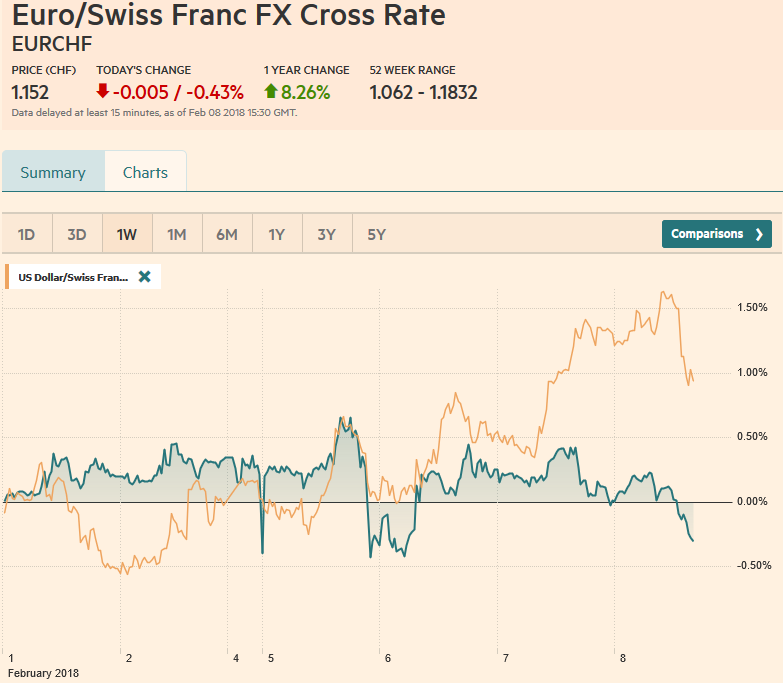

Swiss FrancThe Euro has fallen by 0.43% to 1.152 CHF. |

EUR/CHF and USD/CHF, February 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

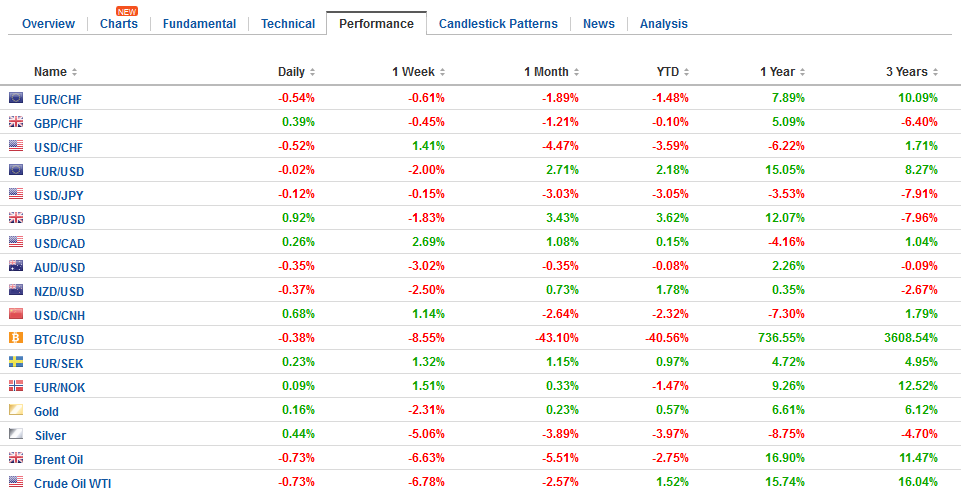

FX RatesThe swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week. The data is likely distorted by the impact of the Lunar New Year, which was earlier in 2017. But the optics work in the China’s favor which is facing increased trade tensions with the US. By China’s calculations, its trade surplus with the US narrowed to $22 bln. Exports rose 12.5, while imports from the US rose 26.5%.

|

FX Daily Rates, February 08 |

| Separately, a Reuters reported that there may be a loosening up of the controls of outbound capital flows (QDLP), and the yuan, which has been strengthening steadily since mid-December snapped back today. The US dollar rose 0.75% against the yuan, its biggest move since the 2015 devaluation. The greenback returned to levels seen at the end of last month (~CNY6.3250).

The Reserve Bank of New Zealand provided a dovish hold for investors, and the New Zealand dollar fell to the its lowest level since January 10 (~$0.7175). The central bank pushed out further when its expects to reach its inflation target (now late 2020, a two-year delay) and shaved its GDP forecast. This signals that policy may be on hold longer than the market previously expected. The strength of the New Zealand dollar (~5% on a trade-weighted basis in the past 2.5 months) was unexpected, but the central bank continues to expect it to weaken. |

FX Performance, February 08 |

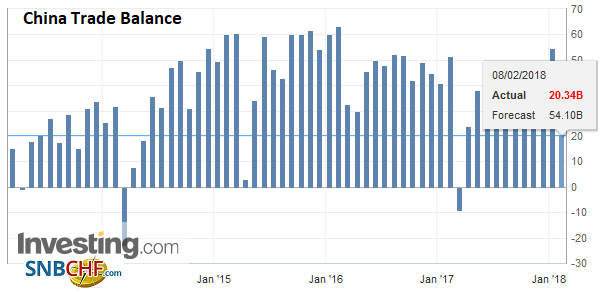

ChinaThere have been several developments in addition to the price action to note. First, China reported a January trade surplus that was less than half the forecast size. The $20.34 bln surplus contrasts with expectations for a little changed reported from the December $54.7 bln. |

China Trade Balance (USD), Jan 2018(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

| Exports were up 11.1%, which marked a small acceleration. That was not issue. |

China Exports YoY, Jan 2018(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

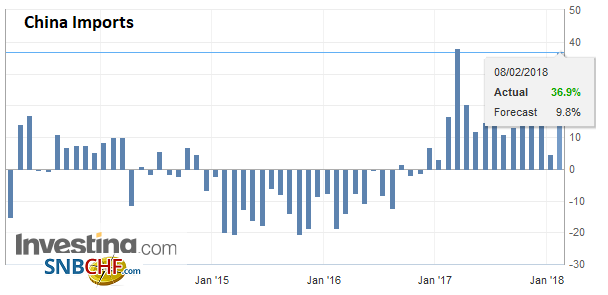

| Imports surged 36.9%. They were up 4.5% year-over-year in December, and while acceleration was expected, nothing on this magnitude was anticipated. |

China Imports YoY, Jan 2018(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

Japan |

Japan Current Account n.s.a., Dec 2017(see more posts on Japan Current Account n.s.a., ) Source: Investing.com - Click to enlarge |

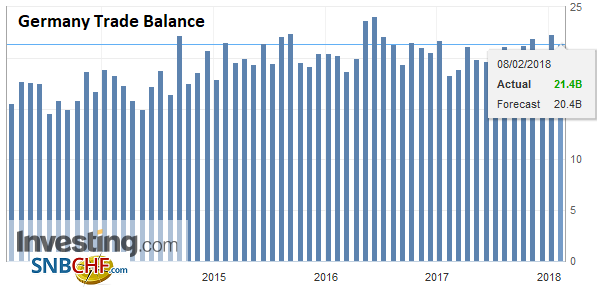

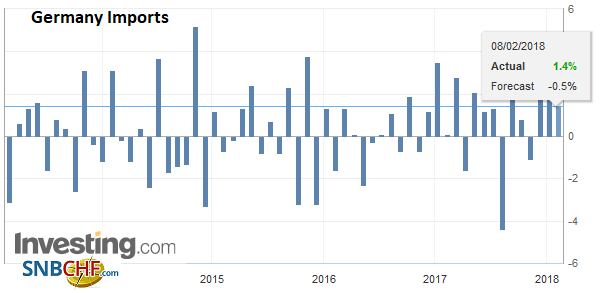

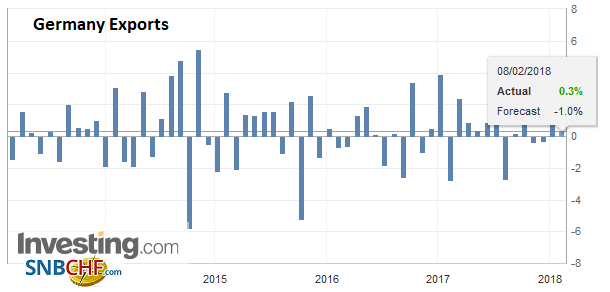

Germany |

Germany Trade Balance, Dec 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

Germany Imports, Dec 2017(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

|

Germany Exports, Dec 2017(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

|

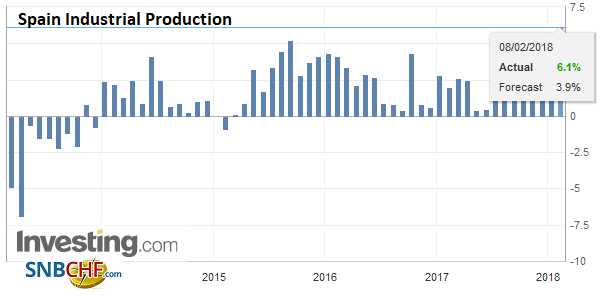

Spain |

Spain Industrial Production YoY, Dec 2017(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

United States |

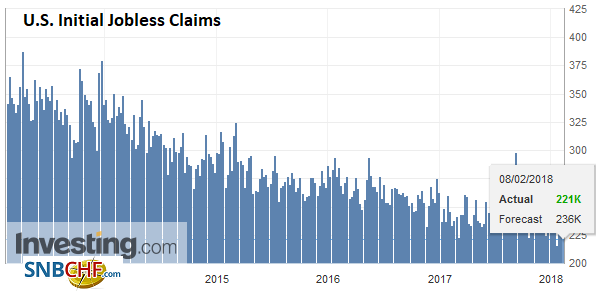

U.S. Initial Jobless Claims, February 08(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

The focus now is on the BOE meeting and quarterly inflation report where forecasts are updated. There is little doubt that the policy is on hold. The question is how many MPC members disagree. The consensus expects no dissents, but a single dissent would not be too much of a miss. Two dissents and the market may take more seriously a hike in May (now about 48% chance). The BOE forecasts had assumed that about 62 bp of tightening would be delivered over the next three years.

It may be interesting to compare the BOE’s forecasts with the new EC forecasts. The EC forecasts were updated earlier this week. They show the US economy expanding 1.8% last year and 1.4% this year before slowing to 1.1% in 2019. Next year’s forecast is particularly pessimistic. Governor Carney argued before Parliament that prior to the referendum, the BOE warned that Brexit would send sterling lower, inflation higher, and would be a negative shock for the economy. And indeed, this has come to pass. The BOE forecasting period covers much of the post-March 2019 period, and yet so little is known. This alone dictates caution.

After the BOE meeting and press conference, attention will shift back to the United States. The performance of the US equity market is important. It is presently little changed. The key is not so much direction as volatility. Some work suggests volatility is auto-correlated, meaning that one volatile day is often followed by another volatile session. The surge is gradually subsiding. Although there appears to be no impact on monetary policy or broader economic trends, many are debating if this marks a new regime for investors.

The other key issue in the US today is the pending government shutdown starting tomorrow unless action is taken. As we noted yesterday, the Senate has a two-year plan that would boost defense and non-defense spending by around $300 bln (including disaster relief) over the next two years. The Senate will likely formally approve the plan early today and then the drama shifts to the House of Representatives. A conservative group (Freedom Caucus) is balking at the increase in domestic spending, and a Democrat group wants a promise for an open debate on immigration, which is what was made in the Senate.

Before the House votes, the US will be auctioning 30-year bonds to round out the quarterly refunding. The soft 10-year auction yesterday weighed on yields and may have encouraged the afternoon pullback in equities.

With today’s losses, the euro has given back half of its gains from the year’s low (January 9 ~$1.1915). A move below $1.2225 would target $1.2150-$1.2160 next. Note that there is a 574 mln euro option struck at $1.2265 that expires today. There are 1 bln euros struck at $1.22 that expires tomorrow. The intraday technical readings suggest consolidation is likely in North American today.

The greenback is firmer against the yen, but has only marginally extended yesterday highs. The market seems tentative. A move above JPY110 would be promising, but last week’s high near JPY110.50 seems distant. There are two option strikes to note that expire today: JPY109.40 ($415 mln) and JPY110 ($475 mln).

Sterling has formed a shelf with its lows over the past two sessions and today in the $1.3835-$1.3850 area. Initial resistance is seen in the $1.3820-$1.3840 area. A move above $1.40 would improve the technical tone and create space for another cent advance in the coming days.

The dollar-bloc currencies are extending their recent losses, and important technical levels have been approached. The Australian dollar, which had been probing $0.8100 at the end of last month is now testing $0.7800. The $0.7820 area housed the 50% retracement of the rally from early December. The 61.8% objective is near $0.7745. The US dollar has made new highs against the Canadian dollar for the year, retracing 50% of the losses since mid-December, but the CAD1.2600-CAD1.2625 may prove sticky today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$TLT,China Exports,China Imports,China Trade Balance,EUR/CHF,EUR/CHF and USD/CHF,Germany Exports,Germany Imports,Germany Trade Balance,Japan Current Account n.s.a.,newslettersent,NZD,Spain Industrial Production,SPY,U.S. Initial Jobless Claims,USD/CHF