Swiss Franc

|

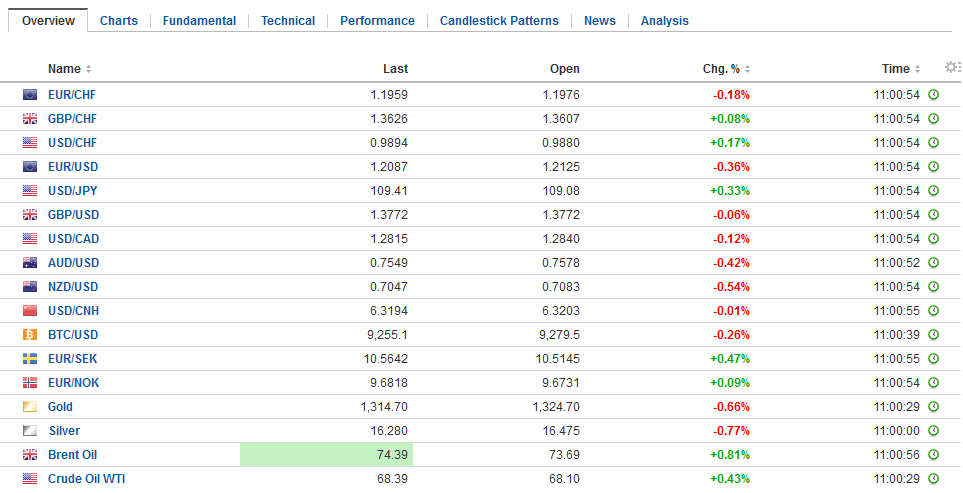

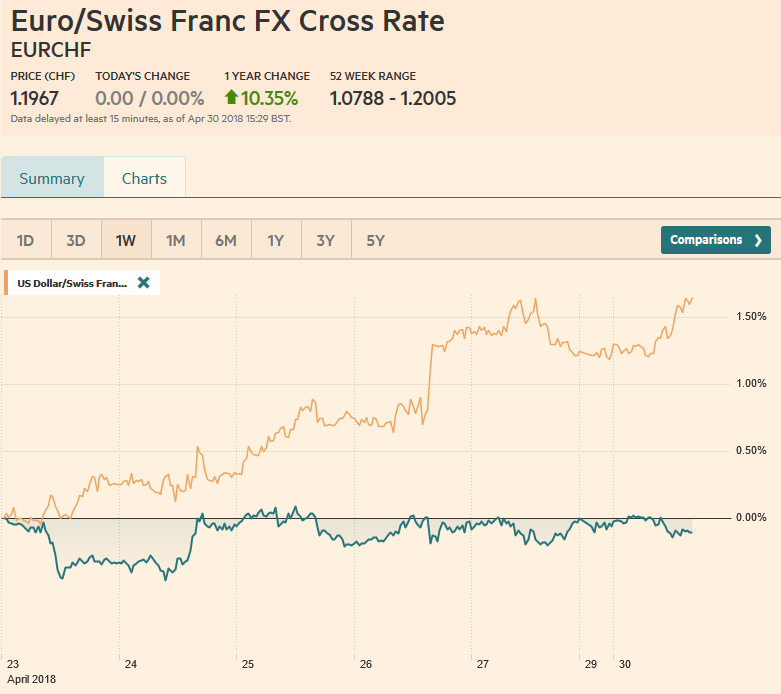

EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThree large corporate deals were announced. T-Mobile appears to have finally figured a way to secure Sprint. It is a $26.5 bln equity tie-up. Marathon Petroleum is reportedly taking Andeavor for $20 bln in cash and stock. Sainsbury is reportedly in advanced talks to buy Walmart’s Asda chain for GBP7.3 bln (~$10 bln) in an equity and cash transaction. Equities are finishing the month on a firm note. Bonds are steady to slightly heavier, and the dollar is firm, though mostly in the ranges seen before the weekend. Japan and China’s markets were closed today, and more than 100 countries are on holiday tomorrow for May Day. |

FX Daily Rates, April 30 |

| There is much talk about a “charm offensive” by North Korea’s Kim Jong Un, and apparent willingness to make concessions. The prospects for a formal end to the Korean War is capturing imaginations. The shuttering of North Korea’s main missile site next month and reported willingness to discuss a complete, verifiable, and irreversible denuclearization of the peninsula has spurred optimism, especially from the US Administration that wants to believe. Foreign investors bought Korean shares for the third consecutive session, but the buying spree was hardly able to dent the cumulative sales for third month (~$1.2 bln).

Separately, South Korea reported disappointing March industrial output figures. A 2.5% decline on the month compares with median forecasts for a 0.4% decline and adding insult to injury, revised down the February increase from 1.1% to 0.8%. The year-over-year pace has declined four of the past five months. The 4.3% year-over-year contraction contrasts with forecasts for a 1.6% fall. The South Korean won is the strongest of the emerging market currencies, gaining 0.8% against the dollar. |

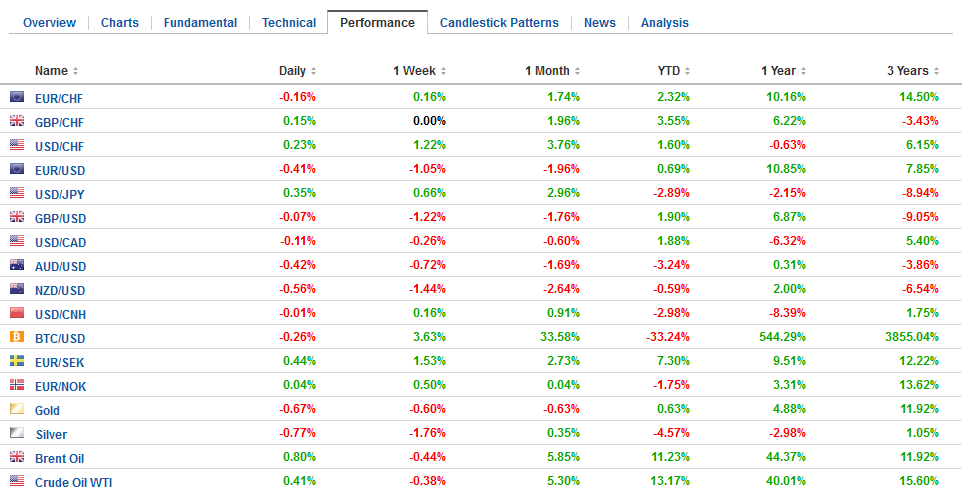

FX Performance, April 30 |

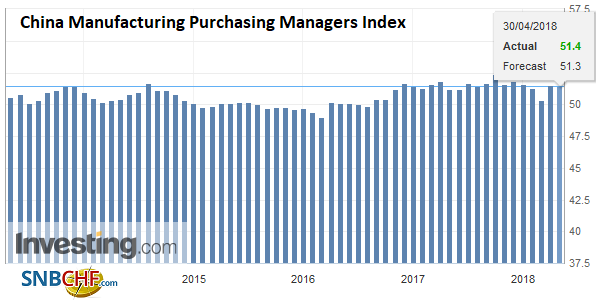

ChinaChina reported is official April PMI. The net takeaway is stability. The manufacturing PMI slipped to 51.4 from 51.5 in March but was better than the 51.3 that was expected. The non-manufacturing PMI unexpectedly edged higher to 54.8 from 54.6. The Caixin surveys will be reported tomorrow. |

China Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

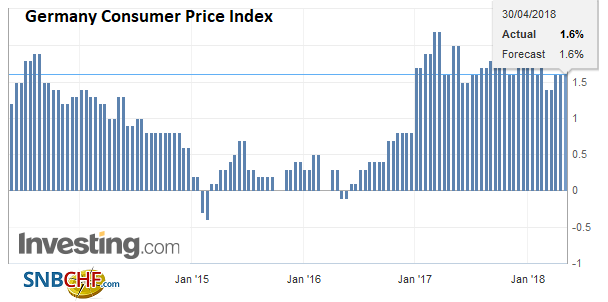

GermanyHowever, inflation is very much the focus ahead of Thursday’s release of preliminary April CPI. German states have reported their CPI figures, and the national estimate will be reported shortly. On balance, the national pace may hold at 1.5% for the second month. Note that it harmonized German CPI rose 1.7% on average in 2017 and 1.4% in Q1 18. If anything, it appears that the core rate may have softened slightly. Italy also reported preliminary April CPI. The harmonized measure eased to 0.6% from 0.9%. |

Germany Retail Sales YoY, May 2013 - Apr 2018(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

| Separately, Germany reported disappointing March retail sales. The Bloomberg survey found a median expectation for a 0.8% increase. Instead, a 0.6% decline was reported. The upward revision in the February series to show a 0.2% decline instead of -0.7% helped keep the year-over-year rate steady at an unimpressive 1.3% pace. |

Germany Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The focus is on the US trade delegation headed for China this week. Press reports show China is trying to diffuse the trade tensions. It willing to take some retaliatory measures for the steel and aluminum tariffs, but it will also challenge the US actions at the WTO. It is, however, willing to take some remedial actions as well. These include reducing some tariffs (autos and some consumer goods), and relaxing rules for some joint ventures. It appears willing to reduce the bilateral trade imbalance by buying more US commodities including LNG.

It has floated the idea of a free-trade agreement. The fact that the US does not have a free-trade agreement with Europe or Japan does not necessarily preclude such deal with China, especially in the current administration, which recognizes security partners to also be economic rivals. Still, it seems a bit far-fetched given the wide-ranging differences.

We argue that even if China accepted all the G20 and IMF best practices, that the US, Japan, and Europe would still clash with it. At the heart of the problem is China’s sheer size and economic prowess would challenge the status quo and the market share enjoyed by US, European and Japanese companies. Chinese economic nationalism (e.g., Made in China 2025) collides with US economic nationalism (“America First) and Fortress Europe.

The ECB reported money supply growth M3 continued to slow. The 3.7% year-over-year pace in March was the slowed in 3.5 years, but officials will look through it as lending remained stronger. Credit to non-financial businesses rose 3.3% year-over-year, up slightly from February and just off the multi-year peak seen in January of 3.4%. With reports of easier credit conditions, lending to households edged up to 3.0% (from 2.9%) to reached their strongest level since 2009.

It has been nearly two months since the Italian election. The Five Star Movement has tried in vain to form a coalition for first with the right and then the left. Former Prime Minister Renzi continues to rule out an alliance. With the center-right winning the weekend regional election in Friuli, it may be given an opportunity to form a government as perhaps the last effort to avoid a new election later this year. The market does not appear to be punishing Italian assets for the political uncertainty.

Sterling’s pre-weekend losses are being extended. It is drawing near the March 1 low seen just above $1.3710. A convincing break would complete a large technical topping pattern and project toward $1.31, which also corresponds to a 50% retracement of the from the October 2016 flash crash low that Bloomberg has around $1.1840.

Disappointing data last week and less than hawkish comments from BOE Governor Carney which dramatically reduced the perceived likelihood of a hike next week provided the catalyst. Over the weekend, UK Home Secretary Rudd resigned after apparently deceiving parliament about the handling of immigrants. Rudd is the fourth minister to resign in the past six months. May’s cabinet has lost another moderate EU voice ahead of the local elections later this week.

This is an important week for the US. There are three main items: auto sales, FOMC meeting and the jobs report. Today’s report of March personal income and consumption figures are typically not market movers. The preliminary estimate of GDP released before the weekend already incorporated today’s data. However, what will stand out is the estimate for the Fed’s preferred inflation measure, the core PCE deflator. Given the underlying increase, the base effect, and some rounding up, it is possible that the Fed’s inflation target of 2% was reached last month.

One of our themes is that US officials can be and are more confident than the other major central banks in reaching their objective. Today’s core PCE and the employment data at the end of the week will reinforce ideas that full employment and price stability (as official defined) are at hand.

Asia and European shares are higher for the third consecutive session. The S&P 500 finished last week with a three-day advance after successfully testing the 200-day moving average in the middle of last week. It is called higher today. There is a small gap between roughly 2702.8 and 2703.6, created by the lower opening on April 19 that may be the key to the upside.

The US dollar is enjoying a firmer tone in Europe after a slow start in Asia. Most of the major currencies are within the pre-weekend ranges, but sterling, which we have noted has a weaker profile. The only optionality of note today are in the yen: $1.4 bln struck at JPY109 and $818 mln at JPY109.50. Sentiment toward the dollar has dramatically improved over the past week or two. However, the near-term technical readings are stretched, and some consolidation/correction looks likely.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,China Manufacturing PMI,EUR/CHF,Germany Consumer Price Index,Germany Retail Sales,newslettersent,SPY,USD/CHF