Tag Archive: Riksbank

Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

Overview: Weak US consumer confidence, especially regarding the labor market boosted speculation of another half-point Fed cut in November when the central bank meets again. This weighed on the dollar. Sterling and the Australian dollar rose to new 2 1/2-year highs. The PBOC followed up yesterday's package with a 30 bp cut in the one-year Medium-Term Lending rate. After extending its losses earlier today, the dollar has steadied and turned higher...

Read More »

Read More »

China Goes Big, and Market (Initially) Gives it the Benefit of the Doubt

Overview: News of China's multifaceted support measures have bolstered risk appetites today. The dollar is mostly softer and only the yen and Swiss franc among the G10 currencies have been unable to find traction against the greenback. Most emerging market currencies are also trading with a firmer bias. China's measures include measures to support the stock and housing markets. The seven-day repo rate was cut by 20 bp (to 1.50%) and reserve...

Read More »

Read More »

USD Remains Soft but Consolidation is Threatened

Overview: The US dollar's recent retreat has been marginally extended today but it seems to be moderating. Still, the greenback is on the defensive, arguably ahead of tomorrow's BLS annual revisions of nonfarm payrolls, where there is talk that April 2023-March 2024 job growth could be slashed from 2.9 mln to 1.9 mln. And that is ahead of Friday's Jackson Hole address by Fed Chief Powell that is expected to be the strongest confirmation of a rate...

Read More »

Read More »

The Greenback Consolidates while Sustaining Break against the Yen

Overview: The dollar is sporting a softer

profile today against all the G10 currencies but the Swedish krona. The

Riksbank sounded more dovish than previously, signaling the possibility of a

cut in each of the last three meetings of the year. The dollar has sustained its

push above JPY160 against the Japanese yen. Most emerging market currencies are

also firmer, with the notable exception of Türkiye and South Africa. Türkiye is

expected to keep its...

Read More »

Read More »

Self-Inflicted Wounds in Europe and Japan Help the Greenback Shrug Off the Drag of Lower Rates

Overview: The dollar is bid. What makes its

performance standout is that it is taking place as US rates have fallen. The US

10-year yield is near 4.20%, the lowest in more than two months. The two-year

yield is near 4.67%. It has fallen every session this week for a cumulative

decline of more than 20 bp. It is not so much that constructive developments

took week, but that Europe and Japan are suffering from self-inflicted injury. Macron's

call for...

Read More »

Read More »

Riksbank Cuts, Oil Slips, and the Yen Remains Under Pressure

(On business trip over next few days. Commentary to resume Monday. Thanks for your patience.) Overview: Sweden's Riksbank became the second G10

central bank to cut rates this year. The Swiss National Bank cut its deposit

rate in March. A couple other large central banks, including the European

Central Bank, and possibly the Bank of Canada, may cut rates next month. The

Swedish krona is the weakest of the G10 currencies today, off by about 0.45%,...

Read More »

Read More »

Market Pushes the Yen Lower, Helped by a Broadly Firmer Greenback

Overview: The dollar is firmer against all the G10

currencies today. The market is somewhat less fearful of intervention and the

yen is extending yesterday's losses. It is rivaling the Australian dollar for

the weakest of the major currencies after the Reserve Bank of Australia left

rates on hold and played down speculation of possibility of a rate hike. Both

currencies are off around 0.4% in late European morning turnover. Disappointing

German...

Read More »

Read More »

Yen Slips, Yuan Jumps, Dollar is Mostly Softer

Overview: The dollar is mostly a little softer

today in thin market conditions, with Tokyo, Seoul, and London closed for

holidays. The Japanese yen is the weakest G10 currency, losing about 0.5% and

slipping through last Friday's lows. At first, after Fed Chair Powell

did not endorse rate hike speculation, the market thought he was dovish. But after the

softer than expected jobs data and weakness in the ISM services, the market

shifted from...

Read More »

Read More »

Corrective Forces Help the Dollar Stabilize

Overview: Corrective

forces helped the dollar stabilize yesterday and it enjoys a firmer today. The

euro has slipped below $1.09, and the dollar has resurfaced above JPY149.00. The

FOMC minutes seem dated by the more than 30 bp decline in the US 10-year yield,

the 7% rally in the S&P 500 and roughly 3% drop in the Dollar Index. The

implied year-end 2024 Fed funds rate has fallen by 10 bp to 4.51% (5.33%

currently). The Japanese government...

Read More »

Read More »

Higher for Longer Lifts the Dollar, while SNB Surprises Many by Standing Pat–Over to the BOE

Overview: The Federal Reserve's hawkish hold, which

included 50 bp less of cuts next year than it had signaled in June, has lifted

the dollar against most currencies today. The notable exception is the Japanese

yen. The greenback did extend its advance to new highs for the year before the

market turned cautious ahead of the outcome of the Bank of Japan meeting

tomorrow. The Swiss franc is the weakest of the G10 currencies after the Swiss

National...

Read More »

Read More »

Week Ahead: Thumbnail Sketch of Central Bank Meetings

The

week ahead is dominated by central bank meetings. Six of the G10 central banks

meets. The post-Covid monetary tightening cycle is ending. The start was not

synchronized, and neither will be end. It is tempting to think that those that

began the tightening cycle early will among the first to finish. Among emerging

markets that is true for Brazil and Chile, both of whom have begun cutting

rates. And Brazil is likely to deliver the second cut in...

Read More »

Read More »

PBOC Sends Signal in Lower Dollar Fix, while the Canadian Dollar makes a 9-Month High

Overview: Hawkish comments by ECB President Lagarde

at the central bank symposium in Sintra and the PBOC's weaker dollar fix have weighed on the greenback today. It is lower against most of the G10 currencies,

but the Japanese yen and Norwegian krone. It also slipped to a new nine-month

low against the Canadian dollar. Emerging market currencies are also mostly firmer,

with the notable exceptions of the Russian rouble and beleaguered Turkish lira....

Read More »

Read More »

Riksbank Hikes 100 bp but the Krona gets No Love

Overview: Yesterday’s late rally in US shares

carried into the Asia Pacific session where all of the large markets advanced. However,

the bears are not abdicating and Europe’s Stoxx 600 is off for the sixth

consecutive session and US futures are trading lower. The sell-off in the bond market

continues. European benchmark yields are mostly 8-10 bp higher and the US 10-year

Treasury yield is up nearly five basis points to approach 3.54%. The two-year...

Read More »

Read More »

The Greenback Firms to Start the New Week, Stocks Slide

Overview: The busy week is off to a slow

start as Japan is on holiday and the UK and Canadian markets are closed to

honor Queen (Australia will commemorate with a holiday on Thursday). Nevertheless,

the sell-off in equities continues and the US dollar is firm. Most of the large

markets in Asia fell. India is a notable exception. Its benchmark rose for the

first time in four sessions, helped by bank shares and Infosys. Europe’s Stoxx

600 is off for...

Read More »

Read More »

Stocks Hit as Central Banks Brandish Anti-Inflation Efforts

Overview: Central banks are committed to combatting inflation even as the economies weaken. This is taking a toll on investor sentiment and is dragging down equities.

Read More »

Read More »

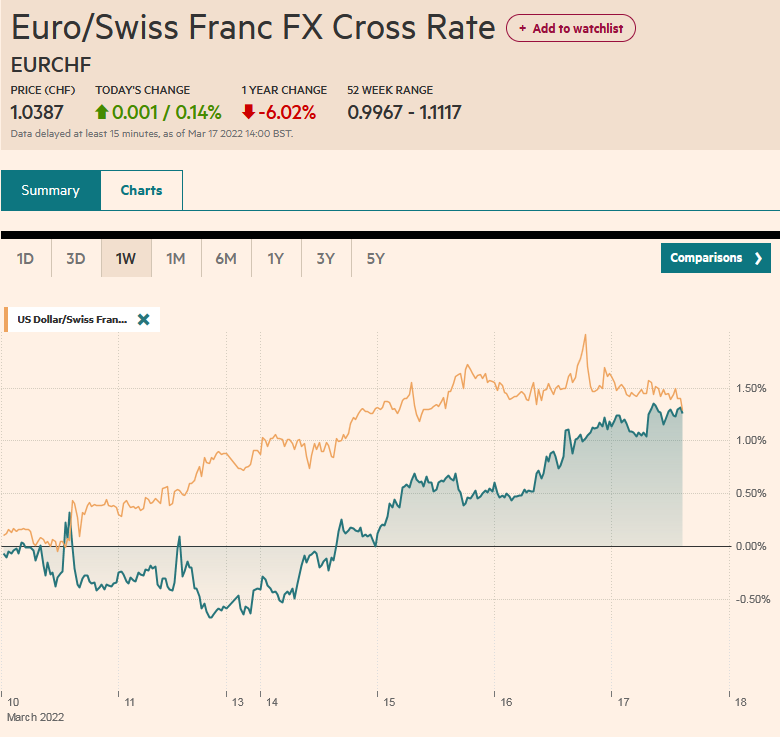

FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Overview: The markets continue to digest the implications of yesterday's Fed move and Beijing's signals of more economic supportive efforts as the Bank of England's move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday's surge. The Hang Seng led the...

Read More »

Read More »

Flash PMIs Play Second Fiddle to US PCE Deflator and Accelerating Inflation

The flash November PMIs would be the main focus in the week ahead if it were more normal times. But these are not normal times, and growth prospects are not the key driver of the investment climate. This quarters' growth is largely baked into the cake. The world's three largest economies, the US, China, and Japan, are likely to accelerate for different reasons in Q4 from Q3. Europe is the weak sibling, and growth in the eurozone and UK may slow...

Read More »

Read More »

Ever Grand

Overview: Coming into yesterday's session, the S&P 500 had fallen in eight of the past ten sessions. It closed on its lows before the weekend and gapped. Nearly the stories in the press blamed China and the likely failure of one of its largest property developers, Evergrande.

Read More »

Read More »

FX Daily, April 27: Markets Mark Time Ahead of Fed

Short-covering ahead of the FOMC's outcome tomorrow appears to be lending the US dollar support today. It has extended yesterday's gains against the euro, sterling, and yen. Among emerging market currencies, the Turkish lira, along with the South Korean won and Taiwanese dollar, lead the few advancers.

Read More »

Read More »

FX Daily, February 10: China’s Expansion Does not Prevent Deflation

Despite a soft close in US indices yesterday, global shares are on the march again today. Led by China and Hong Kong, most large markets in the Asia Pacific region advanced today. Officials gave approval for a new game from Tencent, which helped lift the Hang Seng.

Read More »

Read More »