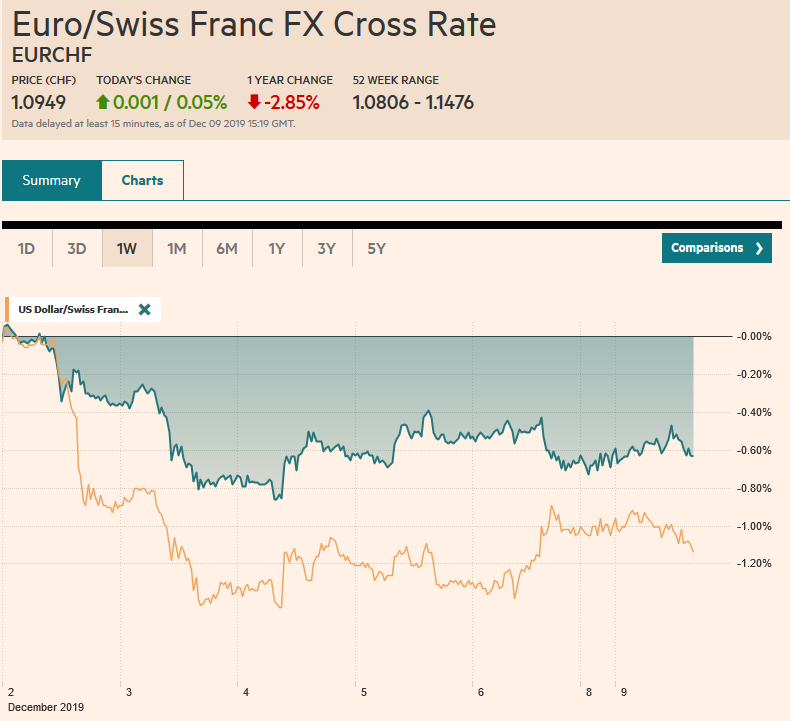

Swiss FrancThe Euro has risen by 0.05% to 1.0949 |

EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for the last three sessions. Benchmark 10-year yields rose in Asia in response to the firmer US rates after the employment data, but European yields and Treasuries are around 2-3 bp lower. Italy and Greek benchmark yields are 5-6 bp lower. The dollar is mixed. It is heavier against sterling, yen, and euro, while the Scandis and dollar-bloc are softer. The quiet turnover appears light. Among emerging markets, the Turkish lira and South African rand are nursing losses, while the Mexican peso is building on its pre-weekend gains. The JP Morgan Emerging Market Currency Index is slipping after a three-day rally in the second half of last week. Gold is firm. After testing $60 a barrel before the weekend, WTI for January delivery has slipped back below $59. Last week it rallied 7.3%, the most since June. |

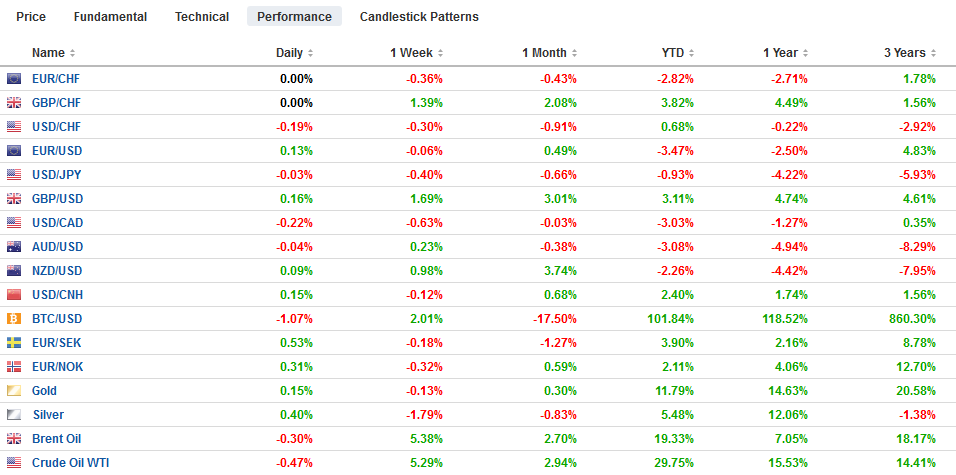

FX Performance, December 09 |

Asia Pacific

Rarely do revised GDP figures capture the market’s attention. However, Japan’s sharp upward revision to Q3 GDP is notable. First is the magnitude. The 0.1% quarter-over-quarter gain initially reported was revised to 0.4%. That lifted the quarterly annualized pace to 1.8% from 0.2%. Private consumption was revised higher to 0.5% from 0.4%, but business investment doubled from the initial estimate of 0.9 to 1.8%. Second, the surge in activity ironically will make the slowdown in Q4 even more pronounced. Some forecasts call for a 2.7% contraction in Q4. The BOJ meets next week, and there is already speculation that it will lower its economic assessment.

China reported reserves and trade data over the weekend. The dollar value of reserves slipped and is understood as more likely an issue of valuation (dollar strengthened, and bond prices fell) than intervention per se. The trade data was more interesting. Exports fell 1.1% year-over-year and were weaker than median forecasts in the Bloomberg and Reuters surveys (-0.8% and -1,0%, respectively). Still, given that China’s exports to the US are off 23%, China appears to have found other markets for its goods. Imports rose by 0.3%, helped by a 41% surge in soy. Imports from the US were up 2.7%. China’s willingness to waive its tariffs on US soy and pork is not a sign of goodwill that many in the media suggest. Given the shortage and the resulting surge in prices, which will again be evident in this week’s CPI report, a more compelling argument is based on China’s domestic needs. Moreover, China moved unilaterally, boosting the importation of US foodstuffs prior to an agreement being struck or any quid pro quo.

Separately, while one does not need to subscribe to theories of international relations of the inevitable clash between the US and China, we have argued the current dynamics are pushing in that direction. We see the trade conflict as just the tip of a larger and multi-dimensional confrontation. China has responded to the US campaign against Huawei (and other Chinese companies) and the US penchant for sanctioning Chinese businesses, by launching a campaign of its own that fits well into its broader import-substitution strategy. It has announced that state and public businesses have three years to replace foreign computers and software with domestic products. The goal is to achieve about one third in 2020, half in 2021, and the remainder in 2022.

The dollar is testing last week’s low a little below JPY108.45. It met offers in early Asia near JPY108.70 and has not managed to re-challenge that area in Europe. Options for about $1.16 bln struck in the JPY108.60-JPY1080.70 area that expires today may help cap the greenback. There is a $2 .5 bln option at JPY109 that expires tomorrow to keep in mind as well. Below JPY108.45, initial support is seen around JPY108.25. There is a $1 bln option at JPY108 that rolls off tomorrow too. The Australian dollar is drifting toward last week’s low (~$0.6815), while last week’s high near $0.6860, tested several times, appears to offer formidable near-term resistance. The dollar slipped against the Chinese yuan in the last three sessions of last week but firmed today. It reached about CNY7.0435 late in the mainland session before consolidating.

Europe

As the UK election draws near, the Tory lead appears to have widened. The latest Survation Poll puts it ahead of Labour by 14 percentage points. This expectation that Brexit can finally be wrapped up continues to underpin sterling, which made a new high for the move today (~$1.3180) in the European morning. On a Tory majority, many look for sterling to reach around $1.35. Our caution is that give sterling’s rally and the technical indicators that are getting stretched, there is risk of “buying the rumor and selling the fact.”

German surprised with a better than expected trade report today. The trade balance itself was little changed around 21.2 bln euros. The composition was different. Exports unexpectedly rose by 1.2%. Most economists had looked for a slight decline. Following the 1.5% increase in exports in September, make its the best two-month performance in a couple of years. Imports, which were forecast to decline by 0.1%, were flat and follows a revised 1.2% increase in September (the initial estimate was 1.3%).

The euro is in about a 25-tick range above $1.1050, as its pre-weekend drop in response to the US jobs data is consolidated. The light buying appears to be running out of steam in the European morning, and recently it has been trading heavier in the North American session. The 20-day moving average is near $1.1045, and a break could spur a test on the $1.10 area. Sterling’s five-day advance against the dollar was arrested by the US jobs data, and the small decline it recorded has been recovered today. Sterling reached $1.3180 in late Asia before backing off toward $1.3150 in early Europe were new bids were found. The $1.3200 area offers the next target.

America

The key events for the US this week include the FOMC meeting and the decision on the December 15 tariffs on Chinese imports. Everyone expects no change in policy and some adjustments to the economic forecasts (dot plot). While some see a chance for a hawkish hold for the forecasts to reflect no change in policy, many of the estimates anticipating a hike next year have to come down. For example, there are seven members who that a fed funds target of over 2% would be appropriate next year. These are vulnerable to lower projections.

The eventful week begins off slowly today. There is no US economic data of note, and Fed officials are in the quiet period ahead of the meeting. Canada reports November housing starts and October permits. These are not typically market movers, but given the shockingly poor employment data before the weekend and the market may be particularly sensitive to additional disappointments. Mexico reports November CPI figures. The year-over-year rate is expected to be little changed around 3%. The central bank meets on December 19. A decline in consumer prices may encourage speculation of a rate cut. Currently, only a small chance of a cut is expected.

Meanwhile, Mexico is push back against Washington’s demands that American officials are allowed to enter Mexico to inspect labor conditions as part of the new demands for the USMCA deal. This appears to be emerging as a sticking point in the attempt to get Democrat support for the new agreement, which Mexico’s Congress has already approved. Another contentious issue is the origination of the steel slab to make autos. The US insists the slab comes from North America to count toward the 70% quota, but much of Mexico’s steel slab comes from other countries (Japan, Brazil, and Germany). Mexico has countered with a proposal that this requirement kicks in only after five years.

On December 9, the US dollar approached CAD1.3150. After the diverging employment reports before the weekend, the greenback charged to about CAD1.3270. It is consolidating today in a narrow range (~CAD1.3250-CAD1.3265). Only a break of the CAD1.3220 area would suggest a near-term high is in place. On the upside, CAD1.3300-CAD1.3320 offers resistance. The US dollar is extended its pullback against the peso for the fifth consecutive session today. It has slipped through the 200-day moving average (~MXN19.2835) for the first time in almost a month. The lows from mid-November were in the MXN19.1760-MXN19.1825 area. Mexico’s high rates still attract carry-trade strategies, especially in subdued conditions. The Dollar Index spent much time in the second half of last week below its 200-day moving average (~97.65). It closed above it before the weekend but is struggling to remain above it today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EUR/CHF,EUR/CHF and USD/CHF,Germany,NAFTA,newsletter,Trade,USD/CHF