Swiss FrancThe Euro has fallen by 0.08% to 1.1779 CHF. |

EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesTrade and equity market volatility, which are not completely separate, continue to dominate investors’ interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This conclusion may have helped lift the S&P 500 around 3% over the past three sessions. However early in the Asian time zone, President Trump’s rhetorical flourish pushed investors off-balance. He instructed Trade Representative Lighthizer to consider putting a tariff on a further $100 bln of Chinese exports to the US in retaliation for what he called China’s “unfair retaliation.” This is not the amount that will be raised, but the value of the goods that will be subject to new tariffs. That means that if the tariff is 25% on $100 bln of goods, it would theoretically raise $25 bln. In terms of size and escalation, if implemented this would be a trade war. And China has threatened to fight back. That said, the real historical experience is not clear. Recall that the US had slapped 100% tariffs on some Japanese goods in early1980s.Few called this a trade war. In any event, the willingness to double down sends a powerful message. Trade Representative Lighthizer tried to play it down, noting that none of the tariffs will take immediate effect. The tariffs are subject to a 60-day public comment period (open season also for lobbyists). And this next set of tariffs have not been decided. |

FX Daily Rates, April 06 |

| Trump’s signal raises the stakes. The increased stakes are translated into greater risks and higher volatility. The news initially knocked equity markets and the dollar down, but not by a lot. The MSCI Asia Pacific Index slipped marginally (less than 0.1%), and some bourses were spared, like Hong Kong and the Hong Kong Enterprise Index, which tracks H-shares. Singapore, an important entrepot, making it particularly vulnerable to trade wars, rose by an impressive 1.2%.

European markets are a bit heavier, with the Dow Jones Stoxx 600 off 0.5% in late morning turnover. Materials, consumer discretionary, and information technology are off the most, while utilities are posting small gains, and real estate is not far behind. With today’s pullback, this European benchmark is still up almost 0.9% for the week. The S&P 500 is off around 0.75%, which would offset most of the gains on the week. What was beginning to appear like a move higher in the greenback against the yen was turned back. The news helped the euro and sterling stabilize, while the dollar-bloc currencies, which are often seen as sensitive to world growth are underperforming. The New Zealand dollar and Canadian dollar the heaviest (off ~0.2%-0.4%). At the same time, there seems to be recognition of, as one observer put it, “huff, puff, and bluff,” and like the equity markets, the uncertainty appears to be pushing participants to the sidelines. |

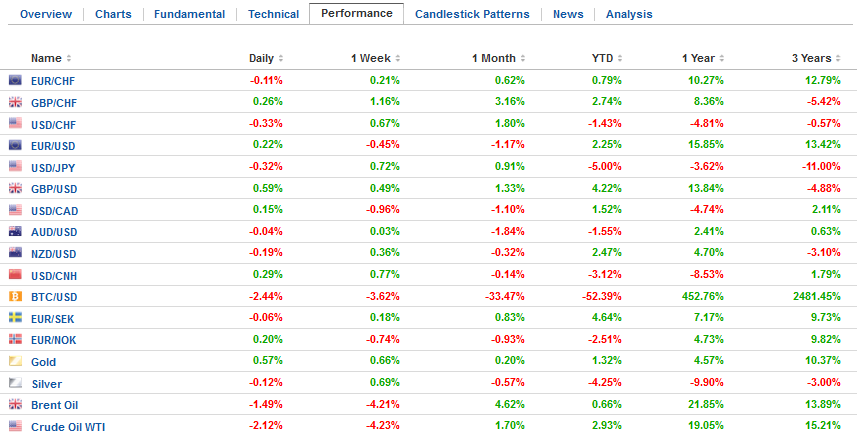

FX Performance, April 06 |

GermanyThe steady stream of disappointing economic data from Europe has continued. The continued data surprises mean that economists continue to underestimate the slowing of the eurozone economy. Today Germany was expected to report a small (~0.2%) rise in industrial output. Instead, it reported that industrial production in February fell 1.6%, the largest drop in nearly four years. The year-over-year pace closed to 2.6% from a revised 6.3%, which is the lowest since March last year. |

Germany Industrial Production, Apr 2013 - 2018(see more posts on Germany Industrial Production, ) Source: Investing.com - Click to enlarge |

United StatesIn this context, the US jobs data, which used to be the most important economic report in the monthly cycle, may be of little lasting consequence, even though there is headline risk. The weekly jobless claims and the ADP report would seem to take away any meaningful downside risk to the non-farm payroll. Before the Fed meets in June, when another rate hike is likely, there will be two more employment reports. Average hourly earnings will retain its central focus. Rising hourly earnings are important in terms of the dynamics of the labor market itself, but also for what it says about core inflation, which is often seen as driven by wage growth, though in reality for many businesses wages can be half of the cost of labor. The Employment Cost Index, which is reported quarterly tries to capture this. It rose 2.6% year-over-year in Q4 2017. Better still are unit labor costs, which incorporate productivity. It rose 2.5% at an annualized pace in Q4 17. Average hourly earnings are running a bit faster, though it is hard to see anything but broad stability within a 2.4%-2.8% range. The employment report is unlikely to change anyone’s mind about the Fed’s June meeting. The market is discounting a little more than an 80% chance. A significant difference between Bloomberg’s calculation and the CME’s is that former calculates a 27% chance of a hike in May, while the latter sees at 3.6%. We see the implied yield of the May Fed Funds contract at 1.69%, matching the current effective rate. |

U.S. Average Hourly Earnings, May 2013 - Apr 2018(see more posts on U.S. Average Hourly Earnings, ) Source: Investing.com - Click to enlarge |

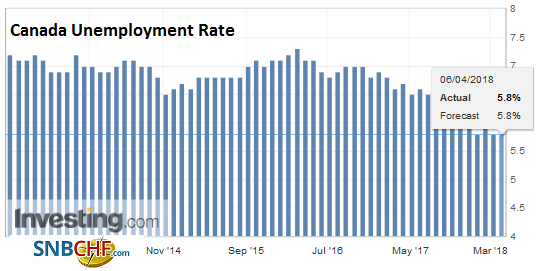

CanadaCanada reports its March employment data at the same time as the US. Canada is expected to have grown 20k jobs after growing 15.4k in February. Last year, Canada created an average of 35.6k jobs a month and 18.5k a month in 2016.The market seems somewhat less sensitive to the mix of full- and part-time positions. Note that Canada reports the hourly earnings of permanent employees, and it rose 3.1% in the year through February and may have accelerated in March. |

Canada Unemployment Rate, May 2013 - Apr 2018(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

This implies practically no chance of a May hike, which matches the Fed’s modus operandi since the rate hike cycle began. Rate increases have only been delivered at meeting with press conferences. While Powell may change this (we have urged a press conference after every meeting), there is no sense of urgency that the Fed would be compelled to lift rates at back-to-back meetings.

Chairman Powell speaks at the Chicago Economics Club today late in the session (2:30 pm ET). He has sounded optimistic in outlook but may echo the sentiments of those Fed officials that have spoken recently that the trade tensions are a downside risk.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: $CAD,$EUR,$JPY,Canada Unemployment Rate,EUR/CHF,Germany Industrial Production,jobs,newslettersent,SPY,Trade,U.S. Average Hourly Earnings,USD/CHF