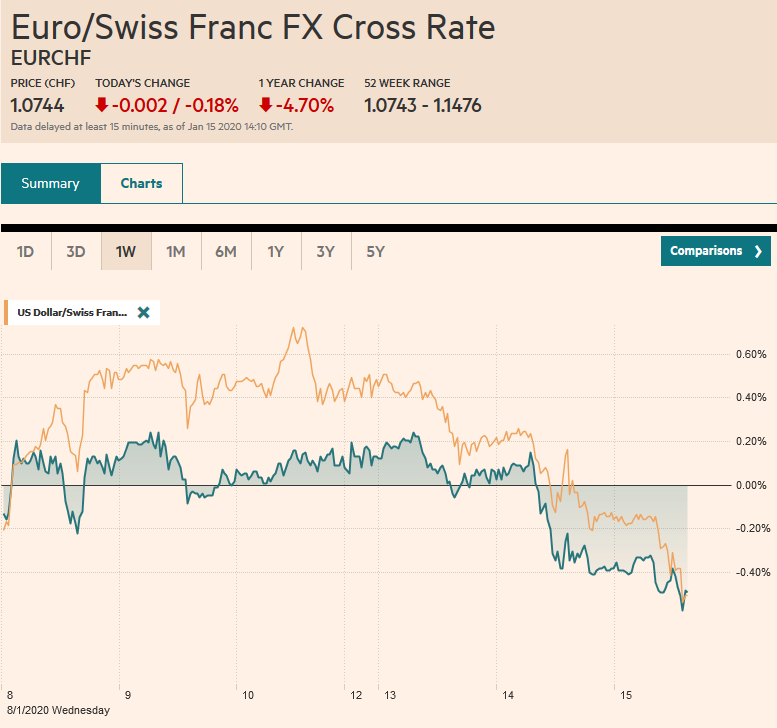

Swiss FrancThe Euro has fallen by 0.18% to 1.0744 |

EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: News that US tariffs on China will remain until through at least the November US election and continued US attempts to stymie China (e.g., more curbs on Huawei under consideration and stepped up efforts to force it to cut subsidies to business) have taken some momentum from the push into risk assets. The MSCI Asia Pacific Index snapped a four-day advance today, with only Australian equities among the large regional markets able to sustain upticks. Europe’s Dow Jones Stoxx 600 is hoving near record highs and is little changed through the morning session. US shares are also little changed. Benchmark 10-year yields are mostly 2-3 basis points lower, though the rate adjustment in the UK continues. The dollar is mixed, with sterling, the Antipodean and Scandis heavier, and leaving the Swiss franc, Japanese yen, and the euro slightly firmer. Emerging market currencies are mostly heavier, with the Chinese yuan slipping for the first time in five sessions. March light sweet crude oil continues to staddle the $58 a barrel level, while gold is recovering from the pullback that saw $1536 yesterday. It is back above $1550 today. |

FX Performance, January 15 |

Asia Pacific

The signing ceremony for Phase 1 of the US-China trade deal is at hand. The actual text of the agreement has been closely guarded. As an executive agreement, which does not require Congressional consent (e.g., NAFTA 2..0) the secrecy is allowed. The US has indicated that even after the deal is published, an annex that details the amounts of goods that China has agreed to purchase will remain confidential. While US officials have denied the existence of other secret deals, the market suspects otherwise. Consider the report that acknowledged that there was nothing in the formal agreement about the tariffs. It turns out that there is an “understanding” that the existing tariffs will not be addressed for ten months after the signing, which incidentally is also after the US national elections. The US wants to monitor implementation before making any concessions.

On commitments for which there is a quantitative target, an assessment may be straightforward. However, qualitative issues are different. Consider currency manipulation and the fact that the US resorted to a 1988 definition rather than the quantitative one that Congress provided in 2015. China has denied claims of systematically “stealing” foreign technology, and it has stiffened penalties for intellectual property violations. Again, judgment calls will be required, which is different than China’s target is to boost the US goods by $200 bln over two years. It seems little has been secured that could not have been achieved two years ago when President Trump rejected the trade agreement that Treasury Secretary Mnuchin had struck. Leaving aside the rhetoric and domestic messaging, to get to the deeper structural issues, it is clear that a multilateral approach is necessary, such as the initiative that was taken this week at the WTO by the US, Europe, and Japan to broaden and deepen prohibitions of state subsidies. This is important because almost 2/3 of traded goods compete with businesses that receive subsidies.

The US dollar reached JPY110.20 yesterday and is consolidating in about a 10-tick range on either side of JPY109.90 today. A break of the JPY109.75 area could see a push toward the JPY109.30-JPY109.40 area, where there are also $1.2 bln in options expiring today. Unable to extend gains much above $0.6900, the Australian dollar is seeing some profit-taking today that has pushed it back to about $0.6880. An option for about A$885 mln at $0.6875 expires today, and a break below there weakens the technical tone. The Chinese yuan rose for the first time in five sessions today, but the US dollar did not sustain the upticks above CNY6.89. Some demand for the yuan is still being linked to the upcoming Lunar New Year as dollars proceeds are converted to yuan to cover costs during the extended holiday. Many remain skeptical about the yuan’s strength outside of the very near-term.

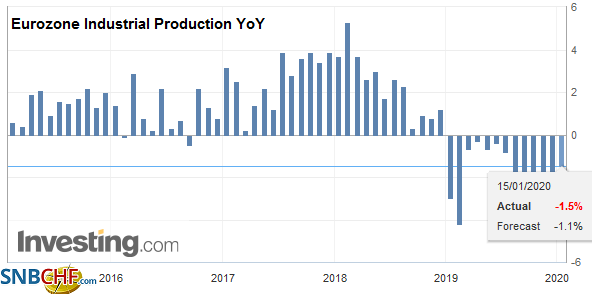

EuropeGermany, France, Italy, and Spain seemed to have reported stronger than expected November industrial output figures recently, but the aggregate report disappointed. Not only did the November increase of 0.2% disappoint forecasts for a 0.3% increase, but the October series was revised to show a large 0.9% decline rather than a 0.5% fall. Still, it was the first gain since August and is consistent with the stabilization of the regional economy. |

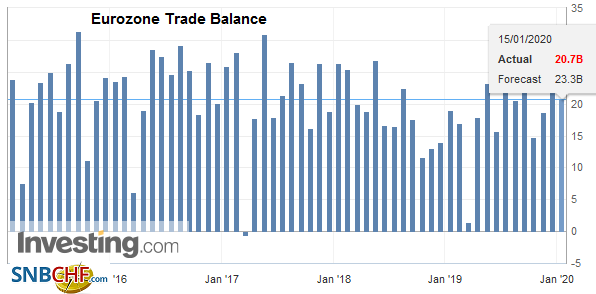

Eurozone Trade Balance, November 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

| Separately, Germany became the first among the G7 to report Q4 19 GDP. The preliminary report is for 2019 estimated growth at 0.6%. If Q4 is backed out, the world’s fourth-largest economy appears to have expanded by 0.1%-0.2%. Growth is not expected to improve much here in 2020 from the slowest pace in six years. |

Eurozone Industrial Production YoY, November 2019(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

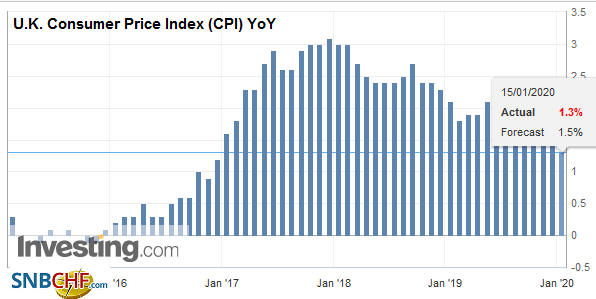

| The UK reported softer than expected consumer price pressures, and this will keep the rate-cut fever elevated. The preferred measure of consumer prices (CPIH) that includes owner housing costs slipped to 1.4% from 1.5%, while economists had forecast a small increase. It is the lowest reading in three years. The same is true of the core rate, which fell to 1.4% from 1.7%. The implied yield of the March short-sterling futures contract fell 4.5 bp to 60.5 bp. The Overnight Index Swaps implies about almost a 2/3 chance of a cut is being discounted for later this month. A week ago, the probability was seen as a little better than a 1-in-20 chance. The UK reports retail sales at the end of the week, and a strong recovery from the 0.6% fall in November may spur some paring back of expectations. |

U.K. Consumer Price Index (CPI) YoY, December 2019(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro is trading with a firmer tone, rising to a little through $1.1150 in the European morning. Large options at $1.1100 roll-off over the next few sessions, starting with a nearly 700 mln euro option today. A move above $1.1160-$1.1180 is needed to lift the tone. Shifting rate expectations have replaced Brexit as the driver for sterling. After popping through $1.3040 briefly in late Asian turnover, it is struggling to hold above $1.30 in Europe. Better support is seen near $1.2960. The intraday technicals suggest the support will likely hold today. Switzerland was added back to the US currency watch list, but officials continue to wrestle with what the OECD says is the most overvalued currency (~17.5%). Thinking that the US citation may dampen Swiss officials’ attempt to resist more currency strength, participants have bid the franc to new two-year highs against the euro today. After being aggressively pushed below CHF1.08 yesterday, the euro was sold through CHF1.0750 today. Lastly, softer than expected, underlying Swedish inflation reduces the chance that the Riksbank follows up last month’s hike (to zero) with another increase when it meets next month. This news is helping the euro recover from a two-day dip and reinforces the sense of new near-term range (SEK10.50-SEK10.60)

America

The signing of Phase 1 of the US and China trade agreement and the publication of the details are center stage today. The ceremony is set for a little before noon in Washington. The fact there are no plans to reduce US tariffs on China for at least the next ten months dampens some enthusiasm. At the same time, US efforts at the WTO and to block more sales to Huawei underscores the idea that the Phase 1 deal does not really impact the larger-scale rivalry between the two, which is not just about economics and trade.

Separately, US banks reported positive results yesterday, and more are expected today (Bank of America, Goldman Sachs, Morgan Stanley, and Blackrock). The US also reports December PPI today. A 0.2% increase in the headline and core rate would bring the former to 1.3% to match the latter. It is typically not a market-mover even in the best of times. The Empire State manufacturing survey is one of the first readings for the new year. It is expected to be little changed from the 3.5 seen in December, which is also the Q4 19 average. Last year, it averaged 4.8. It had averaged 19.8 in 2018. Late in the session, the Fed’s Beige Book for preparation of the January 29 FOMC meeting will be released. Two voting members speak today (Harker and Kaplan), as does Daly. Fed officials seem prepared to look past Q4 data, and possibly even Q1 data, which will be skewed by Boeing’s cutbacks.

Canada reports existing home sales for December today but is unlikely to impact currency trading. The US dollar is slowly recovering against the Canadian dollar and is recording a higher low for the sixth consecutive session. The upside has been slowed by the CAD1.3080 area. A move, and ideally a close above CAD1.3100 would lift the tone. The dollar is flatlining against the Mexican peso around MXN18.80. With a lucrative carry, the sideways movement of the peso works fine. Three-month implied peso volatility is near 7.0%, its lowest level in more than five years. Elsewhere in the region, Brazil reports November retail sales early in the session, and a strong 1.2% gain is expected after a 0.1% rise in October. Late in the session, Argentina reports December CPI. A rise of a little more than 4% is expected in the month, which would lift the year-over-year rate back above 54% from 52.1% in November.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EUR/CHF,Eurozone Industrial Production,Eurozone Trade Balance,newsletter,U.K. Consumer Price Index,U.K. Consumer Price Index,USD/CHF