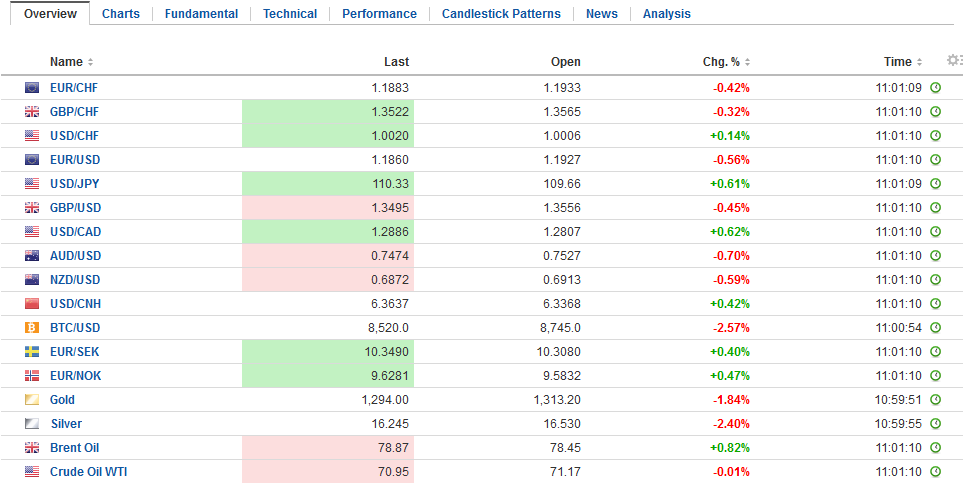

Swiss FrancThe Euro has fallen by 0.44% to 1.1877 CHF. |

EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

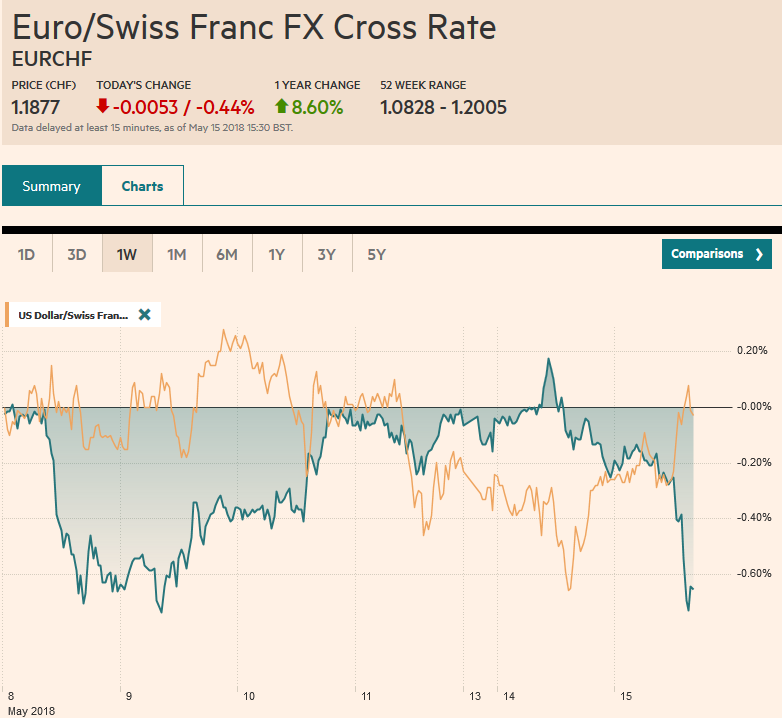

FX RatesUS 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. For its part, India reported higher than expected April inflation. Wholesale prices rose 3.18% year-over-year, up from 2.47% in March. A rise to 2.90% had been expected. The CPI rose to 4.58% from 4.28%.

|

FX Daily Rates, May 15 |

| Option expiry may also impact activity in the North American morning. This includes nearly two billion euros in options struck $1.1940-$1.1950, and another 1.3 bln euros struck between $1.1990 and $1.2000. There is an option at JPY110 for almost $900 mln and JPY109.50-JPY109.55 for another $620 mln. An option struck at $1.35 is good for almost GBP450 mln. The Australian dollar options struck at $0.7500 continue to expire. Today there is A$1.7 bln that will be cut. The Aussie remains pinned just above there after the RBA minutes failed to excite. |

FX Performance, May 15 |

China

China and India were able to buck the regional move. China’s economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades. Retail sales rose 9.4% year-over-year, matching the slowest past since 2004. Urban fixed investment also slowed more than expected. The 7% year-over-year pace is down from 7.5% in March and is the slowest pace since 2000. Industrial output did surprise to the upside, rising 7% year-over-year, up from 6.0% in March.

Eurozone

Turing to Europe, the Five Star Movement, and the League are getting closer to forming a government. The combination of a flat 15% and 20% tax rate coupled with a new benefit for the poor (unemployment insurance or what is dubbed a universal basic income for unemployed/poor) could challenge the EU fiscal rules, but there is little impact on Italian assets. The 10-year bond yield is off a basis point today and is the strongest bond market among the high-income countries today. The two-year yield is off a basis point as well. The premium over Germany has narrowed. And the signal from the equity market is similar. Italian equities are up about 0.3% near midday in Milan. The Dow Jones Stoxx 600 is off fractionally after slipping yesterday too.

French

There are three noteworthy economic reports from Europe today. First, French wages growth accelerated in Q1 to 0.7% form 0.2% in Q4 17. It is the strongest pace since 2013. It follows on the heels of the settlement of the construction sector negotiations in Germany, which also saw an above-inflation settlement like the public sector and metal workers. This will encourage the ECB to look past the near-term softness in the regional CPI.

Germany

The second development was disappointment from Germany. The initial estimate for Q1 GDP was revised to 0.3% from 0.4%. The economy grew 0.6% in Q4 17. Of note, government spending fell for the first time in five years. A critical issue is whether the slowdown is a mid-cycle pause or the cyclical peak. We tend to favor the latter, but recognize that the weakness in Q1 was exaggerated. Investors will be watching the incoming data with this issue in mind. Today’s ZEW survey suggests little improvement is being seen in Q2. The assessment of the current situation slipped to 87.4 from 87.9. The pullback was not as large as expected, but the direction is clear. It has fallen every month since January, but it remains at elevated levels. Consider that last year’s average was 84.1, and the average in Q4 was 88.4 and in Q1 18 the average was 92.7. However, perhaps more to the point, the expectations component remained at -8.2, the weakest expectations in six years.

United Kingdom

The third economic important economic data point was the UK jobs report. The claimant count (2.5%), up 31.2k, after the March rise was upgraded to 15.7k from 11.6k, was a bit more than expected. However, so was the 3m/3m employment change (through March) was stronger than expected at 197k. up from 55k. The ILO unemployment rate was steady at 4.2%. Weekly earnings growth matched expectations. The overall measure slowed to 2.6% from 2.8%, while excluding bonus payments, the underlying measure edged up to 2.9 (from 2.8%. The fact that tightness of the labor market is boosting earnings growth above the pace of inflation will likely keep a rate hike on the table even if pushed out into H2 18.

United States

The North American session is also busy. The US reports April retail sales and the May Empire Stae Manufacturing Survey. Headline retail sales are expected to be halved from the 0.6% pace in March. That, however, may be a misleading optic. The details should be healthier, and the components used for GDP calculations is expected to remain at a firm 0.4%. We suspect the risk is to the downside. The Empire State Survey is one of the first metrics for May, and a modest slowing is expected (15.0 vs. 15.8). After softening in January and February, the survey snapped back in March but eased back to Jan-Feb levels in April.

The Federal Reserve is also in focus. Kaplan speaks for the market open, and the soon-to-be NY Fed President William speaks shortly after midday. The testimony of Fed nominees Clarida and Bowen continue before the Senate. Note that Bernanke and Fischer formally endorsed Clarida.

Canada

Canada reports April existing home sales. Sales declined sharply in January and February (-14.5% and -6.5% respectively). The stabilized in March, rising 1.3%, but may have slowed in April.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Fixed Asset Investment,China Industrial Production,China Retail Sales,EUR/CHF,France Industrial Production,FX Daily,newslettersent,USD/CHF