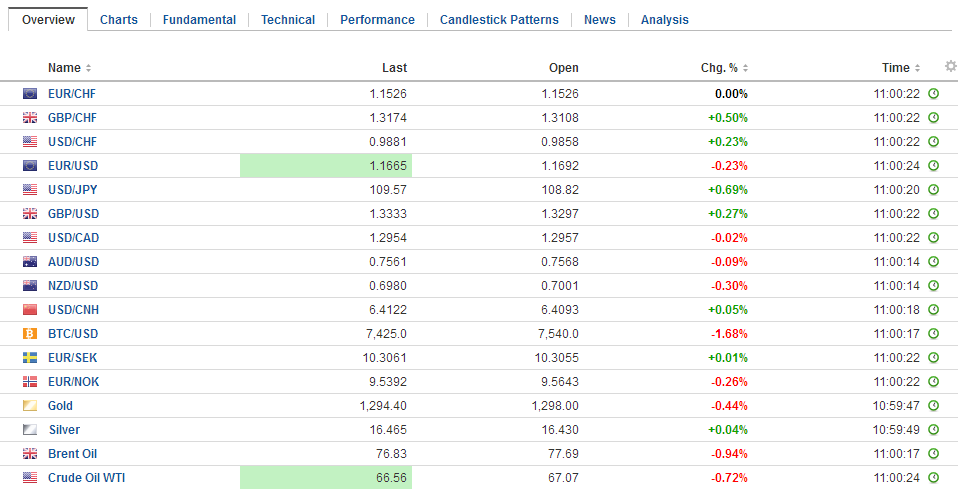

Swiss FrancThe Euro has risen by 0.30% to 1.1558 CHF. |

EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade). The political angst is not focused on Rome but Madrid, where Rajoy lost a vote of confidence. A Socialist-led government is also seen likely to call for elections before the end of the year. None of the major parties in Spain are antagonistic to the EU or the EMU. This year’s budget was passed in late May, so there is no sense of urgency in an economy that remains one of the stronger performers in the union. Despite the first populist-led government in Europe taking office today, Italian debt markets continue to recover from the multi-sigma shock seen earlier in the week. Italy’s two-year yield is off 30 bp today, leaving it up about 22 bp on the week. The 10-year yield is off 19 bp to 2.56%. This represents a 10 bp decline on the week. Spain’s 10-year benchmark yield is off eight basis points this week. Similarly, Italian stocks are outperforming, and among the best performing bourses. Italy’s Milan is up 2.7% to nearly recoup the loss on the week. The DAX is up 0.8%, leaving it off 1.8% for the week, while the Dow Jones Stoxx 600 is up nearly 0.9%, leaving it off 1.2% this week. It is the second weekly loss following that eight-week advancing streak. |

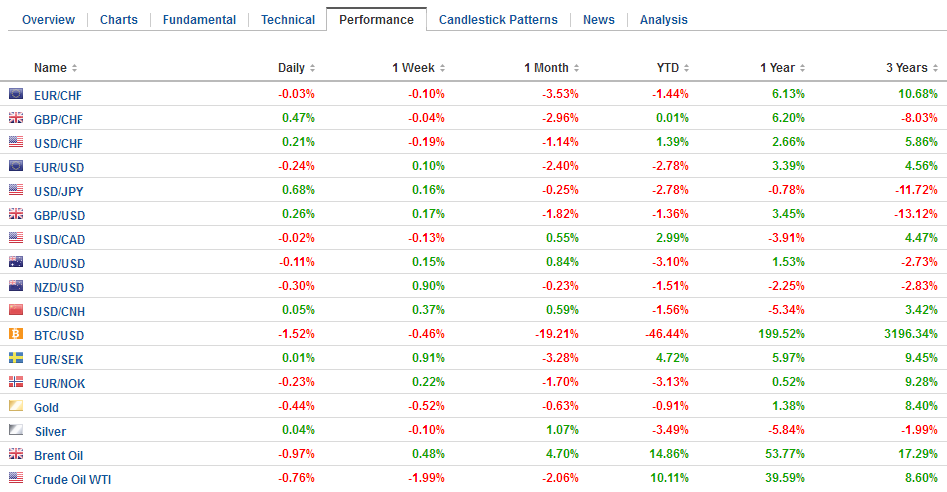

FX Daily Rates, June 01 |

| Some press reports have played up the possibility that the Bank of Italy may have bought around 500 mln short-end debt instruments yesterday. It is not clear if it was part of the QE operations or part of the central bank’s own portfolio management. However, they are not the only ones. Separate reports suggest that Japan Post Insurance (Kampo) bought short-term government bonds around mid-week and seemed to suggest a desire to buy more. The wide bid-offer spreads deterred more buying immediately.

The price action may also be influenced by some large options that expire today that are on the bubble. There is an option struck at $1.17 for 4.6 bln euros (not a typo) that expires today. There are another 1.4 bln euros struck at $1.1625, and 695 mln euros struck at $1.1725. There is an option for $560 mln struck at JPY109.20 that will be cut. At $1.33, there is a GBP340 mln option that expires today and another GBP665 mln struck at $1.3370-$1.3375. There is $1.05 bln struck between CAD1.2925 and CAD1.2950 that expires. Lastly, an option for 307 mln euros struck at CHF1.1525 will also be cut today. With the US tariffs being applied to Europe, Canada, and Mexico, trade issues are front and center. The issue will likely dominate the G7 meeting. Ironically, when tariffs have been justified on national security grounds, and yet it appears US allies will bear a considerably greater burden than China. US Commerce Secretary Ross will be in Beijing for more talks this weekend. Renewing the threat of tariffs on $50 bln more of Chinese goods on the eve of the meeting would seem to poison it before it began after the clear indication that a negotiated settlement was sought. Separately, CNBC and Germany’s WirtschaftsWoche reports that Trump wants to impose a total ban on German luxury cars. Reportedly Trump told Macron this last month. Note that German automakers, including Mercedes (Alabama) and BMW (S.Carolina), produce cars in the US. |

FX Performance, June 01 |

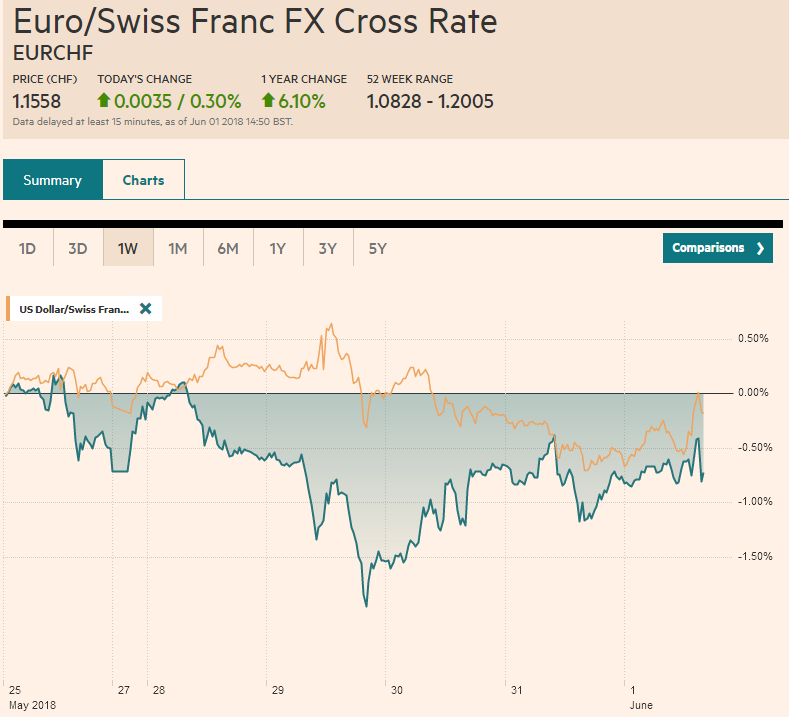

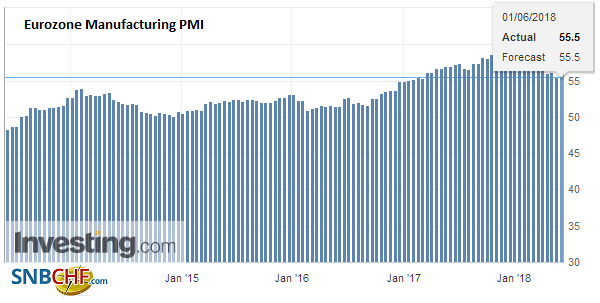

EurozoneThe eurozone’s manufacturing PMI was unchanged from the flash reading of 55.5. It is the lowest since February 2017 and is the fifth consecutive decline. Germany’s flash reading was revised slightly higher to 56.9 from 56.8. This was offset by a sharper downward revision in France to 54.4 from 55.1, which unlike Germany rose from April. Spain and Italy’s reading were softer than expected at 53.4 and 52.7 from 54.4 and 53.5 respectively. |

Eurozone Manufacturing PMI, May 2013 - 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

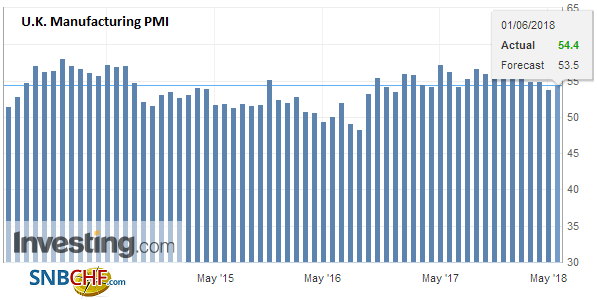

United KingdomThe UK’s manufacturing PMI unexpectedly rose in May. The 54.4 reading compares with 53.9 in April. It is the first increase of the year. The average in 2017 was 55.9, and the average in Q1 was 54.9. The average in the first two months of Q2 is 54.2. Next week’s service PMI covers a considerably larger part of the economy. |

U.K. Manufacturing PMI, May 2013 - 2018(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

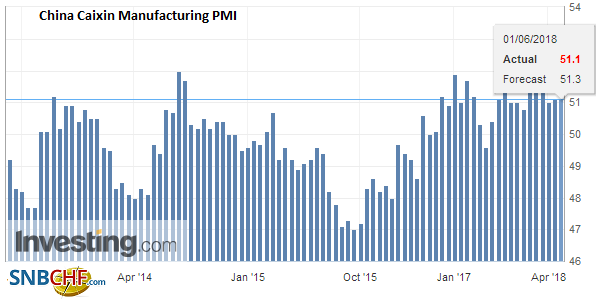

ChinaIn Asia, China’s Caixin manufacturing PMI was unchanged at 51.1. Some expected a small increase following the gain in the government’s version, which puts more weight on the large state-owned enterprises. Japan report better than expected housing starts, construction orders, and Q1 capex, which could see Q1 GDP revised slightly higher. Company profits rose 0.2% in Q1 after 0.9% in Q4 17. There was some fear that profits contracts. Japanese stocks were little changed on the day after the Nikkei fell 1.2% last month. Chinese markets were not impressed with A-shares inclusion into the MSCI Emerging Markets Index. The Shanghai Composite was off 0.65% today to bring the loss on the week of 2.11%. It gained 0.4% in May. The Shenzhen Composite fell 1.2% on the day for a 3.5% loss for the week. I fell 0.5% in May. |

China Caixin Manufacturing PMI, May 2013 - 2018(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The Fed’s Brainard’s constructive comments yesterday confirmed what the market already knows. Even the previously more cautious wing at the Fed favors continued gradual rate increases. There is little doubt that a hike later this month will be delivered. The issue of the potential for the coupon curve to invert remains unresolved. Many of the regional presidents seem to be more concerned than the governors. The notable exception is Williams, who will shortly be at the helm of the NY Fed.

One of the takeaways is that whatever thunder was possible from today’s US jobs report was probably stolen. That means that barring a significant surprise, it is unlikely to trigger a large more. Surveys suggest the market anticipates a recovery from the 164k net new jobs in April. The 12-month average stands at 190k. Earnings growth is more the focus, but it moves slowly and is expected to be unchanged at 2.6%. Later, look for the manufacturing ISM to confirm a strengthening in that sector that has already been foretold by the regional Fed surveys.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CHF,$CNY,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Manufacturing PMI,newslettersent,U.K. Manufacturing PMI,USD/CHF