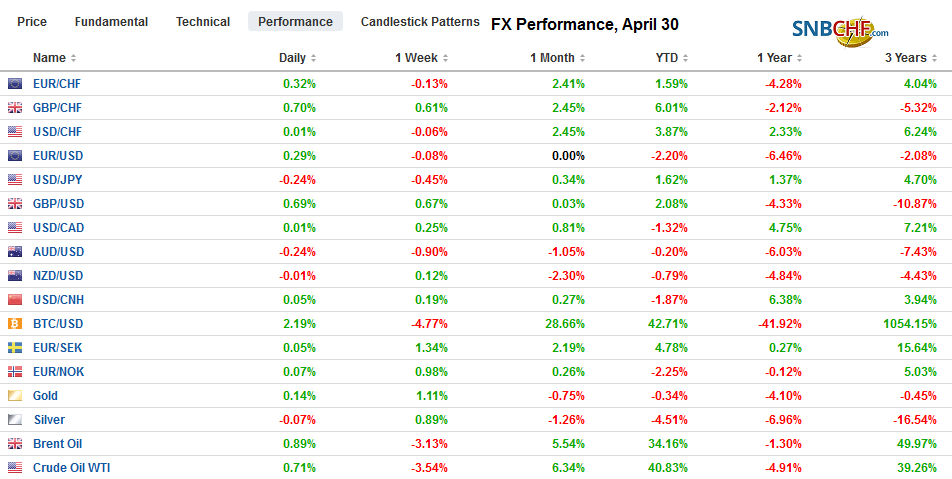

Swiss FrancThe Euro has risen by 0.31% at 1.1437 |

EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

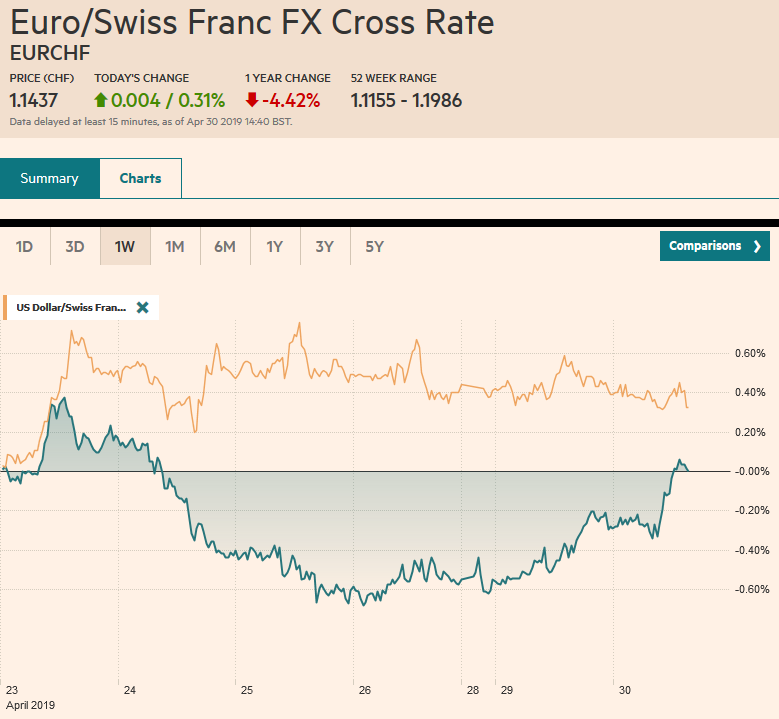

FX RatesOverview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed. Samsung’s profit miss weighed on Korean shares and the won, which is the worst performing currency today, shedding about 0.8%. European stocks are trading heavily, and the Dow Jones Stoxx 600 is off about 0.2% in late morning turnover, the possible first loss in three sessions. Bond yields are firmer, and the German 10-year Bund yield is back above zero. Where the better than expected EMU GDP is most expressed is the euro’s climb above $1.12, where it appeared to have broken out from last week. The dollar is seeing its recent gains pared against all the major currencies. The move began last week and the inability of the dollar to extend its gains in a meaningful way after the stronger than expected Q1 GDP was an early signal, confirming what the failure of the Australian dollar to close below $0.7000 had hinted. |

FX Performance, April 30 |

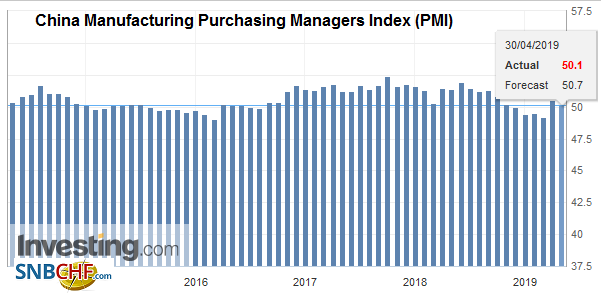

Asia PacificChina’s manufacturing PMI slipped to 50.1 from 50.5, |

China Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on China Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| and the non-manufacturing PMI eased to 54.3 from 54.8. That pushed the composite to 53.4 from 54.0. While disappointing, the data is not horrible. The composite PMI averaged 53.2 in Q1 19 and 52.8 in Q4 18. New orders slowed, and while new export orders improved, they are still below the 50 boom/bust level. |

China Non-Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on China Non-Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

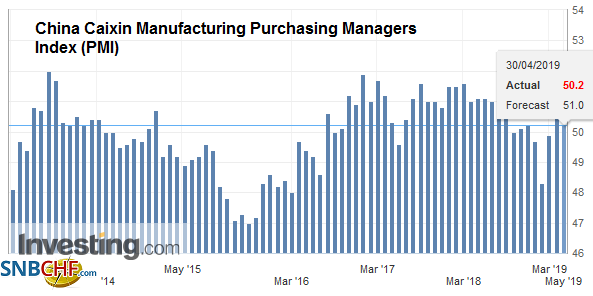

| The Caixin measure, whose sample is more weighted to small and medium firms, eased to 50.2 from 50.8. More stimulative measures from China continues to seem reasonable, though we had not given up on cut in reserve requirements even before today’s reports. |

China Caixin Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on China Caixin Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

South Korea reported a 1.4% rise in March’s industrial output, which narrowed the year-over-year decline to 2.8% from -3.4% in February. This was not sufficient to offset the drag from Samsung’s disappointing earnings report. Recall that last week South Korea reported an unexpected 0.3% contraction in Q1 GDP.

Tokyo markets remain closed this week, but the yen strengthened to three-week highs. The dollar has been sold a little through JPY111.30. In the middle of last week, it set the year’s high near JPY112.40. The next band of support JPY110.75-JPY111.00. Initial resistance is seen near JPY111.60. The disappointing economic news from China spurred almost knee-jerk sales of the Australian dollar. It took out yesterday’s low by 1/100 of a cent and continues to hover around $0.7050. Last week’s low, the first violation of $0.7000 since January 3 was quickly reversed and, we thought, one of the early tells that the US dollar’s leg up was likely complete. The yen and the Aussie have moved back into their previous ranges, as the greenback’s breakout tested. However, to maintain the corrective pressure the Australian dollar needs to rise through the $0.7070 area. The dollar appears to have moved into a new short-term range against the Chinese yuan. It had been hovering near CNY6.70 and since the middle of last week, has traded between about CNY6.7260 and CNY6.7500. The Philippine peso strengthened (~0.4%) on news that S&P upgraded the sovereign debt rating to BBB+ (stable outlook). It was off fractionally in Q1, but its 1.2% gain led the Asian currencies this month.

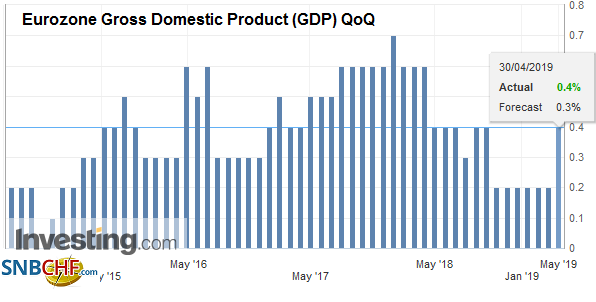

EuropeThe eurozone reported stronger than Q1 GDP and underscores our sense that the survey data was more pessimistic than the real economy. GDP rose 0.4% in Q1 for a 1.2% year-over-year pace. In Q4 18, growth of 0.2% translated into a 1.2% year-over-year gain as well, revised up from 1.1%. France reported earlier that it grew 0.3% from a 1.1% year-over-year rate, ostensibly helped by Macron’s tax cuts in the Yellow Vest protests. Spain’s economy went from strength-to-strength with Q1 growth of 0.7% after 0.6% in Q4 18. The year-over-year rate edged up to 2.4% from 2.3%. Catalonia seemed to be a bigger issue in last weekend’s elections than the economy. Italy’s GDP surprised on the upside, expanding 0.2% in Q1 and lifted the year-over-year rate for the first time in five quarters. The 0.1% year-over-year rise contrasts with forecasts for a 0.1% contraction. Italy also reported its unemployment fell to 10.2% in March from a revised 10.5% in February. It is the lowest level since last August when the cyclical low was recorded (~10.1%). Last March, it was just below 11%. |

Eurozone Gross Domestic Product (GDP) QoQ, Q1 2019 Source: investing.com - Click to enlarge |

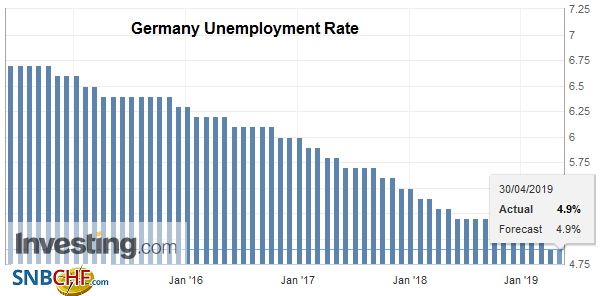

| German unemployment was unchanged at 4.9%. |

Germany Unemployment Rate, April 2019(see more posts on Germany Unemployment Rate, ) Source: investing.com - Click to enlarge |

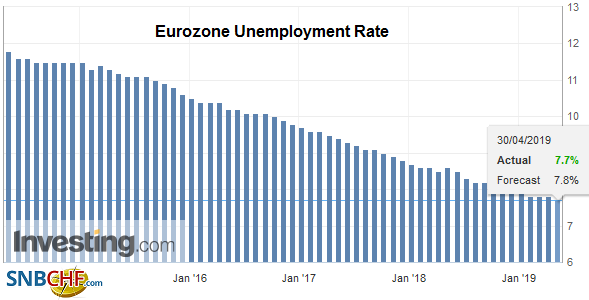

| Unemployment in EMU slipped to 7.7%, a new cyclical low, from 7.8%. In March 2018, it was at 8.5%. |

Eurozone Unemployment Rate, March 2019(see more posts on Eurozone Unemployment Rate, ) Source: investing,com - Click to enlarge |

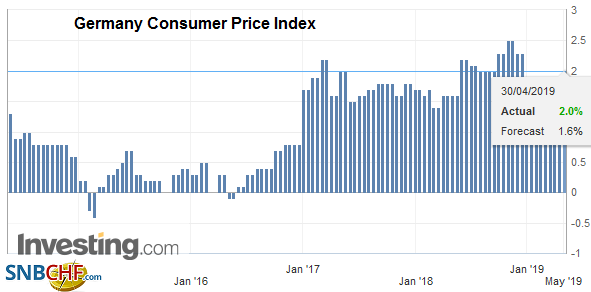

| Separately, preliminary April CPI data has been reported. France, Italy, and Spain have reported increases. All the German states that reported show stronger price pressures. The national figures are due out shortly, and the risk appears to be on the upside of the median forecast in the Bloomberg survey for a 0.5% increase on the month and 1.7% year-over-year rise (from 1.4%). The preliminary EMU figure will be published at the end of the week and headline is expected to increase to 1.6% from 1.4%. The combination of stronger growth and firmer price pressures cannot be to the ECB’s dislike. |

Germany Consumer Price Index (CPI) YoY, April 2019(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

Leaders of local Tory parties have marshaled efforts to push Prime Minister May out. Reports suggest it is the first time in 185 years that this tactic is being used. Recall, earlier this month, there was talk that the party elders were considering changing the rules so May would face a second confidence vote in a year. There appears to be little progress in cross-party talks, and although May continues to reject a customs union arrangement, Labour’s position does not appear fixed, like on a second referendum. The striking thing is that the Brexit mess has not catapulted the Labour Party in the polls. The Tories though are likely to be punished in this week’s local elections, but Labour may not be the largest beneficiary. Therein lies the problem. That referendum that was to unite the Tory Party is on the verge of institutionalizing the split within it. Meanwhile, May has offered to step down once Bexit passes. Now the question is when will she step down if it does not pass. By seeking to delay the Queen’s Speech, in which the legislative agenda is presented by the government, it could hint that May intends to leave over the summer or early Q4.

The euro broke down and tested $1.11 late last week. Goosed by the data, the single currency returned to the scene of the crime, the breakout $1.1200. It has approached $1.1220 area, which is the halfway mark of its decline since April 17 high near $1.1325. The $1.1240-$1.1250 may offer stronger resistance and also houses about 1.5 bln euros in options that expire today. A close back below $1.12 would show dollar bulls are fighting back, but if it is to take place, after the FOMC and before the employment data seems more likely. Sterling is going for the ride. It is higher against the dollar but has yet to resurface above $1.30. It is a little heavier than the euro. The dollar’s gains against the Turkish lira were reversed following a threat by the central bank to hike rates if necessary. Recall that dropping it from the recent central bank statement fanned selling pressures.

America

There are several economic reports from the US today (Q1 unit labor costs, Chicago ISM, house prices, pending home sales, and the Conference Board’s consumer confidence survey), but they are overshadowed by tomorrow’s FOMC meeting. Tomorrow the Treasury will announce the details of the quarterly refunding. Yesterday it indicated that its Q2 borrowing needs would be $53 bln less than it had previously projected. Alphabet revenues missed yesterday, and this saw the stuck punished. Early today, Eli Lily, Merck, and Pfizer report among others, and Apple is out after the close.

Canada reports February GDP. It is expected to be flat after a 0.3% rise in January. The year-over-year pace will slow to 1.4% from 1.6%. The Bank of Canada’s decision to drop the reference to a rate hike last week seems to have already made the adjustment. This suggests the reported may have limited impact. While the euro, yen, and Australian dollar have returned to the ranges that were broken last week, the Canadian dollar has not. However, the greenback looks poised to test the CAD1.3400 area in the near-term. Mexico reports Q1 GDP. A 0.3% expansion in the quarter translates to a 1.4% year-over-year pace, down from 1.7%. Pressure is building on the central bank to cut rates, but inflation gives it little room to maneuver. The Dollar Index breakout was near 97.30 around which the 20-day moving average and retracement objectives.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China Caixin Manufacturing PMI,China Caixin Manufacturing Purchasing Managers Index,China Manufacturing PMI,China Non-Manufacturing PMI,China Non-Manufacturing Purchasing Managers Index,EMU,EUR/CHF,Eurozone Gross Domestic Product QoQ,Eurozone Unemployment Rate,FX Daily,Germany Consumer Price Index,Germany Unemployment Rate,newsletter,USD/CHF