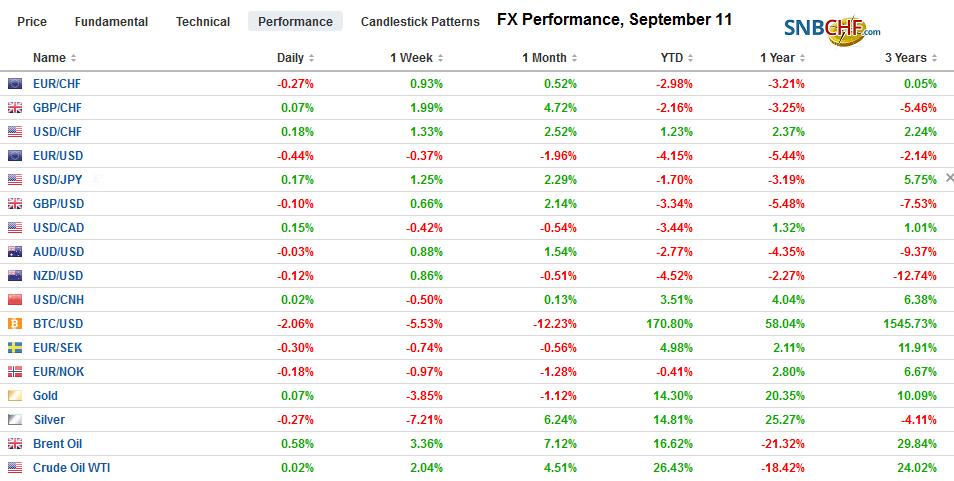

Swiss FrancThe Euro has fallen by 0.31% to 1.092 |

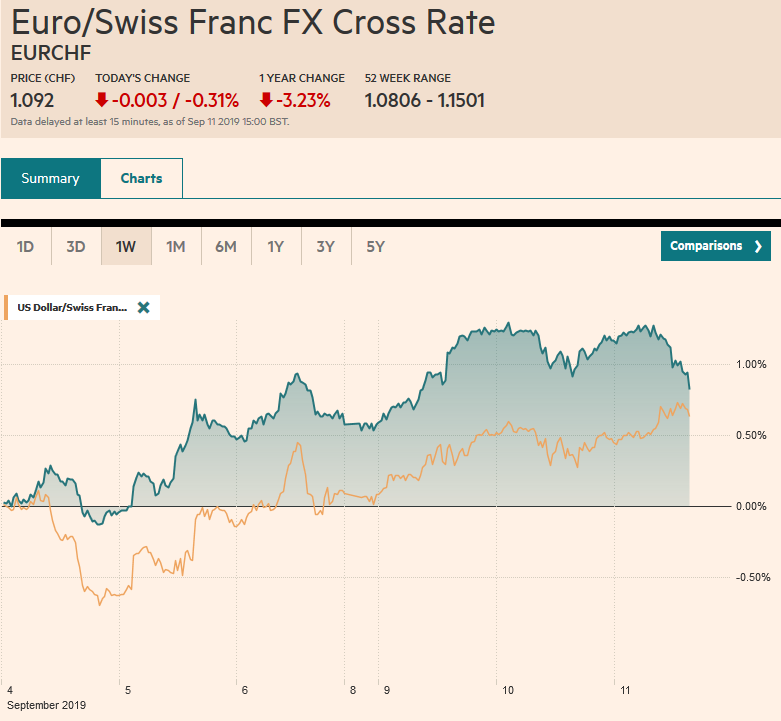

EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas that the political tensions may ease. South Korea reported better trade data for the first ten days of September. Italy’s Conte survived a second vote of confidence yesterday, putting a new government in place. With new appointments to the EC, the risk of an Italy-EU confrontation has been reduced. Nearly all the equity markets in the Asia Pacific regions advanced but China. The Nikkei’s rally was extended into the seventh session, and Korea’s Kospi has six-day advance in tow. Europe’s Dow Jones Stoxx 600 is up nearly 0.6% in late morning turnover and is up about 7.75% since mid-August. US shares are trading firmer, and the S&P 500 is drawing nearer 3000. Coming into today, it has gained about 5.8% since mid-August. Bonds remain under pressure, and benchmark 10-year yields are mostly 1-3 basis points higher. The dollar is firm against most major and emerging market currencies. Of note, the dollar reached new highs since last July against the yen, and after yesterday’s drubbing in the face of softer than expected inflation data, the Swedish krona has stabilized. Gold is trying to snap a four-day drop, while crude is moving higher, recouping yesterday’s losses that ended its four-day advance. |

FX Performance, September 11 |

Asia Pacific

As we noted previously, China reportedly offered as a sign of good faith to make some large purchases of US foodstuffs ahead of the face-to-face meeting sometime next month. We suspect that this reveals/confirms its animal protein and grain shortage. This was partly reflected in the jump in food prices reported yesterday. China announced further liberalization of its capital markets and abolishing the quota system for foreign investors (QFII). This is unlikely to spur a wave of new investment. Investors had found other ways to get Chinese exposure, including Hong Kong Connect. The more important hurdles are the limitations on repatriating funds and the uncertainty around tax issues.

Separately, and after mainland markets closed, China reported a sharp rise in aggregate financing in August. Overall lending rose to CNY1.98 trillion from CNY1.01 trillion in July. The driver is not so much bank lending, which increased to CNY1.2 trillion from CNY1.06 trillion in July. It was the shadow banking, which jumped after slumping in July. It is understood to be the difference between the aggregate lending and bank lending. It is another sign that China is more serious about arresting the economic slowdown than addressing excesses in the credit and the moral hazards that are present.

South Korea exports rose 7.2% in the first 10-days of September in a promising development. Its exports have been contracting on a year-over-year basis since last November. It will take more than this to arrest the pessimism. Base effects and the number of workdays may have inflated the results. Also, semiconductor chip exports were off a third from a year ago. On a different front, South Korea is filing a WTO case against Japan for its export controls. Separately, Korea reported a fall in unemployment to 3.1% in August, its lowest level since 2013, from 4% in July. The won is the strongest of the emerging market currencies, gaining about 0.2% against the dollar today. The won has strengthened in seven of the past nine sessions.

Reports suggest Japan’s Prime Minister Abe may announce a cabinet reshuffle today or tomorrow. Finance Minister Aso and cabinet secretary Suga are expected to retain their posts. Although Suga has been suggested as a possible successor to Abe, who is expected to step down in 2021, the focus is on the next generation. Koizumi, the son of the former Prime Minister, may be given a ministerial post, while Motegi, who has been negotiating with the US on trade, could be the next foreign minister according to reports.

The dollar is rising against the yen for the third consecutive session and four of the past five. The rising US yields seem to be the main driver. The dollar reached JPY107.85 in the Asian hours before consolidating in the European morning. The JPY107.50 area may offer nearby support. The next immediate target is around JPY108.00-JPY108.20. The Australian dollar met our $0.6880 target but gave up its early gains and is little changed. Support near $0.6850 looks solid. The Chinese yuan is little changed with the dollar around CNY7.1160.

Europe

The main focus is on tomorrow’s ECB meeting. The market seems to feel more confident in a rate cut than a resumption of the asset purchase program. There is some thought that reducing the coverage of the negative deposit rate would stimulate more activity by the banks. However, excess reserves are highly concentrated, and some trading capacity appears to have been scrapped. More than material change, exempting more deposits from the negative rates or the full brunt of the negative rates, maybe a compromise with the creditor countries, where the excess reserves are concentrated. Just like the markets are trying to deliver a fait accompli to the Fed, Draghi appears to be forcing (leading?) the ECB. At this juncture, the failure to deliver QE, or signal QE will be delivered, could spur a dramatic rise in European rates.

Before the ECB meeting, the estimate for July industrial production for the eurozone will be published. The median forecast in the Bloomberg survey is for a 0.1% decline. This may prove to be optimistic. All four large countries (Germany, France, Italy, and Spain) reported disappointing figures. Spain concluded the reports today. Industrial output fell 0.4%, which was a little more than expected and is the second consecutive monthly decline.

Scotland’s high court ruled that Johnson’s suspension (prorogation) of Parliament was unlawful because the intent was to frustrate (“stymie”) the representative body. Last week, a lower court said it was a political, not a legal issue. The court, however, refused to call back Parliament and chose to wait for the UK Supreme Court to make a ruling.

The euro remains within the range set Monday (~$1.1015-$1.1070) though is trading with a heavier bias today. It has been capped near the 20-day moving average each of the three sessions this week. It is found a little below $1.1060 today. It appears to be finding support ahead of $1.1020 in the European morning. Sterling is in a narrower range than the euro, and it is also firm just below $1.2370. It has not traded above $1.24 since last July. Resistance above there is seen near $1.2430. Recall that the euro rose against sterling for 14 consecutive weeks through August 9. Since then sterling has been recovering, and this would be the fourth consecutive weekly advance, the longest since January.

AmericaThe US 10-year yield fell five weeks in a row in August taking almost 60 bp off the yield before rising. It rose six basis points last week to break the streak, and it was up a little more than eight basis points in each of the past two sessions. The two-year yield has risen 16 bp this month compared with 23 bp for the 10-year yield. The implied yield of the January 2020 fed funds futures, for example, has risen 3.5 bp this month. Many attribute the sharp backup in bond yields to doubts about the ECB renewing its asset purchases tomorrow. However, we would emphasize the deluge of new investment-grade paper being brought to market. Treasuries are often used as a hedge, and now are competing with an alternative investment for some participants. The decline in prices appears to set off its own dynamics, exacerbating the move. A trendline off the early May and early August lows in the 10-year future note comes in near 128-25 and 128-29 in the coming days. |

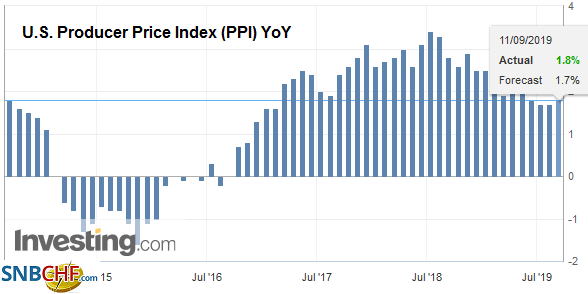

U.S. Producer Price Index (PPI) YoY, August 2019(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

| News that Bolton is no longer Trump’s national security adviser saw oil prices ease on ideas that the US will take a less aggressive stance toward Iran and Venezuela. It does seem that the hawks lost a key ally, but a significant shift in US policy is a different story. It is not clear the extent of Bolton’s influence, which is one of the reasons it believable that Bolton offered to resign before being fired. The first test may be whether the exemptions from the ban on Venezuelan oil are renewed. Bolton or no, it seems unlikely. Iran, whose commercial ties with China appear to be growing, has shown little willingness to engage is fresh deal-making with the US. Separately, the US API estimated that oil inventory fell 7.2 mln barrels, which if confirmed by the EIA, would be the fourth consecutive weekly decline. Inventories have fallen in 10 of the past 12 weeks. The number of oil rigs has fallen in nine of the past 12 weeks. While the EIA revised down global demand and US production forecast, OPEC seemed to play down its “conservative” demand estimates. |

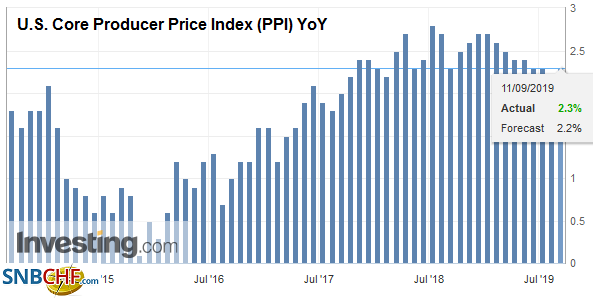

U.S. Core Producer Price Index (PPI) YoY, August 2019(see more posts on U.S. Core Producer Price Index, ) Source: investing.com - Click to enlarge |

We noted yesterday how Mexico’s budget has an optimistic growth assumption that may come back to haunt it next year. Today, we note AMLO’s budget for Mexico is projecting a dramatic turnaround in PEMEX output in its 2020 budget. It assumes that PEMEX output which has fallen for fifteen years, is going to jump 17% next year. Tax changes under the previous government and the decline in output means that oil revenue accounts for nearly 15% of the government revenues, about half of its share eight years ago. That said, the budget assumes oil prices average $49 a barrel next year. October WTI reached its highest level since mid-July (~$58.75) before reversing low. It can fall into the $56.50-$57.00 without doing much damage to the charts.

The US dollar ended a seven-week rally against the Canadian dollar last week with a 1% setback. The greenback traded a little heavier over the last two sessions but found support near CAD1.3135. Initial resistance is seen around CAD1.32. There is a similar pattern in the Mexican peso. The greenback’s seven-week advance ended last week and the follow-through this week appears to have faded as the dollar approached the MXN19.47 area, ahead of the retracement objective near MXN19.45. The first hurdle on the upside is the MXN19.60-MXN19.61 area. The US reports August producer price figures today, which do not typically move the foreign exchange market. The Dollar Index recovered from initial losses that saw it reach a two and a half week low (~97.85) and is flirting with a four-day cap near 98.50. Above there, the scope extends toward 98.80 before the recent high near 99.35 comes into view.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EUR/CHF,newsletter,OIL,U.S. Core Producer Price Index,U.S. Producer Price Index,USD/CHF