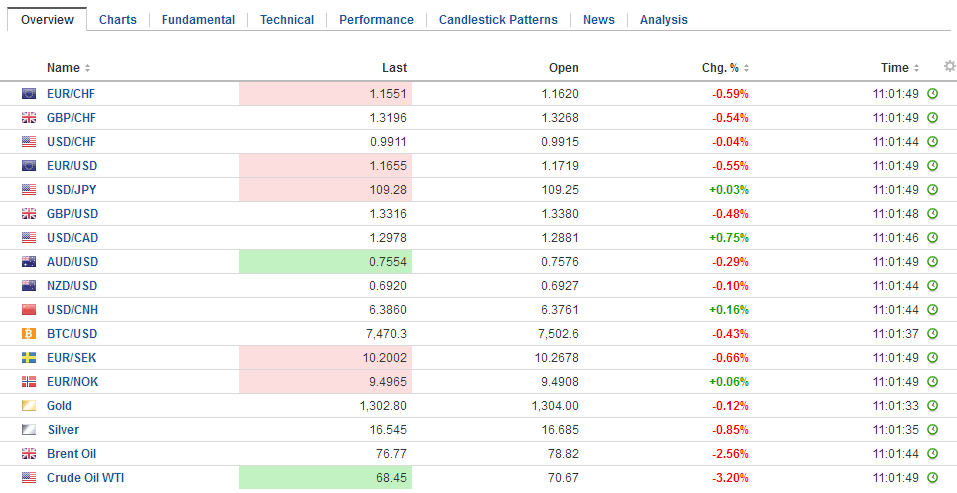

Swiss FrancThe Euro is down by 0.63% to 1.1545 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. |

EUR/CHF and USD/CHF, May 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

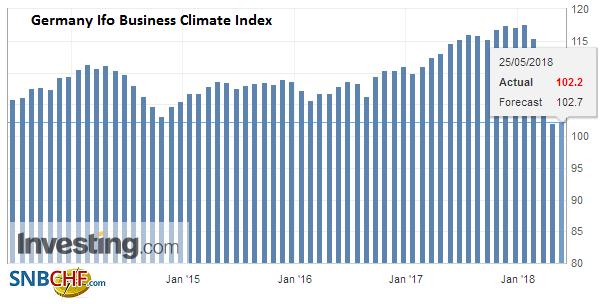

FX RatesItalian stocks are flat, while most European bourses are higher, with the Dow Jones Stoxx 600 up 0.5% in late morning turnover in Europe. The benchmark is lead by real estate, consumer discretionary, and telecom. Still, it is about 0.5% from being flat on the week. If it is unable to recover further ahead of the weekend, the eight-week rally will end. The DAX and CAC advancing streaks of the same magnitudes are also at risk. Spain’s Socialists are trying to force a vote of no confidence in the minority government led by Rajoy. A national court found a couple of Rajoy’s party members had operated an illegal campaign slush fund. Podemos has already called for a confidence vote. But the Socialists and Podemos don’t have sufficient vote in parliament to pull it off and need the support of Ciudadanos. The market impact has been modest as investors do not expect the opposition to succeed. |

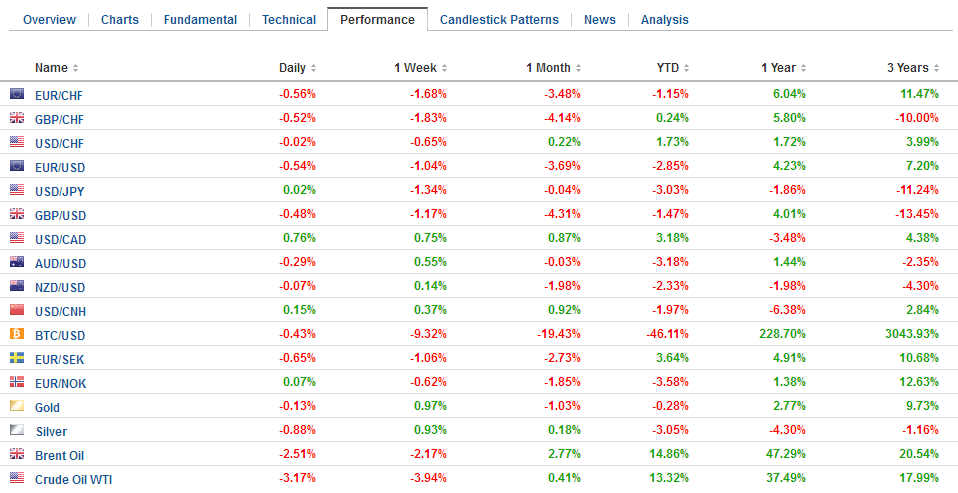

FX Daily Rates, May 25 |

| The Turkish lira is stabilizing today after the government has proposed additional measures. The government will allow businesses who took re-discount dollar loans to repay in lira until the end of July. Officials also increased the size of the NDF auctions. To be sure, the story is not over, and more action is needed to stabilize investor confidence.

The Mexican peso is sitting near its best level for the week after recovering yesterday on the back of its compromise offer in the NAFTA talks. After resisting the US proposal to link wages and domestic content in the auto sector, Mexico signaled it could accept it provided the US drop some of its other controversial demands, including a sunset provision, limits on government contracting opportunities and barriers to imports of Mexico’s seasonal agriculture products. |

FX Performance, May 25 |

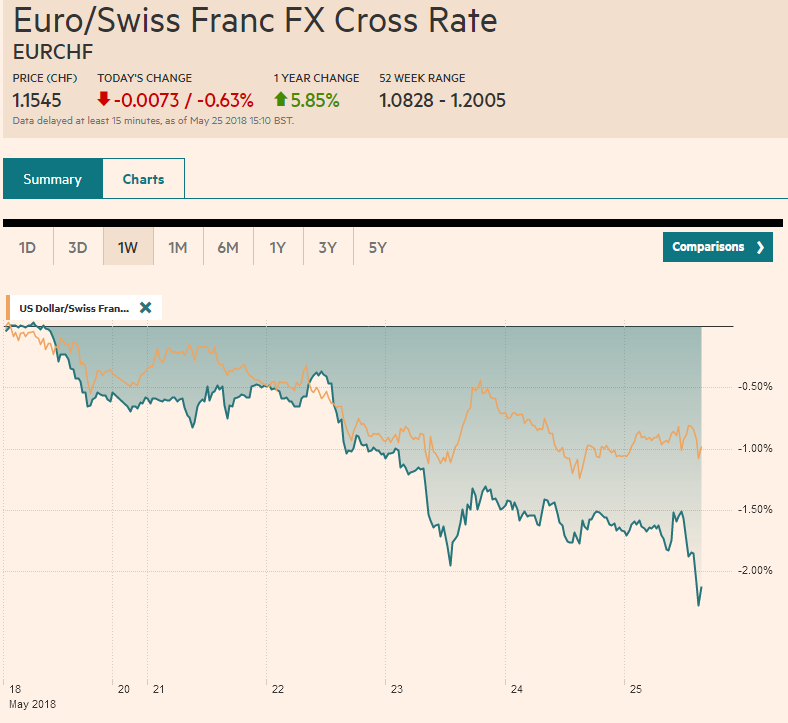

GermanyThe euro and sterling were sold through yesterday’s lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved. |

Germany Ifo Business Climate Index, May 2013 - 2018(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

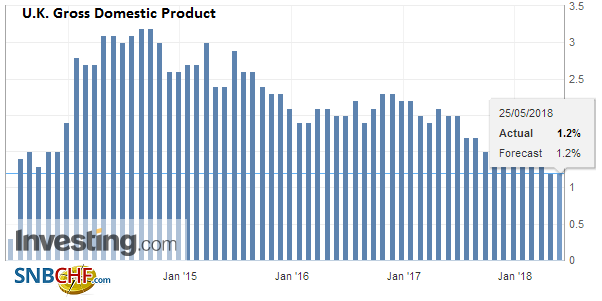

United KingdomThe UK’s data showed better consumption and fixed investment than expected, but weakness in both exports and imports. |

U.K. Gross Domestic Product (GDP) YoY, May 2013 - 2018(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

United StatesThe US reports April durable goods orders. The headline will be dragged lower (~-1.3% after 2.6% gain in March) by the volatile transportation sector. Excluding that, a 0.5% gain is expected (0.1% in March). The FOMC minutes this week showed officials are still reluctant to signal an acceleration of their hikes despite inflation near target and its signal that next month’s 25 bp hike will likely see the interest paid on reserves rise by only 20 bp. |

U.S. Durable Goods Orders, May 2013 - 2018(see more posts on U.S. Durable Goods Orders, ) Source: Investing.com - Click to enlarge |

Japan

Tokyo’s CPI softened in May, a hint for the national figures. This coupled with some cross rate adjustments weighed on the yen. The dollar briefly slipped through JPY109 yesterday, and the old support area near JPY108.65 remained intact. Still, the yen’s gains this week break an eight-week slump.

Concern about the economic implications of the Five Star Movement-League government in Italy weighs on the country’s assets. The 10-year benchmark yield was practically flat on the week coming into today, and it is six basis point higher. German yields have gone in the other direction. The 10-year Bund yield has fallen 20 bp from last week’s high to about 45 bp, the lowest level since early January.

The US 10-year yield is softer for the third session. It peaked a little above 3.08% on Monday and now is near 2.97%. The two-year yield is off a little more than one basis point this week. It is nothing to get excited about but, if sustained, would be only third weekly decline this year. The last dip was in two months ago.

Meanwhile, the Federal Reserve’s custody holdings (for foreign central banks) fell in the week through Wednesday to extend the streak to six weeks. During this period, custody holdings have fallen by about $68 bln. Treasury holdings have dropped around $70 bln. This likely reflects the intervention by several central banks. Agency holdings have increased.

There are a few options expire today that may be relevant for today’s price action. The euro looks boxed in by the $1.1650 (877 mln euros) and $1.1750 (643 mln euros) options. There is a $703 mln option struck at JPY110 that may cap the greenback. There is an A$540 mln option at $0.7600, which the Australian dollar has drawn near in Europe.

Oil prices had been trending higher. The six-week rally in Brent is ending. Yesterday’s 1.3% decline is being followed by a 1.9% pullback today. The trigger are reports that OPEC and non-OPEC members will consider boosting output by as much as one million barrels a day starting as soon as next month. WTI has advanced in five of the past six weeks and weighed by rising US inventories, light sweet crude of July delivery, is off for the fourth consecutive session and is off 2.7% this week (@~$69.40).

US President Trump’s pullout from next month’s summit with North Korea’s Kim Jung Un was as surprising as the seemingly impulsive acceptance of the meeting in the first place. This coupled with the launching of the auto import investigation on national security grounds leave friends and foes off balance. It will likely take several months for the investigation to be complete and in the meantime, the trade focus shifts back to the steel and aluminum tariffs, where the temporary exemptions are set to end next week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,EUR/CHF,Germany IFO Business Climate Index,MXN,newslettersent,OIL,U.K. Gross Domestic Product,U.S. Durable Goods Orders,USD/CHF