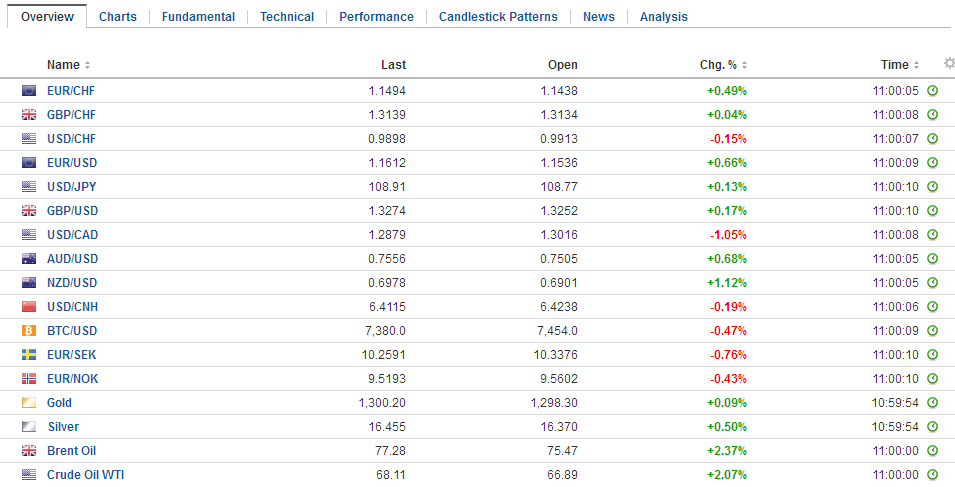

Swiss FrancThe Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. |

EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

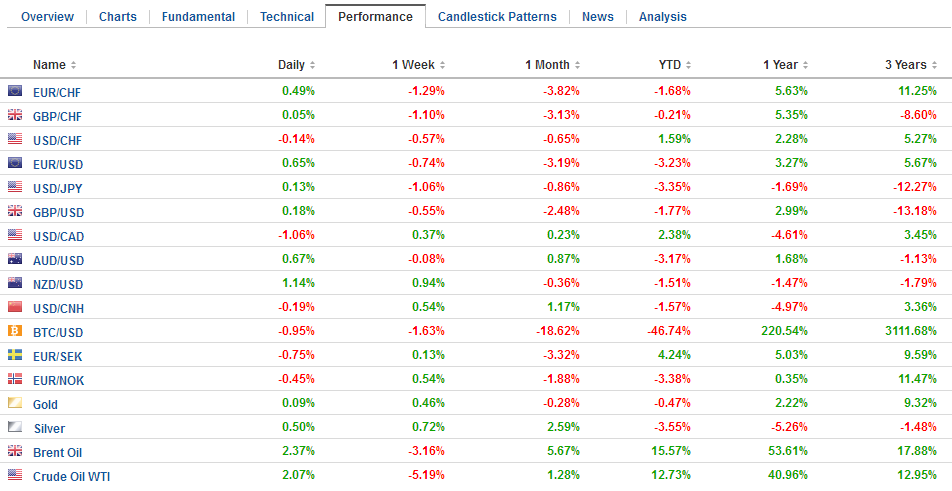

FX RatesAfter what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves. Italy’s 10-year bond yield is off nearly 20 bp today, and the two-year yield is off almost 90 bp. Italian stocks have also stabilized, gaining about 0.5% near midday. With the highest yield in several years, Italy’s bond auction was well received in terms of bid-to-cover ratios. To be sure the political situation remains unresolved. It seems that the Five Star Movement is more willing to find a solution short of elections, but the League is taking more strident tones. Perhaps the strategy is rational and not driven by personalities. The latest SWG poll covering May23-May28 showed the League with 27.5% support, up from around 17% in the March election. M5S, on the other hand, has seen its support slip to 29.5% from nearly 33% in March. Weekly tracking polls concur that the League is the only party that has gained support since the election. Outside of Italy, and Spain, which holds a confidence vote at the end of the week, the other notable development has been heightened trade tensions. Pressure was going to mount in any event, ahead of the June 1 expiration of the exemptions from the US steel and aluminum tariffs. While Europe has been lobbying hard for a permanent exemption, it does not seem likely. NAFTA negotiations are ongoing, and it is not clear what the Trump Administration will do for Canada and Mexico. However, adding to this the Administration indicated that it is moving forward with the tariff on $50 bln of Chinese imports to retaliate for intellectual property right violations. |

FX Daily Rates, May 30 |

| Reportedly, a list of specific products will be released in around two weeks. New curbs may be announced on sensitive technology as well, ahead of the next round of talks that are to begin in a few days. New restrictions on Chinese investment in the US and enhanced export controls are thought to be ready by the end of next month.

Recall that when the US first announced the actions on intellectual property, China threatened to retaliate. That is when Trump countered with a threat of tariffs on another $100 bln of Chinese goods. This time there did not seem to be an immediate response. The US dollar is softer against all the major currencies and most of the emerging market currencies today. The Scandis are leading the way, while the yen and sterling are the laggards. The euro has not traded above the previous day’s high since May 22. Yesterday’s high was seen near $1.1640 yesterday. There is no nearby option expires to note today, but tomorrow there is a 1.3 bln euro strike at $1.1650 that expires. The dollar is consolidating yesterday’s losses against the yen. There are $1.1 bln of options struck between JPY108 and JPY108.15 that will be cut today and a $1.3 bln option struck at JPY109 that expires today. There is nearly GBP590 mln option struck at $1.3270 that also expires today. |

FX Performance, May 30 |

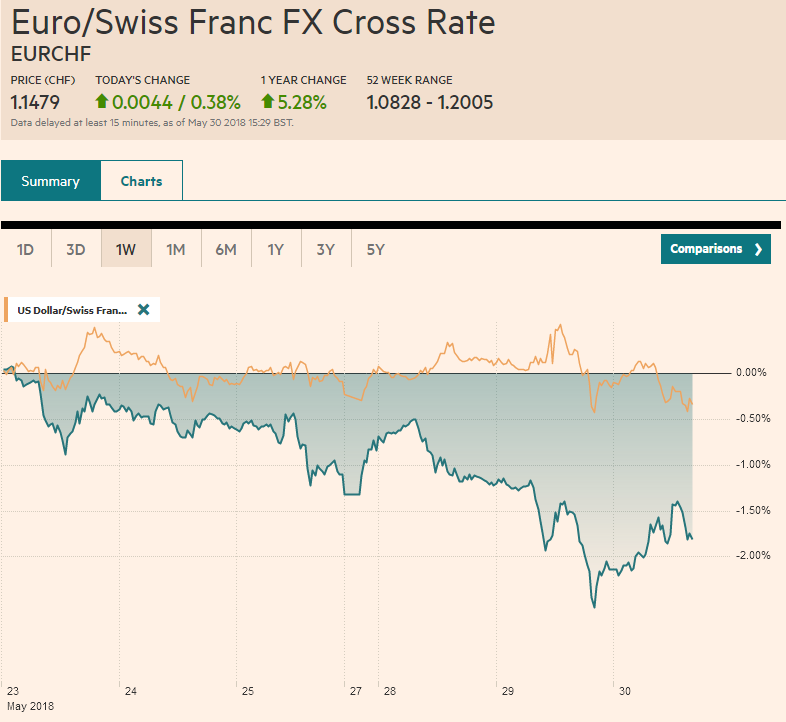

JapanEconomic data released today may have helped soothe investors’ nerves. Both Japan and Germany reported considerably stronger retail sales than the market expected. In Japan, April retail sales rose 1.4%. The median forecast was for a 0.5% increase after a 0.7% decline in March. |

Japan Retail Sales YoY, Apr 2013 - 2018(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

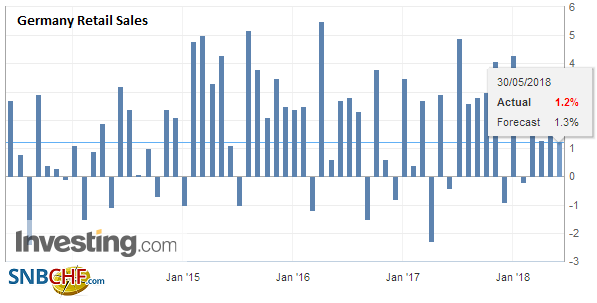

GermanyGerman retail sales rose 2.3% in April. It is the largest increase since October 2016. The median forecast was for a 0.5% increase. The March decline was shaved to 0.4% from -0.6%. |

Germany Retail Sales YoY, April 2013 - 2018(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

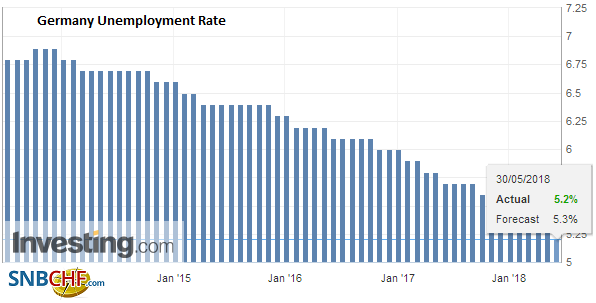

| Separately, Germany reported a strong employment report. Unemployment fell by 11k in May, which nearly matches the three-month average. Unemployment fell by an average of almost 22k a month in 2017. The unemployment rate unexpectedly edged down to 5.2% from 5.3%. Germany states also reported preliminary May CPI figures and the national report will be released shortly. |

Germany Unemployment Rate, May 2013 - 2018(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

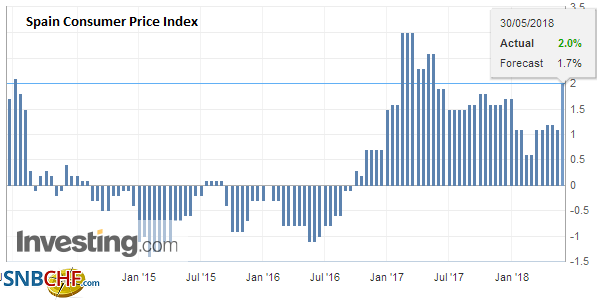

SpainHowever, the state data supports ideas that with the Easter distortions unwinding, inflation will return to where it was previously. Spain’s preliminary CPI points in the same direction. The year-over-year rate rose to 2.1% from a lowly 1.1% in April. The preliminary eurozone May CPI will be released tomorrow. The headline is expected to have risen to 1.6% from 1.2% and the core moving back to 1.0% from 0.7%. |

Spain Consumer Price Index (CPI) YoY, May 2013 - 2018(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

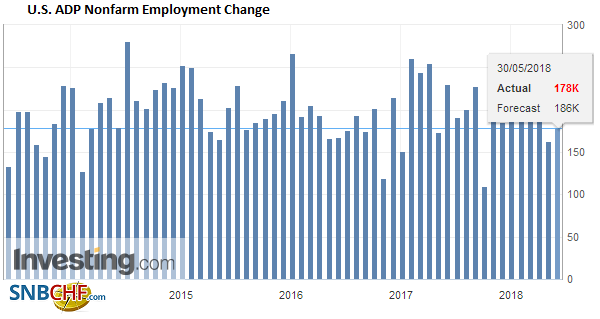

United StatesThe US 10-year yield finished yesterday below 2.80% is seven basis points higher today, while core bond in Europe see the safe haven bid unwind. Equity markets are weaker after yesterday’s US drop. The MSCI Asia Pacific Index was off 1.3%, the most in two months. It appears headed for a third consecutive weekly loss unless it recovers smartly in the next two sessions. The Dow Jones Stoxx 600 is off 0.30%, it third losing session of the week. Financials are still the largest drag, losing over 1%, while energy and real estate and healthcare are recovering. The US calendar features the ADP private-sector job estimate (median guess190k vs 204k in April), a revision to Q1 GDP (minor and too historical for much of a market reaction), an advanced look at April merchandise trade (larger deficit) and later today the Fed’s Beige Book (moderate expansion continues, some price pressures, and labor market tightness). |

U.S. ADP Nonfarm Employment Change, May 2013 - 2018(see more posts on U.S. ADP Nonfarm Employment Change, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports the Q1 current account figures (wider deficit) and industrial and metal prices ahead of the Bank of Canada rate decision. The Bank of Canada is widely expected to leave policy on hold at 1.25%. A rate hike still looks likely in Q3, though trade uncertainty does not help matters.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Germany Retail Sales,Germany Unemployment Rate,Italy,Japan Retail Sales,newslettersent,Spain Consumer Price Index,Trade,U.S. ADP Nonfarm Employment Change,USD/CHF