Summary:

The euro fell every day last week against the Swiss franc.

Italian political anxiety is the key development.

Speculators in the futures market got caught leaning the wrong way.

| The Swiss National Bank’s decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not exactly clear where the euro bottomed in the frenzied activity that followed the SNB’s surprise move. Bloomberg records the euro’s low near CHF0.8520.

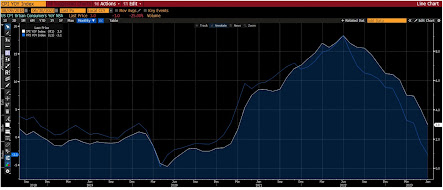

Around the middle of 2015, the euro entered a relatively narrow range against the Swiss franc. With a few exceptions confined the CHF1.05 to CHF1.10 confined the euro until the middle of last year. With the ECB making its gradual way to end its asset purchases, and the SNB making it clear ti will lag, the euro broke out of its range to the upside. It finished last year CHF1.17. After falling with the leg down in global equities in late January and early February, the euro bottomed near CHF1.1450 and proceeded to rally strongly. Shortly after the middle of April, the euro was flirting with the old nemesis near CHF1.20. After some consolidation over the following month, the euro has been pushed lower in recent days. Last Monday, the euro posted a bearish shoot star candlestick pattern after reaching a high near CHF1.1980. The euro worked its way lower, falling for six consecutive sessions through the end of last week. With those losses, the euro retraced to almost the tick 50% of its rally from the early February lows. This is depicted in the Great Graphic, created on Bloomberg. |

EUR/CHF, Nov 2017 - May 2018(see more posts on EUR/CHF, ) |

What is interesting is the euro made new lows today to almost CHF1.1700 before recovering. It is poised to snap its losing streak. If it does close higher, it will only be the fourth session since April 27 (16 sessions). What may be surprising is that the ostensible cause, the anxiety over Italy and the potential Greece-like crisis, has not subsided. Italian debt instruments remain under pressure. The two-year yield is up eight basis points while the 10-year is seven basis points. The five-year credit default swap has surged to 130 bp. It began last week below 100 and had reached a four-year low near 86 bp in late April. Italian stocks are also getting knocked. The 0.8% loss is the largest among the large European markets, and the Dow Jones Stoxx 600 is up about 0.25%.

The technical indicators are not very encouraging that an important low for the euro against the Swiss franc is in place. A break of the CHF1.1660CHF1.1680 area is needed to signal the next leg down, which extends toward CHF1.1480.

In the futures market, speculators have the largest new short franc position since 2007. However, in the five sessions through last Tuesday, May 15, the speculators grew their gross short position by 6.5% to 62.1k contracts. It was the seventh consecutive week that the bears added to the gross short position. The short-term speculative market got caught leaning the wrong way as political concerns about Italy surfaced. Technically, the euro can recover toward CHF1.18 on positioning. It may take the market some time to assess the situation in Italy.

Full story here Are you the author? Previous post See more for Next postTags: $CHF,$EUR,EUR/CHF,Great Graphic,Italy,newslettersent