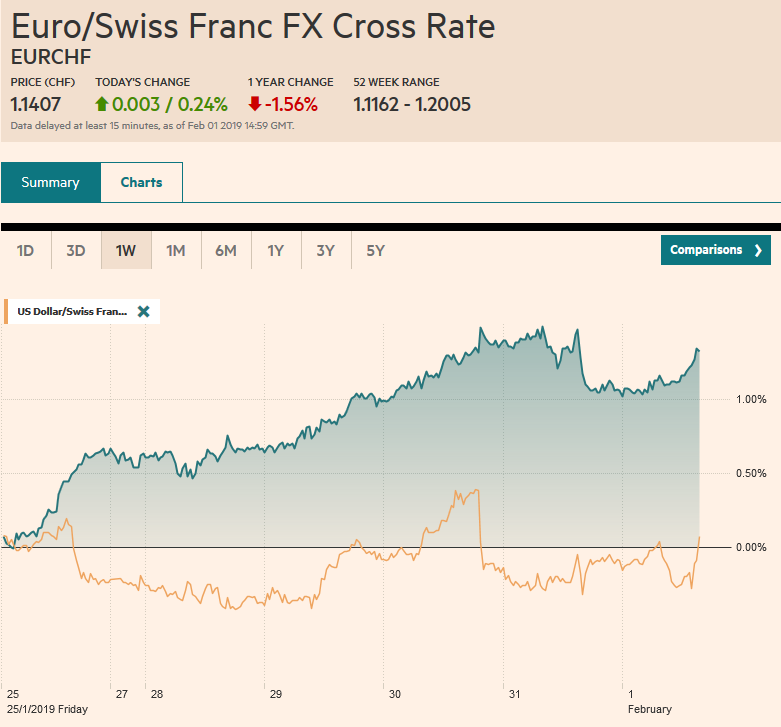

Swiss FrancThe Euro has risen by 0.24% at 1.1407 |

EUR/CHF and USD/CHF, February 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Weak manufacturing PMI readings are curbing risk appetites ahead of the US jobs report. Growth concerns are top and center after dovish Fed and the Bundesbank’s Weidmann warning that Germany may undershoot 1.5% growth this year, though the ink is barely dry on the central bank’s forecast for 1.6% growth this year and next. Equities in Asia were mostly lower, with China, India, and Thailand the notable exceptions. Note that China scrapped automatic margin calls as of today. Shares are doing better in Europe, and the Dow Jones Stoxx 600 is set to extend its streak to the fourth consecutive session to round out the fifth weekly gain. The S&P 500 closed above 2700, seeing its best level since early December. It has approached a key retracement near 2713. Asia-Pacific bonds rallied after yesterday’s US advance, but European bonds are not following suit. Italian bonds are under pressure, with 10-year yields jumping nearly 10 bp. The dollar is narrowly mixed. The Australian dollar and sterling are the heaviest, off about a quarter of a point in late morning turnover in London, while the euro and Swiss franc are edging higher, and the yen virtually flat. |

FX Performance, February 01 |

Asia Pacific

The main takeaway from the regional manufacturing PMI readings is that a combination (and it is hard to separate) of a slowing in the Chinese economy and the trade tensions have rippled across the Asia Pacific region, though the earnings data from many European and American companies also were adversely impacted. Moreover, it is not clear that a trough is in place.

China’s Caixin manufacturing PMI fell to 48.3 in January from 49.7. Last January it stood at 51.5. If a bright spot it to be seen, it is that improved export orders. Japan offered a mixed report. On the one hand, at 50.3 the manufacturing PMI improved from the preliminary reading of 50. On the other hand, it stood at 52.6 in at the end of 2018. Consider two other large economies, South Korea and Taiwan. South Korea’s manufacturing PMI fell to 48.3 from 49.8. It is the third consecutive report below the 50 boom/bust level. Indeed, except for last September and October, the manufacturing PMI has been below 50 since last March. Taiwan’s manufacturing PMI fell for the seventh consecutive month (to 47.5 from 47.7) and has been below 50 since October. Irony may be found in the fact that while the regional economy seemed to be performing so miserably, regional equity benchmarks had their best month in a decade.

Separately, South Korea reported a dramatic drop in its January trade surplus that may also may illustrate regional pressures. At $1.33 bln, the surplus was less than half of what economists expected. The surplus in January 2018 was $2 bln more. Exports were off 5.8% year-over-year after a 1.3% decline in December. Exports to China were nearly a fifth lower (19.1%). Global exports of semiconductor chips were a quarter lower. There are different signals coming from volume and price. Prices of South Korean exports fell 13%, while volume was 8.4% higher.

The dollar has been confined to a tight range just below JPY109. The North American session is bound to change this, and there are three sets of expiring options that may be in play: JPY108.50 (~$435 mln), JPY108.85 (~$520 mln), and JPY109 (~$515 mln). Since the end of November, the dollar has risen against the yen in only two weeks. After testing $0.7300 yesterday, the Australian dollar has pulled back a bit, perhaps on the back of the Chinese data, Some expect the RBA to adopt a more neutral stance at next week’s meeting, and this may help cap the upside. Speculation of an imminent rate cut by the central bank of China served to reinforce the CNY6.70 level as a base for the dollar.

Europe

The flash manufacturing EMU PMI was confirmed by today’s reading at 50.5, but how this was achieved is a bit different than expected. The French manufacturing PMI rebounded to 51.2 from 49.7, the same as the preliminary report indicated, but the German reading was marked further down. The flash estimate put it at 49.9 down from 51.5. Today’s final report shaved it to 49.7. Little recognized or commented on the Germany manufacturing PMI fell every month in 2018 but one, July. Italy’s contraction deepened, with the manufacturing PMI tumbling to 47.8 from 49.2. A Reuters survey found a median forecast for a decline to 48.8. It is the fourth month below 50. Spain was a bright spot. Economists had expected a decline to 50.5 from 51.1. Instead, it jumped to 52.4.

The UK was not immune to what seems like a global slowing in manufacturing to start the year. Its manufacturing PMI fell to 52.8 from 54.2, and well below median forecasts for a 53.5 report. Recall that the PMI had improved in November and December, posting its first back-to-back gain of the year.

The initial estimate for EMU CPI for January was released. The headline rate eased as expected to 1.4% from 1.6%. This is largely a reflection of oil prices. The core rate was expected to be unchanged at 1.0%. Instead, it rose to 1.1%. It is unlikely to materially change expectations that the ECB will respond to the changed risk assessment and the likely staff cuts to growth forecasts.

The euro briefly traded above $1.15 in response to the dovish Fed, but North American players sold into those gains. It was flat in Asia, and European traders are again trying to bid it higher. Barring a dreadful US employment report, the FOMC statement and Powell’s pivot may have stolen its thunder. There are options for 1.2 bln euros struck at $1.15. If one is not playing for a breakout, the near-term risk-reward seems to favor selling into euro gains. Sterling has been sold to new lows for the week near $1.3045, and new buying interest may have been triggered. A bit lower, there is a nearly GBP385 mln option at $1.30 that will be cut today.

America

The US jobs data is the main economic focus, although US PMI and ISM data will also be reported. January auto sales will be released as well. That jobs growth in January does not match the heady 312k increase in December is taken for granted. It is unlikely to spur much of a market reaction provided that other metrics, such as hourly earnings, remain firm. The labor market is strong, and the dovish-sounding Fed recognized it. With the partial government shutdown most of January and the arctic blast, Q1 growth is likely to be adversely impacted on top of the frequent underperformance of the first part of the year. That will set the stage for a stronger rebound in Q2.

The US dollar has been carving a based near CAD13125 since the FOMC statement. A move back above CAD1.3200 is needed to signal a bottom is in place. The US dollar’s nine-week slump against the Mexican peso is being threatened. Last week, it closed just below MXN18.99. The dollar has not closed above its 20-day moving average since early December. It is found near MXN19.0960 today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,FX Daily,MXN,newsletter,SPX,USD/CHF