New Orleans, to be included. The move says nothing about what Congress may do as early as next month (though maybe not until June) in the fourth fiscal support effort, which is to center on state and local governments. The National Association of Governors requested $500 bln in federal assistance. States governments are not allowed to seek the protection of bankruptcy laws. Even if legislation was passed to approve of state bankruptcy, it would likely face a constitutional challenge.

Between the loss of restaurant demand and the shuttering of slaughterhouses and meat processing plants due to workers being infected is driving up wholesale prices of meat. Not only does the work put employees in close proximity, but also many workers are poor and live close quarters. Infections among inspectors have also been reported. Some farmers are culling their herds and flocks. The National Guard is being called in some places to help in some of the slaughterhouses. Some farmers, according to reports, are altering their feed to slow their growth. Facilities and farmers in Canada and Brazil have also been impacted. The US, Canada, and Brazil together account for about 65% of the world’s trade in meat. On the other hand, Europe, which accounts for about 20% of the meat trade, has not been disrupted. Reports indicate that the US has two weeks of meat production in freezers. Some of the plant shutdowns are preparing to re-open with new safeguards for workers. While shortages cannot be ruled out, it seems more likely that at least at first, higher prices will distribute the scarcity. More broadly, labor needed to pick crops, and the logistics of shipping is also begun taking a toll. Some countries, like Vietnam and Cambodia, have begun limited exports of rice.

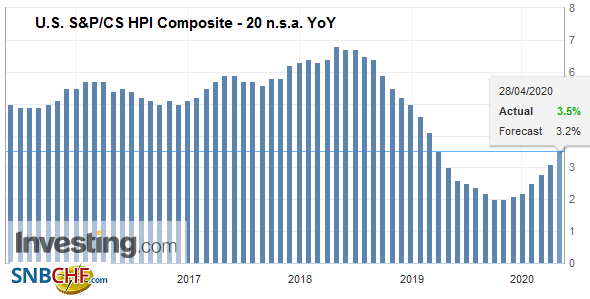

| The US reports March trade figures and February house prices, but it is tomorrow’s estimate of Q1 GDP that draws attention. The Atlanta and NY Fed trackers point to a small contraction, while the median forecast in the Bloomberg survey is for a 3.8% annualized decline in output. The FOMC meeting concludes tomorrow, followed by Powell’s press conference. Mexico reports its March trade figures today as well, and its estimate of Q1 GDP is due Thursday. It is expected to report its fifth consecutive quarterly contraction. |

U.S. S&P/CS HPI Composite - 20 n.s.a. YoY, February 2020(see more posts on U.S. S&P/CS HPI Composite - 20 n.s.a., ) Source: investing.com - Click to enlarge |

As we have noted, the Canadian dollar is more correlated to risk appetites (we use the S&P 500 has a proxy) than oil prices. The US dollar has been sold through CAD1.40 for the first time in nearly two weeks. It has fallen to about CAD1.3950 in the European morning. The next area of support is seen near the month’s lows around CAD1.3855. That said, as we have seen elsewhere, the intraday technicals are stretched. The Mexican peso is also benefitting from the risk-on attitude. The dollar, which began the week above MXN25.00, is now near MXN24.44. There is support in the MXN24.20-MXN24.30 area, but last week’s low was near MXN23.85.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF,FX Daily,Hong Kong,Japan Unemployment Rate,newsletter,OIL,Riksbank,U.S. S&P/CS HPI Composite - 20 n.s.a.,USD/CHF