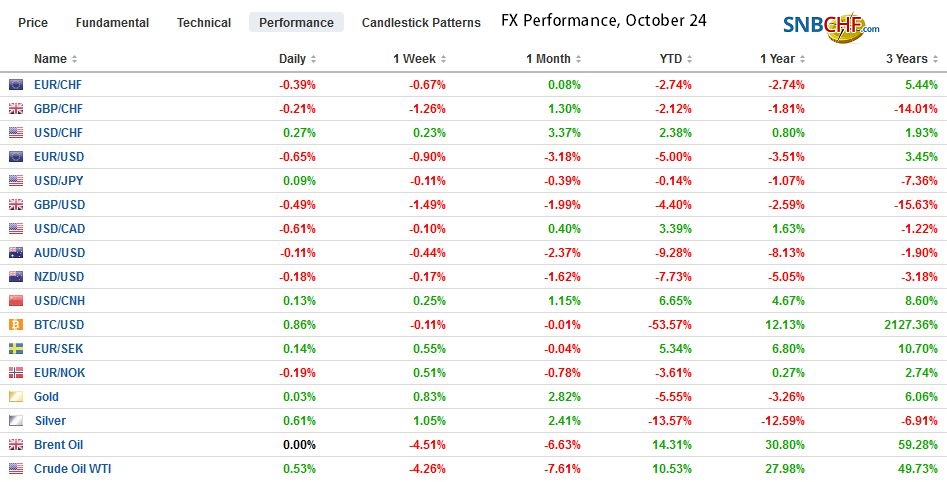

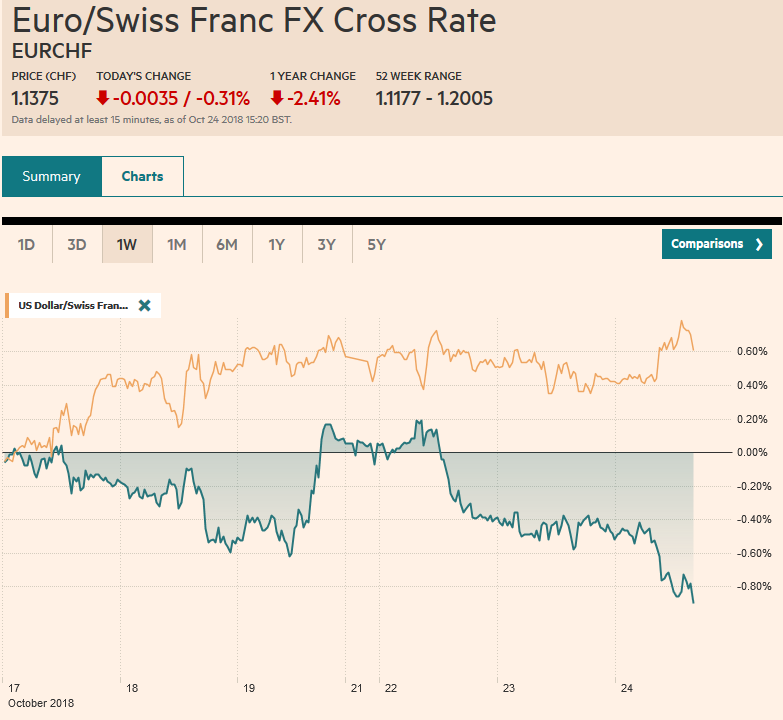

Swiss FrancThe Euro has fallen by 0.31% at 1.1375 |

EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is firmer against the major currencies and most emerging market currencies. While the seemingly fragile equity markets are still the center of investors’ attention, the weakness of the eurozone flash PMI is disconcerting and has sent the euro closer to $1.14. China’s officials continue to unveil initiatives to minimize the disruption of the equity and debt markets while seemingly adding to moral hazard risks. It was sufficient to stabilize the Shanghai Composite, but smaller cap equities in Shenzhen eased. European bourses are mostly higher, with the Dow Jones Stoxx 600 trying to break the five-day losing spell. The S&P 500, gapped lower yesterday, and rallied to close the gap late in the session, but still extended its losing streak to five sessions. It is called about 1% low to retest the 2700 area that was taken out intraday yesterday. Fragile equities, the 3-4% drop prices yesterday, with some follow-through selling today, and some disappointing data, is helping push down bond yields across the board. Yields in Asia-Pacific were off one-two basis points, while peripheral European bond yields are off two-four basis points. Core European yields are off slightly, while the US 10-year yield is easing back toward yesterday’s lows (~3.11%). |

FX Performance, October 24 |

Asia-Pacific: Instead of announcing a large comprehensive package to deal with the financial instability, Chinese officials are bleeding in new initiatives on a daily basis. The thrust is to minimize the fallout from the widespread use of equity as collateral, which is the immediate issue. At the same time, other measures, like the tax cuts, are meant to support the economy more broadly. There is concern that trade tensions are disrupting economies, but the evidence is less clear-cut. Look at the flash PMIs for Japan and Australia. Japan’s manufacturing PMI rose to 53.1 from 52.5. Australia’s manufacturing PMI also rose (54.3 vs. 54), however, what dragged the composite lower (51.2 from 52.5) was the unexpected weakness in the service PMI (50.8 vs. 52.2). Weakness in services is seen as a reflection of domestic conditions, while the manufacturing PMI is understood as an indication of the export sector.

EMU: The Bundesbank warned that the German economy might have stagnated in Q3, but it sound upbeat that the expansion would resume in Q4. Today’s flash PMI suggests the BBK may have been optimistic. The flash composite, reflecting a decline in manufacturing (52.3 vs. 53.7) and services (53.6 vs. 55.9) fell to 52.7 from 55.0. It is lower than any forecast in the Bloomberg survey and represents a new cyclical low (time series is only three-years-old). France did marginally better. Its manufacturing PMI eased (51.2 from 52.5), but the service sector unexpectedly improved (55.6 from 54.8). This was sufficient to lift France’s composite reading to 54.3 from 54.0. When it comes to aggregate figures, the manufacturing decline is understandable, but the service decline was a little larger than the decrease in the manufacturing PMI, and the composite fell to 52.3 from 53.7. It appears to be building into the estimate more weakness in the periphery when final estimates are reported next week.

European Central Banks: The flash PMI makes a poor backdrop for the conclusion of the ECB meeting tomorrow and Draghi’s press conference. The challenge for Draghi is that without updated staff forecasts (due in December), he will likely only be able to deviate slightly from his optimism last month that was pinned largely on the improvement of the labor market. The commitment to complete the asset purchases at the end of the year is so strong that survey disappointment will not derail the strategy. It is too early place much weight on today’s data to impact expectations of a small hike in Q4 2019. Separately, Sweden’s Riksbank met and stuck to the script, suggesting it was moving closer to a rate hike. The signal is for a move in either December or February. The market had been leaning toward February, but maybe there is a slight movement toward December. Sweden’s underlying inflation (CPIF) is at its highest level since 2008 and unemployment is near its lowest level since then as well.

Brexit: While the EU and UK appear close to striking a deal, the domestic challenge to Prime Minister May is mounting. News today is of protests by seven senior officials. May speaks to her party’s backbenchers today (1922 Committee). With five months before Brexit, there has been little progress on the underlying problem: What satisfies the EU is unsatisfactory for the UK cabinet and Parliament. May’s initial proposal was more to the liking of her domestic constituencies, but the EC rejected it. As May moved toward the EC, she became more estranged from parts of her cabinet, and in Parliament, she will likely need opposition party support to the Conservative defectors.

Oil: Fear that Saudi Arabia would use weaponize oil in the face of criticism of the murder of the Khashoggi have eased with repeated reassurances. Late yesterday after oil prices had already dropped 4-5% did the markets learn that API estimated a large 9.88 mln barrel oil build, nearly three times larger than expected. The official EIA estimate, to be released today an hour after the US equity market opens, is expected to show a 3.7 mln barrel build. US production has averaged more than 10.5 mln barrels a day since April. US exports have been strong. In a reversal of fortunes, we note that Mexico (Pemex) imports 1.4 mln barrels. The US imported 3.2 mln barrels of Brent, which is the most in five years. The next big technical level basis WTI for December delivery is near $65 a barrel, where the 200-day moving average and a technical retracement objective are found.

Bank of Canada: The Bank of Canada is widely expected to hike rates 25 bp. It will be the fifth hike in the cycle that began last summer. The question is whether it is a hawkish hike, in which Governor Poloz sounds optimistic and signals that he intends to remove monetary accommodation gradually or if it is a dovish hike, where a more cautionary line is struck. We are more inclined to see the hawkish hold. The NAFTA 2.0 agreement removes a bothersome uncertainty. The labor market is strong, unemployment is near a 40-year low, and growth remains firm, notwithstanding the disappointing retail sales reported last week. The next hike in the gradual process is earmarked for Q1 19.

US: Not much can be taken away from President Trump’s ongoing campaign criticizing the Fed and going as far as to suggest it may have been a mistake to appoint Powell as Chair. However, we suspect that nearly any other person who a sat in the chair, within reason, would have done the same thing this year. With real interest rates still negative, unemployment falling, a powerful fiscal stimulus to juice an economy that was already growing above trend, a gradual increase in rates is prudent and has not choked off the economy by any stretch. Growth in Q2 was over 4% and the first look at Q3 growth at the end of the week is expected to be over 3%. We are concerned that late-cycle economic data is accumulating, but it seems premature to end the cycle, especially when the House Ways and Means Chair promised to take up Trump’s call for a 10% cut in middle-class income taxes if the Republicans retain majorities in both houses of Congress.

FX: The Dollar Index is breaking above the 96.00 cap. The high for the year is near 97.00, seen in August and that is the next major target. The euro bounced off the initial test on $1.1400, but a 1.3 bln euro option at $1.1450 that expires may cap it. A break of $1.14 would target the August 15 low near $1.13. Today is the first day in a little more than a month that sterling has not traded above $1.30. A convincing break of $1.2920 undermines the technical outlook and suggest potential back toward $1.2660, also the low from August 15. The dollar has been confined to a narrow range on either side of JPY112.50 where an $800 mln expiring option is struck. The dollar-bloc currencies, including the Canadian dollar, are little changed.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,newsletter,SPX,USD/CHF