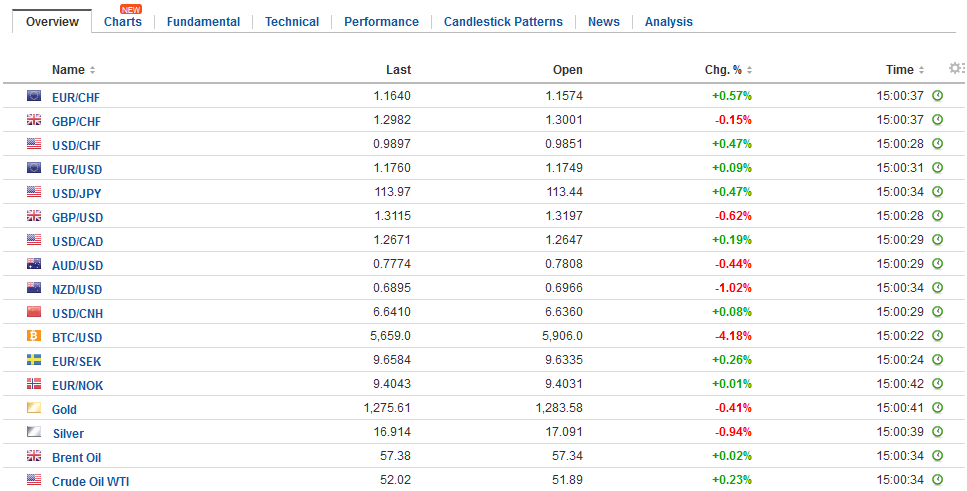

Swiss FrancThe Euro has risen by 0.51% to 1.1627 CHF. |

EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of asset purchases at a pace half of the current 60 bln a month. Anticipation of the new Fed Chair, which President Trump says will be announced: “very, very soon.” Anticipation of US tax reform proposal that will be released as soon as the budget is approved. Anticipation of US corporate earnings, with FANG, shares off for the fifth session yesterday, the longest downdraft of the year. The 10-year US yield is sitting just below the 2.40% level, which marks the upper end of the six-month trading range. It has finished the North American session once above there since the end of Q1. This has helped put a floor under the dollar against the yen. When the yield faltered at the cap yesterday, the dollar pulled back to JPY113.25 and recovered in the afternoon session in Tokyo and through the European morning to return to the JPY113.75 area. There is nearly a $1 bln option struck at JPY113.50 that expires today and a nearly $720 mln strike at JPY114.00 the will be cut. |

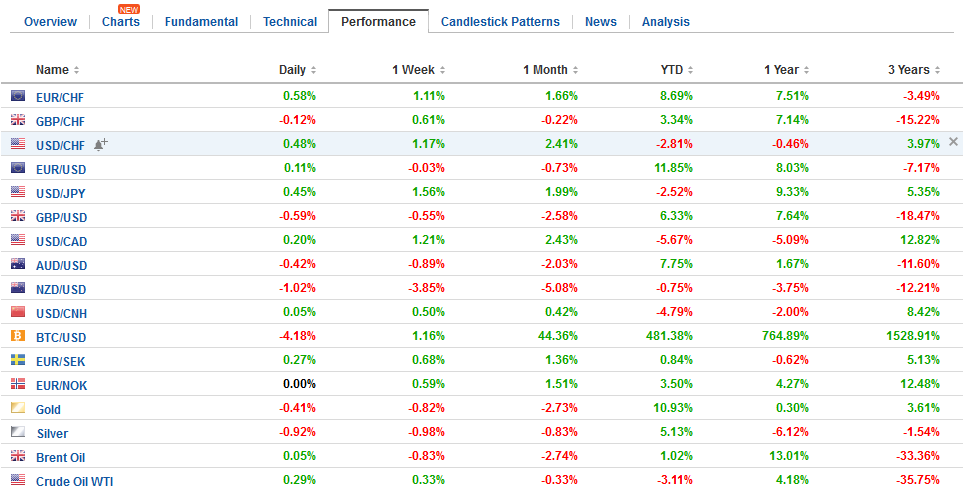

FX Daily Rates, October 24 |

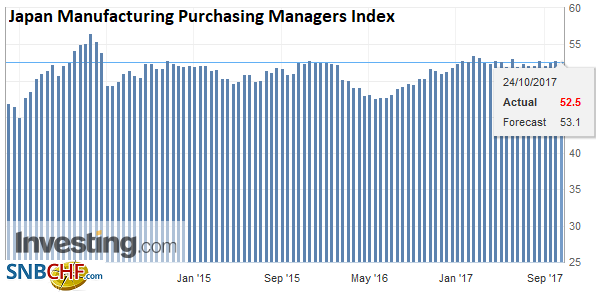

| The Nikkei extended its gains for a 16th consecutive session. There have been two developments to note in Japan. First, the flash manufacturing PMI for October eased to 52.5 from 52.9, though output remained strong. The September reading was a four-month high. Second, reports suggest that next week the BOJ may lower its forecast for (core) CPI for the current fiscal year. Japan reports the September CPI figures at the end of the week. The targeted core rate, which excludes fresh food, is expected to be steady 0.7%. The BOJ’s current forecast is for it to reach 1.1% by the end of March 2018. |

FX Performance, October 24 |

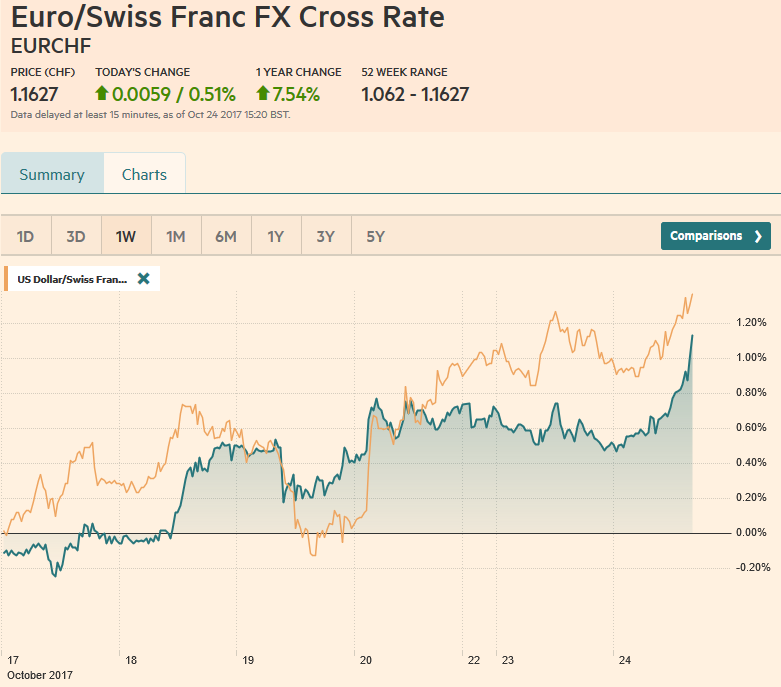

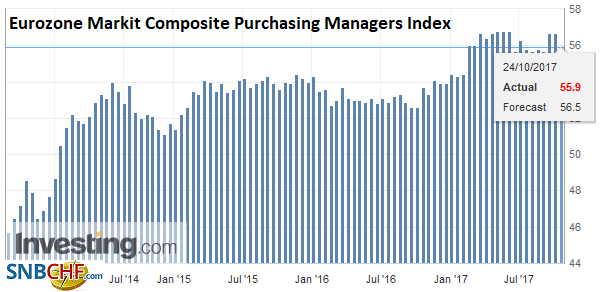

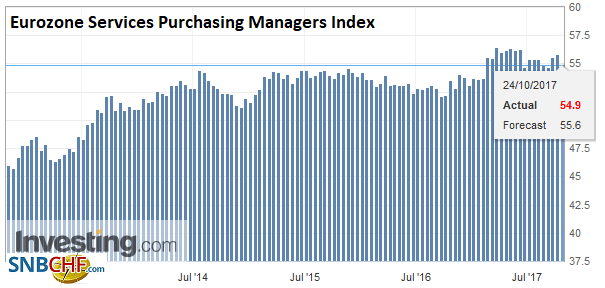

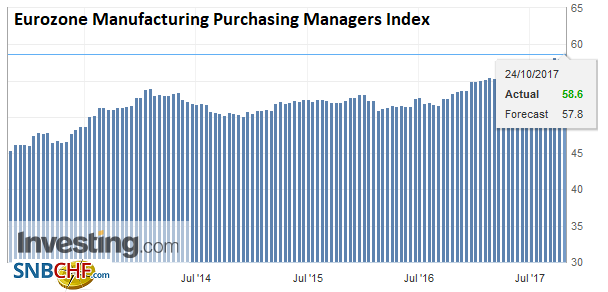

EurozoneThe eurozone reported its flash PMI readings. They were mixed and gave a sense that the regional economy continues to expand at an above-trend clip but a slightly slower pace. The composite slowed to 55.9 from 56.7, which is somewhat more than expected. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Oct 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| The weaker results were a function of unexpected slowing in the service sector, which is about the domestic economies, while the manufacturing sector, where exports are more significant, accelerated. |

Eurozone Services Purchasing Managers Index (PMI), Oct 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

| The services PMI slipped to 54.9 from 55.8, while the manufacturing PMI rose to 58.6 from 58.1. Manufacturing employment was the highest on record (time series began 1997).

Separately, the ECB reported that banks mostly kept lending standards unchanged in Q3, while there was a pick-up in demand. Credit standards for mortgages and consumer loans eased. According to the report, the ECB’s asset purchases have had a positive impact on liquidity positions and market-financing conditions. It has had a negative impact on net interest margins. In the Q3 survey, banks said they used the liquidity created by asset purchases to mainly grant loans. The bank survey underscores what the ECB will likely call the re-scaling of its asset purchases rather than tapering, which as it noted previously, implies an endpoint. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

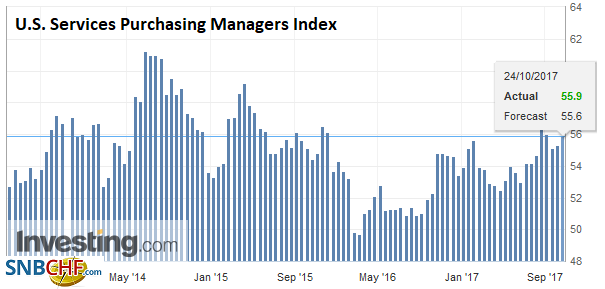

United StatesTurning to the Federal Reserve, the debate for many is over Powell vs. Taylor, to replace Yellen. Even though President Trump has indicated he likes Yellen, and it is difficult to envision a more competent handling of tapering, rate hikes and now balance sheet reduction, so much of what he seems to be trying to do is reverse the general thrust of recent years. Framing the issue now as Powell vs. Taylor may be a false choice in the sense that the White House may name both to the Chair and Vice Chair positions. |

U.S. Services Purchasing Managers Index (PMI), Oct 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

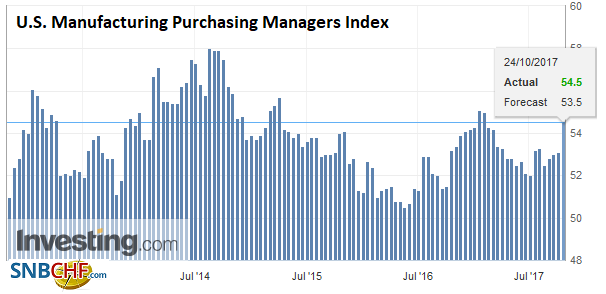

| The North American session features the US preliminary PMI. A similar pattern as seen in Europe is expected, with manufacturing faring better than services. |

U.S. Manufacturing Purchasing Managers Index (PMI), Oct 2017 Source: Investing.com - Click to enlarge |

| The highlights of the week come later. Weekly initial jobless claims made new cyclical lows last week and we’ll get the first look at Q3 GDP at the end of the week. |

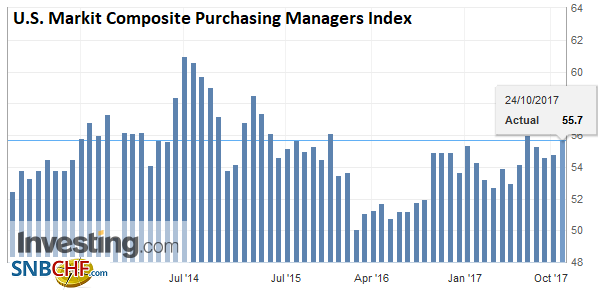

U.S. Markit Composite Purchasing Managers Index (PMI), Oct 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

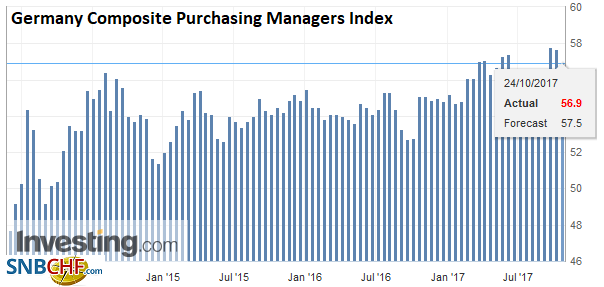

Germany |

Germany Composite Purchasing Managers Index (PMI), Oct 2017(see more posts on Germany Composite Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

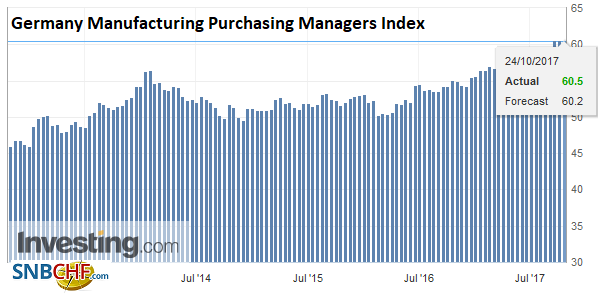

Germany Manufacturing Purchasing Managers Index (PMI), Oct 2017 Source: Investing.com - Click to enlarge |

|

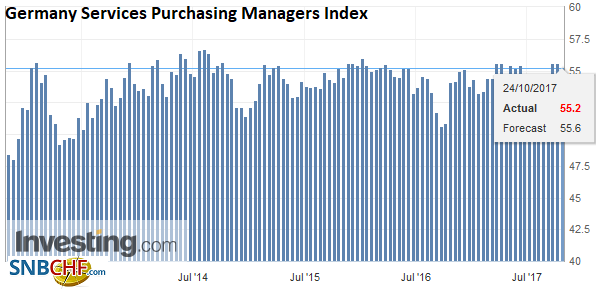

Germany Services Purchasing Managers Index (PMI), Nov 2017(see more posts on Germany Services Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

|

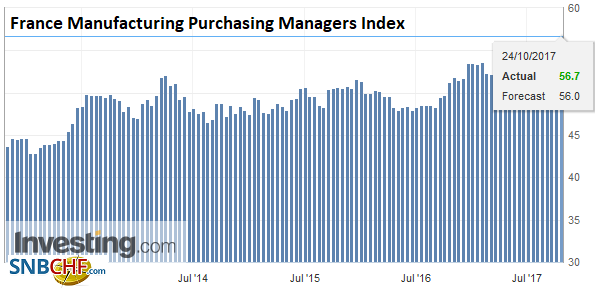

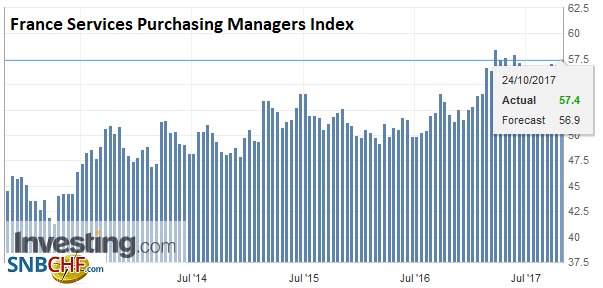

France |

France Manufacturing Purchasing Managers Index (PMI), Oct 2017 Source: Investing.com - Click to enlarge |

France Services Purchasing Managers Index (PMI), Oct 2017 Source: Investing.com - Click to enlarge |

|

Japan |

Japan Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on Japan Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

While the confrontation between Catalonia and Madrid continues, the market has moved on. Spain’s 10-year bond yield is up 1.5 bp today, while German, French and Italian yields are up nearly four basis points. Spain’s stock market is up about 0.25% while the Dow Jones Stoxx 60 is down marginally. CaixaBank reported better than expected Q3 profit. Other Spanish banks will be reporting in the coming days. CaixaBank said the Catalonia crisis had a moderately negative impact on deposits. Deposits stabilized, reportedly, since CaixaBank was one of more than 1300 companies that shifted their legal headquarters out of Catalonia.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,France Manufacturing PMI,France Services PMI,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newslettersent,U.S. Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF