Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China’s markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan’s Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%. However, European and US shares are edging higher, and other measures of safe-haven buying are relaxing. US Treasury yields are up a couple of basis points, and European bonds are also narrowly mixed. Gold is around $10 lower, giving back the lion’s share of the pre-weekend gain. Oil prices have recovered from the earlier drop that saw the March WTI contract fall to a little below $50.50 before rebounding. The dollar is mostly higher. Against the majors, the Australian dollar, which had been beaten up last week, seemingly as a proxy for China’s whose markets were closed, has managed to hold its own against the greenback. Sterling, which had been a big winner into month-end, is seeing those gains unwound. Most emerging market currencies are lower as well, paced by the onshore yuan that fell by 1.1%.

Asia Pacific

Even before China’s markets opened today, officials were offering liquidity and credit support. Banks were also urged to be flexible with businesses and be prepared to lend. The focus is on emergency liquidity and disaster relief. Using the power of moral suasion in the way that officials do, short-selling was discouraged. China injected CNY1.2 trillion ($175 bln) into the banking system, which included CNY150 bln ($22 bln) new funds. Rates were cut by 10 bp, but the new benchmark, the Loan Prime Rate is not set until February 20. Separately, China is dramatically increasing meat imports, according to the Commerce Ministry. To the extent that beef and pork are processed grains (corn and soy), importing meat is more efficient. For the record, though obviously dated, the Caixin manufacturing PMI reportedly fell to 51.1 from 51.5. More telling, corporate profits in December fell 6.3% year-over-year, pointing to the economic challenges prior to the coronavirus.

Japan’s January manufacturing PMI was revised lower from the flash reading of 49.3. Its final estimate was 48.8, which is still above the 48.4 of November. Japan also reported January auto sales fell 11.1% from year-ago levels. It was the fourth consecutive year-over-year decline and warns that Japan continues to feel the impact of the sales tax increase.

The Reserve Bank of Australia meets tomorrow. The manufacturing PMIs moved in opposite directions. The AiG version fell to 45.4 from 48.3, while the CBA version rose to 49.6 from 49.1. Separately, December building approvals slipped but less than expected (-0.2% rather than 5% than economists forecast, and the November series was revised to 10.9% from 11.8%). While the market favors a standpat stance, it is only temporary, and a rate cut is fully discounted in Q2.

The dollar found a base near JPY108.30, the pre-weekend low. It recovered to JPY108.70 in late Asian turnover giving early European’s a low-risk selling opportunity near the 50% retracement of the key reversal on January 31. The risks extend to last month’s low near JPY107.65. The Australian dollar made a marginal new low before stabilizing. It had closed below its lower Bollinger Band previous week (two standard deviations below its 20-day moving average) and is edging back into it today. It needs to resurface above $0.6730 to give confidence a low is in place. The dollar jumped against the Chinese yuan, and with today’s gain has recovered about 50% of what it had lost since last August (at about CNY7.0125). The next retracement objective is found near CNY7.0530.

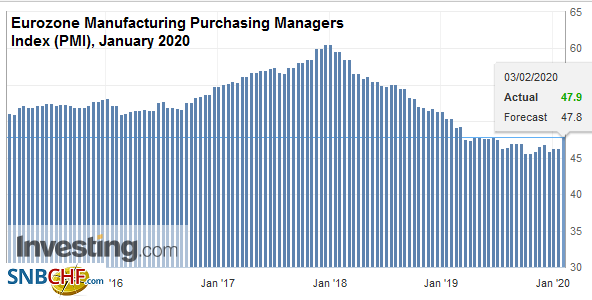

EuropeThe UK may have left the EU, but how they will relate going forward remains a known unknown. The year-long negotiations are about to begin in earnest. Today, both the UK Prime Minister and the EU will lay out their goals. The UK seeks a Canada-like agreement that does not require regulatory convergence. It threatens to walk away from negotiations if it does not get what it wants. The EU wants to link the future relationship to continued alignment. A tariff-free and quota-free agreement is not possible if there is divergence, especially on environmental and labor issues. Talks will begin proper late this month or early March. While the shock of the coronavirus will have a negative economic impact, the January manufacturing PMI was better than expected. Germany’s is revised to 45.3 from 45.2 flash reading and the December’s 43.7. It is the highest since last February. France matched the flash report of 51.0, which is up from December’s 50.4. Italy, whose economy contracted by 0.3% in Q4 19, saw the PMI rise to 48.9 from 46.2, well above expectations for 47.3. Spain also surprised on the upside at 48.5. Although it edged down from 48.7 in December, it was better than the 47.4 forecasts. The aggregate manufacturing PMI for the region rose to 47.9 from 46.3 in December. It matches the highest since last April and is consistent with the slow recovery that seems to be underway. |

Eurozone Manufacturing Purchasing Managers Index (PMI), January 2020(see more posts on Eurozone Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

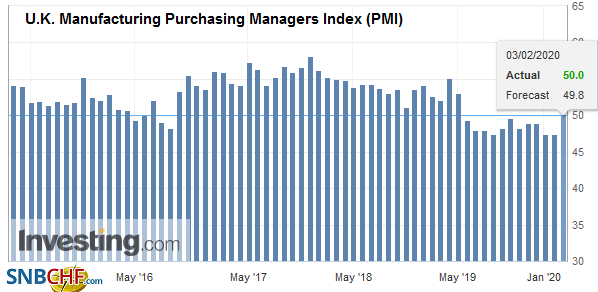

| The UK’s manufacturing PMI rose to the 50 boom/bust level from 49.8 flash reading and 47.5 in December. Sentiment indicators have shown a rebound since the election and may have helped encourage the Bank of England to standpat last week. The manufacturing PMI has not been above 50 since last April. Of note, new orders rose to 51.2 from 46.4. |

U.K. Manufacturing Purchasing Managers Index (PMI), January 2020(see more posts on U.K. Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

Month-end flows appear to have exaggerated the demand for the euro, and it is softer today. Indeed the pullback has seen it retrace (38.2%) of last week’s gains. The nex retracement (50%) is near $1.1045. There are two sets of expiring options at $1.1075 and $1.1100 (for about 930 mln euros and 515 mln euros, respectively, that may help block the upside. Sterling met a wall of sellers in the $1.3200 area, and it fell a little through $1.3060 in the European morning before finding a bid. The $1.3100 area may offer the nearby cap, and it is reinforced today by the expiry of an option for almost GBP400 mln.

America

President Trump has frequently been critical of OPEC for creating an artificial scarcity and not allowing oil prices to fall as much as market forces would drive them. The price of oil plummeted about 15% last month, and this is spurring OPEC into action. Saudi Arabia has been pushing for an emergency meeting of OPEC and non-OPEC members to discuss an action plan.Russia, arguably the most important of the non-OPEC members that are willing to cooperate (some times), has been balking but now seems ready to agree to a meeting. The most recent drop is related to demand considerations in light of the economic fallout from the coronavirus. Bloomberg reported estimates suggesting China’s oil consumption may fall by 20% or three million barrels a day. The expected dates are either February 8-9 or February 14-15. In this context, a meeting increases the pressure (and likelihood) for new action. There is speculation OPEC+ could agree to a 500k barrel cut in output to support prices.

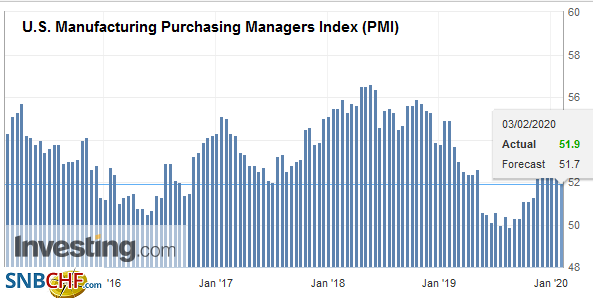

| The US reports the manufacturing ISM and PMI for January today, and the former is given more weight by market participants it appears. A rebound is expected from the 47.8 reading, and the median forecast calls for 48.5, which would be the best since October. New orders are expected to edge higher. Note that the flash manufacturing PMI declined for the second month. The US also reports January auto sales. Canada also reports the January manufacturing PMI. In December it stood at 50.4, the lowest since August. Mexico reports both the manufacturing and non-manufacturing surveys, and while both are expected to remain below the 50 boom/bust level, a small gain in manufacturing is expected to be offset by a slight decline in the non-manufacturing survey. |

U.S. Manufacturing Purchasing Managers Index (PMI), January 2020(see more posts on U.S. Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

The US dollar extended last week’s gains against the Canadian dollar, but the momentum appears to be slowing. A convincing break now of the CAD1.3215-CAD1.3225 area would suggest a top may be in place. The Mexican peso has weathered the volatility and the risk-off environment like a champ as the high-interest rates offer a cushion. It is consolidating with a firmer bias against the dollar. The Dollar Index has recouped (38.2%) of last week’s decline near 97.65. The 200-day moving average is a little higher, and the next retracement (50%) is found a touch above 97.75. The intraday technicals are stretched in the European morning.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CNY,Currency Movement,EMU,Eurozone Manufacturing Purchasing Managers Index,newsletter,OIL,Post-Brexit,U.K. Manufacturing Purchasing Managers Index,U.S. Manufacturing Purchasing Managers Index