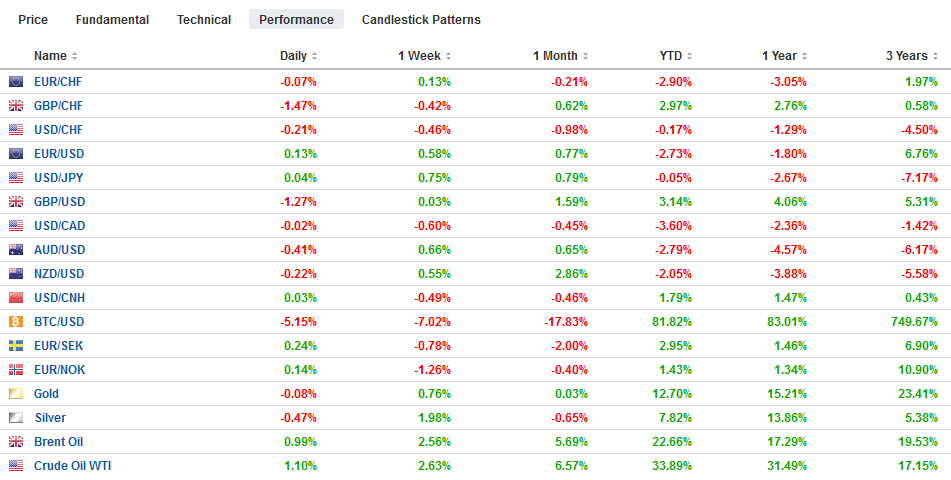

Swiss FrancThe Euro has risen by 0.04% to 1.0945 |

EUR/CHF and USD/CHF, December 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Efforts by a UK Prime Minister emboldened by a strong electoral victory to ensure that trade negotiations with the EU are not extended as the divorce has encouraged further profit-taking on sterling. After testing the $1.35 area on the exit polls last week, sterling had returned to where it closed before the results were known near $1.3160. Sterling is leading all the major currencies lower against the dollar, and the large accessible emerging market currencies (e.g., South African rand, Turkish lira, Russian rouble, Hungarian forint) are also weaker today. The global equity rally was extended in Asia after the S&P 500 gapped higher yesterday (3183.7 to 3183.6), with Hong Kong, China, Taiwan, and South Korea markets up over 1%. However, the four-day rally in Europe’s Dow Jones Stoxx 600 is struggling, and US shares are trading a little heavier as well. Benchmark 10-year yields rose in Asia Pacific but are lower in Europe, led by a 5 bp drop in the Gilt yield. The US 10-year Treasury yield is little changed near 1.83%. Gold and January WTI are hovering around their closing levels (~$1477 and $60) |

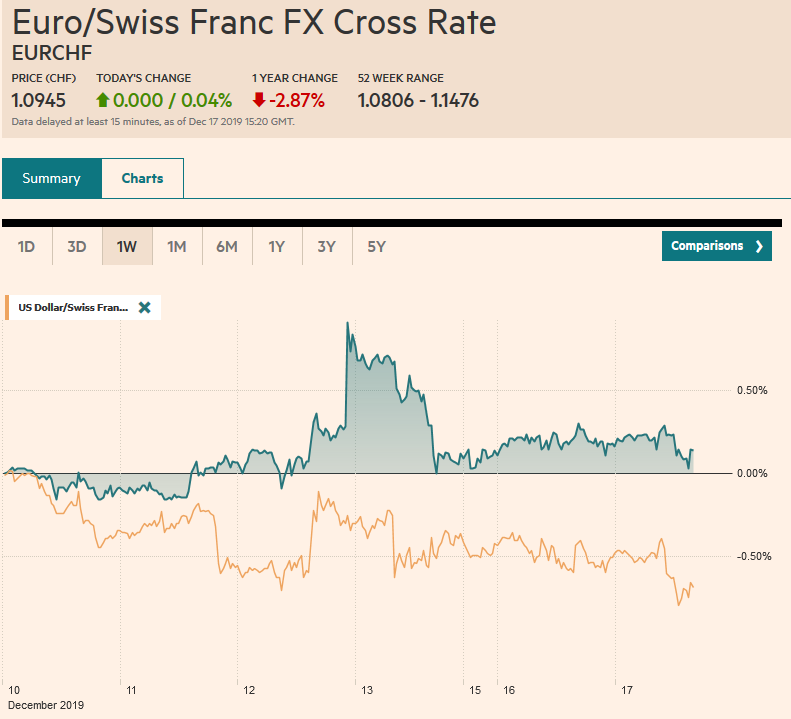

FX Performance, December 17 |

Asia Pacific

Singapore, as a regional entrepot, is often seen as reflective of the broader regional trends. Its November trade figures offered a mixed picture. Overall, exports fell 5.9% year-over-year after a 12.5% decline in October. However, electronic exports slump deepened to -23.3% after a 16.4% decline in October. Non-electronic exports rose 1.3%, even though pharma and petrochemical exports fell. In the month of November alone, exports rose 5.8% after a 3.1% decline in October.

The minutes from the Reserve Bank of Australia meeting earlier this month suggested the bar may be low to ease policy in early 2020. The RBA indicated that early next year, it will reassess the policy outlook, and while the economy is performing in line with its expectations, and any deterioration will likely see lower rates. The market leans toward a rate cut at the first meeting next year on February 4.

The dollar has been confined to about a 15-tick range against the Japanese yen today through most of the European morning. It is trading within yesterday’s range (~JPY109.25-JPY109.70), which was inside the pre-weekend range (~JPY109.00-JPY109.70). The intraday technicals favor the downside in the North American session. There are expiring options at JPY109.75 (~$790 mln) and JPY110 (~$400 mln) that may block the upside and about $480 mln option at JPY109.50. The bearish (shooting star) candlestick formation from before the weekend did not spur follow-through selling yesterday, but it has emerged today. The Aussie peaked near $0.6940 at the end of last week and reached about $0.6845 in the European morning. The intraday technicals are stretched, but strong support is not seen until $0.6800-$0.6820. The Chinese yuan continued to trade in narrow ranges with the dollar straddling the CNY7.0 level.

EuropePrime Minister Johnson is seeking to embody in UK law that the trade negotiations with the EU will not extend past the end of next year. This underscores a point we have been at pains to make. The UK election and passage of the Withdrawal Bills (as soon as this week) does not preclude the UK leaving the EU with only the WTO rules to govern the new trade relationship, which has long been regarded as a “hard Brexit.” A standstill agreement runs through next year as the new relationship is negotiated. The UK is said to seek a Canada-like agreement with the EU. The rub is that it took seven years to settle. |

U.K. Unemployment Rate, October 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

| French protesters are gearing up for the third round of demonstrations against President Macron’s pension reforms. Reports suggest the economic impact may be more severe than the Yellow Vest protests seen previously. The risk is that this may sap the resilience of the French economy before the German economy finds better traction. |

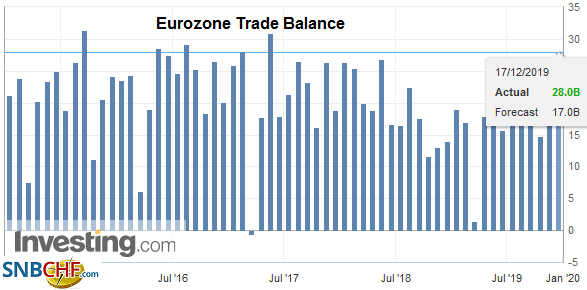

Eurozone Trade Balance, October 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

For the seventh consecutive session, the euro is recording a higher low. However, the pre-weekend high near $1.12 has not been approached. Like yesterday, the single currency is stalling near $1.1160. There is an option for a little more than 610 mln euros struck at $1.1185 that expires today and another one (~615 mln euros) at $1.1150. The euro has not traded below $1.11 since December 11. Sterling settled near $1.32 the day before the election and finished around $1.3160 on the day of the election. It reached about $1.3155 early in the European session today. There is an option for about GBP250 mln at $1.32 that expires today. The decline has left the intraday technicals extended, and intraday resistance is seen now near $1.3220.

America

Boeing’s decision to temporarily halt production of its 737 model will have knock-on effects on the US economy and weigh on Q1 growth. Economists will likely cut growth forecasts by 0.6%-1.0% (annualized rate). The impact detected in numerous reports, including ISM/PMI, industrial output, and durable/factory orders. Employment may be less impacted as at least some of the workforce will be redeployed by the company. The duration of the production halt is not known, which makes discerning the extent of economic impact more difficult. Separately, the US reports November industrial output figures today, and they are expected to be lifted by the end of the GM strike. October saw a 0.8% decline in industrial production and a 0.6% fall in manufacturing. An increase in utility output may also underpin the headline. The US also reports November housing starts and permits. The former is expected to have increased while the latter is forecast to decline. Fed speakers include Kaplan and Rosengren.

Mild strain was evident in the funding market yesterday as the corporate tax deadline and auction settlements were expected to have drained around $85 bln. The overnight repo rate ticked up to 1.70% from 1.62%. It is the highest since the end of October. The Federal Reserve’s term repo that extends to mid-January was over-subscribed ($50 bln offered vs. bids for $54.25 bln).

The little dust-up between the US and Mexico over the new labor attaches that are legislated by new NAFTA being considered by the House of Representatives this week has been resolved. This apparently helped press the dollar below MXN19.00 yesterday. Mexico’s chief negotiator, Seade accepted US Trade Representative Lighthizer’s explanation that these are not inspectors. The conflict resolution mechanism is one of the innovations of the treaty. The dispute panels consist of three people. One from a list of American Mexico selects, and one from a list of Mexicans America pick and a person from a third country. Note that Mexico is preparing to hike the minimum wage by 20% to MXN123.22 pesos.

The US dollar spiked down to CAD1.3115 yesterday, its lowest level in a month before rebounding to close a little above CAD1.3150, important support we identified. The greenback needs to overcome a band of resistance seen between about CAD1.3180 and CAD1.3210 to improve the technical tone. There is an option for $1.2 bln struck at CAD1.3210 that expires tomorrow. The high yield Mexico offers continues to attract funds for the year-end period. The US dollar extended its declines to almost MXN18.92, which it has not seen since mid-July. The peso’s strength is boosting confidence that the central bank will deliver its fourth rate cut here in H2 19 on Thursday. We expect some caution in North America today as the dollar is approaching the lower Bollinger Band (two standard deviations below the 20-day moving average) found near MXN18.9175 and signs that the technical indicators are getting stretched.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,Currency Movement,EUR/CHF,Eurozone Trade Balance,Mexico,newsletter,Singapore,U.K. Unemployment Rate,USD/CHF