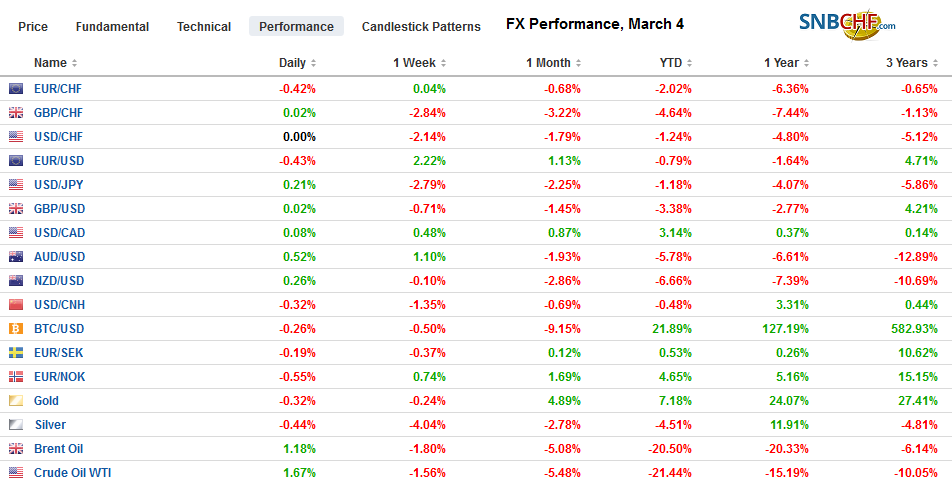

Swiss FrancThe Euro has fallen by 0.49% to 1.0627 |

EUR/CHF and USD/CHF, March 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday’s dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the markets closed, equities began recovering, and the recovery carried over to the Asia Pacific region and Europe. Although a few markets fell (Hong Kong, Australia, and India), the MSCI Asia Pacific Index extended its recovery into the third session. The same is true of Europe’s Dow Jones Stoxx 600, which is up about 1.3% near midday in Europe. US shares are recovering, and indications point to a nearly 2% opening gain in the S&P 500. Bond yields have tumbled after the US 10-year broke below 1.0%, and the 30-year Treasury yield fell to nearly 1.5%, and the global bond market rally continues, and European peripheral bonds are participating. All of the major currencies but the Canadian dollar gained against the greenback yesterday, but today, the dollar-bloc and Swiss franc are leading the move against the greenback. However, the euro is little changed, and the yen and sterling are around 0.25%-0.30% lower. After falling every day last week, the JP Morgan Emerging Market Currency Index is edging higher today for the third consecutive advance. Gold is shaving yesterday’s more than $50 gain, and April WTI is higher for the third session but is inside yesterday’s range. |

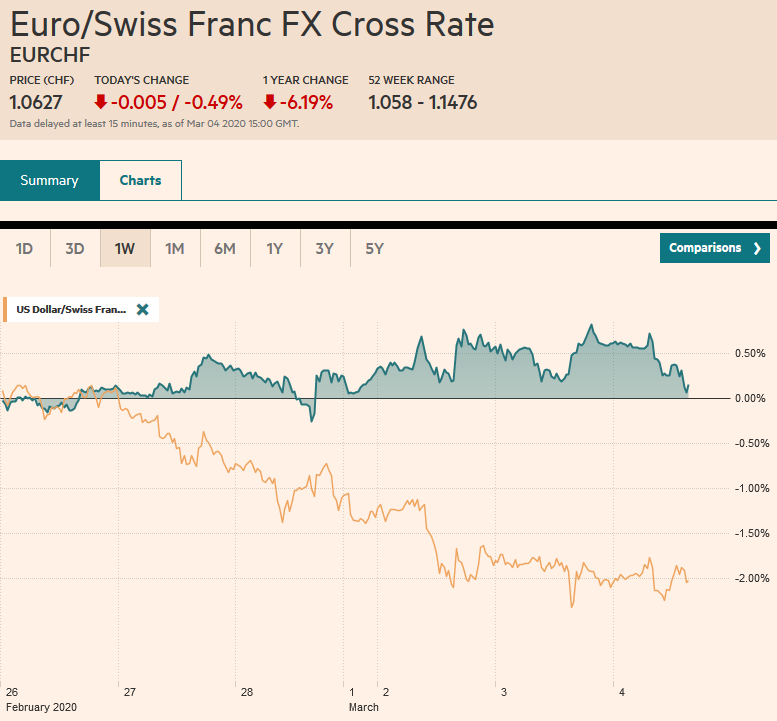

FX Performance, March 4 |

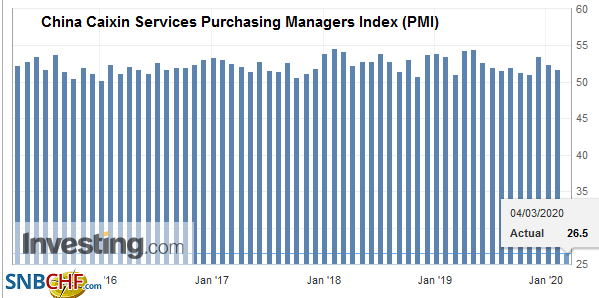

Asia PacificJapan’s final services and composite PMI were little changed from the flash readings (46.8 and 47.0, respectively). The focus is shifting to the BOJ’s meeting (March 18-19). A downgrade of its economic assessment is likely a done deal, but the issue is whether it will deliver further easing and if it does, what form will it take. Will the BOJ cut its minus 10 bp deposit rate, or will it expand its asset purchases (ETFs?), or will it stress its willingness to use its existing facilities for which it has been quietly tapering? Hong Kong Monetary Authority quickly matched the Fed’s 50 bp cut as the economic slump deepened. The February PMI fell to 33.1 from 46.8. China’s Caixin composite dropped to 27.5 from 51.9. The services component fell to 26.5 (from 51.8) and is the first sub-50 reading since the series began in 2005. New orders, export orders, and employment slumped. |

China Caixin Services Purchasing Managers Index (PMI), February 2020(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

Australia’s service and composite PMI readings edged higher than the flash report but were still down from January. They both stand at 49.0 up from 48.4 and 48.3 flash reading, respectively. In January, services were at 50.6, and the composite was at 50.2. The market has nearly fully discounted a follow-up rate cut next month after yesterday’s move. Still, the Australian dollar is pushing higher for the third consecutive session. Australian equities slumped 1.7% (the most in the region), dragged down by information technology, financials, energy, and health care.

South Korea aims at a new supplemental budget of almost $10 bln to help the economy cope with the virus. The central bank held an emergency meeting but stood pat as it did at last week’s scheduled meeting. That said, it does appear that some members may have sought a rate cut.

The dollar fell to a new five-month low (~JPY106.85) in early Asia, but recovered to trade near JPY107.70 just before European markets opened. There is an expiring option at JPY107.50 for almost $845 mln today. The session high does not seem to be in place yet, and a close above JPY108.00-10 would be constructive. The Australian dollar’s resilience to the RBA’s rate cut and the anticipation of another and the poor Chinese data is impressive. It hit a multi-year low near $0.6435 last week and was two cents higher yesterday before pulling back as US stocks skid lower. It is consolidating in the upper end of yesterday’s range. It has not closed above its 20-day moving average since early January. It is near $0.6645 today. The US dollar slumped below CNY6.95, which was the bottom end of the range since the local markets re-opened after the extended Lunar New Year shutdown on February 3. The next chart point is near CNY6.9175. The dollar’s 0.5% decline today is the largest since last December.

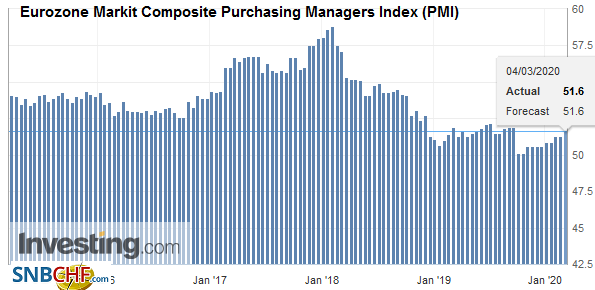

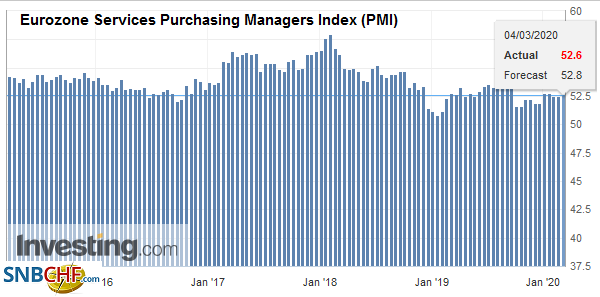

EuropeThe ECB meets next week and after the Fed’s move and speculation is elevated that it will deliver a 10 bp rate cut (which would bring the deposit rate to minus 60 bp) and boost the assets purchases by at least 10 bln euros a month (to a total of 30 bln). The rate cut seems largely discounted. The final EMU PMI reading was not as weak as some had feared. The composite was unchanged from the flash reading at 51.6, even though the services component slipped to 52.6 from 52.8. |

Eurozone Markit Composite Purchasing Managers Index (PMI), February 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| The EMU composite PMI has not fallen since last September. German service PMI eased to 52.5 from the preliminary reading of 53.3 and down from 54.2 in January. This dragged the final composite to 50.7 from 51.2 in January (from 51.1 flash estimate). French services were shaved (52.5 from 52.6 flash reading), but the composite was revised to 52.0 from 51.9, a clear improvement from January’s 51.1. |

Eurozone Services Purchasing Managers Index (PMI), February 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

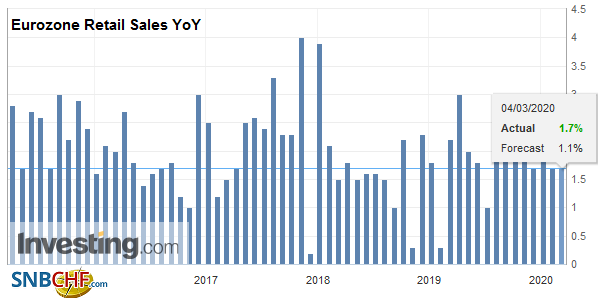

| The bigger surprise was in the resilience of Italy and Spain. Italy’s service PMI firmed to 52.1 from 51.4, and the composite rose to 50.7 from 50.4. Spain’s services slipped to 52.1 from 52.3, but the composite rose to 51.8 from 51.5. Separately, the EMU report January retail sales rose 0.6% after slumping a revised 1.1% in December (initially -1.6%). |

Eurozone Retail Sales YoY, January 2020(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

The UK’s final PMI was not as good as the flash estimate, but the improvement from November and December last year cannot be denied. The service PMI was shaved to 53.2 from 53.3, off from January’s 53.9. The composite eased to 53.0 from 53.3. The initial estimate was for no change from January. The composite reading was at 49.3 in the last two months of 2019. The Bank of England’s next MPC meeting is on March 26, and it will be chaired by the new Governor (Bailey). The market appears to be leaning toward a cut, and after the Fed’s move yesterday, there is more talk of a 50 bp reduction in the base rate, which seems a bit exaggerated at this juncture. The budget is the next key event (March 11).

The euro is in about a 20-tick range on either side of $1.1165 as it consolidates the recent move that saw it briefly trade above $1.12 yesterday for the first time in two months. There is an option for 1.2 bln euro at $1.12 that expires today, but the 1.5 bln euro at a $1.1150 strike that also expires may be more relevant. Yesterday, the euro also traded below $1.11, where an option for about 940 mln euros rolls off today too. A break and close below $1.11 could encourage more position adjustments ahead of the US job data at the end of the week. Sterling continues to trade as it has done for the past two sessions in the lower end of the range seen before last weekend. It is stuck between roughly $1.2740 and $1.2850. The intraday technicals seem to favor a test on the upside in the North American session.

America

Could it be as simple as the “buy the rumor” of a Fed cut on Monday and “sell the fact” when it was delivered Tuesday? What makes this situation more complicated is that the market quickly understood the unusual inter-meeting move as in addition to not instead of a move at the March 17-18 FOMC meeting. The fed funds market has fully discounted a 25 bp move and is pricing in better than a two-in-three chance of a 50 bp move. Powell’s assessment that the coronavirus may weigh on activity for “some time” also is consistent with easier policy. The Fed Chair also addressed some critics head-on. He acknowledged that the rate cut will not reduce the rate of infection or fix broken supply chains. Nevertheless, in a unanimous decision, the FOMC delivered the emergency rate cut. even though the “fundamentals remain strong” to provide “a meaningful boost to the economy.” The Fed’s aggressiveness stems from officials’ assessment of the risks. Those risks that impelled it to act are the same ones that compel investors to reduce exposure.

The Bank of Canada meets today. It stood standpat in the face of three Fed cuts last year but is widely expected to deliver a 25 bp rate cut now. We had previously thought it would come in Q2, but the evolving circumstances have brought it forward. Indeed, the market is pricing in around a 60% chance that a 50 bp cut is delivered.

While the Bank of Canada meeting is the highlight for the North American session, the US sees the ADP private-sector employment estimate (median forecast from the Bloomberg survey is 170k vs. 291k in January), the final PMI, and non-manufacturing ISM. The Fed’s 50 bp rate cut and the likelihood that the move was in addition not instead of reduction at the March 17-18 meeting steals most of the thunder from the high-frequency data. The Fed’s Beige Book, prepared for the meeting, will be released late in the session, and it may offer insight into the impact of the virus on the economy and business plans. US Vice President meets with US airlines today. Although many observers focus on the supply-shock emanating from the virus, the airlines, for example, are experiencing a powerful demand shock. An index of airlines’ stock is off more than 25% over the past two weeks.

The US dollar peaked at the end of last week, near CAD1.3465. It has found support near CAD1.3320 this week. It is consolidating now ahead of the Bank of Canada meeting outcome. Like the Australian dollar did yesterday after the RBA cut, the Canadian dollar looks poised to strengthen today. A break of CAD1.3320 could spur a quick move toward CAD1.3270. N A recovery in oil prices and risk appetites are favorable for the Canadian dollar, and its technical indicators are poised to improve. Note that an option for $935 mln at CAD1.3300 expires today. There is another option that is nearly at the money (CAD1.3350) for $630 mln that also expires today. We continue to expect that Mexico’s high real and nominal rates will allow it to recover quickly as the markets stabilize. This is already playing out. The dollar poked above MXN20.00 at the end of last week and was down to MXN19.1550 yesterday before bouncing back on the equity weakness. Look for support to be tested in the MXN19.00-MXN19.10 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of Canada,China Caixin Services PMI,Currency Movement,ECB,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,federal-reserve,newsletter,USD/CHF