Swiss FrancThe Euro has fallen by 0.21% to 1.0565 |

EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

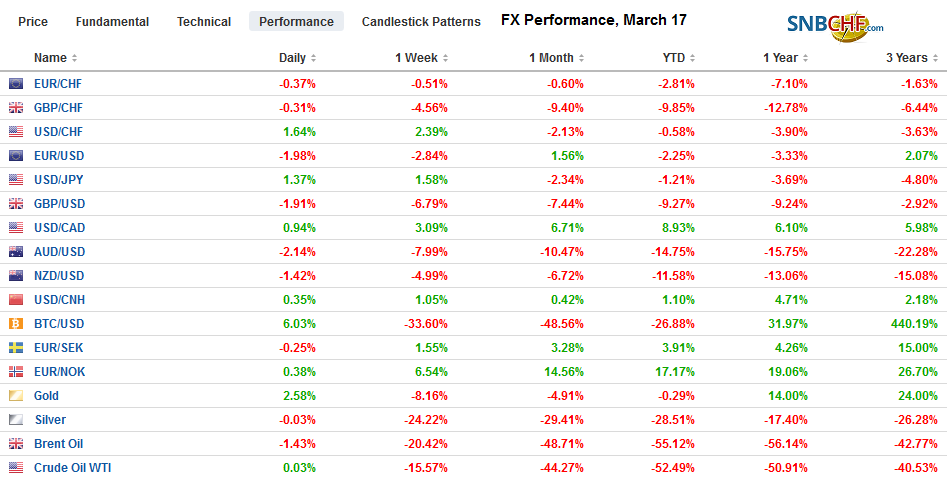

FX RatesOverview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity markets to rise. The Nikkei eked out a small gain, but the broader Topix rose 2.6%. The rest of the regional markets extended recent losses. European bourses posted early gains, which were quickly reversed, and the Dow Jones Stoxx 600 is nursing a 2.4% loss in late morning turnover. US shares are flat. Bond yields are mostly higher, with Sweden the main exception after it announced a large bond-buying program. The US 10-year yield is up around eight basis points to 80 bp. The dollar is riding high, gaining against most of the major and emerging market currencies. Gold is off around 2.7% to extend the slide for a sixth consecutive session. Oil is trying to stabilize, and the May WTI contract is straddling $29.5 a barrel. |

FX Performance, March 17 |

Asia

After doubling the size of its ETF purchase program last week to JPY12 trillion, the BOJ bought a record JPY120.4 bln today. The ETF buying more closely tracks the Topix than the Nikkei, which helps explain the divergence. It purchased about JPY100 bln of the ETF yesterday and has now bought more than JPY800 bln this month. In addition to size, the other element that stands out in today’s purchases is that they were executed even though the Topix was higher in the morning session.

Officials have shut the Philippines stock, bond, and currency markets. The main problem stemmed from the sell-off of the bond market. The dollar-denominated 10-year benchmark yield has risen nearly 100 bp over the past week (to ~3.2%). The cost of insuring against default (credit default swaps) has increased almost four-fold over the past month and more than doubled since March 3. Around 125 bp, it is near a seven-year high. The 15% slide in its equity market over the past two weeks has been at the upper end of losses. The peso itself has been more resilient, falling less than 2% over the past two weeks.

The number of new Covid-19 cases in China reportedly fell to 21 yesterday. One was domestically sourced, but reports indicate the other 20 were from people who returned from abroad. The number of cases outside now exceeds the number of cases in China.

The dollar is trading in its narrowest range against the yen for several days. It is inside yesterday’s range and so far is in a JPY105.80-JPY107.20 range. The intraday technicals seem to favor the downside. There is an expiring option at JPY106.75 for $1.3 bln and another one for about a third of the size at JPY106. There is no relief for the Australian dollar. It is falling for the seventh consecutive session. After falling 1.4% yesterday, it is off more than 1% today as the market seems determined to test the $0.6000 area. Recall it settled at the end of February above $0.6500. The dollar rose about 0.35% against the Chinese yuan and finished the mainland session around CNY7.0175, its highest close since February 26.

Europe

The EU will close its external borders to non-essential visits for 30-days and restrict outbound travel. Within European restrictions on travel have been imposed. France’s Macron announced the government would guarantee 300 bln euros (~$335 bln) of bank loans to businesses and defer taxes and social security payments. Last week, Germany, through the KfW, announced the willingness to provide for as much as 550 bln euros of business loans. Germany will also ease its relatively strict bankruptcy rules for afflicted businesses for the next six months.

The Eurogroup of finance ministers agreed on an aid package worth about 105 bln euros (~1% EMU GDP). About 40% would be for working capital and investment in the European Investment Bank. Another 28 bln euros were earmarked for investment funds and the remainder, structural funds. However, these were not really new measures. The finance ministers agreed to ease the fiscal rules, which had already been signaled. Separately, France, Italy, and Spain have imposed new limits on short-selling.

| Sweden’s Riksbank relaunched its asset purchases, announcing a SEK300 bln (~$30 bln) government, muni, and covered bonds over the remainder of the year. It is roughly 6% of Sweden’s GDP. It comes on the heels of a SEK500 bln lending program announced at the end of last week. The challenge is that the central bank already owns SEK340 bln of bonds, including more than half the conventional bonds and a quarter of the outstanding inflation-linked bonds. It is being forced by circumstances to expand the range of bonds it buys. It is clear that the central bank, which became the first central bank to lift rates back from negative territory, is loath to go back down that road.

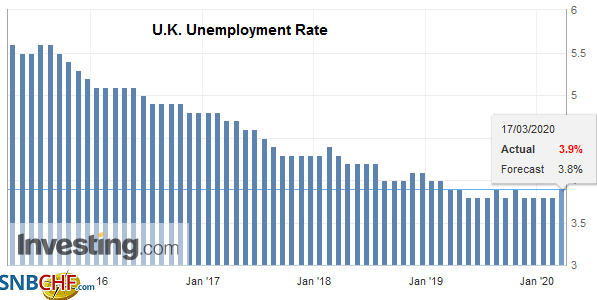

Those claiming unemployment benefits in the UK rose by 17.3k in February. It was the first increase since last October and the most since last February. It is a small sign of things to come. The earnings data and the ILO unemployment estimate are reported with an extra month lag. Earnings rose 3.1% with and without bonus payments in the three-months year-over-year pace, and the unemployment rate ticked up to 3.9% (from 3.8%) in January. Separately, the German ZEW survey was worse than expected. The expectations component crashed to -49.5 from 8.7, while the current assessment fell to -43.1 from -15.7. Tragically, the worse is still to come. |

U.K. Unemployment Rate, January 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro is heavy. It was not able to sustain the push above $1.12 yesterday and is returning below $1.11 in the European morning. Yesterday’s low was near $1.1050, and that is the next immediate target. It corresponds to a (61.8%) retracement of the rally from last month’s low below $1.08 to the recent high just shy of $1.15. The next area of support is around $1.10. Sterling is extending its slide. It has been sold below $1.22, as its losing streak continues to the sixth consecutive session. It is at its weakest level since last September. Support is not seen until $1.20.

America

The Financial Times argued that the expansion of the Fed’s currency swap lines with several other central banks was the most important measure it took as it slashed its target range by 100 bp and announced intentions to buy $700 bln of Treasuries and mortgage-backed securities. It was embraced by the media as coordination. It is hyperbole. Here is what happened: the dollar last week surged by the most in years, as an acute shortage emerged. Yet, the standing swap lines the Fed were barely used. It could have been the price, so the thinking went. So the Fed cut the premium in half to 25 bp. Given the magnitude of the shock, the Fed also offered swaps of longer duration. One has to stretch the definition of coordination to squeeze the swap decision into it. If the tweaks to the swap program were important, they were not in practice.

The cross-currency basis swaps moved more extreme yesterday. The 200-day moving average of the discount to LIBOR that yen would be swapped into the dollar is about 30 bp. Before the weekend, it surged to around 90 bp, and yesterday it jumped to 140 bp before settling near 120 bp. Japanese banks tapped the swap line for $32 bln in the first operation since the tweaks were announced. They took $30.3 bln from the 84-day facility (paying 37 bp) and $2.05 bln of the seven-day swap (41 bp). It is the most since 2008, but the three-month cross-currency basis swap is near -127 bp.

The basis swap for the euro was not as dramatic, but it too became more extreme after the Fed’s announcement. It finished near an 82 bp discount, the most in a couple of years after finishing last week below 70 bp. The 200-day moving average is almost 14 bp. The strain was also evident in the spread between OIS and LIBOR, which can be understood as interest rate differential between onshore and offshore dollars. The BOE and the ECB will auction the swaps tomorrow.

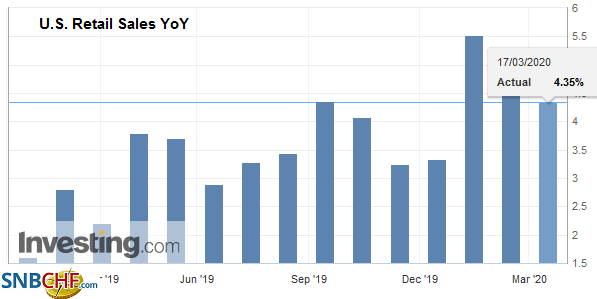

| The US reports February retail sales and industrial production figures. Economists expect around a 0.2% gain the headline retail sales after a 0.3% gain in January. The core measure, which excludes autos, gasoline, and building materials, among other components, was flat in January and is expected to bounce back. |

U.S. Retail Sales YoY, February 2020(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

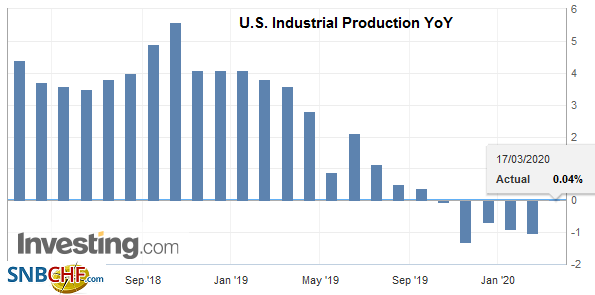

| Industrial output is forecast to have risen by 0.4% in February after a 0.3% decline in January. Manufacturing had fallen by 0.4% and is expected to have recouped about half of it in February. Still, the data is old, and the dismal March Empire State manufacturing survey reported yesterday underscored how fast the economy has turned. |

U.S. Industrial Production YoY, February 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

The US dollar staged a large outside up day against the Canadian dollar by trading on both sides of the previous day’s range, and closing above its high. After closing above CAD1.40, follow-through buying has lifted it toward CAD1.4080. There is little chart-based resistance now until the January 2016 high near CAD1.47. The US dollar is hugging its highs against the Mexican peso near MXN23.00. Nearby support is seen near MXN22.50, and a break would signal a test on MXN22.00

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,cross currency basis swap,Currency Movement,EUR/CHF,newsletter,Philippines,U.K. Unemployment Rate,U.S. Industrial Production,U.S. Retail Sales,USD/CHF